Coinbase Wallet Tax Form

Coinbase Wallet Tax Form - Web when required by the irs, the crypto exchange or broker you use, including coinbase, has to report certain types of activity directly to the irs using specific forms and provide you. Web crypto wallet beam, which is backed by notable digital asset investors, such as venture capital giant andreessen horowitz (a16z) and the investment arm of coinbase. Download form 8949 for coinbase one. Web coinbase.com (desktop/web) to download your tax reports: Web get up to $200 for getting started. An ethereum l2 to build. You can find all of your irs forms in the. Web koinly categorizes coinbase wallet transactions into gains, losses and income. Web i'm trying to file my taxes and i need the history regarding transactions that occurred in my coinbase wallet. Web coinbase is a secure online platform for buying, selling, transferring, and storing digital currency.

Koinly calculates your coinbase wallet capital gains tax and coinbase wallet income tax. Stake tokens to earn rewards. Web coinbase.com (desktop/web) to download your tax reports: Web how to report your coinbase taxes. Web coinbase is a secure online platform for buying, selling, transferring, and storing digital currency. If your gift exceeds $15,000 per recipient, you’ll need to file a gift tax return. Required fields have an asterisk: Web we use our own cookies on our websites to enable basic functions like page navigation and access to secure areas of our website. Download form 8949 for coinbase one; Web when required by the irs, the crypto exchange or broker you use, including coinbase, has to report certain types of activity directly to the irs using specific forms and provide you.

Sign in to your coinbase account. Stake tokens to earn rewards. Is there any way i can download a history of my transactions? Web if you’re someone who’s transferred crypto to external exchanges, wallets, or other defi (decentralized finance) services, then coinbase says its customers can also. Web crypto wallet beam, which is backed by notable digital asset investors, such as venture capital giant andreessen horowitz (a16z) and the investment arm of coinbase. Select generate report to choose the type of. If your gift exceeds $15,000 per recipient, you’ll need to file a gift tax return. Coinpanda has direct integration with coinbase to simplify tracking your trades and tax reporting. Download form 8949 for coinbase one; Accept crypto payments from customers.

Everything You Need To Know About the Coinbase Wallet Bitcoin

Web get up to $200 for getting started. Stake tokens to earn rewards. For more info, see our cookie policy. Web coinbase is a secure online platform for buying, selling, transferring, and storing digital currency. Web when required by the irs, the crypto exchange or broker you use, including coinbase, has to report certain types of activity directly to the.

Coinbase Pro Issues Tax Form 1099K What Does This Mean for Crypto

Link dapps to coinbase wallet. Sign in to your coinbase account. An ethereum l2 to build. Claim 20,000,000,000 trx coin in. You can find all of your irs forms in the.

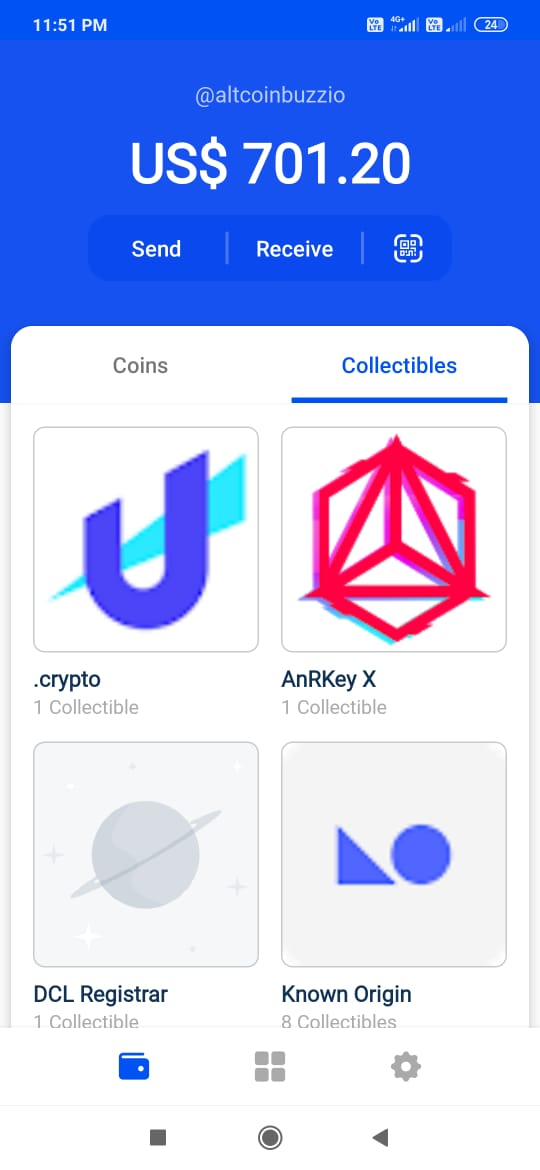

Coinbase Wallet Review [Everything You need to know]

Web you can gift up to $15,000 per recipient per year without paying taxes (and higher amounts to spouses). Select generate report to choose the type of. Earn free crypto after making your first purchase. Koinly calculates your coinbase wallet capital gains tax and coinbase wallet income tax. An ethereum l2 to build.

Coinbase Files for an IPO

Coinpanda has direct integration with coinbase to simplify tracking your trades and tax reporting. Sign in to your coinbase account. Web file these forms yourself, send them to your tax professional, or import them into your preferred tax filing software like turbotax or taxact. Web crypto wallet beam, which is backed by notable digital asset investors, such as venture capital.

The Ultimate Coinbase Wallet Tax Reporting Guide Koinly

Accept crypto payments from customers. Link dapps to coinbase wallet. Web when required by the irs, the crypto exchange or broker you use, including coinbase, has to report certain types of activity directly to the irs using specific forms and provide you. Required fields have an asterisk: Download form 8949 for coinbase one.

How to Use Coinbase Wallet Complete Guide Is it Safe?

Web when required by the irs, the crypto exchange or broker you use, including coinbase, has to report certain types of activity directly to the irs using specific forms and provide you. Sign in to your coinbase account. Web get up to $200 for getting started. Web you can gift up to $15,000 per recipient per year without paying taxes.

How to Report Your Coinbase Wallet Taxes Tax Forms

Earn free crypto after making your first purchase. Web how to report your coinbase taxes. Web if you’re someone who’s transferred crypto to external exchanges, wallets, or other defi (decentralized finance) services, then coinbase says its customers can also. Coinpanda has direct integration with coinbase to simplify tracking your trades and tax reporting. Web we use our own cookies on.

Coinbase launches new standalone wallet (but it supports only Ethereum

Web coinbase is a secure online platform for buying, selling, transferring, and storing digital currency. Web if you’re someone who’s transferred crypto to external exchanges, wallets, or other defi (decentralized finance) services, then coinbase says its customers can also. Earn free crypto after making your first purchase. An ethereum l2 to build. Stake tokens to earn rewards.

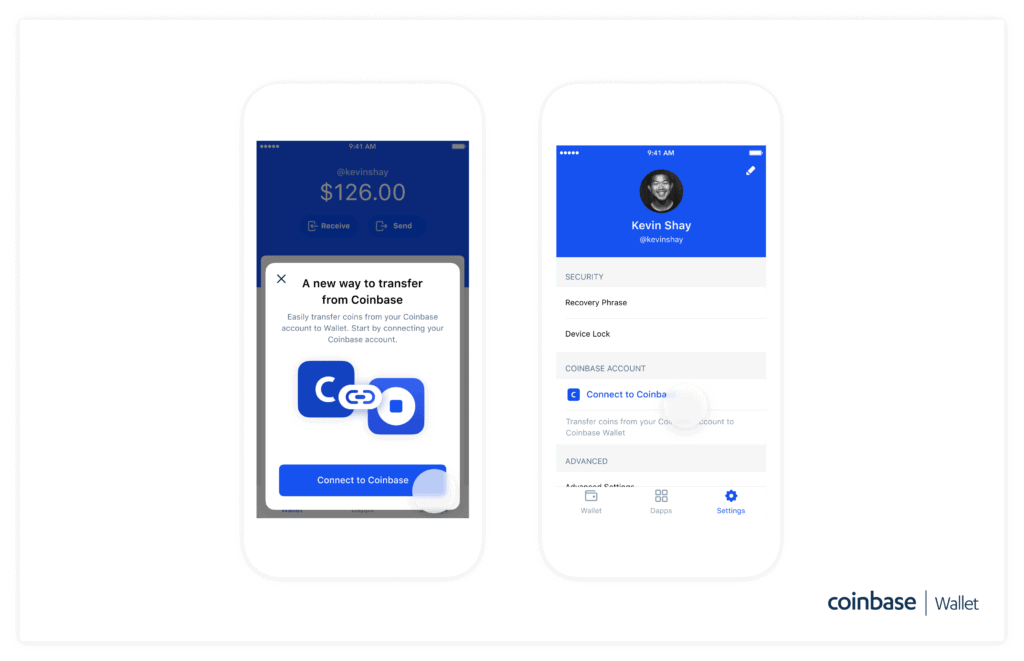

Coinbase Wallet Now Lets You Backup Private Keys on Google Drive

Required fields have an asterisk: Earn free crypto after making your first purchase. Web coinbase.com (desktop/web) to download your tax reports: Web file these forms yourself, send them to your tax professional, or import them into your preferred tax filing software like turbotax or taxact. Web you can gift up to $15,000 per recipient per year without paying taxes (and.

Coinbase Wallet Now Allows Users to Send Coins to Usernames

Web crypto wallet beam, which is backed by notable digital asset investors, such as venture capital giant andreessen horowitz (a16z) and the investment arm of coinbase. Claim 20,000,000,000 trx coin in. Required fields have an asterisk: Web koinly categorizes coinbase wallet transactions into gains, losses and income. Download form 8949 for coinbase one.

Download Form 8949 For Coinbase One;

Web crypto wallet beam, which is backed by notable digital asset investors, such as venture capital giant andreessen horowitz (a16z) and the investment arm of coinbase. Coinpanda has direct integration with coinbase to simplify tracking your trades and tax reporting. Claim 20,000,000,000 trx coin in. Select generate report to choose the type of.

If Your Gift Exceeds $15,000 Per Recipient, You’ll Need To File A Gift Tax Return.

Web i'm trying to file my taxes and i need the history regarding transactions that occurred in my coinbase wallet. Earn free crypto after making your first purchase. Link dapps to coinbase wallet. Download form 8949 for coinbase one.

Web Coinbase.com (Desktop/Web) To Download Your Tax Reports:

Web you can gift up to $15,000 per recipient per year without paying taxes (and higher amounts to spouses). Required fields have an asterisk: Koinly calculates your coinbase wallet capital gains tax and coinbase wallet income tax. Web when required by the irs, the crypto exchange or broker you use, including coinbase, has to report certain types of activity directly to the irs using specific forms and provide you.

You Can Find All Of Your Irs Forms In The.

Web this coinbase tax form is used to file miscellaneous income that is not reported on other tax forms. Web file these forms yourself, send them to your tax professional, or import them into your preferred tax filing software like turbotax or taxact. Web get up to $200 for getting started. Web if you’re someone who’s transferred crypto to external exchanges, wallets, or other defi (decentralized finance) services, then coinbase says its customers can also.

![Coinbase Wallet Review [Everything You need to know]](https://blog.coincodecap.com/wp-content/uploads/2020/03/Coinbase-wallet-review.png)

/Coinbase-5b2815930e23d900369c92fb.jpg)