Ca State Withholding Form

Ca State Withholding Form - Web landlord tenant lawyer. Backup withholding supersedes all types of withholding. Web employee action request (ear) std. Web state of california. Form 590 does not apply to payments of backup withholding. Web simplified income, payroll, sales and use tax information for you and your business Quickstart guide and ear samples. Employee withholding amount required for remittal: Choosing not to have income tax withheld: If you wish to claim exempt,.

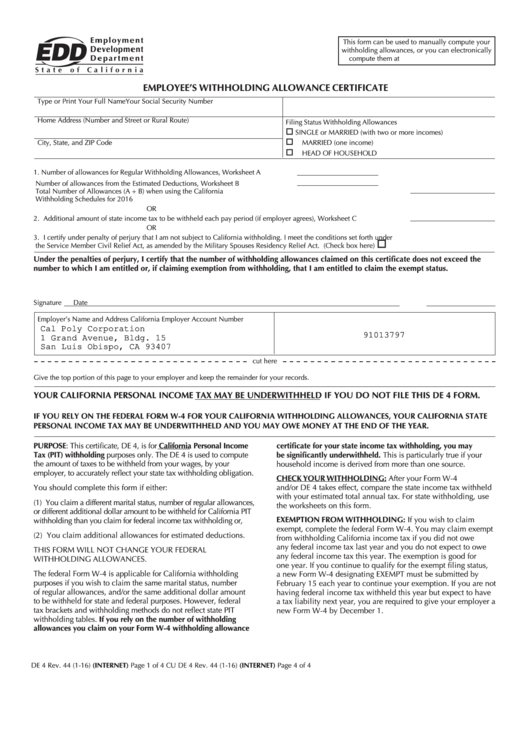

When you hire an employee, they must complete and sign both of the following withholding certificates: Web the income tax withholdings formula for the state of california includes the following changes: Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Choosing not to have income tax withheld: Web state of california. 686 form and federal withholdings toolkit. If there is ca withholding reported on the. Arrasmith founder and chief legal counsel of the law offices. Web simplified income, payroll, sales and use tax information for you and your business

If there is ca withholding reported on the. Web simplified income, payroll, sales and use tax information for you and your business Employee withholding amount required for remittal: Form 590 does not apply to payments of backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. 686 form and federal withholdings toolkit. Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. If you wish to claim exempt,. For state withholding, use the worksheets on this form. When you hire an employee, they must complete and sign both of the following withholding certificates:

West Virginia Employers Withholding Tax Tables 2017 Awesome Home

Web state income tax withheld with your estimated total annual tax. If you wish to claim exempt,. The low income exemption amount for married with 0 or 1 allowance. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Web by checking the appropriate.

FL195 Withholding for Support Free Download

Arrasmith founder and chief legal counsel of the law offices. Web the income tax withholdings formula for the state of california includes the following changes: Web employee action request (ear) std. Quickstart guide and ear samples. Web simplified income, payroll, sales and use tax information for you and your business

Ca State Withholding Form How To Fill Out

686 form and federal withholdings toolkit. If there is ca withholding reported on the. Form 592 is also used to. Web simplified income, payroll, sales and use tax information for you and your business If you wish to claim exempt,.

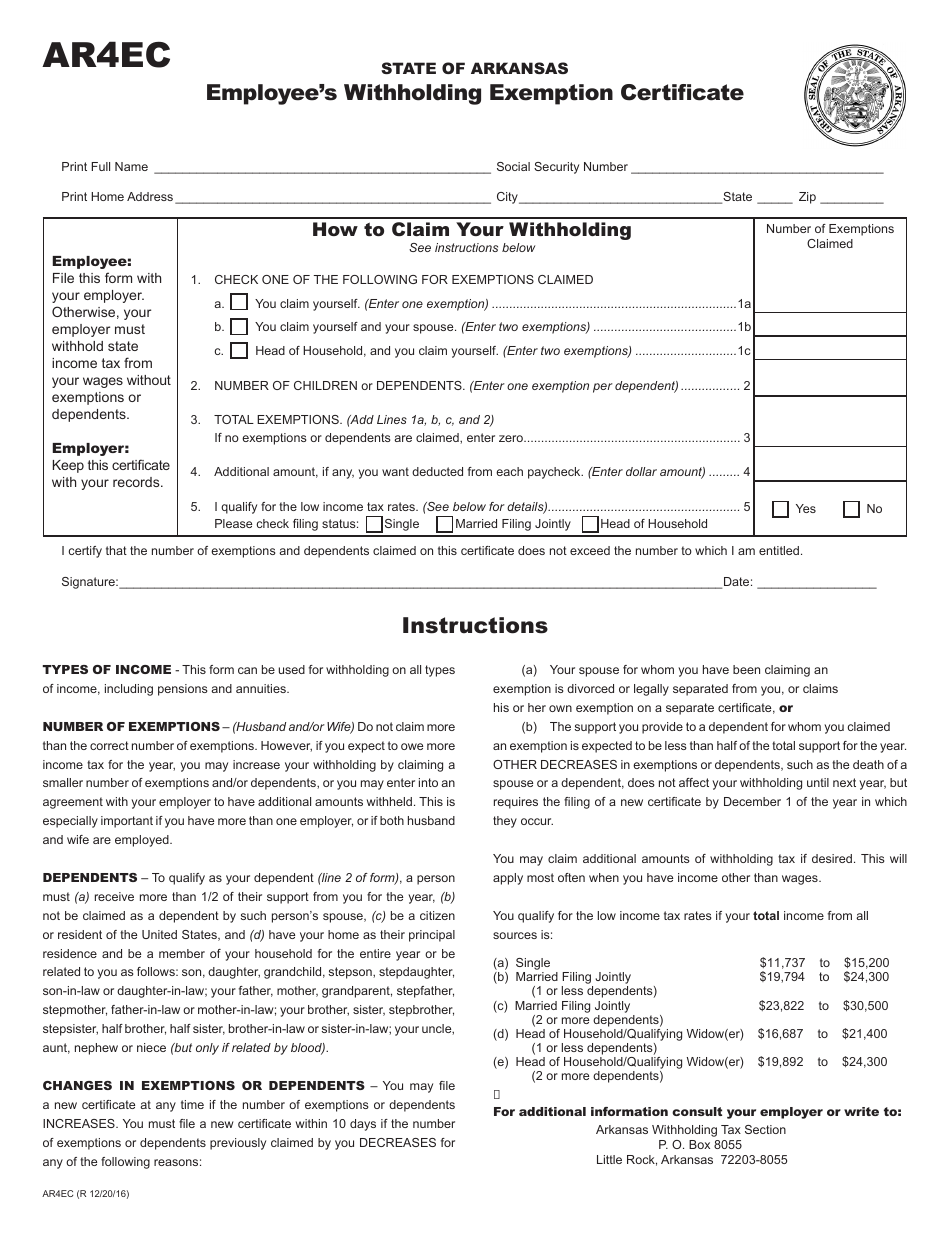

Form AR4ec Download Fillable PDF or Fill Online Employee's Withholding

Web there are no reductions or waivers for backup withholding and no set minimum threshold. 686 form and federal withholdings toolkit. Web california provides two methods for determining the amount of wages and salaries to be withheld for state pit: Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web form de 4p at edd.ca.gov.

Kansas State Tax Withholding Form 2022

When you hire an employee, they must complete and sign both of the following withholding certificates: Web employee action request (ear) std. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web the income tax withholdings formula for the state of california includes the following changes: Web california withholding schedules for 2023 california provides two.

1040ez Printable Form carfare.me 20192020

Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Web employee action request (ear) std. Web there are no reductions or waivers for backup withholding and no set minimum threshold. Web california provides two methods for determining the amount of wages and salaries.

CA FTB 589 2019 Fill out Tax Template Online US Legal Forms

When you hire an employee, they must complete and sign both of the following withholding certificates: Web california provides two methods for determining the amount of wages and salaries to be withheld for state pit: Backup withholding supersedes all types of withholding. Web there are no reductions or waivers for backup withholding and no set minimum threshold. Choosing not to.

California Worksheet A Withholding 2022 Calendar Tripmart

Web the income tax withholdings formula for the state of california includes the following changes: Web state of california. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Web california provides two methods for determining the amount of wages and salaries to be.

Fillable Employee Development Department State Of California Employee

Web employee action request (ear) std. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal income. Web state income tax withheld with your estimated total annual tax. 686 form and federal withholdings toolkit. Arrasmith founder and chief legal counsel of the law offices.

9+ California Rent and Lease Template Free Download

Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal income. If there is ca withholding reported on the. Web there are no reductions.

If There Is Ca Withholding Reported On The.

Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Quickstart guide and ear samples. When you hire an employee, they must complete and sign both of the following withholding certificates: Backup withholding supersedes all types of withholding.

For State Withholding, Use The Worksheets On This Form.

The low income exemption amount for married with 0 or 1 allowance. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web simplified income, payroll, sales and use tax information for you and your business Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations.

Tax Withheld On California Source Income Is Reported To The Franchise Tax Board (Ftb) Using Form 592, Resident And Nonresident Withholding Statement.

Web form de 4p at edd.ca.gov for california state withholding. Form 590 does not apply to payments of backup withholding. Web california provides two methods for determining the amount of wages and salaries to be withheld for state pit: Web state income tax withheld with your estimated total annual tax.

Employee Withholding Amount Required For Remittal:

You (or in the event of death, your beneficiary or estate) can. Web employee action request (ear) std. Web state of california. 686 form and federal withholdings toolkit.