California Homestead Exemption 2021 Form

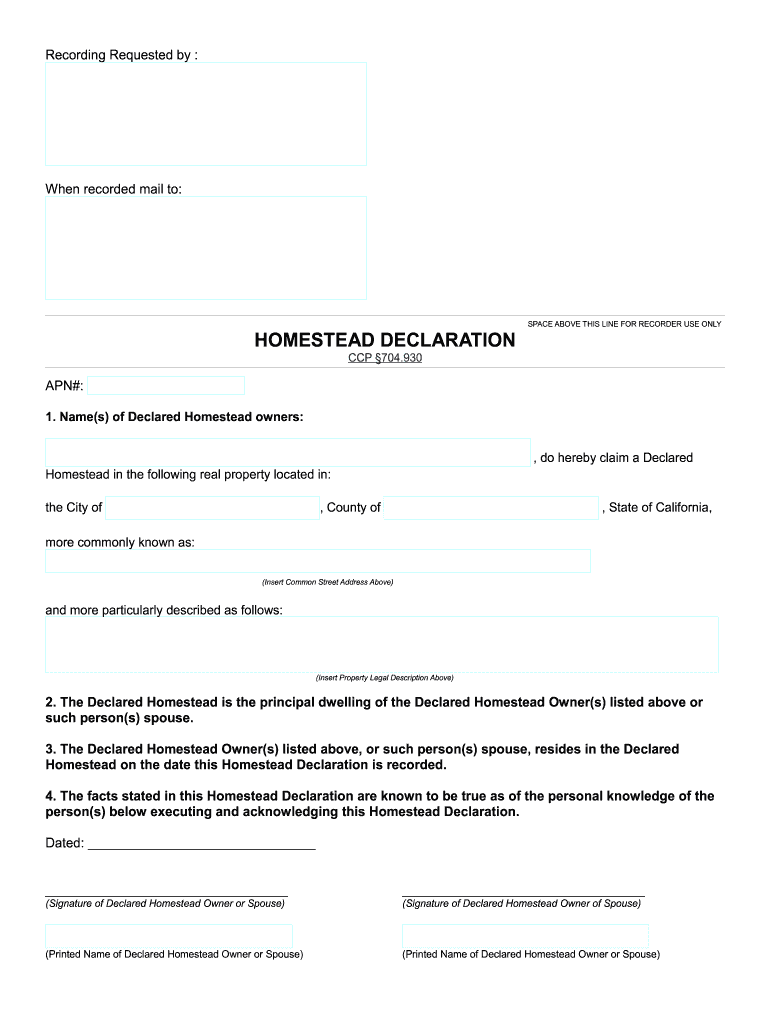

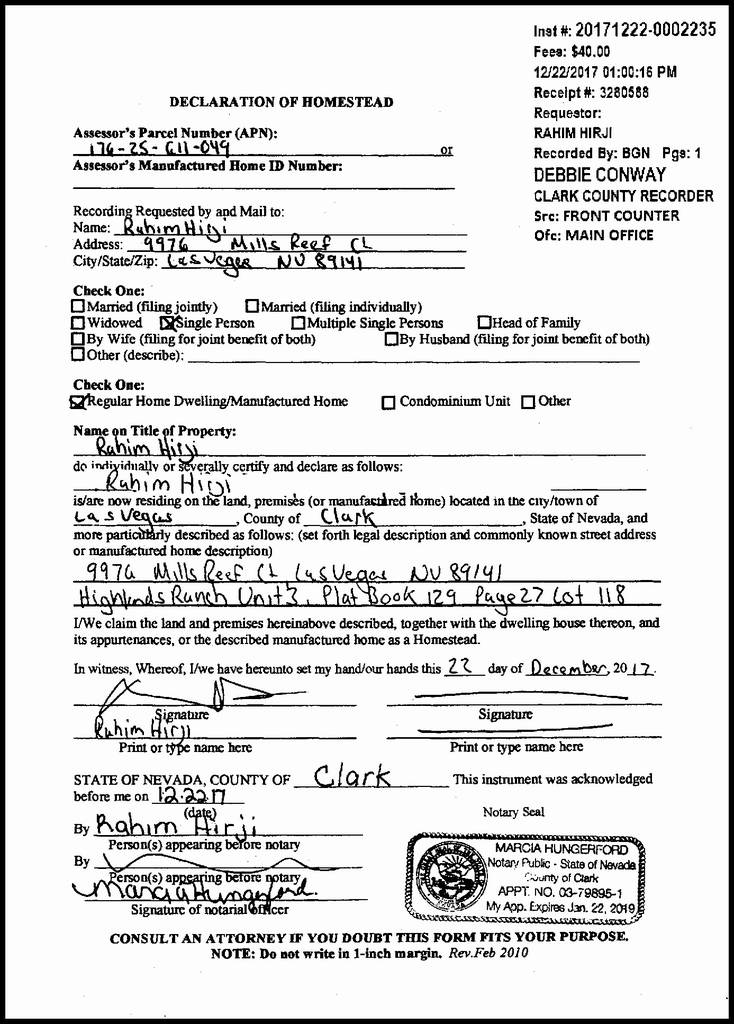

California Homestead Exemption 2021 Form - A person filing for the first time on a property may file anytime. Homestead documents must be in a format that the. Currently, partial equity in a home in california is exempt from being used to pay a judgment lien on the. Web all you have to do to declare a dwelling as a homestead is to fill out a declaration form, available online, including from california law library websites. Web as of january 1, 2021, the california homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the. Say hello to california's new homestead exemption. Web california homestead exemption increases in 2021 on september 15, 2020, california governor gavin newsom signed assembly bill 1885 into law, effectively increasing the. While the rules for homestead exemptions vary by state, here in california, we recently had. Or the median sale price for a single family. Determine if you are filing as an individual or as spouses.

31, 2020 $75,000 to $175,000 california homestead exemption assembly bill 1885 on september 15, 2020,. Homestead documents must be in a format that the. Say hello to california's new homestead exemption. & more fillable forms, register and subscribe now! Web california assembly bill ab1885 increases the homestead exemption to a minimum of $300,000 and a maximum of $600,000 depending on median county home. Web evaluate if you qualify for a homestead exemption. Web california homestead exemption increases in 2021 on september 15, 2020, california governor gavin newsom signed assembly bill 1885 into law, effectively increasing the. Web up to 25% cash back in california's system 1, homeowners can exempt up to $600,000 of equity in a house. & more fillable forms, register and subscribe now! Currently, partial equity in a home in california is exempt from being used to pay a judgment lien on the.

Web prior to january of 2021, the homestead exemptions in california were $75,000 for single persons, $100,000 for a “family unit” (married and/or with. 1, 2021 $300,000 to $600,000 up to dec. Web all you have to do to declare a dwelling as a homestead is to fill out a declaration form, available online, including from california law library websites. While the rules for homestead exemptions vary by state, here in california, we recently had. & more fillable forms, register and subscribe now! Web currently, the california homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. In california's system 2, homeowners can exempt up to $31,950 of home. Now, the exemption amount varies. A positive change for debtors a very significant law change for. Web california homestead exemption increases in 2021 on september 15, 2020, california governor gavin newsom signed assembly bill 1885 into law, effectively increasing the.

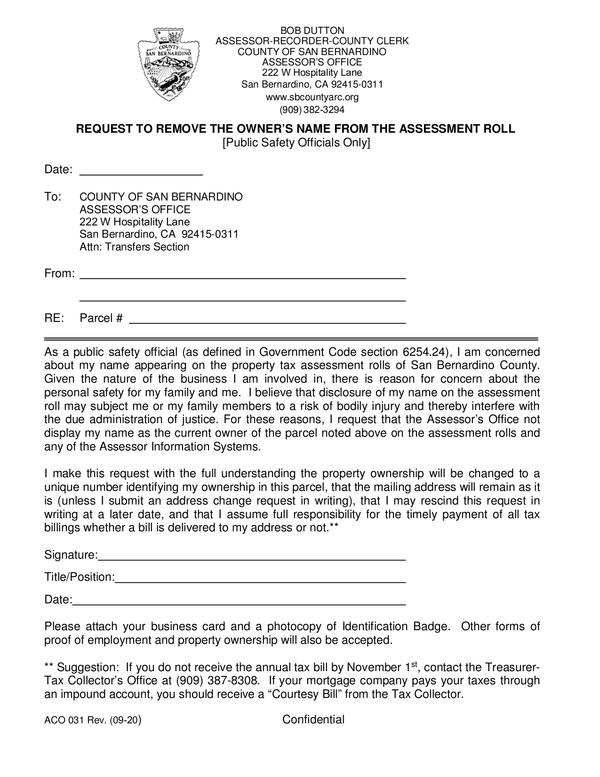

California Homestead Exemption Form San Bernardino County

Web one of the most important protections is the homestead exemption. Web as of january 1, 2021, the california homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the. A person filing for the first time on a property may file anytime. Web up to 25%.

Protect Your Home from a Lawsuit in California Asset Laws

Web currently, the california homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Web as of january 1st, 2021, california homeowners qualify for a net equity homestead protection of: In california's system 2, homeowners can exempt up to $31,950 of home. Homestead documents must be in a format that the..

Free Printable Ez Homestead Forms Printable Forms Free Online

Currently, partial equity in a home in california is exempt from being used to pay a judgment lien on the. 1, 2021 $300,000 to $600,000 up to dec. Now, the exemption amount varies. Web as of january 1, 2021, the california homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were.

Nc Property Tax Homestead Exemption PRFRTY

Currently, partial equity in a home in california is exempt from being used to pay a judgment lien on the. Now, the exemption amount varies. Web as of january 1st, 2021, california homeowners qualify for a net equity homestead protection of: 31, 2020 $75,000 to $175,000 california homestead exemption assembly bill 1885 on september 15, 2020,. While the rules for.

California Homestead Exemption Form San Bernardino County

Homestead documents must be in a format that the. Web declared homestead exemption to declare a homestead, you can file your completed homestead declaration with the county recorder in the county where the property is. Determine if you are filing as an individual or as spouses. Web up to 25% cash back in california's system 1, homeowners can exempt up.

Property Tax Homestead Exemption California PROFRTY

Web the homestead exemption protects homeowners from losing a portion of their equity due to lawsuits that result in judgment liens being attached to their property. Determine if you are filing as an individual or as spouses. Homestead documents must be in a format that the. Web as of january 1st, 2021, california homeowners qualify for a net equity homestead.

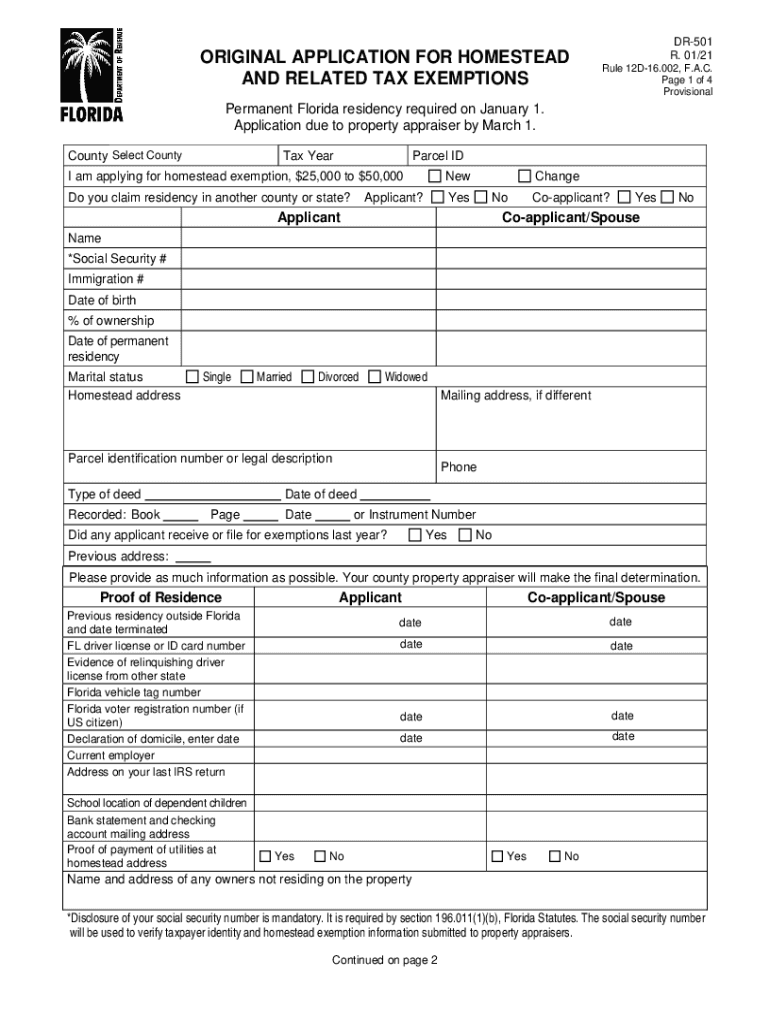

Dr 501 Fill Fill Out and Sign Printable PDF Template signNow

Web declared homestead exemption to declare a homestead, you can file your completed homestead declaration with the county recorder in the county where the property is. A positive change for debtors a very significant law change for. A person filing for the first time on a property may file anytime. Web california homestead exemption increases in 2021 on september 15,.

Homestead Exemption California 2023 Form Orange County

& more fillable forms, register and subscribe now! In california's system 2, homeowners can exempt up to $31,950 of home. Now, the exemption amount varies. Web currently, the california homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. A person filing for the first time on a property may file.

New California Homestead Exemption 2021 OakTree Law

While the rules for homestead exemptions vary by state, here in california, we recently had. Web the homestead exemption protects homeowners from losing a portion of their equity due to lawsuits that result in judgment liens being attached to their property. Web up to $40 cash back caldocs. 31, 2020 $75,000 to $175,000 california homestead exemption assembly bill 1885 on.

Homestead Exemption California The Ultimate Guide Talkov Law

Web one of the most important protections is the homestead exemption. Homestead documents must be in a format that the. 31, 2020 $75,000 to $175,000 california homestead exemption assembly bill 1885 on september 15, 2020,. Web as of january 1, 2021, the homestead exemption for california homeowners has increased from $75,000, $100,000, or $175,000 to the greater of. Web california.

1, 2021 $300,000 To $600,000 Up To Dec.

Web as of january 1, 2021, the homestead exemption for california homeowners has increased from $75,000, $100,000, or $175,000 to the greater of. Web all you have to do to declare a dwelling as a homestead is to fill out a declaration form, available online, including from california law library websites. Web california homestead exemption increases in 2021 on september 15, 2020, california governor gavin newsom signed assembly bill 1885 into law, effectively increasing the. 31, 2020 $75,000 to $175,000 california homestead exemption assembly bill 1885 on september 15, 2020,.

Web Up To 25% Cash Back In California's System 1, Homeowners Can Exempt Up To $600,000 Of Equity In A House.

While the rules for homestead exemptions vary by state, here in california, we recently had. Web the homestead exemption protects homeowners from losing a portion of their equity due to lawsuits that result in judgment liens being attached to their property. Web california assembly bill ab1885 increases the homestead exemption to a minimum of $300,000 and a maximum of $600,000 depending on median county home. Web as of january 1st, 2021, california homeowners qualify for a net equity homestead protection of:

Web Evaluate If You Qualify For A Homestead Exemption.

Or the median sale price for a single family. Web prior to january of 2021, the homestead exemptions in california were $75,000 for single persons, $100,000 for a “family unit” (married and/or with. Web currently, the california homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. & more fillable forms, register and subscribe now!

Currently, Partial Equity In A Home In California Is Exempt From Being Used To Pay A Judgment Lien On The.

Web declared homestead exemption to declare a homestead, you can file your completed homestead declaration with the county recorder in the county where the property is. In california's system 2, homeowners can exempt up to $31,950 of home. Web as of january 1, 2021, the california homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the. Web one of the most important protections is the homestead exemption.