California Form 541

California Form 541 - Attach this schedule to form 541. Complete line 1a through line 1f before. Schedule b income distribution deduction. If a trust, enter the number of: Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula. Enter this adjustment amount on the corresponding line on schedule ca (540 or. Web schedule g california source income and deduction apportionment. Schedule g california source income and deduction apportionment. Web complete california tax form 541 instructions online with us legal forms. Web we last updated the beneficiary's share of income, deductions, credits, etc.

Report income distributed to beneficiaries; In this case, estimated tax payments are not due for 2021. Web file form 541, california fiduciary income tax return, for 2021 on or before march 1, 2022, and pay the total tax due. Web to the california form or schedule to figure your california adjustment amount. Web we last updated california form 541 in february 2023 from the california franchise tax board. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated for tax year 2022. File an amended return for the estate or trust;. Web form 541, california fiduciary income tax return. Beneficiary's share of income, deductions,.

Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Web schedule g california source income and deduction apportionment. This form is for income earned in tax year 2022, with tax returns. Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated for tax year 2022. Report income received by an estate or trust; Report income distributed to beneficiaries; Complete line 1a through line 1f before part ii. The form, 541 is similar to an individual. Web we last updated the beneficiary's share of income, deductions, credits, etc.

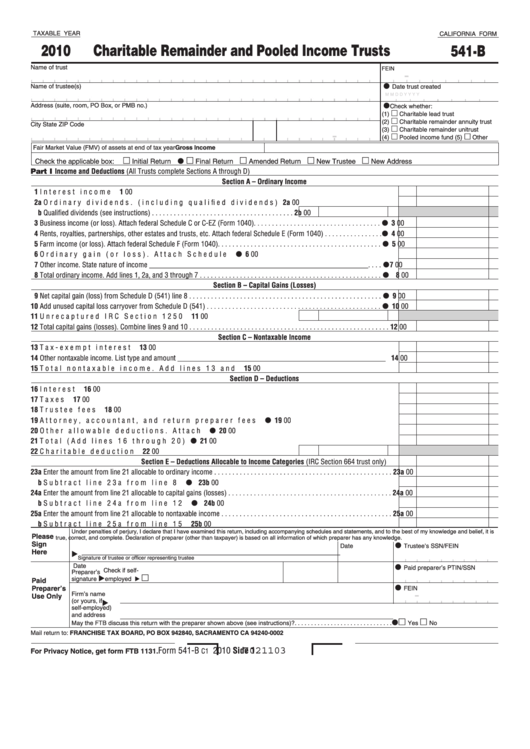

Fillable California Form 541B Charitable Remainder And Pooled

Web we last updated the beneficiary's share of income, deductions, credits, etc. This form is for income earned in tax year 2022, with tax returns due in april. Web these related forms may also be needed with the california form 541 schedule p. File form 541 in order to: Alternative minimum tax and credit limitations — fiduciaries.

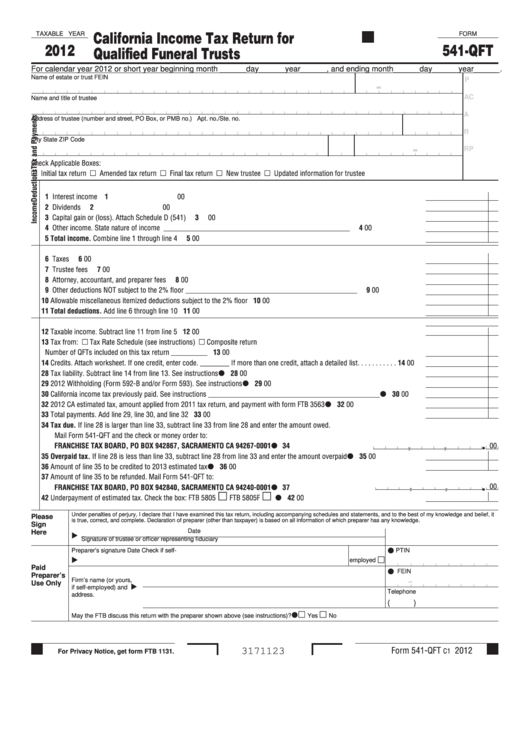

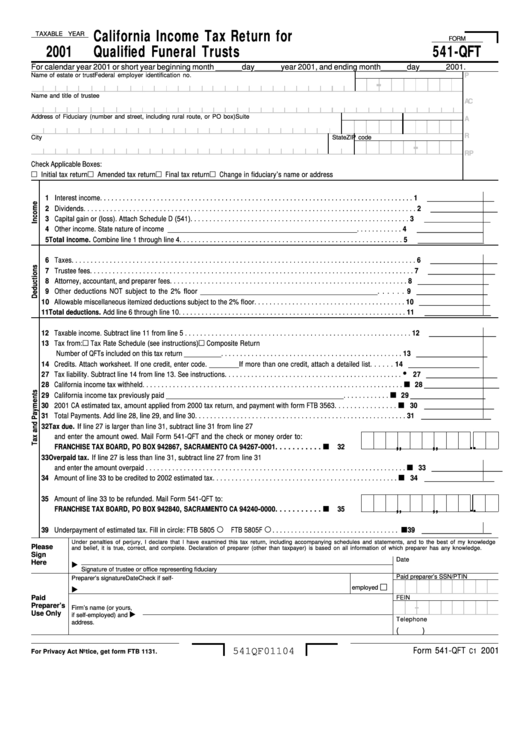

Fillable Form 541Qft California Tax Return For Qualified

Complete line 1a through line 1f before part ii. Used to report a charitable or other deduction under irc section. File form 541 in order to: Web complete california tax form 541 instructions online with us legal forms. Enter this adjustment amount on the corresponding line on schedule ca (540 or.

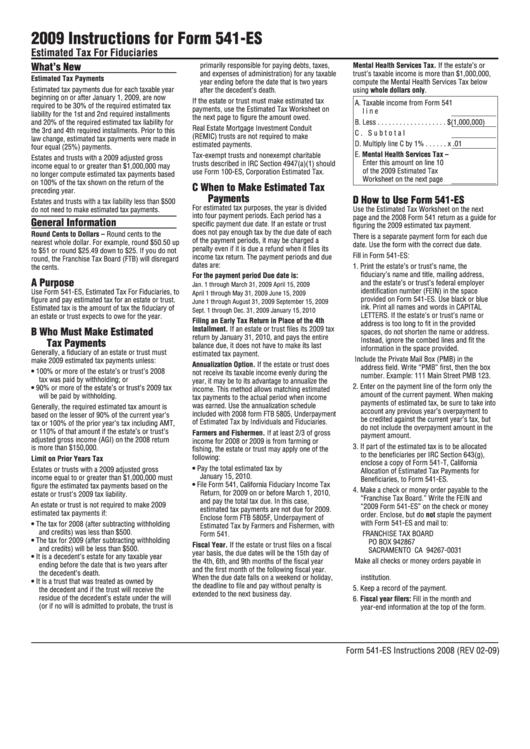

ads/responsive.txt California form 541 Instructions 2017 Inspirational

Report income distributed to beneficiaries; Easily fill out pdf blank, edit, and sign them. Web these related forms may also be needed with the california form 541 schedule p. Web 2020 california fiduciary income tax return form 541 for calendar year 2020 or fiscal year beginning (mm/dd/yyyy) _____, and ending (mm/dd/yyyy) _____ • type of entity. Web 7991213schedule p (541).

Fillable California Form 541Es Estimated Tax For Fiduciaries 2009

Web these related forms may also be needed with the california form 541 schedule p. Complete, edit or print tax forms instantly. Used to report a charitable or other deduction under irc section. You can download or print. Part i fiduciary’s share of alternative.

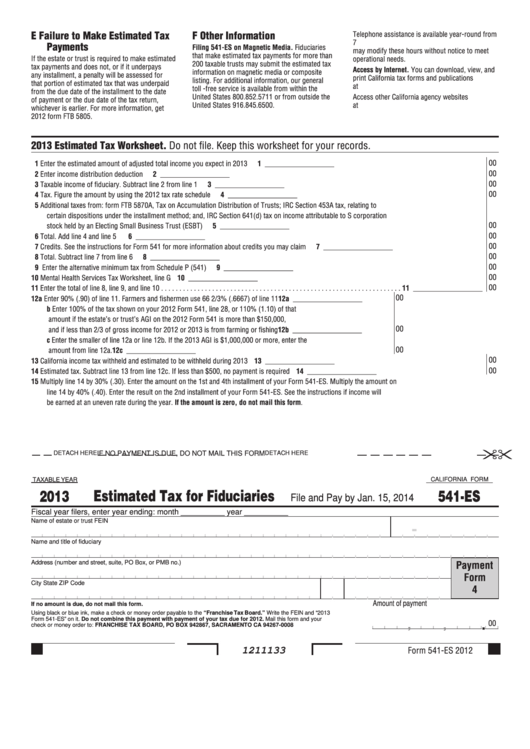

California Form 541Es Estimated Tax For Fiduciaries 2013 printable

File form 541 in order to: Used to report a charitable or other deduction under irc section. Web 7991213schedule p (541) 2021 side 1. Web form 541, california fiduciary income tax return. Attach this schedule to form 541.

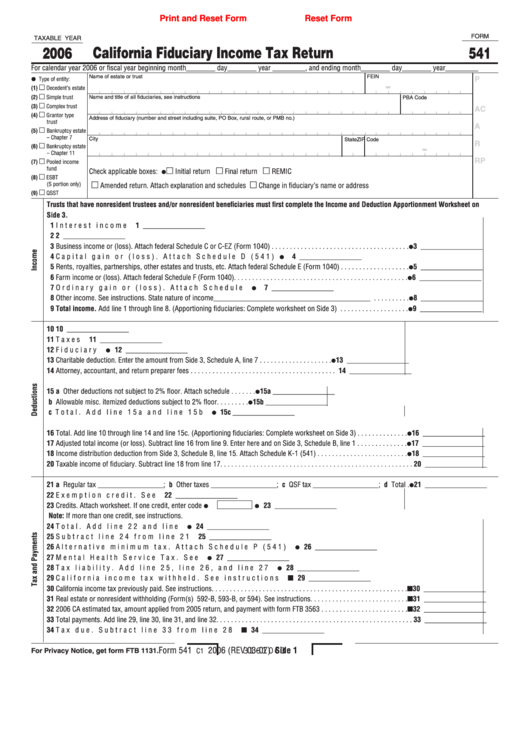

Fillable Form 541 California Fiduciary Tax Return 2006

File form 541 in order to: Complete line 1a through line 1f before part ii. Web we last updated the beneficiary's share of income, deductions, credits, etc. Note, that the trust will be required to file a california form 541. Complete, edit or print tax forms instantly.

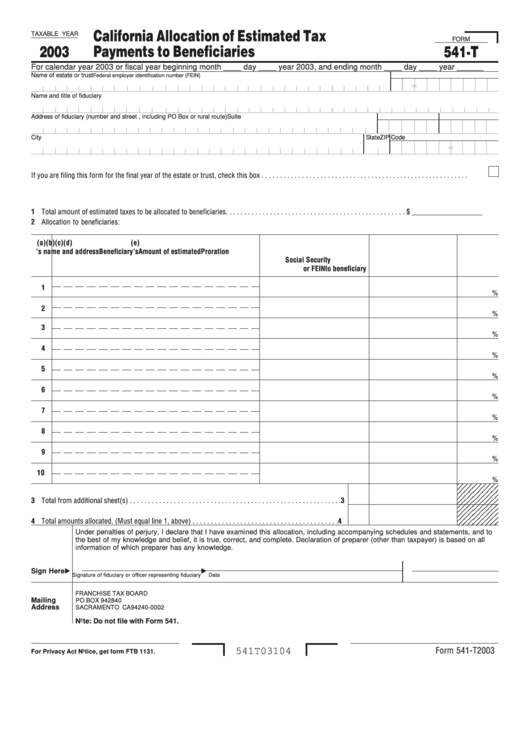

Form 541T California Allocation Of Estimated Tax Payments To

Web form 541, california fiduciary income tax return. Attach this schedule to form 541. Beneficiary's share of income, deductions,. Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula. Complete line 1a through line 1f before.

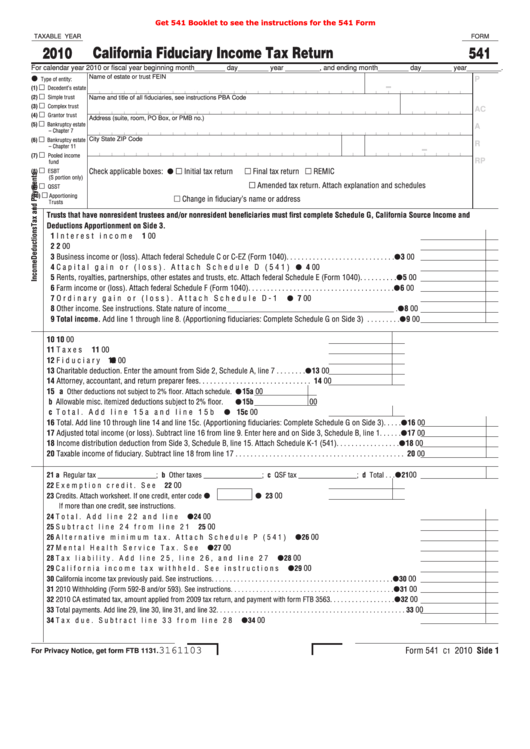

Fillable Form 541 California Fiduciary Tax Return 2010

File an amended return for the estate or trust;. File form 541 in order to: Save or instantly send your ready documents. Complete line 1a through line 1f before part ii. Web the fiduciary (or one of the fiduciaries) must file form 541 for a trust if any of the following apply:

Form 541Qft California Tax Return For Qualified Funeral

Web the backbone of the tax return for a california trust is the franchise tax board form 541, california fiduciary income tax return. Web we last updated the beneficiary's share of income, deductions, credits, etc. Web form 541, california fiduciary income tax return. You can download or print. Schedule g california source income and deduction apportionment.

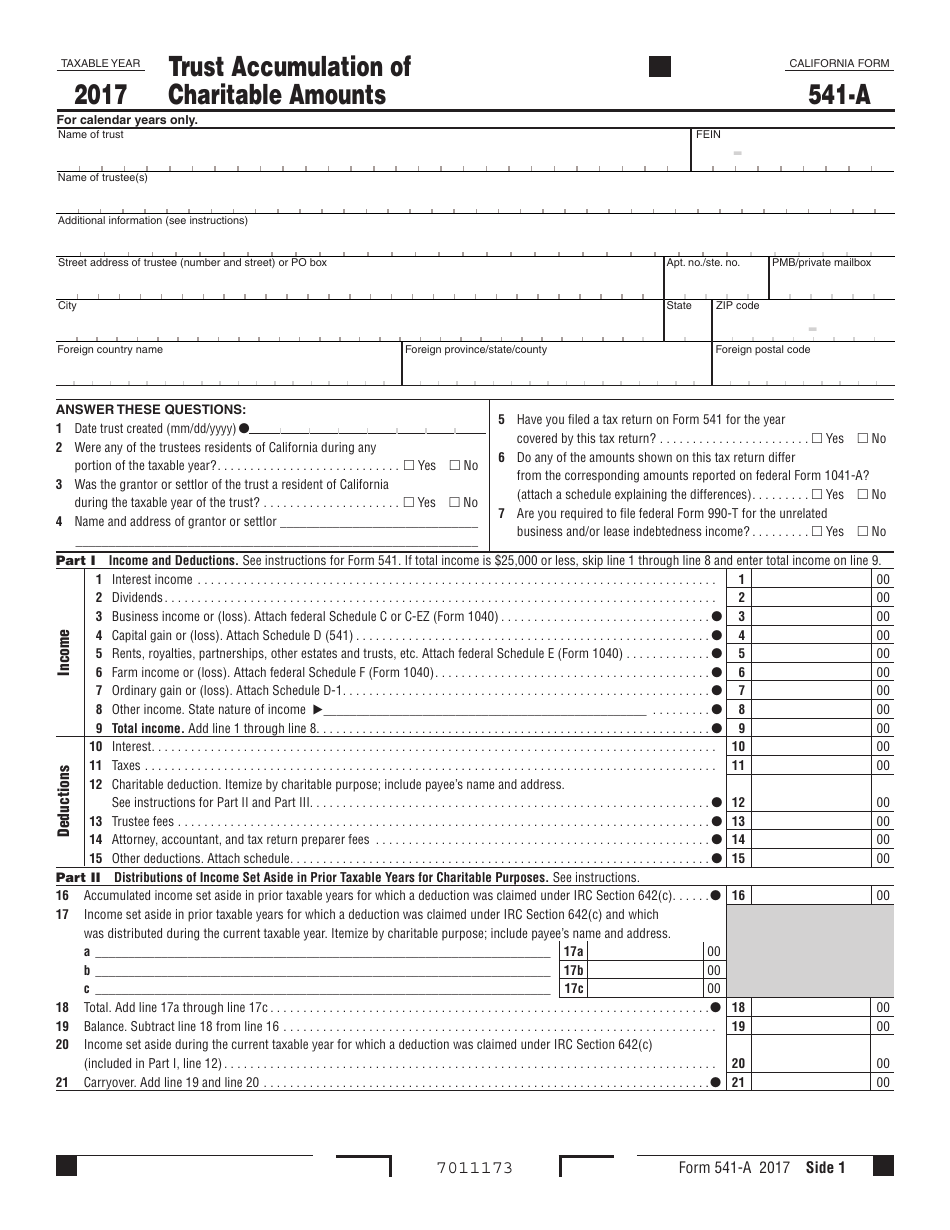

Form 541A Download Printable PDF or Fill Online Trust Accumulation of

In this case, estimated tax payments are not due for 2021. Report income distributed to beneficiaries; If a trust, enter the number of: Web filing form 541, california fiduciary income tax return. Beneficiary's share of income, deductions,.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Complete, edit or print tax forms instantly. If a trust, enter the number of: Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated for tax year 2022. Complete line 1a through line 1f before.

Schedule G California Source Income And Deduction Apportionment.

Web these related forms may also be needed with the california form 541 schedule p. Ad edit, sign and print tax forms on any device with signnow. • gross income for the taxable year of more than $10,000 (regardless. Used to report a charitable or other deduction under irc section.

Web We Last Updated California Form 541 In February 2023 From The California Franchise Tax Board.

Web file form 541, california fiduciary income tax return, for 2021 on or before march 1, 2022, and pay the total tax due. Report income distributed to beneficiaries; Used to report a charitable or other deduction under irc section. Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula.

Web 7991213Schedule P (541) 2021 Side 1.

Web what form to file. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the beneficiary's share of income, deductions, credits, etc. You can download or print.