California Form 100S Instructions 2021

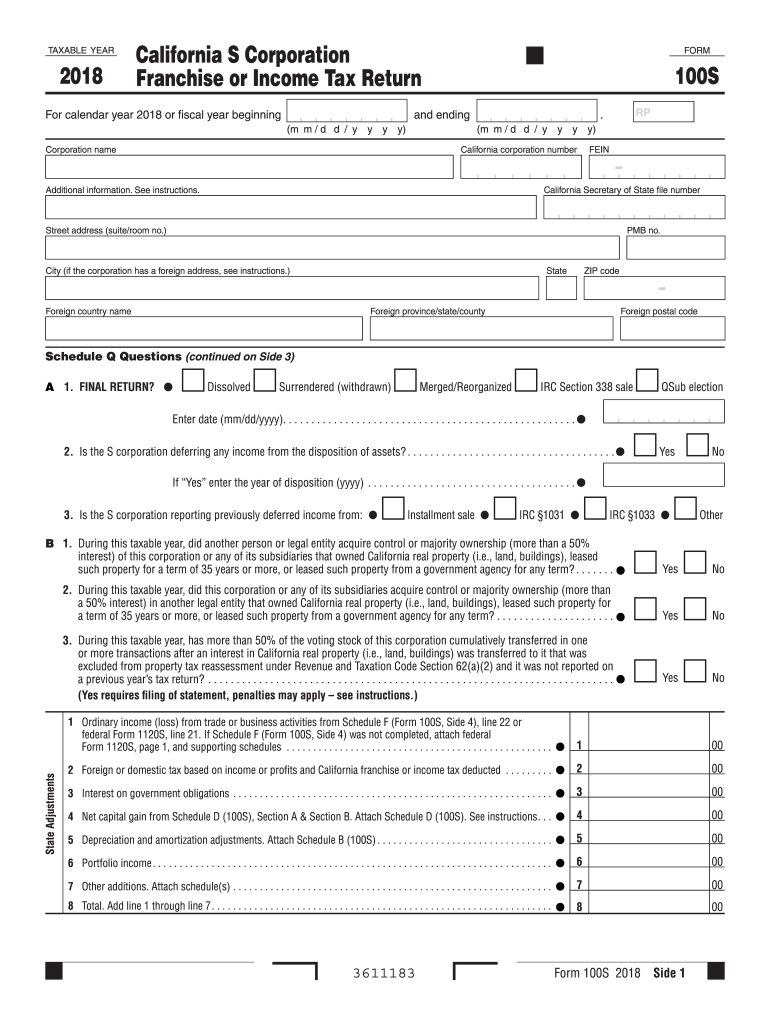

California Form 100S Instructions 2021 - Corporation name california corporation number fein. See the links below for the california ftb form instructions. Web ca form 100s, california s corporation franchise or income tax return. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Web schedule h (100), dividend income deduction schedule p (100), alternative minimum tax and credit limitations — corporations ftb 3539, payment for automatic extension for. Web form 100 booklet pdf form content report error it appears you don't have a pdf plugin for this browser. Web file now with turbotax. Web 3611203 form 100s 2020 side 1 b 1. This is a reminder for you and your clients to make sure to file form 100s, california s. A claim for refund of an overpayment of tax should be.

Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Corporation name california corporation number fein. Web schedule h (100), dividend income deduction schedule p (100), alternative minimum tax and credit limitations — corporations ftb 3539, payment for automatic extension for. This is a reminder for you and your clients to make sure to file form 100s, california s. We are taking appointments at our field offices. Web 2021 instructions for form 100 california corporation franchise or income tax return. Web for more information on california s corporations, please see form 100s booklet (california s corporation franchise or income tax return booklet). California corporation franchise or income tax return. References in these instructions are to the internal revenue code (irc) as of.

20 released updated instructions for 2021 form 100x, amended corporation franchise or income tax. This form is for income earned in tax year 2022, with. Web file now with turbotax. Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. See the links below for the california ftb form instructions. Web schedule h (100), dividend income deduction schedule p (100), alternative minimum tax and credit limitations — corporations ftb 3539, payment for automatic extension for. Web form 100 booklet pdf form content report error it appears you don't have a pdf plugin for this browser. California corporation franchise or income tax return. Follow these steps to mark the california (ca) return as an initial return: References in these instructions are to the internal revenue code (irc) as of january.

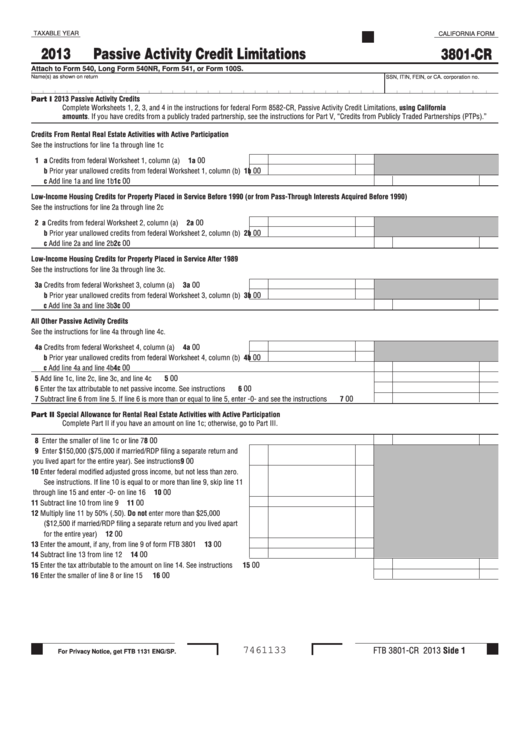

Fillable California Form 3801Cr Passive Activity Credit Limitations

See the links below for the california ftb form instructions. Web 2021 instructions for form 100. All federal s corporations subject to california laws must file form 100s. Web 3611203 form 100s 2020 side 1 b 1. This form is for income earned in tax year 2022, with.

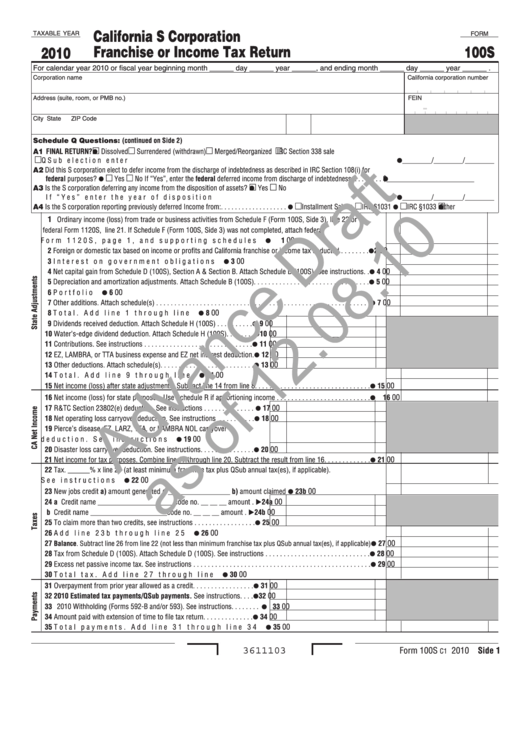

Form 100s Draft California S Corporation Franchise Or Tax

We are taking appointments at our field offices. A claim for refund of an overpayment of tax should be. Web 2021 instructions for form 100 california corporation franchise or income tax return. Or fiscal year beginning (mm/dd/yyyy), and ending (mm/dd/yyyy).rp. 2022 s corporation income tax returns due and tax due (for.

Top 9 Form 100s Templates free to download in PDF format

Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. Web check out this ftb booklet for more information about s corporation tax liability. Web form 100 booklet pdf form content report error it appears you don't have a pdf plugin for this browser. A claim for refund.

California Form 100s Instructions PDF Fill Out and Sign Printable PDF

Corporation name california corporation number fein. See the links below for the california ftb form instructions. Web for more information on california s corporations, please see form 100s booklet (california s corporation franchise or income tax return booklet). We are taking appointments at our field offices. All federal s corporations subject to california laws must file form 100s.

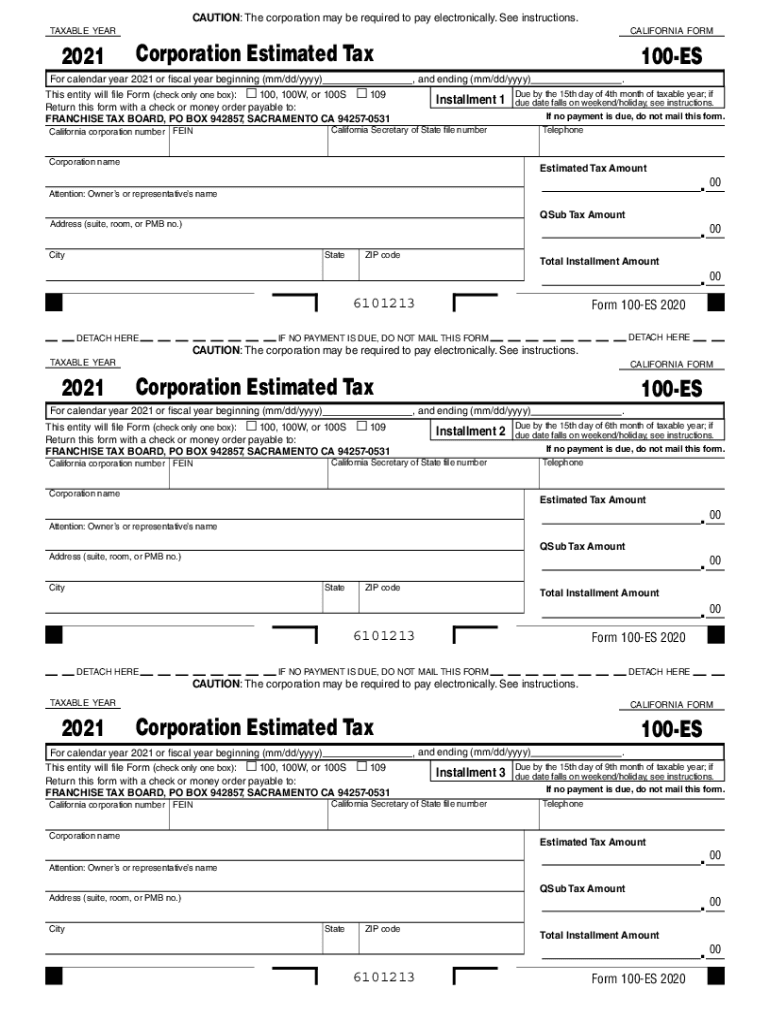

2021 Form CA FTB 100ES Fill Online, Printable, Fillable, Blank pdfFiller

This is a reminder for you and your clients to make sure to file form 100s, california s. Web ca form 100s, california s corporation franchise or income tax return. Follow these steps to mark the california (ca) return as an initial return: 20 released updated instructions for 2021 form 100x, amended corporation franchise or income tax. Web the california.

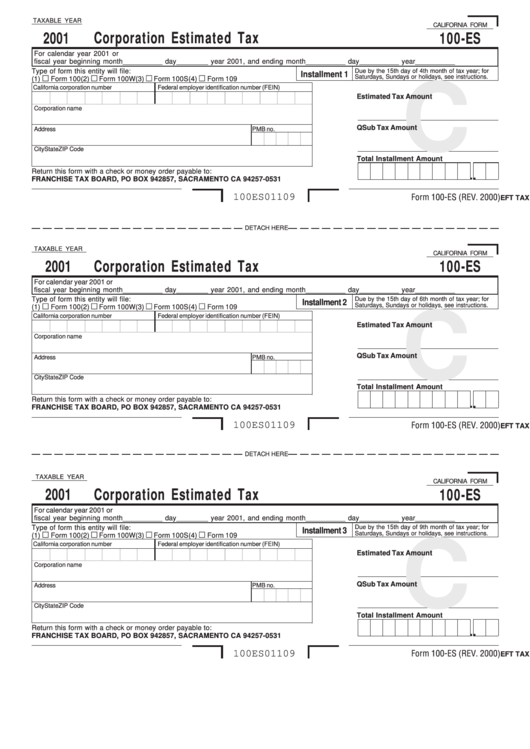

Form 100Es Corporation Estimated Tax California printable pdf download

Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. A claim.

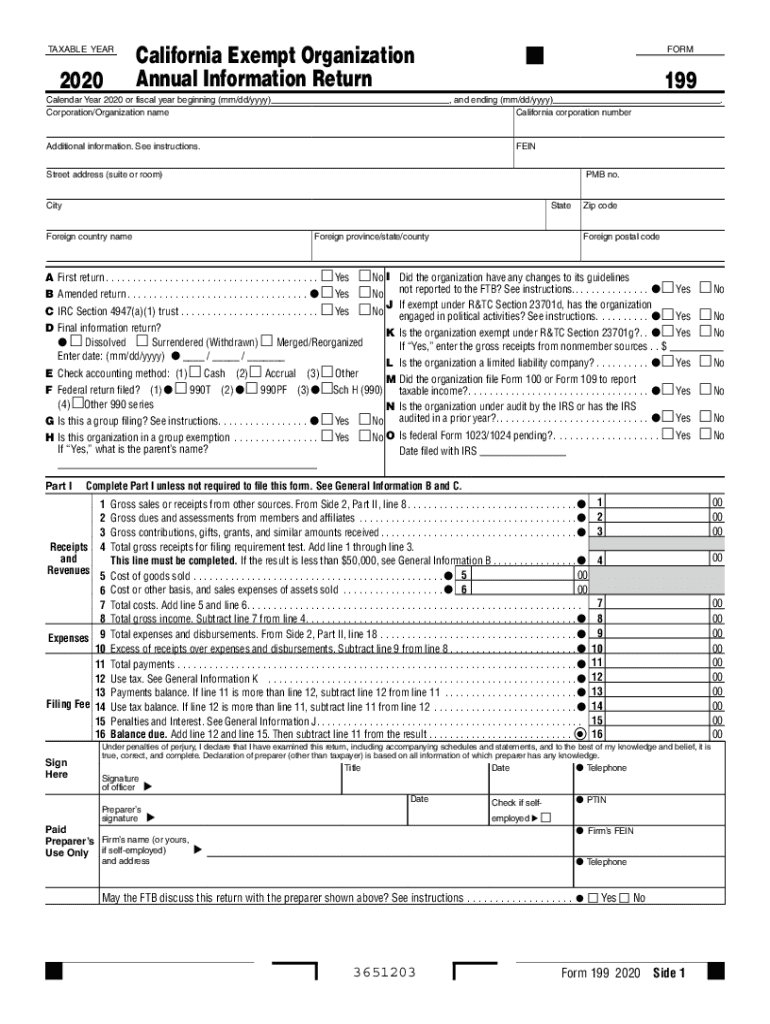

CA FTB 199 20202021 Fill out Tax Template Online US Legal Forms

We are taking appointments at our field offices. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). All federal s corporations subject to california laws must file form 100s. This is a reminder for you and your clients to make sure to file form 100s, california s. A claim for refund.

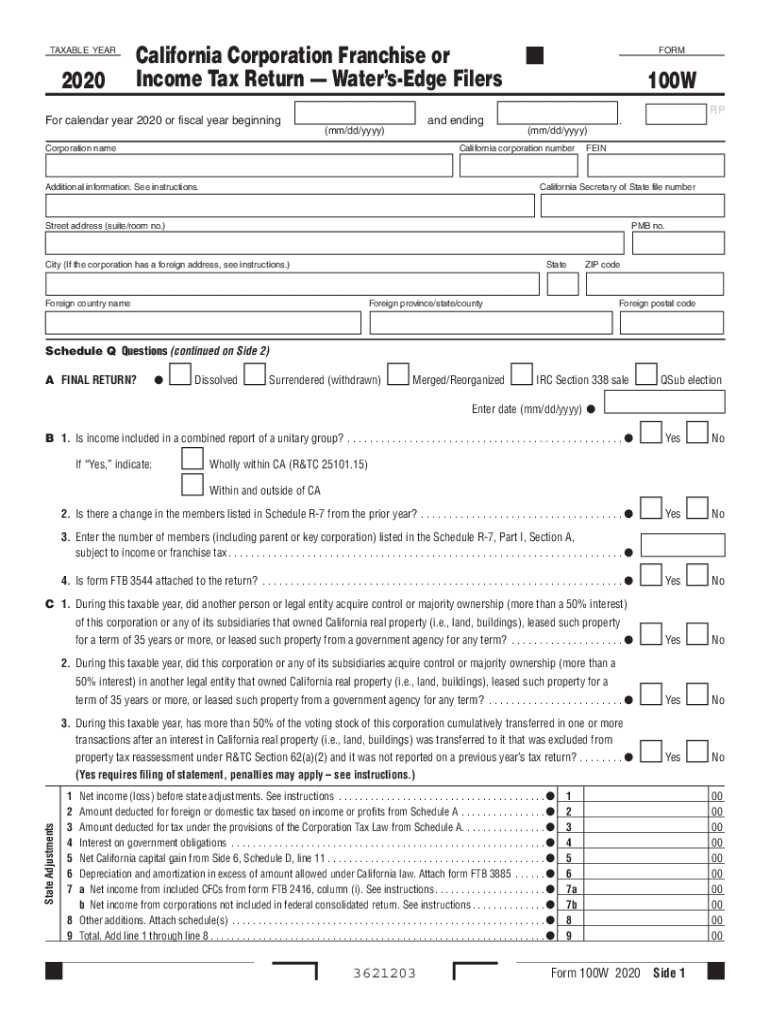

CA FTB 100W 20202022 Fill out Tax Template Online US Legal Forms

20 released updated instructions for 2021 form 100x, amended corporation franchise or income tax. Web file now with turbotax. California corporation franchise or income tax return. References in these instructions are to the internal revenue code (irc) as of january. Or fiscal year beginning (mm/dd/yyyy), and ending (mm/dd/yyyy).rp.

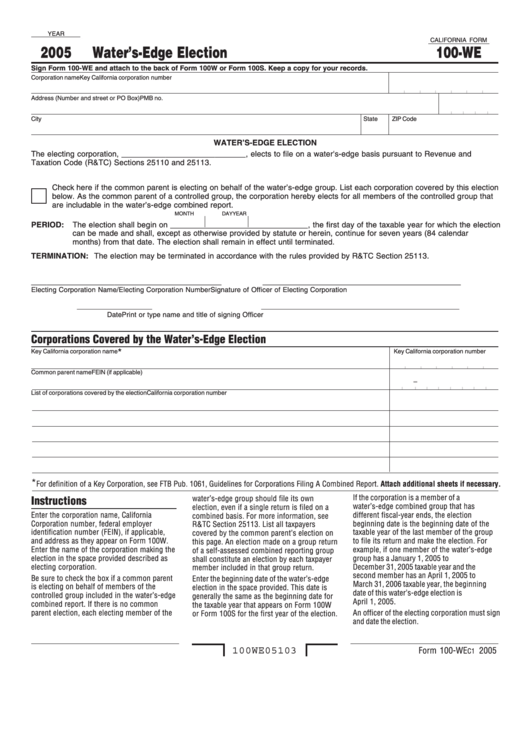

California Form 100We Water'SEdge Election 2005 printable pdf

Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. 2022 s corporation income tax returns due and tax due (for. Or fiscal year beginning (mm/dd/yyyy), and ending (mm/dd/yyyy).rp. We are taking appointments at our field offices. Web file now with turbotax.

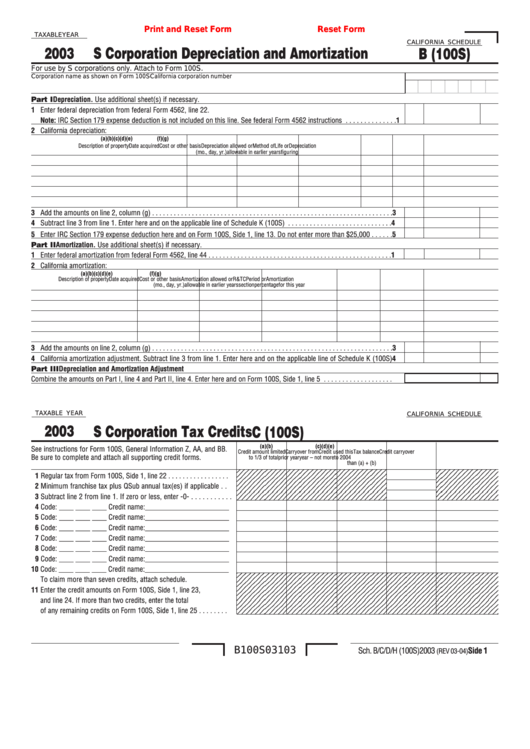

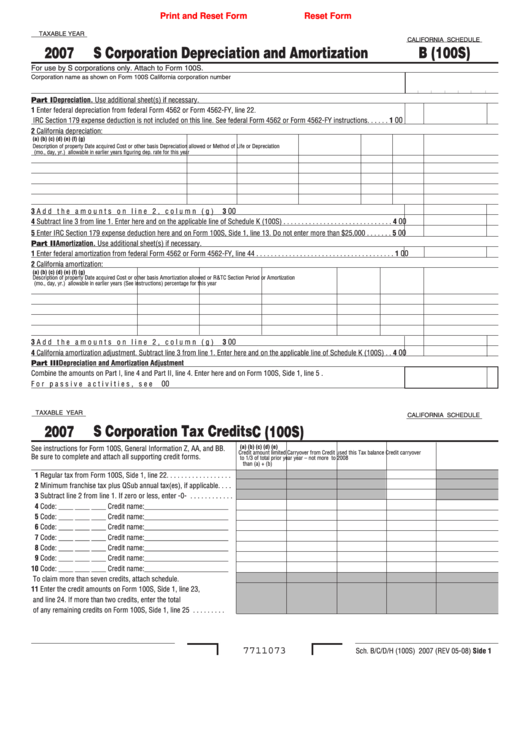

Fillable California Schedule B (100s) S Corporation Depreciation And

Or fiscal year beginning (mm/dd/yyyy), and ending (mm/dd/yyyy).rp. Web 2021 instructions for form 100. See the links below for the california ftb form instructions. Web file now with turbotax. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation).

Web The California Franchise Tax Board (Ftb) Jan.

2022 s corporation income tax returns due and tax due (for. References in these instructions are to the internal revenue code (irc) as of. Web 2021 instructions for form 100. All federal s corporations subject to california laws must file form 100s.

Web Ca Form 100S, California S Corporation Franchise Or Income Tax Return.

References in these instructions are to the internal revenue code (irc) as of january. See the links below for the california ftb form instructions. Follow these steps to mark the california (ca) return as an initial return: A claim for refund of an overpayment of tax should be.

Use Revenue And Taxation Code (R&Tc) Sections 19011, 19021, 19023, 19025 Through 19027, And 19142 Through 19161 To Determine The Estimated Tax.

20 released updated instructions for 2021 form 100x, amended corporation franchise or income tax. Corporation name california corporation number fein. California corporation franchise or income tax return. Web 3611203 form 100s 2020 side 1 b 1.

Original Due Date Is The 15Th Day Of The 3Rd Month After The Close Of The Taxable Year And Extended Due Date Is The 15Th Day Of The 9Th Month After The Close Of The Taxable.

Web check out this ftb booklet for more information about s corporation tax liability. Or fiscal year beginning (mm/dd/yyyy), and ending (mm/dd/yyyy).rp. Web schedule h (100), dividend income deduction schedule p (100), alternative minimum tax and credit limitations — corporations ftb 3539, payment for automatic extension for. Web for more information on california s corporations, please see form 100s booklet (california s corporation franchise or income tax return booklet).