California Form 3893

California Form 3893 - Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. If an entity does not make that first. Any remitter (individual, business entity, trust, estate, or reep) who. Can i calculate late payment. Web find california form 593 instructions at esmart tax today. The provisions of assembly bill 150 do not require the. This form is for income earned in tax year. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Web march 31, 2023.

Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web march 31, 2023. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. If an entity does not make that first. We anticipate the revised form 3893 will be available march 7, 2022.

Web march 31, 2023. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web the california franchise tax board dec. The provisions of assembly bill 150 do not require the. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: This form is for income earned in tax year. Web if the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb 3893. If an entity does not make that first. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. We anticipate the revised form 3893 will be available march 7, 2022.

California Form 3893 Passthrough Entity Tax Problems Windes

Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Any remitter (individual, business entity, trust, estate, or reep) who. Can i calculate late payment. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web if the qualified entity makes a.

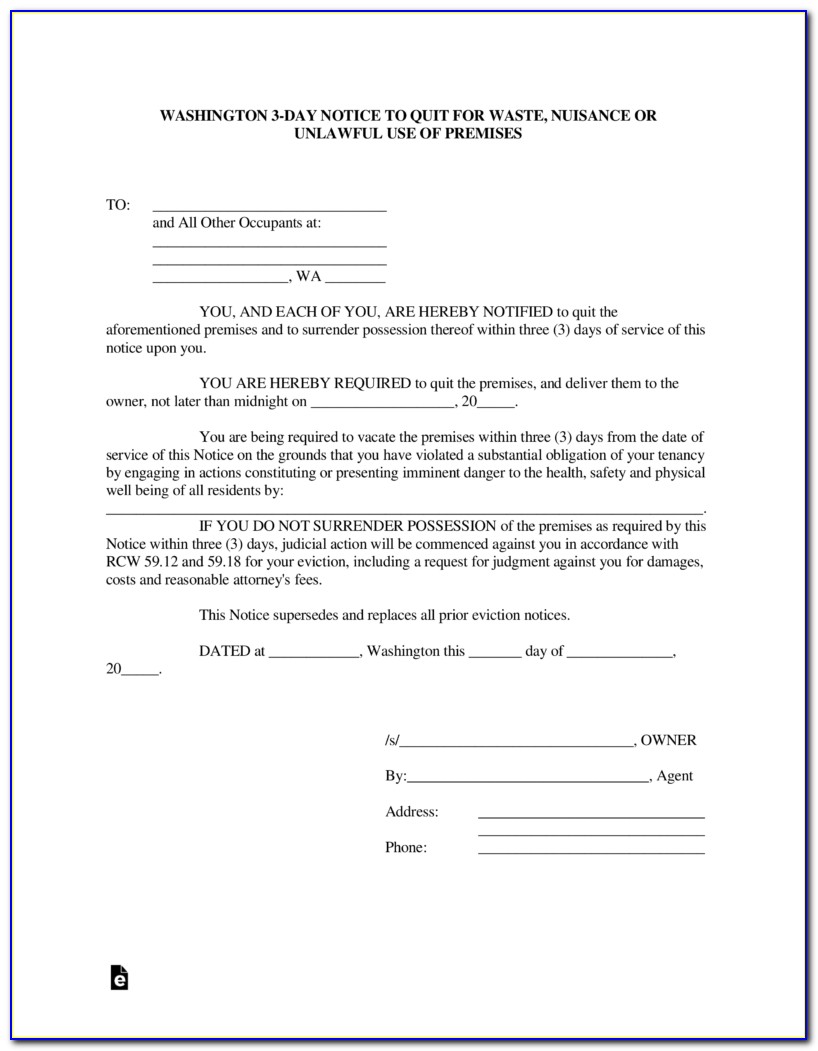

Texas 3 Day Notice To Vacate Form Form Resume Examples jP8JGb61Vd

The provisions of assembly bill 150 do not require the. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. This form.

3893 California St UNIT 11 Rancho Photos

Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Can i calculate late payment. The provisions of assembly bill 150 do not require the. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web find california form 593 instructions at esmart tax today.

3893 California St UNIT 11 Rancho Photos

This form is for income earned in tax year. Web find california form 593 instructions at esmart tax today. Can i calculate late payment. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593.

3893 California St Rancho Photos

A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: We anticipate the revised form 3893 will be available march 7, 2022. Web form 3893.

24 Hour Notice To Vacate Form California Form Resume Examples

Web if the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb 3893. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Can i calculate late payment. Web the california franchise tax board dec. Web find california form 593 instructions at esmart tax today.

3893 California St UNIT 11 Rancho Photos

Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web form 3893 procedure tax software 2022.

3893 California St UNIT 11 Rancho Photos

Any remitter (individual, business entity, trust, estate, or reep) who. Web if the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb 3893. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web use form ftb 3893 to pay an elective tax for taxable years.

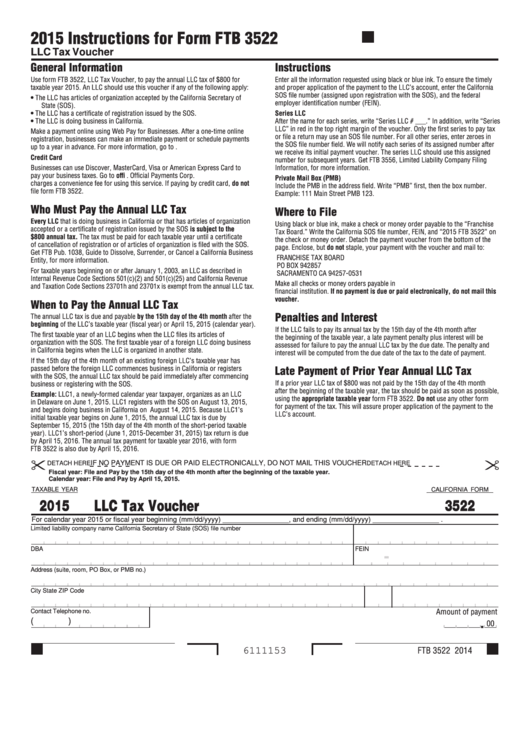

California Form 3522 Llc Tax Voucher 2015 printable pdf download

Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. We anticipate the revised form 3893 will be available march 7, 2022. Web march 31, 2023. Web find california form 593 instructions at esmart tax today. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593.

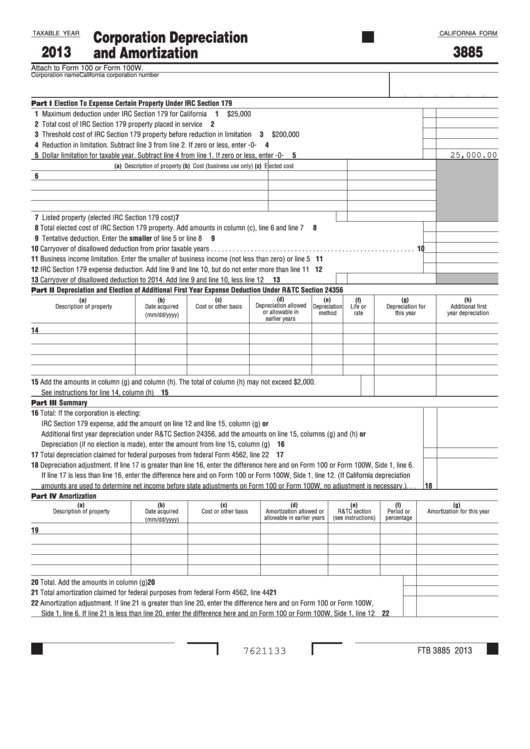

Fillable California Form 3885 Corporation Depreciation And

The provisions of assembly bill 150 do not require the. Any remitter (individual, business entity, trust, estate, or reep) who. We anticipate the revised form 3893 will be available march 7, 2022. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. If an entity.

Web The California Franchise Tax Board Dec.

Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: This form is for income earned in tax year. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Can i calculate late payment.

Any Remitter (Individual, Business Entity, Trust, Estate, Or Reep) Who.

A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no.

The Provisions Of Assembly Bill 150 Do Not Require The.

Web march 31, 2023. If an entity does not make that first. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web if the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb 3893.

Web Find California Form 593 Instructions At Esmart Tax Today.

We anticipate the revised form 3893 will be available march 7, 2022.