California Form Llc-12

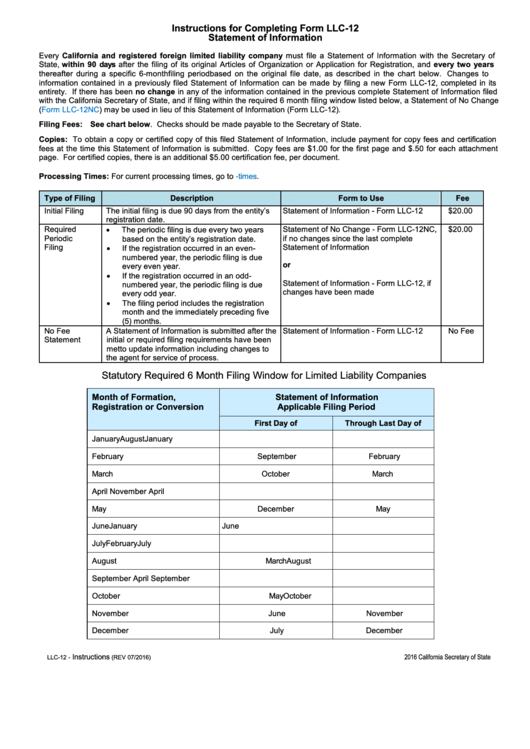

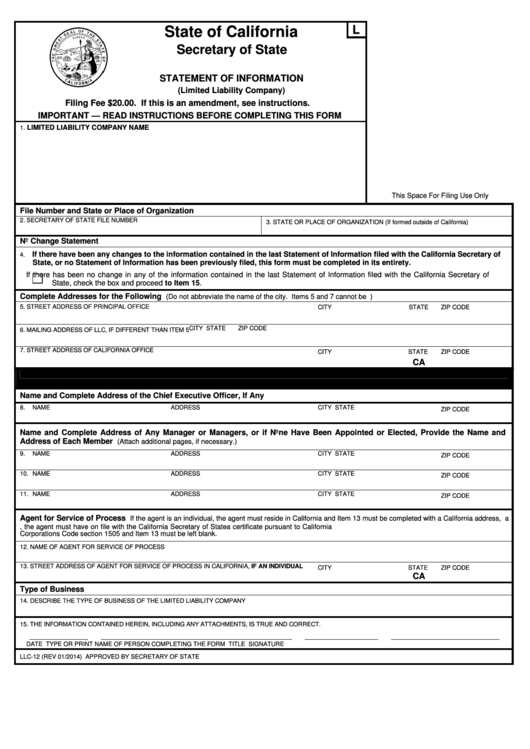

California Form Llc-12 - This form is used by the state of california for recording information related to limited liability companies, or llcs. An llc should use this voucher if any of the following apply: • the llc has a certificate of. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. You can complete the form online or send the duly filled form with the payment of $20 to the secretary of state. Include the full legal name of each member that meets one or both of the definitions above. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web click to edit settings and logout. Statement of information (limited liability company) important — read instructions. Web (enter the exact name of the llc.

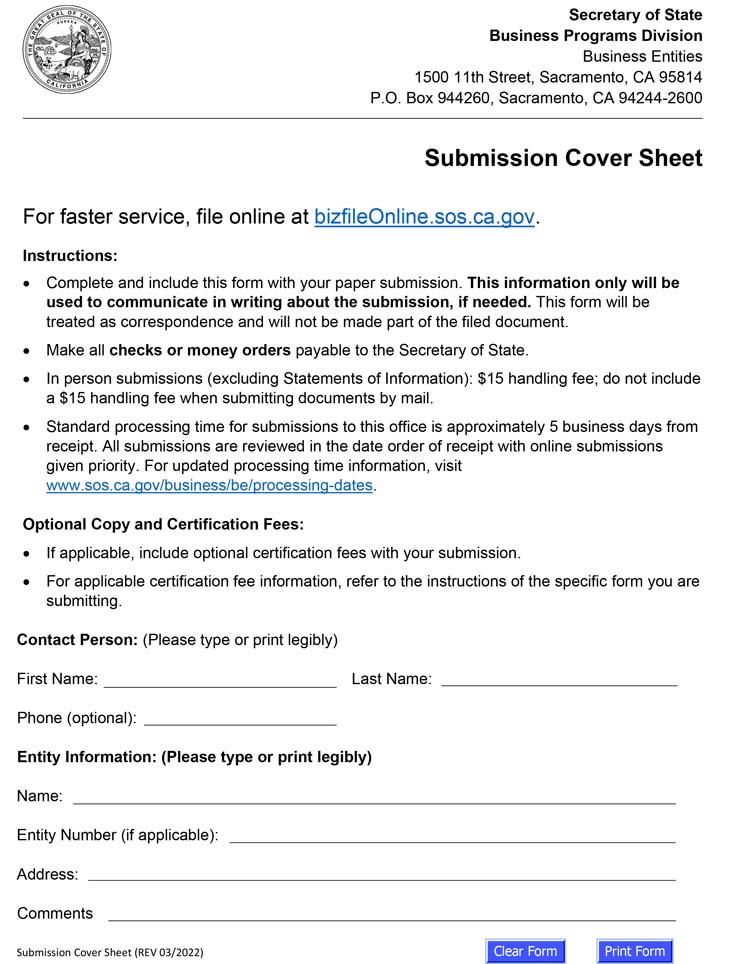

If you registered in california using an alternate name, see instructions.) 2. Only amendments available based on entity type and status will appear in the list. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Choose the desired amendment and click to open the form wizard. After the initial statement is filed, the following schedule can be used to determine the filing period when subsequent statements are due: • the llc has articles of organization accepted by the california secretary of state (sos). Web for faster service file statements of information, common interest development statements and publicly traded disclosure statements online at bizfileonline.sos.ca.gov. Web click to edit settings and logout. Enter the limited liability company number issued by. Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022.

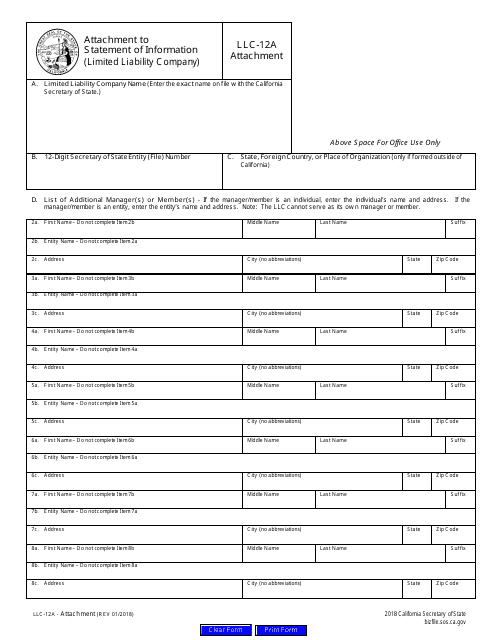

Other states may call this document a biennial or annual report. You can complete the form online or send the duly filled form with the payment of $20 to the secretary of state. An llc should use this voucher if any of the following apply: © 2023 ca secretary of state Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california and federal tax purposes. Care should be taken to complete every field. Web sponsor of a committee, or within the preceding 12 months before it qualified. If you registered in california using an alternate name, see instructions.) 2. Use if the limited liability company has more than one manager or member. Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022.

Agent for Service of Process CA Registered Agent TRUiC

• the llc has articles of organization accepted by the california secretary of state (sos). Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Only amendments available based on entity type and status will appear in the list. © 2023 ca.

Statement of Information (What Is It And How To File One)

Due within 90 days of initial registration and every two years thereafter. The status of the llc can be checked online on the secretary of state’s business search at businesssearch.sos.ca.gov. After the initial statement is filed, the following schedule can be used to determine the filing period when subsequent statements are due: Include the full legal name of each member.

2012 Form CA LLC12 Fill Online, Printable, Fillable, Blank pdfFiller

State, foreign country, or place of organization (only if. © 2023 ca secretary of state The status of the llc can be checked online on the secretary of state’s business search at businesssearch.sos.ca.gov. An llc should use this voucher if any of the following apply: This form is used by the state of california for recording information related to limited.

Fill Form LLC2 only can be filed to list (California)

Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Only amendments available based on entity type and status will appear in the list. • the llc has articles of organization accepted by the california secretary of state (sos). Enter the name.

Instructions For Completing Form Llc12 Statement Of Information

Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. File by mail or in person At the top of the details, click the icon file amendment. Web for faster service file statements of information, common interest development statements and publicly traded.

California Discovery Request Fill Online Printable Fillable Blank

Weber, ph.d., california secretary of state 1500 11th street sacramento, california 95814 office: At the top of the details, click the icon file amendment. State, foreign country, or place of organization (only if. • the llc has a certificate of. Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company.

Form LLC12 Download Fillable PDF, Statement Of Information (limited

You can complete the form online or send the duly filled form with the payment of $20 to the secretary of state. Due within 90 days of initial registration and every two years thereafter. Use if the limited liability company has more than one manager or member. Include the full legal name of each member that meets one or both.

Form LLC12A Download Fillable PDF or Fill Online Attachment to

Use if the limited liability company has more than one manager or member. Nevertheless, that is still more than 6. State, foreign country, or place of organization (only if. Include the full legal name of each member that meets one or both of the definitions above. Web as of july 19, the average credit card interest rate is 20.44%, down.

California Limited Liability Company / Form a California LLC

Other states may call this document a biennial or annual report. Web obtain, view, and print copies of business entity records (corp, llc, lp) order certified copies and certificates of status (corp, llc, lp) business entity records order form (pdf) online certified copy verification Care should be taken to complete every field. If you registered in california using an alternate.

Statement Of Information Form Llc 12 California Best Reviews

Web what is an llc 12? A window will appear with all amendments available to file online. Attachment to statement of information: Enter the name of the limited liability company exactly as it is of record with the california secretary of state. Web click to edit settings and logout.

Web Llc Tax Voucher General Information Use Form Ftb 3522, Llc Tax Voucher, To Pay The Annual Limited Liability Company (Llc) Tax Of $800 For Taxable Year 2022.

Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Use if the limited liability company has more than one manager or member. Web click to edit settings and logout.

State, Foreign Country Or Place Of Organization (Only If Formed Outside Of California) 4.

At the top of the details, click the icon file amendment. The status of the llc can be checked online on the secretary of state’s business search at businesssearch.sos.ca.gov. Attachment to statement of information: An llc should use this voucher if any of the following apply:

Web As Of July 19, The Average Credit Card Interest Rate Is 20.44%, Down Slightly From The 20.58% Recorded The Week Before, According To Bankrate.com.

Web sponsor of a committee, or within the preceding 12 months before it qualified. This form is used by the state of california for recording information related to limited liability companies, or llcs. Care should be taken to complete every field. State, foreign country, or place of organization (only if.

Only Amendments Available Based On Entity Type And Status Will Appear In The List.

• the llc has articles of organization accepted by the california secretary of state (sos). After the initial statement is filed, the following schedule can be used to determine the filing period when subsequent statements are due: Enter the name of the limited liability company exactly as it is of record with the california secretary of state. Web obtain, view, and print copies of business entity records (corp, llc, lp) order certified copies and certificates of status (corp, llc, lp) business entity records order form (pdf) online certified copy verification