Chapter 13 Secured Debt

Chapter 13 Secured Debt - Debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. The quick rule is that a. Web here's how chapter 13 bankruptcy generally works: What you'll have to pay will depend on whether the claim is a: Secured debts are treated differently than unsecured debts. Web in chapter 13 bankruptcy, you'll divide debt into secured debt, priority unsecured debt, and general unsecured debt. Debtors typically are able to keep property classified as secured debt. Web in order to be eligible to file for bankruptcy protection under chapter 13 of the bankruptcy code, the amount of secured debt that an individual debtor can have is limited. Apply today for financial freedom! Chapter 13 plans are often used to cure arrearages on a mortgage, avoid underwater junior mortgages or other liens, pay back taxes over time, or partially repay general unsecured debt.

Debtors typically are able to keep property classified as secured debt. Web in chapter 13 bankruptcy, you'll divide debt into secured debt, priority unsecured debt, and general unsecured debt. It's more likely that a chapter 13 debtor will have a problem with the secured debt limit than the limit on unsecured debt, and here's why. You'll find both lists below. Mortgages, automobile loans, and home equity loans or lines of credit. If it seems like your debts are too high, you might still qualify for chapter 13… Web here's how chapter 13 bankruptcy generally works: Web a chapter 13 plan may provide for the four general categories of debt: Ad combine credit card debts, high interest loans, and other bills to low monthly payment. Web secured and unsecured debt in chapter 13 when you're filling out your bankruptcy paperwork, you'll want to know how to divide your debts into unsecured and secured categories.

Web in order to be eligible to file for bankruptcy protection under chapter 13 of the bankruptcy code, the amount of secured debt that an individual debtor can have is limited. How much you pay on a given debt depends on a number of factors. Web what debt is forgiven in chapter 13 bankruptcy? • $1,257,850 in secured debts; Web chapter 13 bankruptcy allows you to catch up on missed mortgage or car loan payments and restructure your debts through a repayment plan. Web secured debts include: Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. Web the court deems the aggregate amount of $525.00 as reasonable compensation (and the secured creditor may file a single flat fee rule 3002.1 notice of such amount) for chapter 13 secured. Check if you qualify for debt relief. Apply today for financial freedom!

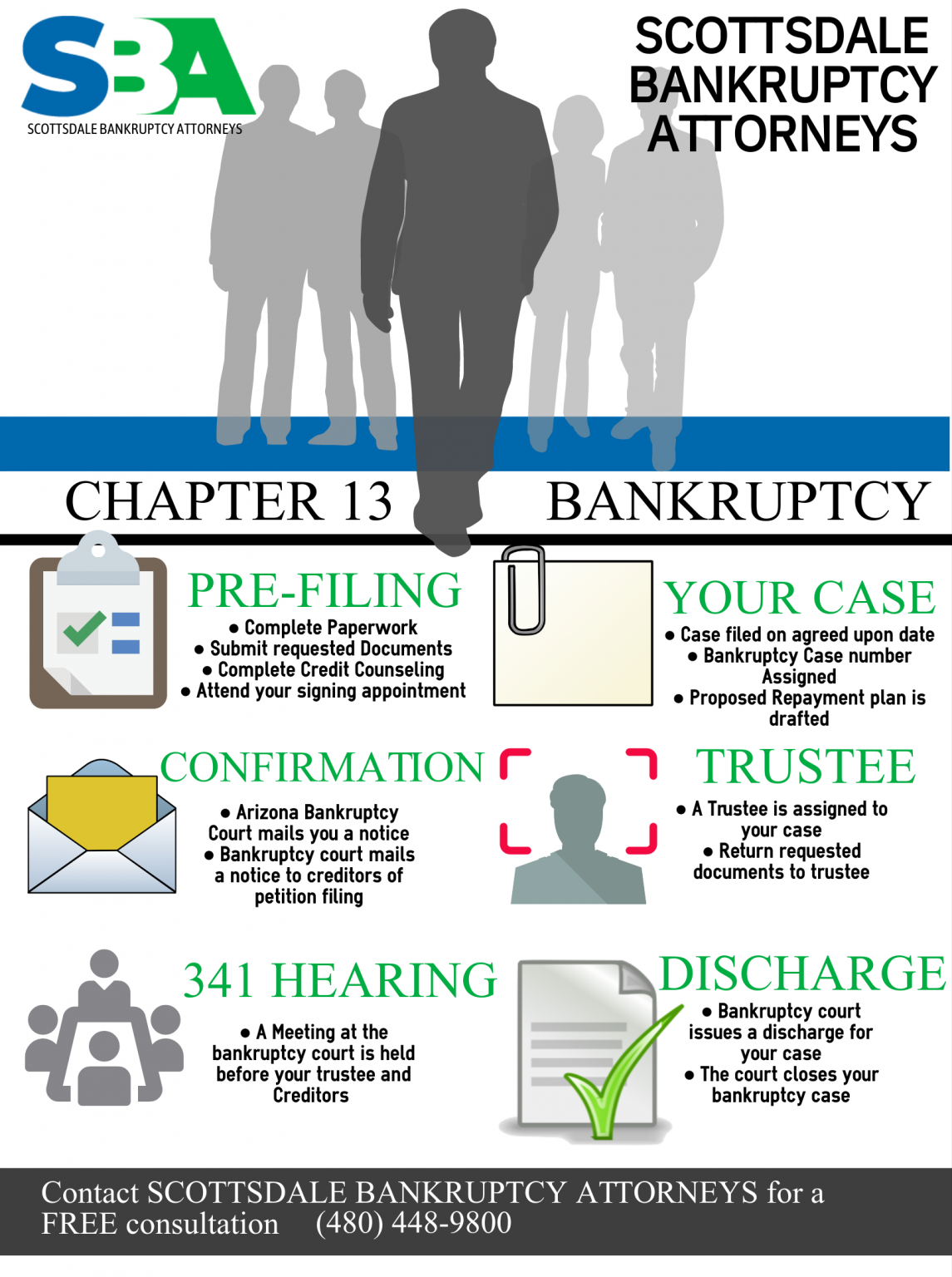

Chapter 13 Bankruptcy Allows you to consolidate all of your personal

Read on to learn more about which debts can be discharged in chapter 13. How much you pay on a given debt depends on a number of factors. The debt limit is $1,257,850 (the. Debtors typically are able to keep property classified as secured debt. If it seems like your debts are too high, you might still qualify for chapter.

Services CT Bankruptcy Attorneys

Web in order to be eligible to file for bankruptcy protection under chapter 13 of the bankruptcy code, the amount of secured debt that an individual debtor can have is limited. If it seems like your debts are too high, you might still qualify for chapter 13… Web here's how chapter 13 bankruptcy generally works: Web what debt is forgiven.

The Pros and Cons of Secured Debt In Newsweekly

This is an increase of more than $25,000, about the same amount of increase announced in 2019 for unsecured debt. And, • $419,275 in unsecured debts. If it seems like your debts are too high, you might still qualify for chapter 13… Secured debts are treated differently than unsecured debts. Web by cara o'neill, attorney.

Secured and Unsecured Debt Limitations Under Chapter 13

• $1,257,850 in secured debts; The quick rule is that a. Web as of april 1, 2022: The debtor must resume regular mortgage payments directly to the mortgage lender and remain current. Web chapter 13 bankruptcy allows you to catch up on missed mortgage or car loan payments and restructure your debts through a repayment plan.

What Is Chapter 13 Bankruptcy? Experian

It's more likely that a chapter 13 debtor will have a problem with the secured debt limit than the limit on unsecured debt, and here's why. Web in chapter 13 bankruptcy, you'll divide debt into secured debt, priority unsecured debt, and general unsecured debt. Mortgages, automobile loans, and home equity loans or lines of credit. Debts—or claims as they're called.

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

It's more likely that a chapter 13 debtor will have a problem with the secured debt limit than the limit on unsecured debt, and here's why. Ad combine credit card debts, high interest loans, and other bills to low monthly payment. Web secured debt limit: Any debt that you can erase in chapter 7, you can wipe out in chapter.

Chapter 13 Bankruptcy Better Debt Consolidation AV Bankruptcy

It's more likely that a chapter 13 debtor will have a problem with the secured debt limit than the limit on unsecured debt, and here's why. The debtor must resume regular mortgage payments directly to the mortgage lender and remain current. You keep your property and repay some or all of your debts through a repayment plan which lasts for.

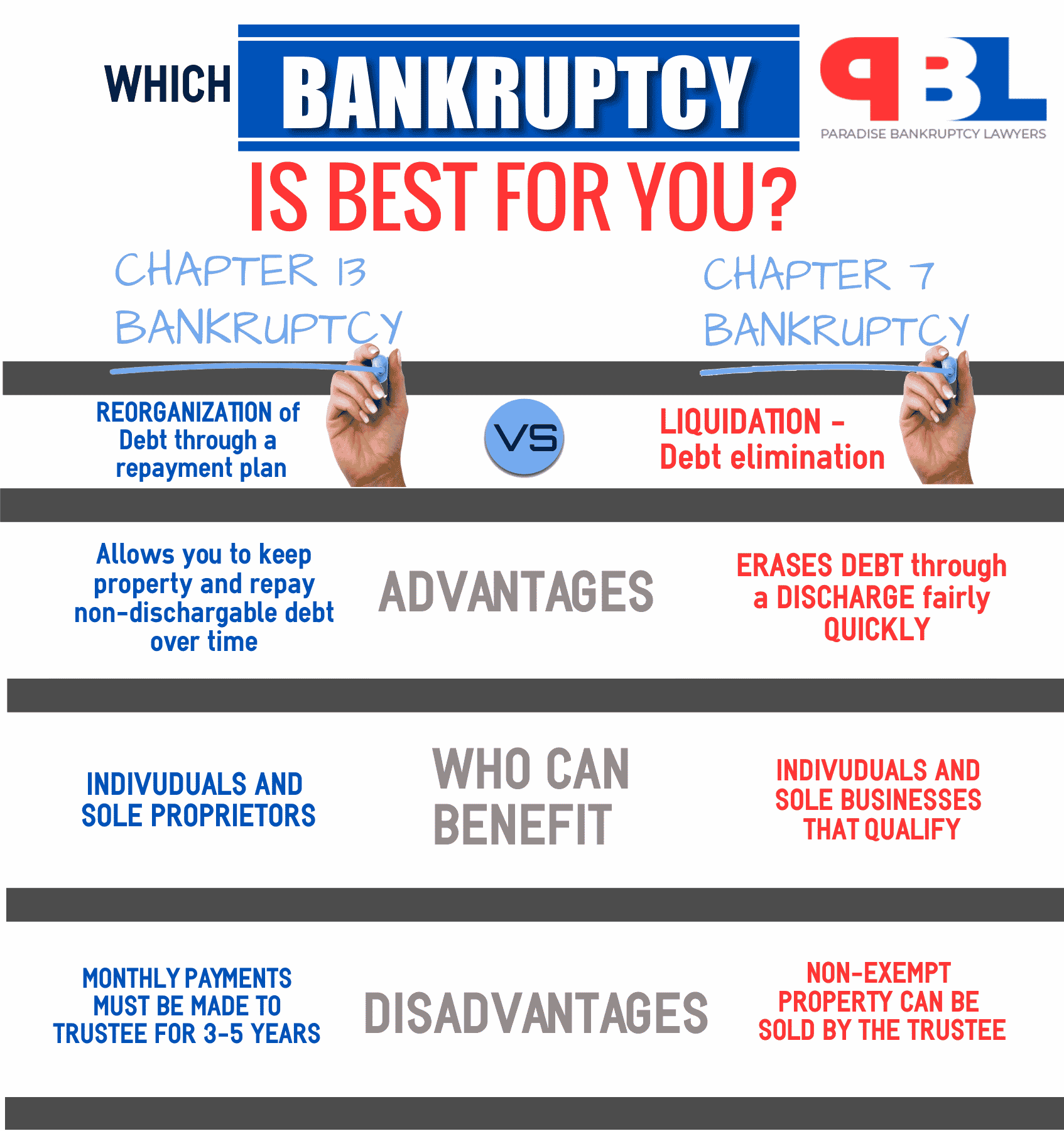

Paradise, NV Debt Relief Attorney Chapter 13 Bankruptcy, 7026053306

As of april 1, 2019, chapter 13 debt limits are: Ad combine credit card debts, high interest loans, and other bills to low monthly payment. Web as of april 1, 2022: Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no.

Chapter 13 Bankruptcy A Different Way to Deal with Debt Pruvent PLLC

Web secured debts in chapter 13: Ad compare online the best debt consolidators. Web a chapter 13 plan may provide for the four general categories of debt: Debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. Ad combine credit card debts, high interest loans, and other bills to low monthly payment.

What Does Chapter 13 Bankruptcy Do With The Debt I Owe? iBankruptcy

• $1,257,850 in secured debts; Web the court deems the aggregate amount of $525.00 as reasonable compensation (and the secured creditor may file a single flat fee rule 3002.1 notice of such amount) for chapter 13 secured. You keep your property and repay some or all of your debts through a repayment plan which lasts for three or five years..

Debts—Or Claims As They're Called In Bankruptcy—Aren't All Paid In The Same Way In A Chapter 13 Case.

Ad compare online the best debt consolidators. This is an increase of more than $25,000, about the same amount of increase announced in 2019 for unsecured debt. Web you are eligible to file for chapter 13 relief if your total secured and unsecured debts total less than $2,750,000 at the time you file. Web as of april 1, 2022:

Secured Debts Are Treated Differently Than Unsecured Debts.

Web secured and unsecured debt in chapter 13 when you're filling out your bankruptcy paperwork, you'll want to know how to divide your debts into unsecured and secured categories. Web a chapter 13 plan may provide for the four general categories of debt: Check if you qualify for debt relief. Debtors typically are able to keep property classified as secured debt.

Chapter 13 Plans Are Often Used To Cure Arrearages On A Mortgage, Avoid Underwater Junior Mortgages Or Other Liens, Pay Back Taxes Over Time, Or Partially Repay General Unsecured Debt.

It's more likely that a chapter 13 debtor will have a problem with the secured debt limit than the limit on unsecured debt, and here's why. You keep your property and repay some or all of your debts through a repayment plan which lasts for three or five years. Ad compare online the best debt consolidators. For instance, you'll pay all of your priority debt —such as support obligations and most tax debt—in your chapter 13.

Web To Qualify For Chapter 13 Bankruptcy, You Must Have Less Than $1,395,875 In Secured Debt For Cases Filed Between April 1, 2022, And March 31, 2025.

The quick rule is that a. How much you must pay for each type of debt differs. Web secured debts in chapter 13: Web secured debts include: