Chapter 13 With No Disposable Income

Chapter 13 With No Disposable Income - See irm 5.9.10, processing chapter 13. Chapter 13 is available only to individuals (wage earners and sole proprietors) with regular income. In this case, you can rope in debts that normally would not apply in chapter 7, and you also have the court’s protection while. Here is what is considers specifically: You don't have to be employed to file a chapter 13 bankruptcy, but you do have to show you're capable of making those monthly payments to your trustee. Web form 22c is the sheet used to calculate your disposable income for chapter 13 purposes. The amount that remains after deducting expenses is your monthly disposable income. Web statement of the u.s. Web the zero percent plan in chapter 13 bankruptcy is where all of your payments are being made to get you out of default with secured creditors (like mortgage companies), or else, going to help you get. If you think you can do it, then just craft a budget on schedule j that shows $550.

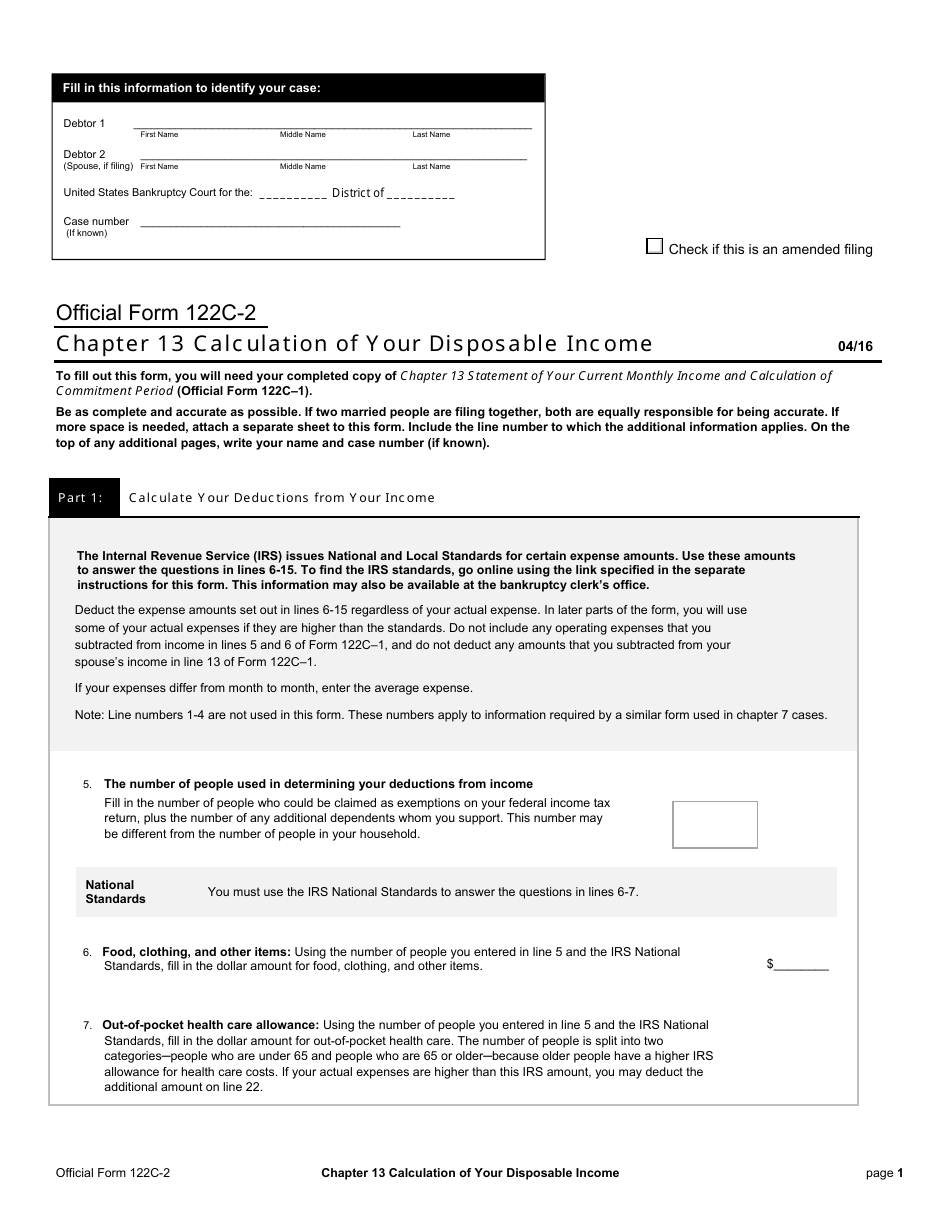

You don't have to be employed to file a chapter 13 bankruptcy, but you do have to show you're capable of making those monthly payments to your trustee. Chapter 13 is designed to serve as a flexible vehicle for the repayment of part or all of the allowed claims of the debtor. He said on the means test my income is over median and my disposable income… If you think you can do it, then just craft a budget on schedule j that shows $550. Simply put, “disposable income” is “current monthly income. Your disposable income first goes to your secured and priority. Web form 22c is the sheet used to calculate your disposable income for chapter 13 purposes. Web do i qualify for chapter 13 if i have negative disposable income on the means test? Web in a chapter 13 matter, you'll fill out the chapter 13 calculation of your disposable income form. Bankruptcy law does chapter 13 take all disposable income?

To qualify for chapter 13, you will have to show the bankruptcy court that you will have enough income after subtracting certain allowed expenses and required. Web in chapter 13, your plan payments must pay that $30,000 over 36 or 60 months. Web in a chapter 13 matter, you'll fill out the chapter 13 calculation of your disposable income form. In this case, you can rope in debts that normally would not apply in chapter 7, and you also have the court’s protection while. Section 1322 emphasizes that purpose by fixing a minimum of. Your last six months of income divided by six to get average. Web you must have sufficient disposable income. Web form 22c is the sheet used to calculate your disposable income for chapter 13 purposes. See irm 5.9.10, processing chapter 13. Chapter 13 is designed to serve as a flexible vehicle for the repayment of part or all of the allowed claims of the debtor.

How much disposable do you have each month?

Attorney told me i have to file a chapter 13. Web statement of the u.s. With a trustee fee of 10%, you would need to pay roughly $550 per month in the chapter 13 for 60 months. You don't have to be employed to file a chapter 13 bankruptcy, but you do have to show you're capable of making those.

shobhadesignexpert Llc Bankruptcy Chapter 7

Michael anderson february 10, 2021 before the court will confirm your chapter 13. Web the zero percent plan in chapter 13 bankruptcy is where all of your payments are being made to get you out of default with secured creditors (like mortgage companies), or else, going to help you get. See irm 5.9.10, processing chapter 13. The amount that remains.

Official Form 122C2 Download Fillable PDF or Fill Online Chapter 13

In this case, you can rope in debts that normally would not apply in chapter 7, and you also have the court’s protection while. Chapter 13 is available only to individuals (wage earners and sole proprietors) with regular income. If you think you can do it, then just craft a budget on schedule j that shows $550. Michael anderson february.

Disposable Personal U.S. Bureau of Economic Analysis (BEA)

Web does chapter 13 take all disposable income? Web chapter 13 calculation of your disposable income. Bankruptcy law does chapter 13 take all disposable income? Your disposable income first goes to your secured and priority. See irm 5.9.10, processing chapter 13.

How to Quest Smart Ways to Utilize Your Disposable

Web in chapter 13, your plan payments must pay that $30,000 over 36 or 60 months. Here is what is considers specifically: Web chapter 13 calculation of your disposable income. Chapter 13 is available only to individuals (wage earners and sole proprietors) with regular income. If you think you can do it, then just craft a budget on schedule j.

Disposable Apa Itu Dan Bagaimana Cara Menghitungnya?

Web chapter 13 calculation of your disposable income. Web in a chapter 13 matter, you'll fill out the chapter 13 calculation of your disposable income form. If you think you can do it, then just craft a budget on schedule j that shows $550. Web instead, it appears in section 1325 (b) (2), which concerns many of the important details.

10 Disposable Items You Can Live Without The No Drama Mama

He said on the means test my income is over median and my disposable income… Web in chapter 13 bankruptcy, you must devote all of your disposable income to the repayment of your debts over the life of your chapter 13 plan. Web you must have sufficient disposable income. Your last six months of income divided by six to get.

5 Ways to Manage Your Disposable The Money Shed

Web does chapter 13 take all disposable income? Bankruptcy law does chapter 13 take all disposable income? Web form 22c is the sheet used to calculate your disposable income for chapter 13 purposes. Web this chapter is not available to corporations, limited liability companies (llcs), or partnerships. Attorney told me i have to file a chapter 13.

Households With The Least Disposable Suffer dg mutual

For most people, this requires regular income. Web this chapter is not available to corporations, limited liability companies (llcs), or partnerships. Web in chapter 13, your plan payments must pay that $30,000 over 36 or 60 months. Your disposable income first goes to your secured and priority. Web you must have sufficient disposable income.

Difference Between Personal and Personal Disposable

To qualify for chapter 13, you will have to show the bankruptcy court that you will have enough income after subtracting certain allowed expenses and required. Web instead, it appears in section 1325 (b) (2), which concerns many of the important details of the chapter 13 repayment plan the debtor must propose. Bankruptcy law does chapter 13 take all disposable.

Chapter 13 Is Available Only To Individuals (Wage Earners And Sole Proprietors) With Regular Income.

Section 1322 emphasizes that purpose by fixing a minimum of. Bankruptcy law does chapter 13 take all disposable income? Michael anderson february 10, 2021 before the court will confirm your chapter 13. For most people, this requires regular income.

Web Statement Of The U.s.

He said on the means test my income is over median and my disposable income… Simply put, “disposable income” is “current monthly income. Your last six months of income divided by six to get average. Web chapter 13 calculation of your disposable income.

Web Instead, It Appears In Section 1325 (B) (2), Which Concerns Many Of The Important Details Of The Chapter 13 Repayment Plan The Debtor Must Propose.

Web in chapter 13, disposable income is income (other than child support payments received by the debtor) less amounts reasonably necessary for the maintenance or support of the debtor or dependents and less charitable contributions up to 15% of the debtor's gross income. Attorney told me i have to file a chapter 13. In this case, you can rope in debts that normally would not apply in chapter 7, and you also have the court’s protection while. To qualify for chapter 13, you will have to show the bankruptcy court that you will have enough income after subtracting certain allowed expenses and required.

Web In A Chapter 13 Matter, You'll Fill Out The Chapter 13 Calculation Of Your Disposable Income Form.

Web this chapter is not available to corporations, limited liability companies (llcs), or partnerships. Web in determining how much you have available to pay your debts for purposes of a chapter 13 filing, the courts will apply living standards specified under irs national and local standards to determine what is. Web in chapter 13, your plan payments must pay that $30,000 over 36 or 60 months. See irm 5.9.10, processing chapter 13.

/184333739-F-56a0671d3df78cafdaa16be9.jpg)