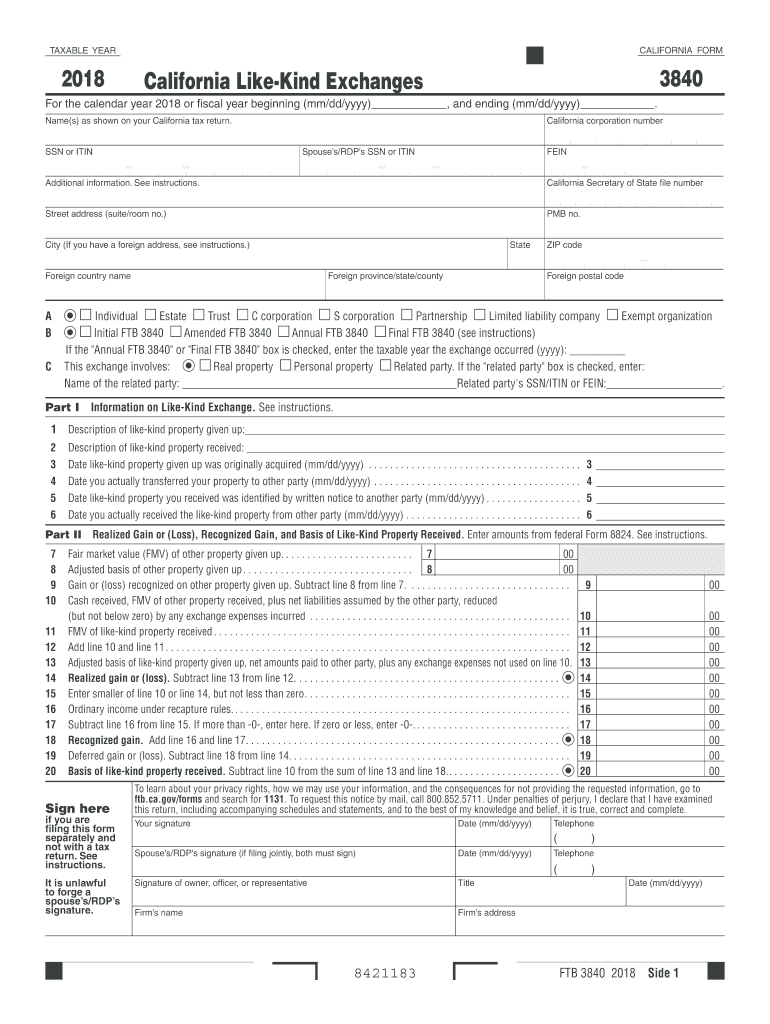

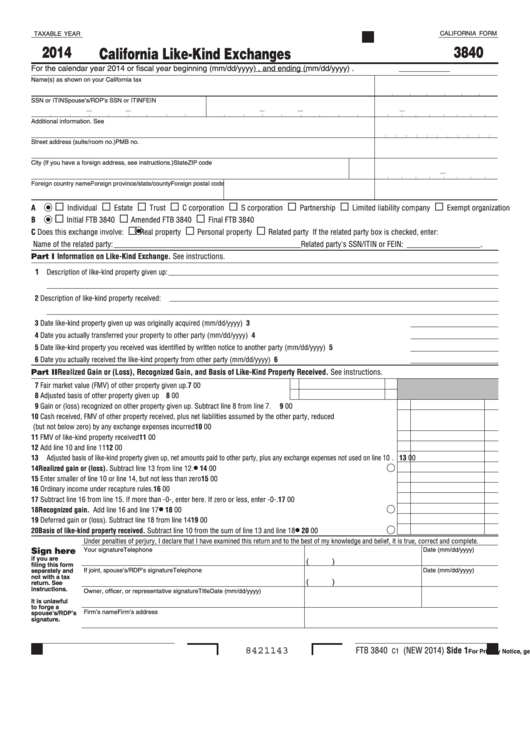

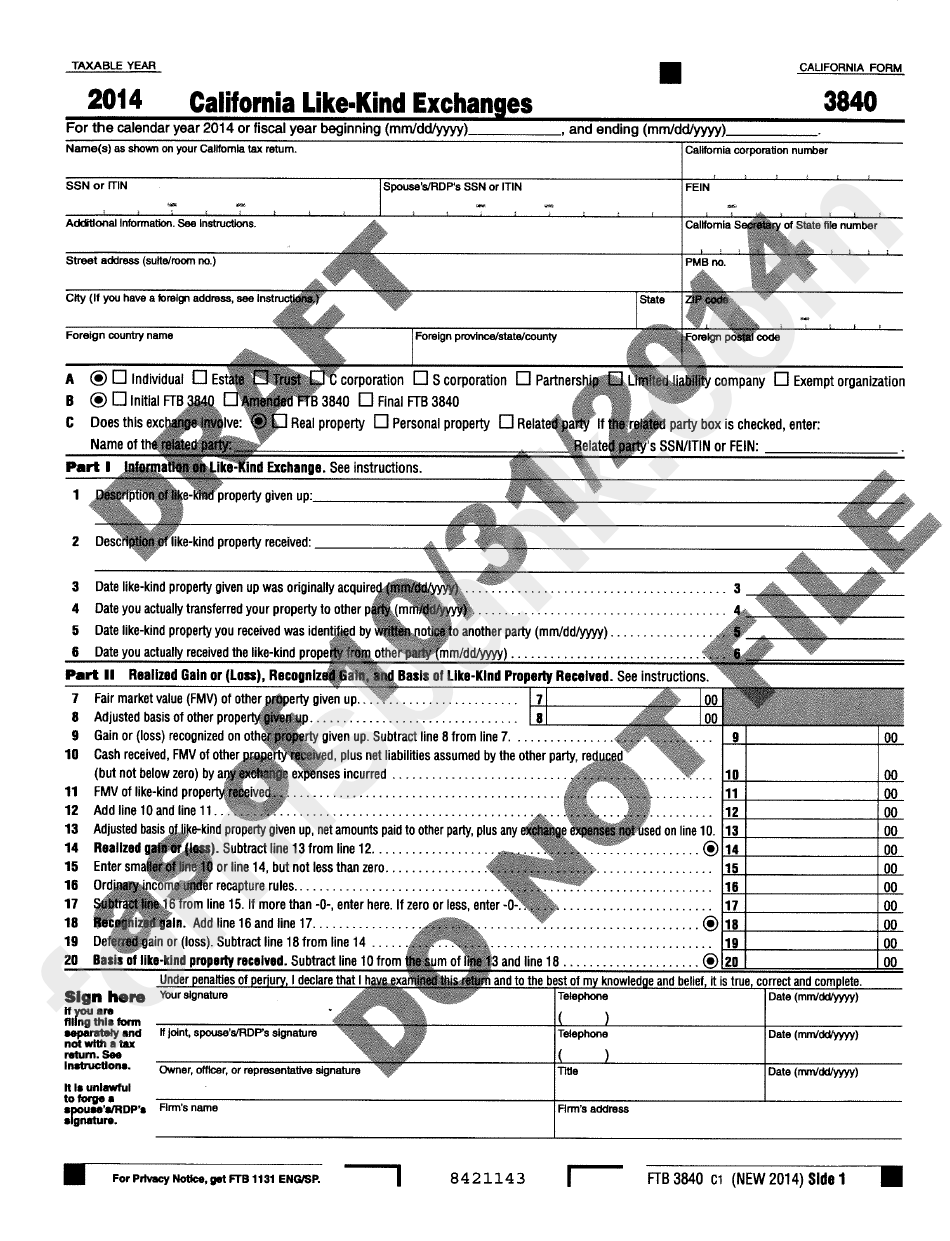

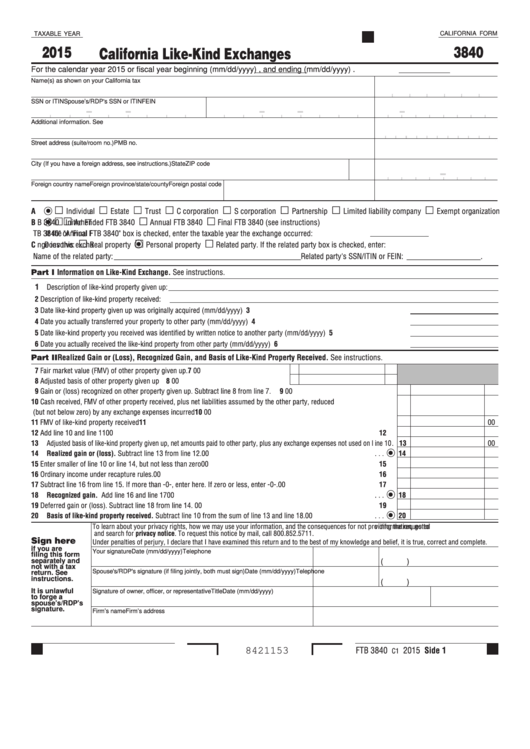

California Form 3840

California Form 3840 - Web for taxpayers with no other california filing requirement, sign and mail form ftb 3840 to: Web ca form 3840. Web california form 3840 is required to be filed so california can receive the income tax on the sale of the replacement property in some other state, when sold years. Web after the initial filing year, lacerte will proforma the california information to screen 57.019, until the final form 3840 is filed. Taxable year 2022 california form. Enjoy smart fillable fields and. To print form 3840 with the return, mark the print form 3840 checkbox. Web 29 votes how to fill out and sign ca form 3840 instructions 2022 online? Web attach form ftb 3840 to the california tax return, or file separately as a california information return if the taxpayer does not otherwise have a california filing requirement. Ad fill, sign, email ca form 3840 & more fillable forms, register and subscribe now!

If you make $70,000 a year living in california you will be taxed $11,221. If this is the year the asset is being. Enjoy smart fillable fields and. Ad fill, sign, email ca form 3840 & more fillable forms, register and subscribe now! Your average tax rate is 11.67% and your marginal. To print form 3840 with the return, mark the print form 3840 checkbox. Web california form 3840 is required to be filed so california can receive the income tax on the sale of the replacement property in some other state, when sold years. Web ca form 3840. Web after the initial filing year, lacerte will proforma the california information to screen 57.019, until the final form 3840 is filed. Get your online template and fill it in using progressive features.

Either way, the form is due by the extended. Web information on this screen is used for form 3840. Web attach form ftb 3840 to the california tax return, or file separately as a california information return if the taxpayer does not otherwise have a california filing requirement. Taxable year 2022 california form. If you make $70,000 a year living in california you will be taxed $11,221. Web ftb 3840 instructions require that the full address (or assessor’s parcel number, county, and state) must be reported. For the calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy) name(s) as. For current year exchanges, ultratax cs automatically. Enjoy smart fillable fields and. Web simplified income, payroll, sales and use tax information for you and your business

[3840 x 2160] California wallpaper

Web the new california form ftb 3840 will be required for taxpayers who complete a 1031 tax deferred exchange after january 1, 2014 when they sell. Your average tax rate is 11.67% and your marginal. Web ca form 3840. Form ftb 3840 must be filed for the taxable year of the exchange and for each subsequent taxable year, generally, until.

Form 3840 Fill out & sign online DocHub

If you make $70,000 a year living in california you will be taxed $11,221. Web attach form ftb 3840 to the california tax return, or file separately as a california information return if the taxpayer does not otherwise have a california filing requirement. For the calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy) name(s) as. Complete,.

California Form 3840 California LikeKind Exchanges 2014 printable

Web information on this screen is used for form 3840. Complete, edit or print tax forms instantly. Web ftb 3840 instructions require that the full address (or assessor’s parcel number, county, and state) must be reported. For current year exchanges, ultratax cs automatically. Ad fill, sign, email ca form 3840 & more fillable forms, register and subscribe now!

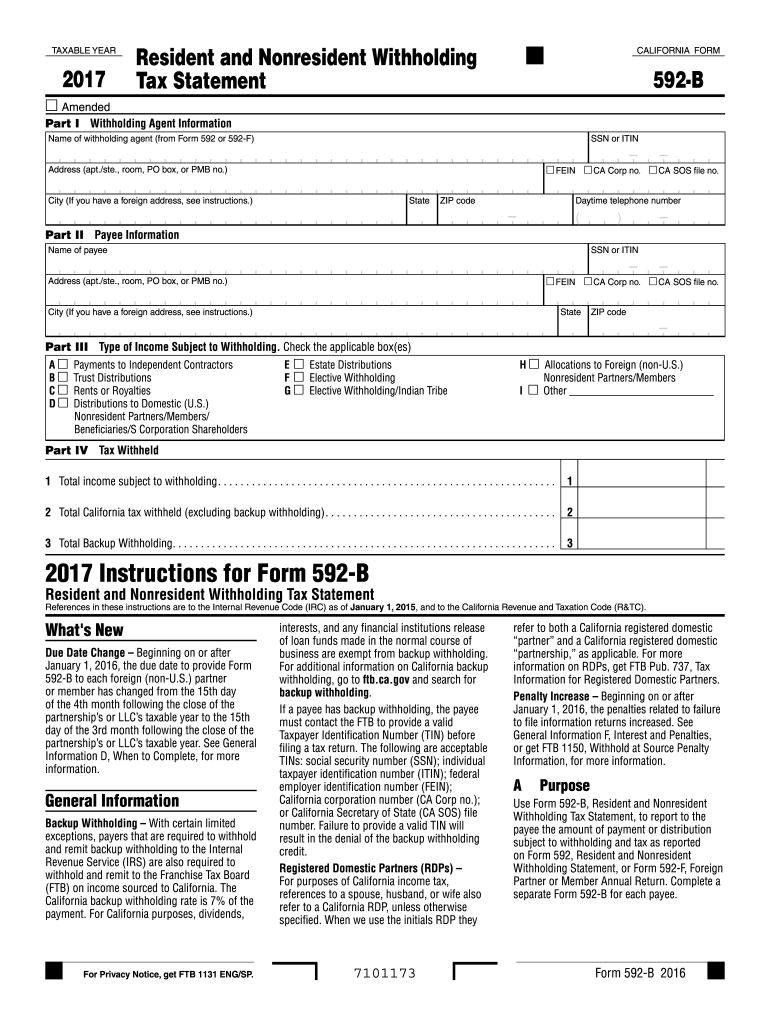

2017 Form CA FTB 592B Fill Online, Printable, Fillable, Blank PDFfiller

Web 29 votes how to fill out and sign ca form 3840 instructions 2022 online? Form ftb 3840 must be filed for the taxable year of the exchange and for each subsequent taxable year, generally, until the california. Web the new california form ftb 3840 will be required for taxpayers who complete a 1031 tax deferred exchange after january 1,.

California Form 3840 Draft California LikeKind Exchanges 2014

Form ftb 3840 must be filed for the taxable year of the exchange and for each subsequent taxable year, generally, until the california. Enjoy smart fillable fields and. Ad fill, sign, email ca form 3840 & more fillable forms, register and subscribe now! Either way, the form is due by the extended. For current year exchanges, ultratax cs automatically.

Fillable California Form 3840 California LikeKind Exchanges 2015

Taxable year 2022 california form. Web 29 votes how to fill out and sign ca form 3840 instructions 2022 online? Web simplified income, payroll, sales and use tax information for you and your business Enjoy smart fillable fields and. Web for taxpayers with no other california filing requirement, sign and mail form ftb 3840 to:

CA Form 3840 Intuit Accountants Community

To print form 3840 with the return, mark the print form 3840 checkbox. Web simplified income, payroll, sales and use tax information for you and your business Ad fill, sign, email ca form 3840 & more fillable forms, register and subscribe now! Your average tax rate is 11.67% and your marginal. For the calendar year 2020 or fiscal year beginning.

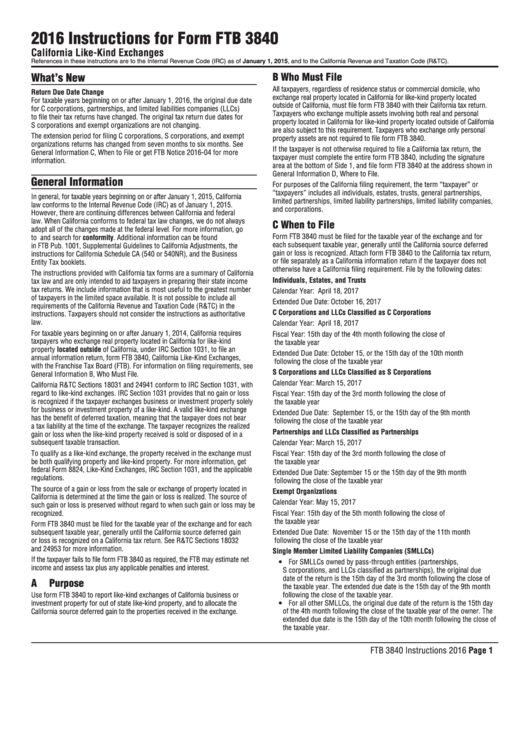

Instructions For Form Ftb 3840 2016 printable pdf download

Web california form 3840 is required to be filed so california can receive the income tax on the sale of the replacement property in some other state, when sold years. Web after the initial filing year, lacerte will proforma the california information to screen 57.019, until the final form 3840 is filed. Web simplified income, payroll, sales and use tax.

Fond d'écran la nature, paysage, canyon, Montagnes, des arbres, eau

If you make $70,000 a year living in california you will be taxed $11,221. Complete, edit or print tax forms instantly. Web ftb 3840 instructions require that the full address (or assessor’s parcel number, county, and state) must be reported. Web attach form ftb 3840 to the california tax return, or file separately as a california information return if the.

Sierra Buttes Young America Lake, California [3840×2160] [OC] EarthPorn

Enjoy smart fillable fields and. Web attach form ftb 3840 to the california tax return, or file separately as a california information return if the taxpayer does not otherwise have a california filing requirement. Web 29 votes how to fill out and sign ca form 3840 instructions 2022 online? If this is the year the asset is being. Taxable year.

Web 29 Votes How To Fill Out And Sign Ca Form 3840 Instructions 2022 Online?

Form ftb 3840 must be filed for the taxable year of the exchange and for each subsequent taxable year, generally, until the california. Web information on this screen is used for form 3840. Web the new california form ftb 3840 will be required for taxpayers who complete a 1031 tax deferred exchange after january 1, 2014 when they sell. Web ftb 3840 instructions require that the full address (or assessor’s parcel number, county, and state) must be reported.

Enjoy Smart Fillable Fields And.

Ad fill, sign, email ca form 3840 & more fillable forms, register and subscribe now! Web ca form 3840. To print form 3840 with the return, mark the print form 3840 checkbox. Web after the initial filing year, lacerte will proforma the california information to screen 57.019, until the final form 3840 is filed.

If You Make $70,000 A Year Living In California You Will Be Taxed $11,221.

For the calendar year 2020 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy) name(s) as. Your average tax rate is 11.67% and your marginal. Either way, the form is due by the extended. Web california form 3840 is required to be filed so california can receive the income tax on the sale of the replacement property in some other state, when sold years.

Get Your Online Template And Fill It In Using Progressive Features.

Web for taxpayers with no other california filing requirement, sign and mail form ftb 3840 to: If this is the year the asset is being. Web attach form ftb 3840 to the california tax return, or file separately as a california information return if the taxpayer does not otherwise have a california filing requirement. Taxable year 2022 california form.

![[3840 x 2160] California wallpaper](https://preview.redd.it/rv62wnvs1zw41.jpg?width=960&crop=smart&auto=webp&s=1b09cdb713a52ae5d8cda440c70312ed1ae7255b)

![Sierra Buttes Young America Lake, California [3840×2160] [OC] EarthPorn](https://external-preview.redd.it/xLMqeQhSrVNpkcudJia58c16c_TxM3EJhO4cZgpwr8g.jpg?auto=webp&s=3aaf64783bedeed463f954c35a0cdef7182dd057)