Colorado Form Dr 0004

Colorado Form Dr 0004 - That calculation is designed to withhold the required colorado income tax due on your wages throughout. Web the colorado department of revenue announced that starting in 2022, employees can use the new form dr 0004, colorado employee withholding certificate. You (and your spouse, if filing jointly) only need to complete this worksheet once. Web what is form dr 0004? The colorado department of revenue introduced. Easily fill out pdf blank, edit, and sign them. Web transfer of title upon death designated beneficiary form. Form dr 0004 is the new colorado withholding certificate that is optional for employees to complete starting in 2022. 15 released the 2023 colorado employee withholding certificate form for individual income tax purposes. It is not meant to.

Web transfer of title upon death designated beneficiary form. That calculation is designed to withhold the required colorado income tax due on your wages throughout. If you do not complete this certificate, then your employer will calculate your. Web what is form dr 0004? You (and your spouse, if filing jointly) only need to complete this worksheet once. Web colorado employee withholding certificate dr 0004: This certificate is optional for employees. Web dr 0004 is a form to calculate withholding allowances for state of colorado personal income tax. Web the colorado department of revenue (dor) nov. Web the final version of form dr 0004 was also released.

It is not meant to. Web how to complete the colorado department of revenue form 0104ep 2012 instructions online: Web the colorado department of revenue (dor) nov. Web colorado form dr 0004, employee withholding certificate, takes effect implementation date: 16 issued information on the state withholding certificate, dr 0004, for corporate income and individual income tax. Web learn how to use the 2023 co withholding form dr 0004 in quickbooks online and desktop payroll products. To begin the form, utilize the fill & sign online button or tick the preview image. Web form dr 0004 is the new colorado withholding certificate that is optional for employees to complete starting in 2022. Web transfer of title upon death designated beneficiary form. You (and your spouse, if filing jointly) only need to complete this worksheet once.

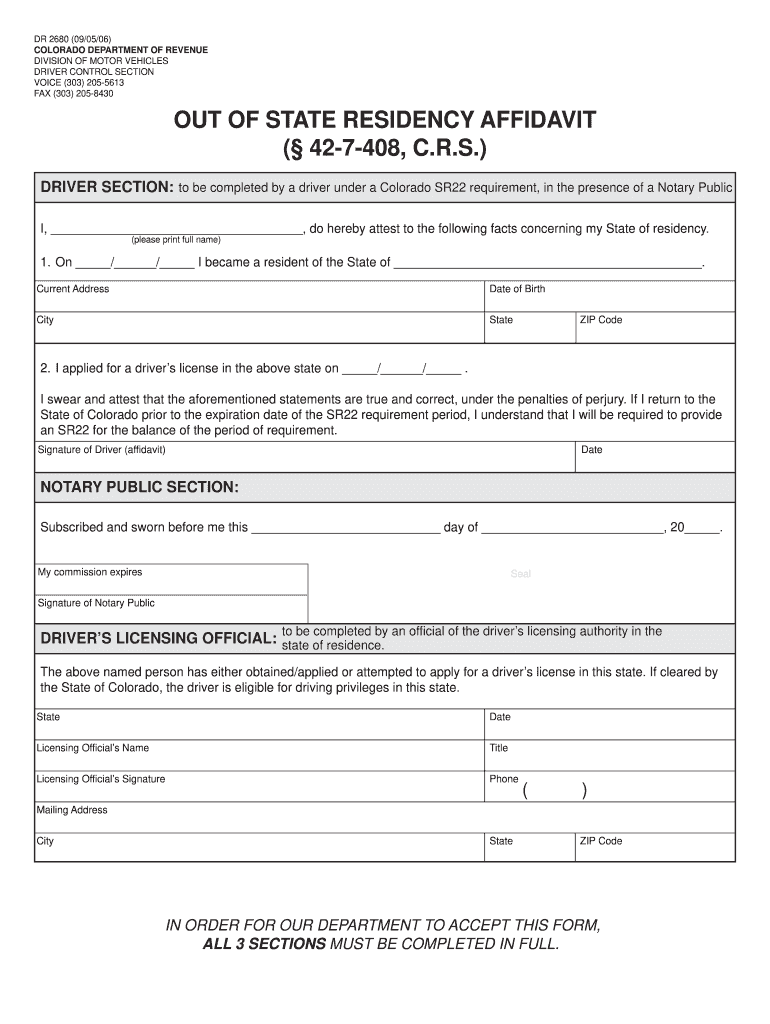

State Colorado Fill Online, Printable, Fillable, Blank pdfFiller

You (and your spouse, if filing jointly) only need to complete this worksheet once. Web july 17, 2022 by employee services colorado has a new tax form available for employees to make changes to their colorado state tax withholding. This certificate is optional for employees. The colorado department of revenue introduced. (opens in new window) (effective august 10, 2016) dr.

Colorado Form 104CR (Tax Credits for Individuals) 2021 Colorado

Web dr 0004 is a form to calculate withholding allowances for state of colorado personal income tax. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. 15 released the 2023 colorado employee withholding certificate form for individual income tax purposes. Web dr 0004 (11/05/21) colorado department of revenue tax.colorado.gov 2022 colorado employee withholding.

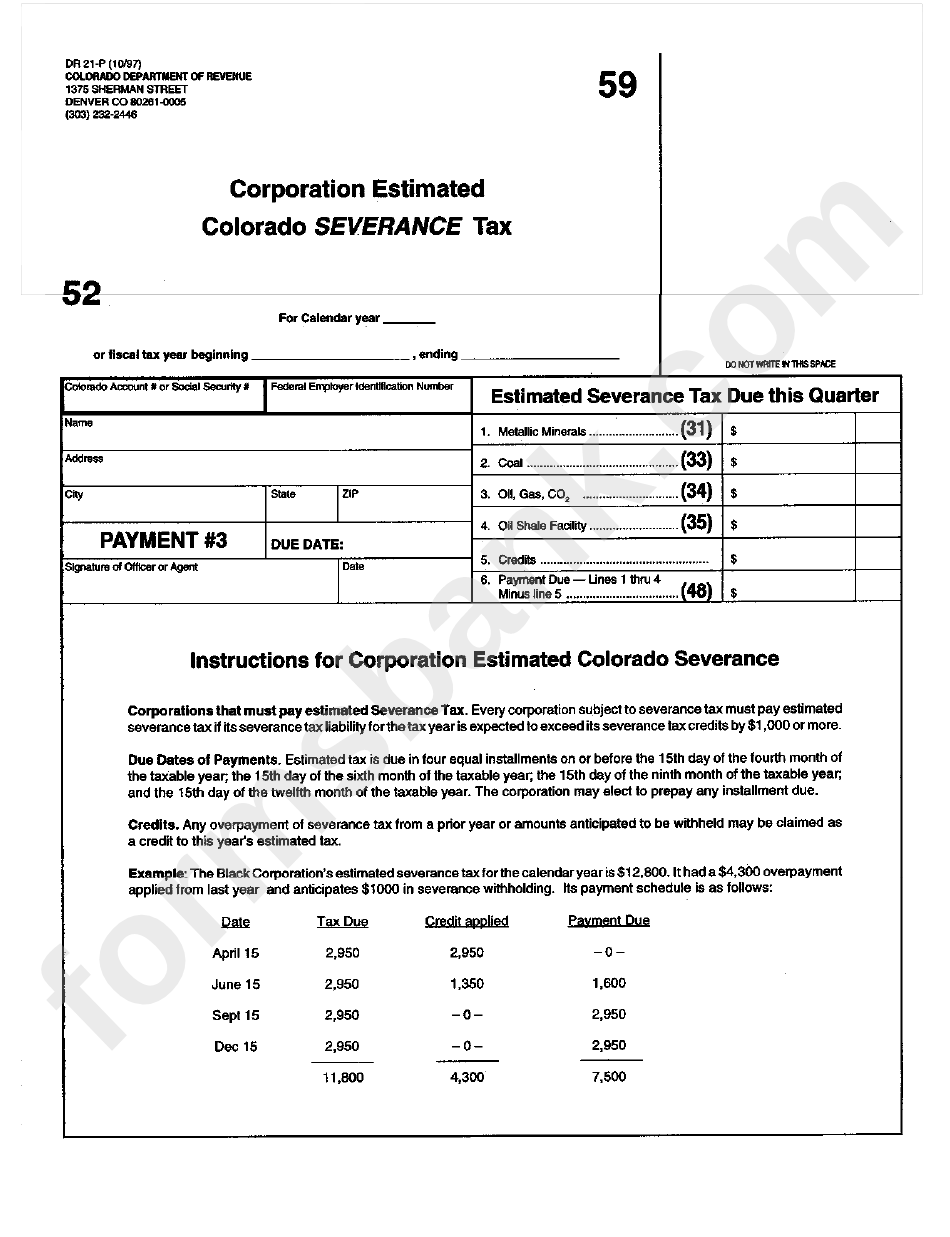

Form Dr 21P Corporation Estimated Colorado Severance Tax printable

Easily fill out pdf blank, edit, and sign them. To begin the form, utilize the fill & sign online button or tick the preview image. 15 released the 2023 colorado employee withholding certificate form for individual income tax purposes. Web how to complete the colorado department of revenue form 0104ep 2012 instructions online: It is not meant to.

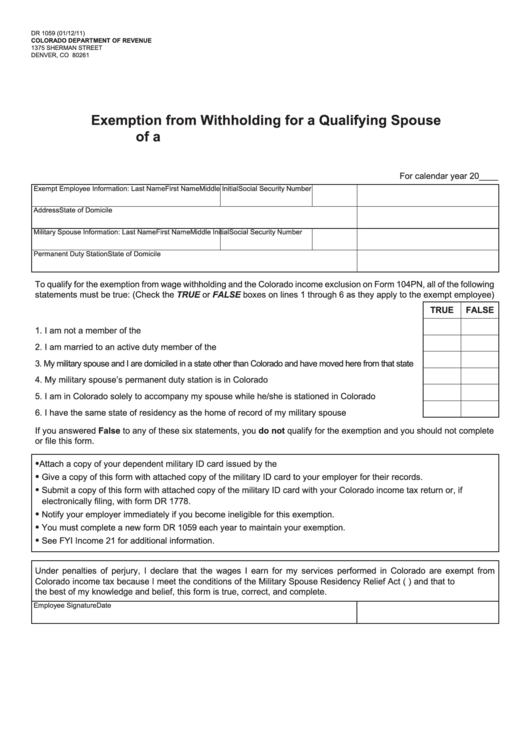

Form Dr 1059 Exemption From Withholding For A Qualifying Spouse Of A

Web dr 0004 (11/05/21) colorado department of revenue tax.colorado.gov 2022 colorado employee withholding certificate this certificate is optional for employees if. Web dr 0004 is a form to calculate withholding allowances for state of colorado personal income tax. 16 issued information on the state withholding certificate, dr 0004, for corporate income and individual income tax. When and how to complete.

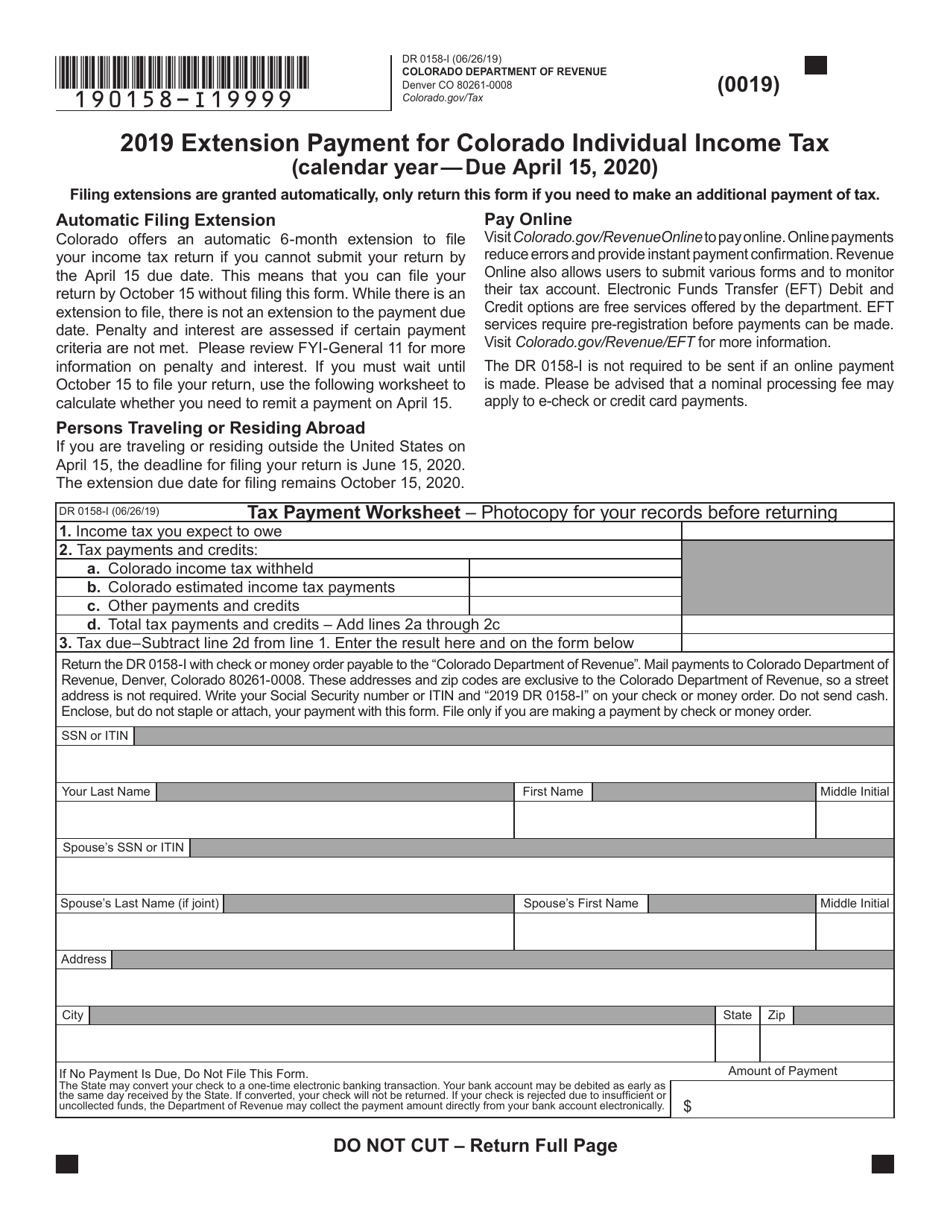

Form DR0158I Download Fillable PDF or Fill Online Extension Payment

Web colorado form dr 0004, employee withholding certificate, takes effect implementation date: Web form dr 0004 is the new colorado withholding certificate that is optional for employees to complete starting in 2022. The colorado department of revenue introduced. To begin the form, utilize the fill & sign online button or tick the preview image. (opens in new window) (effective august.

What Is The Annual Withholding Allowance For 2022 Gettrip24

15 released the 2023 colorado employee withholding certificate form for individual income tax purposes. Web the colorado department of revenue nov. Save or instantly send your ready documents. To begin the form, utilize the fill & sign online button or tick the preview image. The colorado department of revenue introduced.

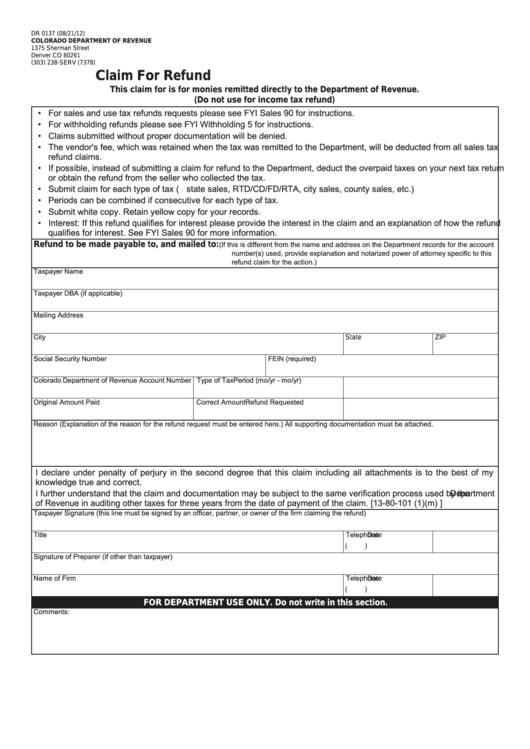

Form Dr 0137 Colorado Claim For Refund printable pdf download

You (and your spouse, if filing jointly) only need to complete this worksheet once. Web the colorado department of revenue nov. Colorado’s 2022 withholding formula and its new optional withholding certificate were released nov. (opens in new window) (effective august 10, 2016) dr 2011. When and how to complete corevenueonline 2.07k subscribers subscribe like share 1.8k views 1 year ago.

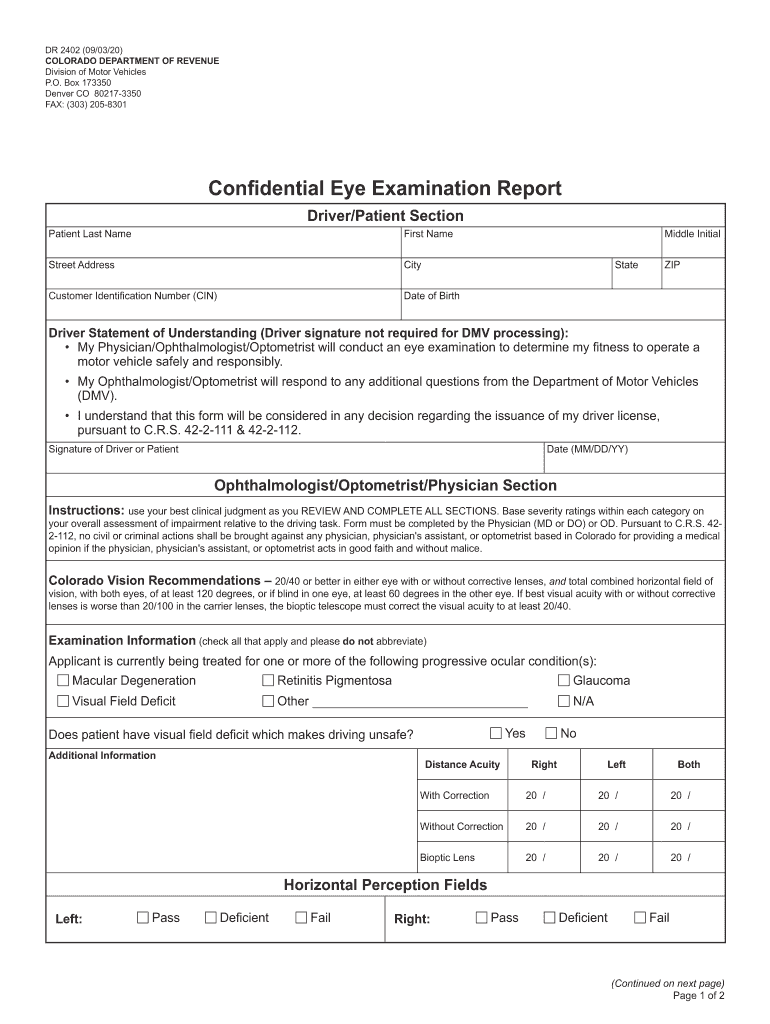

Dr 2402 Fill Online, Printable, Fillable, Blank pdfFiller

The colorado department of revenue introduced. Save or instantly send your ready documents. If you do not complete this certificate, then your employer will calculate your. 16 issued information on the state withholding certificate, dr 0004, for corporate income and individual income tax. Web july 17, 2022 by employee services colorado has a new tax form available for employees to.

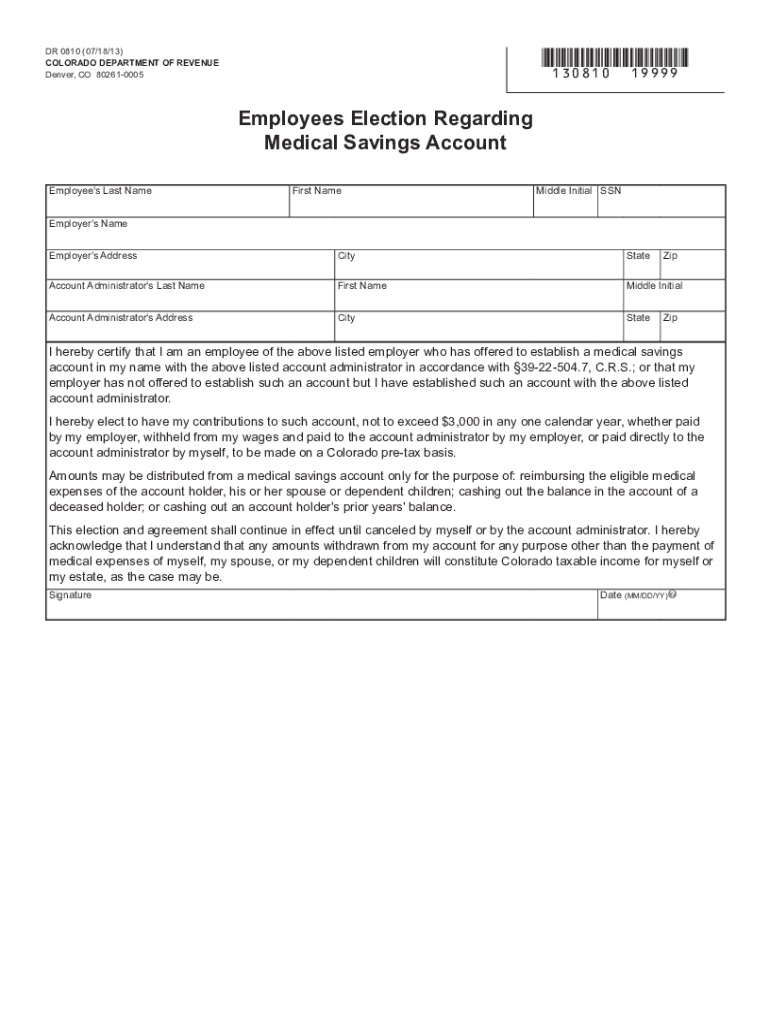

Colorado Form DR 0810 Medical Savings Account Employee Fill Out and

Web the colorado department of revenue announced that starting in 2022, employees can use the new form dr 0004, colorado employee withholding certificate. Web the colorado department of revenue (dor) nov. Web dr 0004 is a form to calculate withholding allowances for state of colorado personal income tax. Easily fill out pdf blank, edit, and sign them. Web dr 0004.

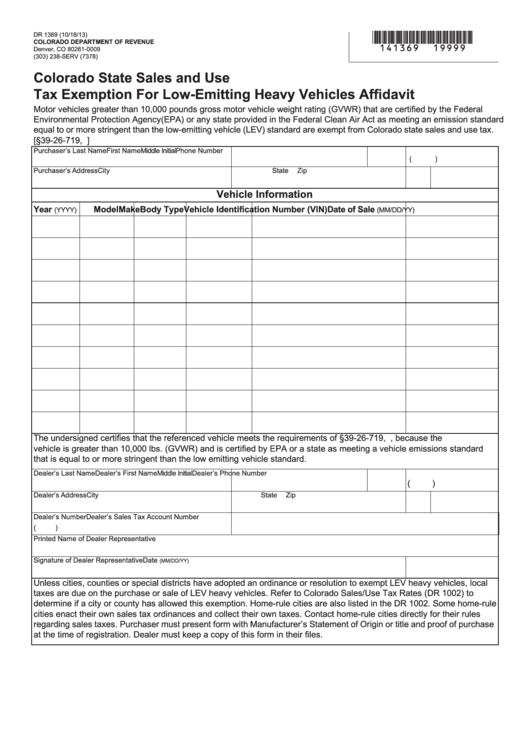

Form Dr 1369 Colorado State Sales And Use Tax Exemption For Low

Web dr 0004 is a form to calculate withholding allowances for state of colorado personal income tax. Web form dr 0004 is the new colorado withholding certificate that is optional for employees to complete starting in 2022. Web the colorado department of revenue announced that starting in 2022, employees can use the new form dr 0004, colorado employee withholding certificate..

Web The Colorado Department Of Revenue (Dor) Nov.

Form dr 0004 is the new colorado withholding certificate that is optional for employees to complete starting in 2022. The colorado department of revenue introduced. Web dr 0004 (11/05/21) colorado department of revenue tax.colorado.gov 2022 colorado employee withholding certificate this certificate is optional for employees if. To begin the form, utilize the fill & sign online button or tick the preview image.

Web What Is Form Dr 0004?

When and how to complete corevenueonline 2.07k subscribers subscribe like share 1.8k views 1 year ago. This certificate is optional for employees. Save or instantly send your ready documents. Web dr 0004 is a form to calculate withholding allowances for state of colorado personal income tax.

(Opens In New Window) (Effective August 10, 2016) Dr 2011.

Web the colorado department of revenue announced that starting in 2022, employees can use the new form dr 0004, colorado employee withholding certificate. Web the final version of form dr 0004 was also released. Web transfer of title upon death designated beneficiary form. Web colorado employee withholding certificate dr 0004:

Colorado’s 2022 Withholding Formula And Its New Optional Withholding Certificate Were Released Nov.

Web the colorado department of revenue nov. That calculation is designed to withhold the required colorado income tax due on your wages throughout. You (and your spouse, if filing jointly) only need to complete this worksheet once. Web learn how to use the 2023 co withholding form dr 0004 in quickbooks online and desktop payroll products.