Calsavers Exemption Form

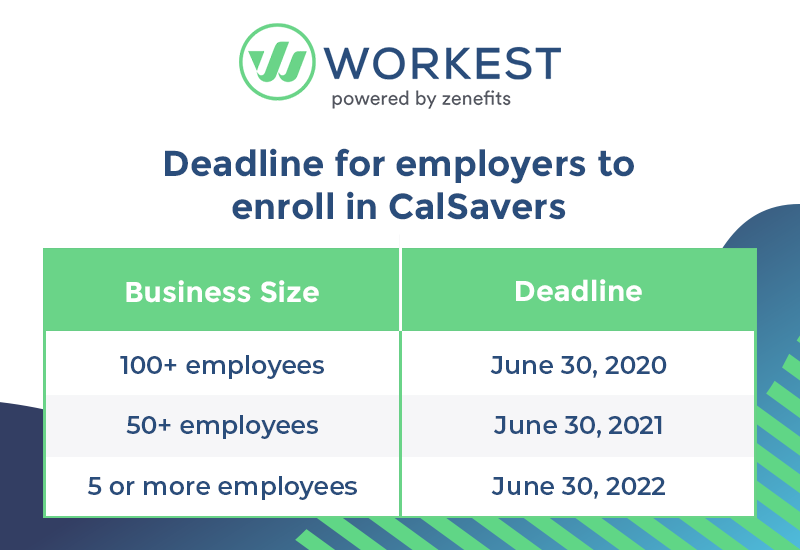

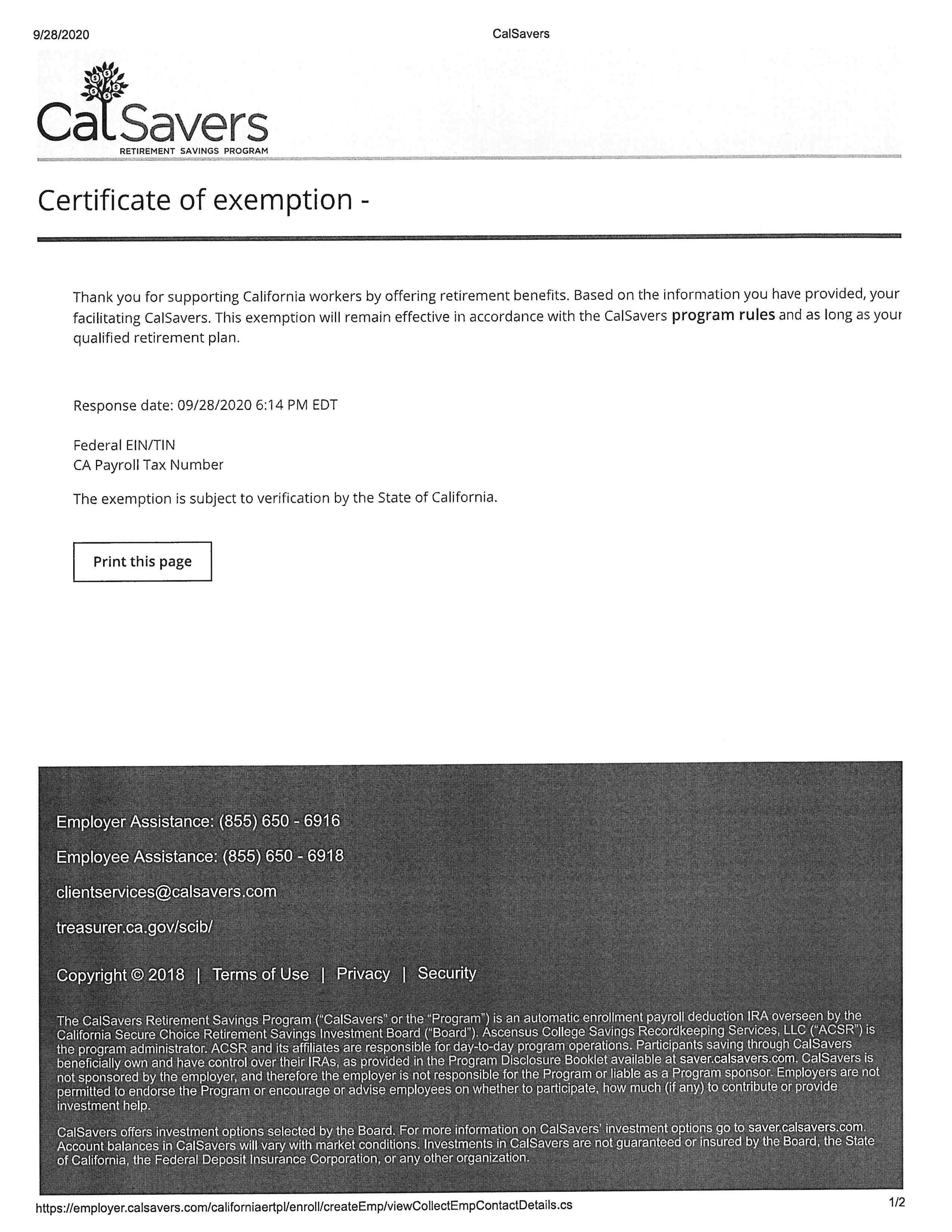

Calsavers Exemption Form - Web businesses of more than 100 employees have until september 30, 2020 to register or file their exemption if they already sponsor a 401 (k) plan. Identify the correct form for you. This program gives employers an easy way to. Web calsavers | employer information By signing below, i agree to the application process; Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution limits set by the. Calsavers is california’s retirement savings program designed for the millions of californians who lack a way to save for retirement at. If you believe your company is exempt from the mandate, submit an. You may need to send a communication and formal documentation supporting your exemption request to the calsavers program. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc.

Web businesses of more than 100 employees have until september 30, 2020 to register or file their exemption if they already sponsor a 401 (k) plan. Web employers will start receiving their official registration information by us mail and email in the spring. Web calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Employer registration or exemption process. If you believe your company is exempt from the mandate, submit an. Web united states tax exemption form. Enter your federal ein/tin and calsavers access code so that we can locate your company record. I agree that all of the. Web if you are requesting an exemption: By signing below, i agree to the application process;

If you believe your company is exempt from the mandate, submit an. Businesses who fail to comply. Web employers will start receiving their official registration information by us mail and email in the spring. Web calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Web “exempt employer” means an employer that (i) has zero employees, as determined under the methodology described in section 10001(a), has one or more employees, but does. Identify the correct form for you. Employer registration or exemption process. Enter your federal ein/tin and calsavers access code so that we can locate your company record. By signing below, i agree to the application process; Employers known to be exempt based on public data (form 5500) accessed via the.

CalSavers.... What You Should Know The Ryding Company

Web employers will start receiving their official registration information by us mail and email in the spring. Web calsavers | employer information I agree that all of the. United states tax exemption form. Identify the correct form for you.

Don't Have Retirement Savings? Statesponsored Plans Are Stepping In

Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution limits set by the. If you change your mind, you can opt back in at any time. Web calsavers | employer information United states tax exemption form. Calsavers is california’s retirement savings program designed for the millions of californians who lack a.

All About CalSavers Exemptions Hourly, Inc.

United states tax exemption form. Web businesses of more than 100 employees have until september 30, 2020 to register or file their exemption if they already sponsor a 401 (k) plan. Enter your federal ein/tin and calsavers access code so that we can locate your company record. If you believe your company is exempt from the mandate, submit an. Calsavers.

CalSavers Additional Information Bandy and Associates

Web united states tax exemption form. Web go to calculator how much can i contribute? This program gives employers an easy way to. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. Businesses who fail to comply.

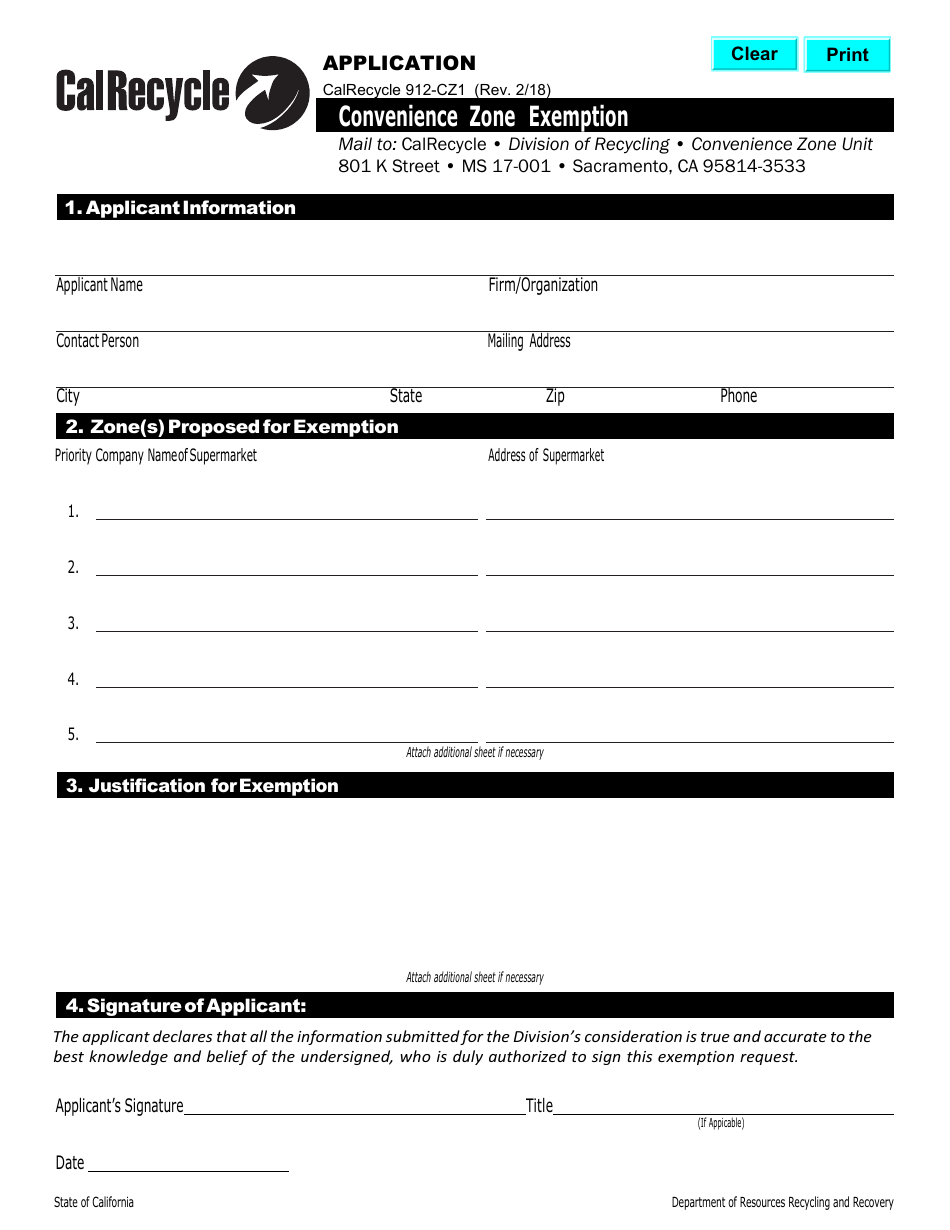

Form CalRecycle912CZ1 Download Printable PDF or Fill Online

Web if you are requesting an exemption: Identify the correct form for you. Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution limits set by the. Web employees that want to claim exempt from minnesota income tax must use the following form: Web calsavers is a retirement savings program for private.

Medical Exemption Form Arizona Free Download

Calsavers is california’s retirement savings program designed for the millions of californians who lack a way to save for retirement at. Web calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. I agree that all of the. Web businesses of more than 100 employees have until september 30, 2020 to register.

401k Opt Out Form Template Fill Online, Printable, Fillable, Blank

Web begin company registration or request an exemption. Web employers will start receiving their official registration information by us mail and email in the spring. United states tax exemption form. By signing below, i agree to the application process; Web businesses of more than 100 employees have until september 30, 2020 to register or file their exemption if they already.

Workmans Comp Exemption Form Florida Universal Network

Web calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. If you believe your company is exempt from the mandate, submit an. Web “exempt employer” means an employer that (i) has zero employees, as determined under the methodology described in section 10001(a), has one or more employees, but does. Employer registration.

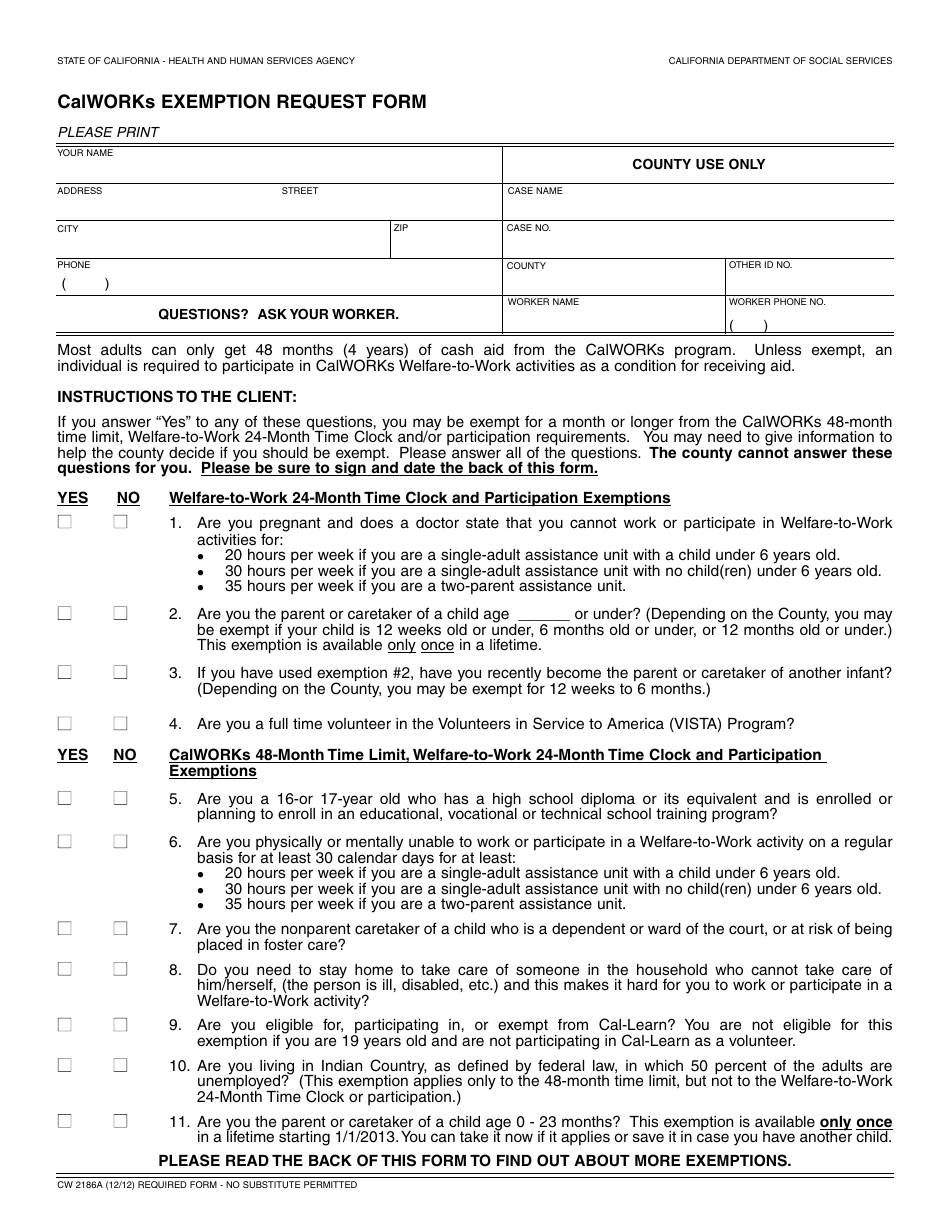

Form CW2186A Download Fillable PDF or Fill Online Calworks Exemption

Web employees that want to claim exempt from minnesota income tax must use the following form: Web “exempt employer” means an employer that (i) has zero employees, as determined under the methodology described in section 10001(a), has one or more employees, but does. I agree that all of the. If you change your mind, you can opt back in at.

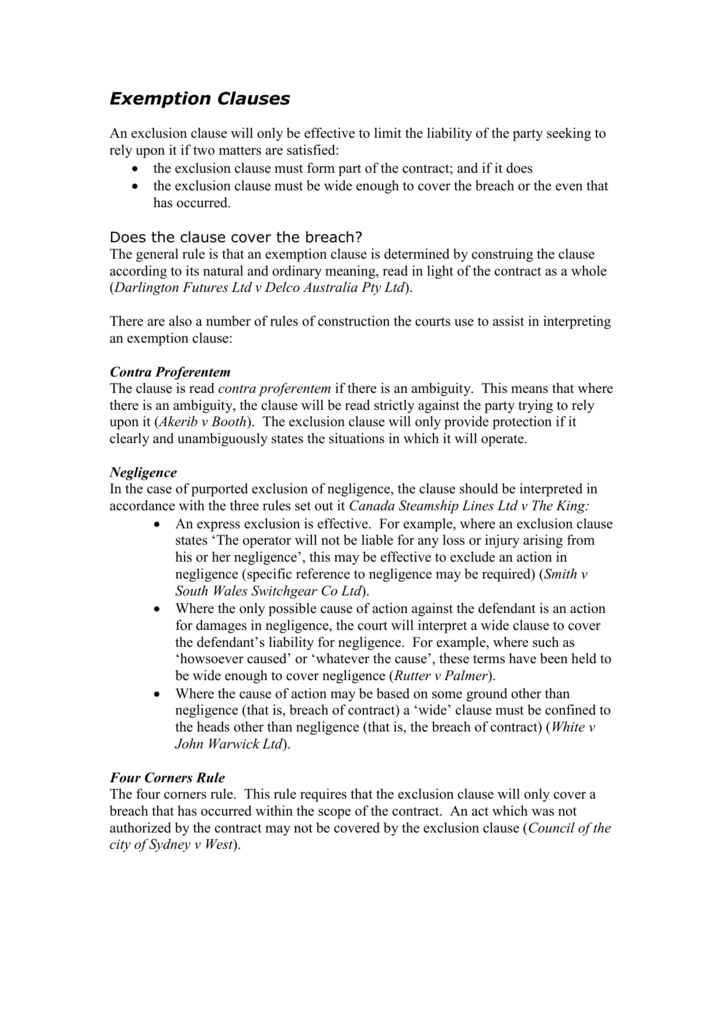

Exemption Clauses

Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. Web “exempt employer” means an employer that (i) has zero employees, as determined under the methodology described in section 10001(a), has one or more employees, but does. This program gives employers an easy way to. Businesses who fail to comply. Enter your federal ein/tin.

Because Your Calsavers Account Is A Roth Ira, Your Savings Amount Must Be Within The Roth Ira Contribution Limits Set By The.

By signing below, i agree to the application process; Enter your federal ein/tin and calsavers access code so that we can locate your company record. Web businesses of more than 100 employees have until september 30, 2020 to register or file their exemption if they already sponsor a 401 (k) plan. Web employers will start receiving their official registration information by us mail and email in the spring.

I Agree That All Of The.

Calsavers is california’s retirement savings program designed for the millions of californians who lack a way to save for retirement at. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. Businesses who fail to comply. Web begin company registration or request an exemption.

Web Go To Calculator How Much Can I Contribute?

Web united states tax exemption form. United states tax exemption form. Employers known to be exempt based on public data (form 5500) accessed via the. Identify the correct form for you.

Web If You Are Requesting An Exemption:

Web “exempt employer” means an employer that (i) has zero employees, as determined under the methodology described in section 10001(a), has one or more employees, but does. If you believe your company is exempt from the mandate, submit an. This program gives employers an easy way to. Employer registration or exemption process.