Chapter 7 Bankruptcy Repossession

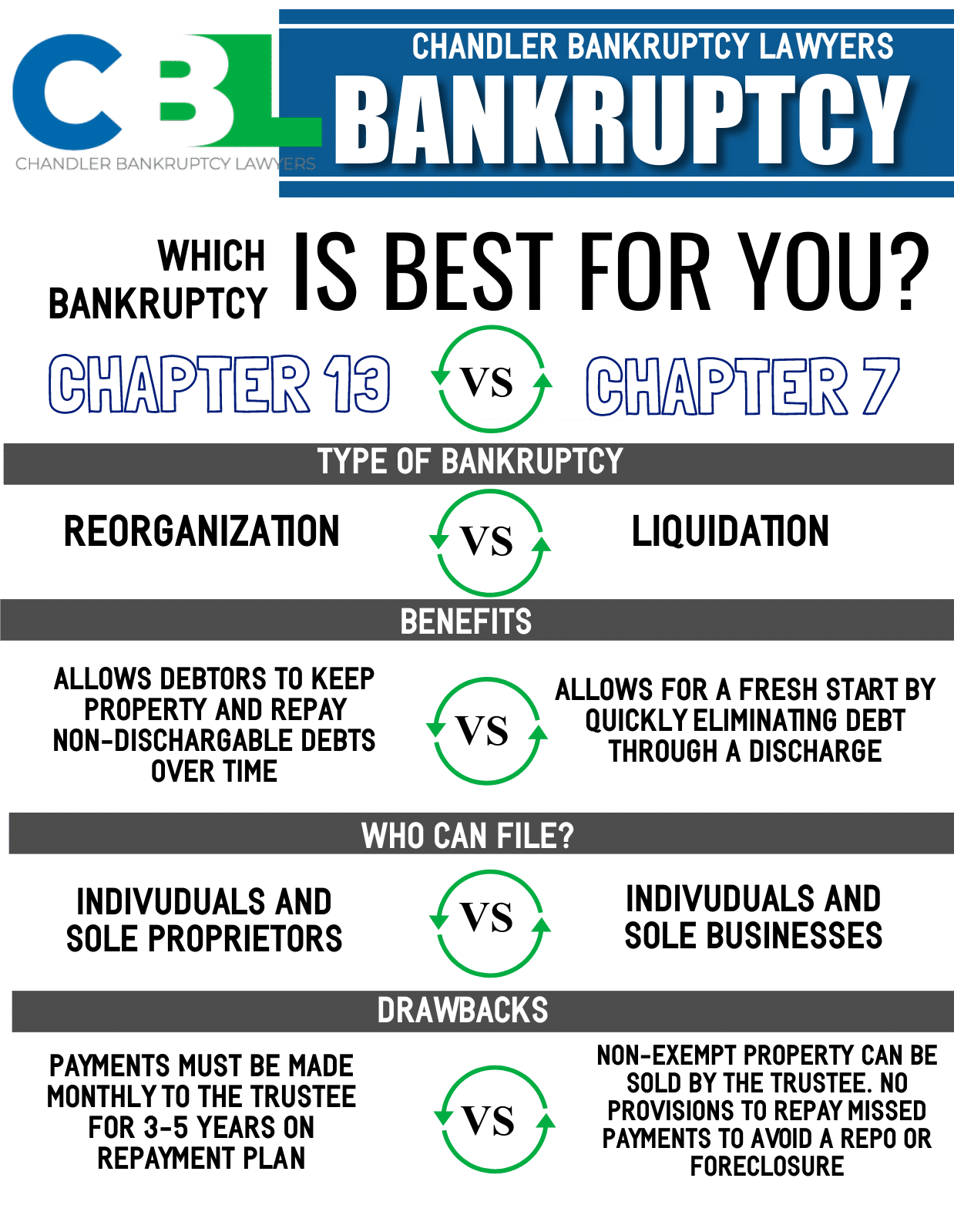

Chapter 7 Bankruptcy Repossession - Web chapter 7 refers to a “liquidation” bankruptcy and is designed for individuals and businesses in financial difficulty who do not have the ability to pay their existing debts. Web repossessions and chapter 7 bankruptcy unfortunately, having your car repossessed isn’t the end of the road on your car loan. Web (2) when filing the report of sale in a case under chapter 7, chapter 12, or chapter 13, notify the auditorauditor of the name and address of the bankruptcy trustee. Web chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. If your car has been repossessed, filing for chapter 7 bankruptcy may allow you more time to negotiate with your lender and get your car. When the lender hasn't repossessed your car yet if you're behind in your payments and file for bankruptcy… Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Ideally, you should file for bankruptcy before your. How a chapter 13 bankruptcy can help with a voluntary repossession;. Web bankruptcy could help you with voluntary repossession.

Web the basic steps in filing for bankruptcy include gathering all financial information and documentation, completing a credit counseling course, filling out bankruptcy forms, submitting the forms to the bankruptcy court, attending a meeting with creditors, and completing a financial management course. Vehicle repossession & chapter 7 bankruptcy reaffirmation agreements vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession. How a chapter 13 bankruptcy can help with a voluntary repossession;. However, it is vital to remember that an automatic stay typically only lasts for a few months. However, you'd likely be more successful filing for chapter 13 if you're behind on your car payments and want to keep your car. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in accordance with the provisions of the bankruptcy. If you wish to file for chapter 7 bankruptcy and keep your car, our kansas city car repossession attorneys. If the real property is located in another. When you file for chapter 7 bankruptcy in michigan, you have more options for recovering your vehicle. When the lender hasn't repossessed your car yet if you're behind in your payments and file for bankruptcy…

Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Ideally, you should file for bankruptcy before your. Web how chapter 7 bankruptcy can help get a repossessed car back here's what you can expect in chapter 7 bankruptcy. Web what if the car has already been sold at auction? Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in accordance with the provisions of the bankruptcy. Web the basic steps in filing for bankruptcy include gathering all financial information and documentation, completing a credit counseling course, filling out bankruptcy forms, submitting the forms to the bankruptcy court, attending a meeting with creditors, and completing a financial management course. How a chapter 7 bankruptcy can help with a voluntary repossession; Web car repossession & bankruptcy my car was repossessed. Learning how to file for chapter 7 bankruptcy. Vehicle repossession & chapter 7 bankruptcy reaffirmation agreements vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession.

Will a Chapter 7 Bankruptcy Prevent a Car Repossession? Smith, Barden

If the real property is located in another. If you wish to file for chapter 7 bankruptcy and keep your car, our kansas city car repossession attorneys. Learn how chapter 7 and chapter 13 bankruptcy can help you prevent a motor vehicle repossession, and how you might be able to get your car back if the repo. Web chapter 7.

Long Island Chapter 7 Bankruptcy Lawyer Macco Law Group

Web in order to repossess your car under chapter 7 bankruptcy, your creditor must get court approval first. Web bankruptcy could help you with voluntary repossession. Web chapter 7 bankruptcy can delay car repossession temporarily. However, some forms of debt, such as back taxes, court. Many americans owe more on their car than it is worth and their loan is.

Filing For Chapter 7 Bankruptcy Prevents Car Repossession?

Web car repossession & bankruptcy my car was repossessed. Web how chapter 7 bankruptcy can help get a repossessed car back here's what you can expect in chapter 7 bankruptcy. Web chapter 7 bankruptcy can delay car repossession temporarily. When you file for chapter 7 bankruptcy in michigan, you have more options for recovering your vehicle. Web chapter 7 bankruptcy.

Chapter 7 Bankruptcy Do you qualify, how to file

Many americans owe more on their car than it is worth and their loan is “underwater.” here’s what you need to know about vehicle repossession and how chapter 7 bankruptcy. Web repossessions and chapter 7 bankruptcy unfortunately, having your car repossessed isn’t the end of the road on your car loan. Instead, the bankruptcy trustee gathers and sells the debtor's.

Requirements for Chapter 7 Bankruptcy Cases Hurst Law Firm

Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web repossessions and chapter 7 bankruptcy unfortunately, having your car repossessed isn’t the end of the road on your car loan. Web chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt.

Do I Qualify for Chapter 7 Bankruptcy? Bankruptcy

How a chapter 13 bankruptcy can help with a voluntary repossession;. Learn how chapter 7 and chapter 13 bankruptcy can help you prevent a motor vehicle repossession, and how you might be able to get your car back if the repo. Web what if the car has already been sold at auction? Web a chapter 7 bankruptcy case does not.

CHAPTER 7 BANKRUPTCY Chandler Bankruptcy Lawyer Low Fees 1 BK Law

However, some forms of debt, such as back taxes, court. When you file for chapter 7 bankruptcy in michigan, you have more options for recovering your vehicle. Web your creditors can go to court and and receive an order that allows them to repossess your car. Web if your car is about to be repossessed, or it has just been.

Filing For Chapter 7 Bankruptcy Prevents Car Repossession?

If your car has been repossessed, filing for chapter 7 bankruptcy may allow you more time to negotiate with your lender and get your car. Learning how to file for chapter 7 bankruptcy. Web your creditors can go to court and and receive an order that allows them to repossess your car. Web car repossession & bankruptcy my car was.

Everything You Need to Know About Chapter 7 Bankruptcy Loan Lawyers

Web your creditors can go to court and and receive an order that allows them to repossess your car. If you wish to file for chapter 7 bankruptcy and keep your car, our kansas city car repossession attorneys. Web chapter 7 bankruptcy can delay car repossession temporarily. Many americans owe more on their car than it is worth and their.

Bankruptcy Chapter 7 Stock Photo Download Image Now Bankruptcy

However, some forms of debt, such as back taxes, court. Web chapter 7 bankruptcy can stop vehicle repossession. Web what if the car has already been sold at auction? Vehicle repossession & chapter 7 bankruptcy reaffirmation agreements vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession. Web the basic steps in.

However, You'd Likely Be More Successful Filing For Chapter 13 If You're Behind On Your Car Payments And Want To Keep Your Car.

Web the basic steps in filing for bankruptcy include gathering all financial information and documentation, completing a credit counseling course, filling out bankruptcy forms, submitting the forms to the bankruptcy court, attending a meeting with creditors, and completing a financial management course. Web in order to repossess your car under chapter 7 bankruptcy, your creditor must get court approval first. Learn how chapter 7 and chapter 13 bankruptcy can help you prevent a motor vehicle repossession, and how you might be able to get your car back if the repo. If your car has been repossessed, filing for chapter 7 bankruptcy may allow you more time to negotiate with your lender and get your car.

Web A Chapter 7 Bankruptcy Case Does Not Involve The Filing Of A Plan Of Repayment As In Chapter 13.

Web chapter 7 bankruptcy can stop vehicle repossession. If you wish to file for chapter 7 bankruptcy and keep your car, our kansas city car repossession attorneys. You may want to work with a legal aid organization if you aren’t comfortable filling out the chapter 7. Ideally, you should file for bankruptcy before your.

Vehicle Repossession & Chapter 7 Bankruptcy Reaffirmation Agreements Vehicle Repossession & Chapter 13 Bankruptcy If Your Car Is Still In Your Possession Let’s Summarize… Car Repossession.

How a chapter 13 bankruptcy can help with a voluntary repossession;. Web if approved, the court puts an automatic temporary stay in place that stops creditors from trying to collect payments or taking action such as wage garnishment, repossession, or foreclosure, while the bankruptcy case is pending. Web chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. Web bankruptcy could help you with voluntary repossession.

Instead, The Bankruptcy Trustee Gathers And Sells The Debtor's Nonexempt Assets And Uses The Proceeds Of Such Assets To Pay Holders Of Claims (Creditors) In Accordance With The Provisions Of The Bankruptcy.

However, it is vital to remember that an automatic stay typically only lasts for a few months. Web chapter 7 bankruptcy can delay car repossession temporarily. Web if your car is about to be repossessed, or it has just been repossessed, bankruptcy can help. Web what if the car has already been sold at auction?