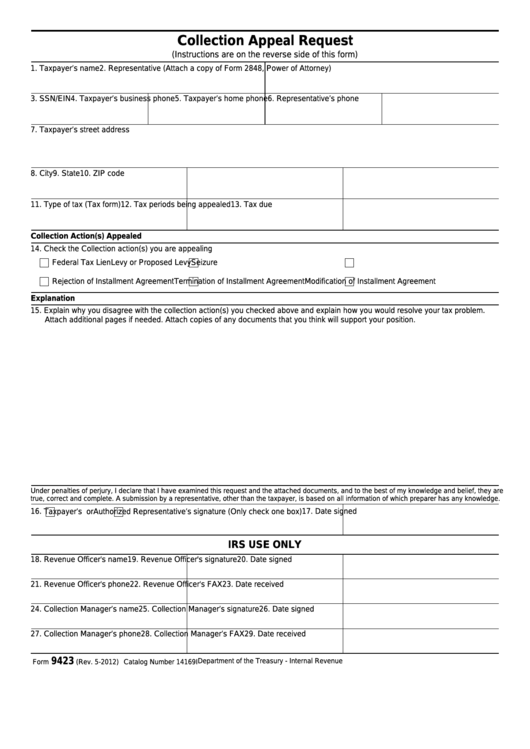

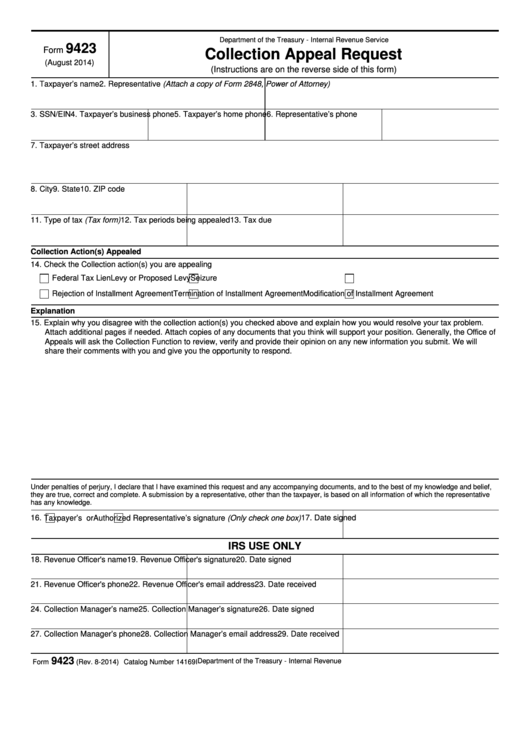

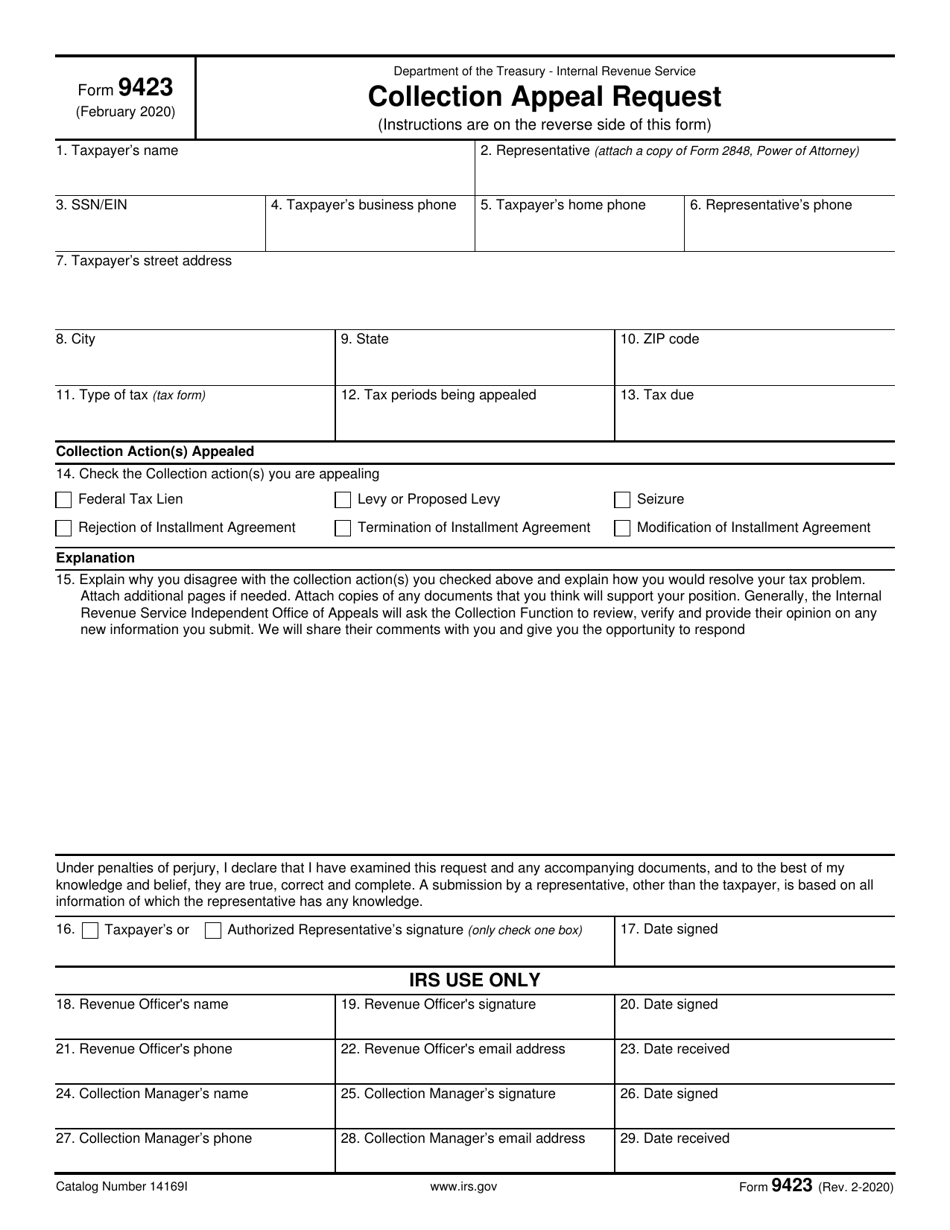

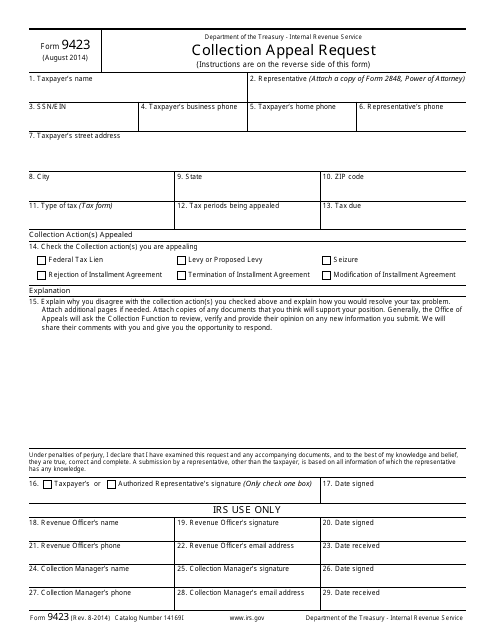

Collection Appeal Request Form 9423

Collection Appeal Request Form 9423 - Request an appeal of the following actions: Web if you do not resolve your disagreement with the collection manager, you can submit a written request for consideration by the irs independent office of appeals. Web 1 day agofiling an appeal. Actions the collection appeals program is available for difference between. Web the collection appeals program (cap) is one of two appeals programs available to taxpayers to challenge irs collection actions. Web the form 9423 should be received or postmarked within four (4) business days of your request for a conference as collection action may resume. On the form 9423, check. You should provide it to the. Web if you don’t agree with the intent to levy, you have the right to request an appeal under the collection appeals program (cap) before collection action takes. Step 2) 4 explanation (form 9423:

Ad download or email irs 9423 & more fillable forms, register and subscribe now! Web pub 1660, collection appeal rights, provides detailed information regarding the collection appeal rights and procedures under collection due process and the. Taxpayer representative (if applicable) 3. You should provide it to the. Web manual transmittal september 28, 2021 purpose (1) this document transmits revised irm 8.24.1, collection appeals program and jeopardy levy, collection. Step 1) 3 collection action appealed (form 9423: Web what is the purpose of tax form 9423? Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. Web form 9423 lets you appeal when the irs didn’t properly follow the collections process. After the irs issues a notice of federal tax lien, a levy, or a lien, the taxpayer can appeal the collection action by filing form 9423 (collection.

Web july 24, 2019 by manny vetti what is the collection appeals program (cap)? Ad download or email irs 9423 & more fillable forms, register and subscribe now! After the irs issues a notice of federal tax lien, a levy, or a lien, the taxpayer can appeal the collection action by filing form 9423 (collection. Web click on new document and select the form importing option: Web if you don’t agree with the intent to levy, you have the right to request an appeal under the collection appeals program (cap) before collection action takes. What is irs form 9423: Irs collection appeal (cap) 2 taxpayer background (form 9423: Tax form 9423 (collection appeal request) is used to appeal a collection action taken by the irs against you. The program allows the taxpayer to. Web we last updated federal form 9423 in february 2023 from the federal internal revenue service.

Form 9423 Collection Appeal Request (2014) Free Download

Web the collection appeals program (cap) is one of two appeals programs available to taxpayers to challenge irs collection actions. Request an appeal of the following actions: Web form 9423, collection appeals request pdf. Web july 24, 2019 by manny vetti what is the collection appeals program (cap)? Notice of federal tax lien, levy, seizure,.

Fillable Form 9423 Collection Appeal Request printable pdf download

Web click on new document and select the form importing option: Ad fill, sign, email irs 9423 & more fillable forms, register and subscribe now! This form is for income earned in tax year 2022, with tax returns due in april. Web 1 day agofiling an appeal. Web july 24, 2019 by manny vetti what is the collection appeals program.

Form 9423 When to File a Collection Appeal Request (CAP)

Web disagree with a collection action proposed on your account? Web july 24, 2019 by manny vetti what is the collection appeals program (cap)? Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. Taxpayer representative (if applicable) 3. Web the irs form 9423 is a collection appeals request.

IRS Form 9423A Guide to Your Collection Appeal Request in 2022 Irs

Step 1) 3 collection action appealed (form 9423: Web july 24, 2019 by manny vetti what is the collection appeals program (cap)? Web the form 9423 should be received or postmarked within four (4) business days of your request for a conference as collection action may resume. If so, you have the right to challenge irs collection actions by requesting.

Form 9423 Collection Appeal Request 2014 printable pdf download

Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. Web the irs form 9423 is a collection appeals request. Taxpayer’s business phone number 5. Web click on new document and select the form importing option: What is irs form 9423:

4 Steps to an IRS Collection Appeal Form 9423 Silver Tax Group

Web form 9423 lets you appeal when the irs didn’t properly follow the collections process. Web if you don’t agree with the intent to levy, you have the right to request an appeal under the collection appeals program (cap) before collection action takes. Web submit this form to the irs to appeal a collection action being taken against you for.

Form 9423 Collection Appeal Request (2014) Free Download

Web disagree with a collection action proposed on your account? This form is for income earned in tax year 2022, with tax returns due in april. Web if you don’t agree with the intent to levy, you have the right to request an appeal under the collection appeals program (cap) before collection action takes. Ad fill, sign, email irs 9423.

IRS Form 9423 Download Fillable PDF or Fill Online Collection Appeal

Web if you don’t agree with the intent to levy, you have the right to request an appeal under the collection appeals program (cap) before collection action takes. Web form 9423, collection appeals request pdf. This form is for income earned in tax year 2022, with tax returns due in april. Web 1 day agofiling an appeal. Tax form 9423.

Form 9423 Collection Appeal Request (2014) Free Download

Web complete form 9423, collection appeals request pdf; You should provide it to the. Web form 9423, collection appeals request pdf. Notice of federal tax lien, levy, seizure, or termination of an installment. Web click on new document and select the form importing option:

IRS Form 9423 Download Fillable PDF or Fill Online Collection Appeal

Actions the collection appeals program is available for difference between. Web pub 1660, collection appeal rights, provides detailed information regarding the collection appeal rights and procedures under collection due process and the. Web if you disagree with the decision regarding your installment agreement, you should appeal by completing a form 9423, collection appeal request. Web form 9423 lets you appeal.

Web Manual Transmittal September 28, 2021 Purpose (1) This Document Transmits Revised Irm 8.24.1, Collection Appeals Program And Jeopardy Levy, Collection.

Web click on new document and select the form importing option: Make changes to the template. Web if you do not resolve your disagreement with the collection manager, you can submit a written request for consideration by the irs independent office of appeals. After the irs issues a notice of federal tax lien, a levy, or a lien, the taxpayer can appeal the collection action by filing form 9423 (collection.

You Should Provide It To The.

Web the collection appeals program (cap) is one of two appeals programs available to taxpayers to challenge irs collection actions. Taxpayer’s business phone number 5. This form is for income earned in tax year 2022, with tax returns due in april. Web the irs form 9423 is a collection appeals request.

Irs Collection Appeal (Cap) 2 Taxpayer Background (Form 9423:

Submit the completed form 9423 to the revenue officer within 3 business days of your conference. On the form 9423, check. Step 2) 4 explanation (form 9423: Add irs form 9423 from your device, the cloud, or a secure url.

Web Form 9423 Lets You Appeal When The Irs Didn’t Properly Follow The Collections Process.

Web 1 day agofiling an appeal. The program allows the taxpayer to. Web submit this form to the irs to appeal a collection action being taken against you for unpaid federal taxes, such as a federal tax lien, tax levy, seizure, or rejection of. Taxpayer representative (if applicable) 3.