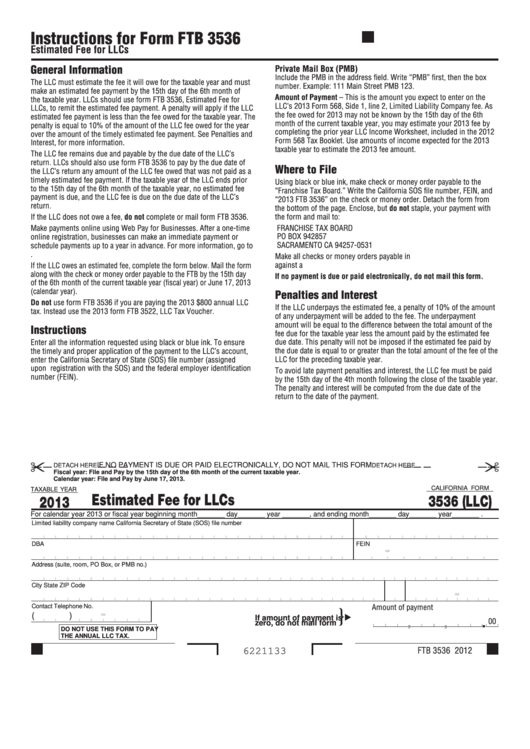

Ca Form 3536

Ca Form 3536 - Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. This form is used to estimate and pay the annual llc tax. Afterward, llcs will need to file form 3536 by june 15 every year. Llcs must file form 3536 within six months after formation. This form is due by the “15th day of the 6th month” after your llc is approved. In this form, you’ll report the: Use form ftb 3536 if you are paying the 2022 $800 annual llc tax. Web the fee is $900 for llcs that make between $250,000 and $500,000 during the year. It summarizes your california llc’s financial activity during a taxable year. Llc return of income (fee varies) each year, all llcs must also file form 568, called the llc return of income.

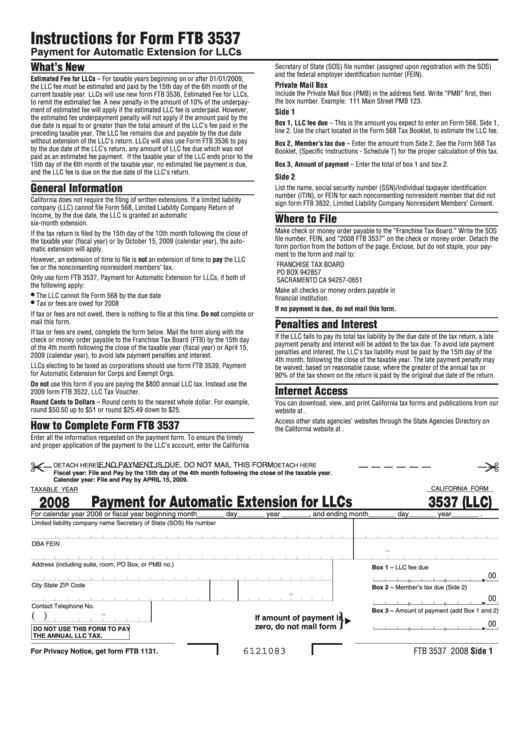

Instead use the 2022 form ftb 3522, llc tax voucher. 16, 2023, to file and pay taxes. Llcs must file form 3536 within six months after formation. Web look for form 3536 and click the link to download; Llc return of income (fee varies) each year, all llcs must also file form 568, called the llc return of income. You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. This form is due by the “15th day of the 6th month” after your llc is approved. Web your annual llc tax will be due on september 15, 2020 (15th day of the 4th month) your subsequent annual tax payments will continue to be due on the 15th day of the 4th month of your taxable year. Ftb 3536, estimated fee for llcs. When are my estimate payments due?

Amounts will carry to the ca 568, line 6 and produce a detailed statement. Llc return of income (fee varies) each year, all llcs must also file form 568, called the llc return of income. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. This form is used to estimate and pay the annual llc tax. Form 3536 only needs to be filed if your income is $250,000 or more. Llcs must file form 3536 within six months after formation. When are my estimate payments due? Llcs use ftb 3536 to. Use form ftb 3536 if you are paying the 2022 $800 annual llc tax. The fee is $2,500 for llcs that make between $500,000 and $1,000,000 during the tax year.

2017 Form 3536 Estimated Fee For Ll Cs Edit, Fill, Sign Online Handypdf

Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Ftb 3536, estimated fee for llcs. Amounts will carry to the ca 568, line 6 and produce a detailed statement. Web look for form 3536 and click the link to download; Enter all the information requested using.

CA Form 1073 20142021 Complete Legal Document Online US Legal Forms

The annual tax payment is due with llc tax voucher (ftb 3522). Llcs must file form 3536 within six months after formation. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Web file form ftb 3536. Exempt organizations forms and payments.

California Form 3536 (Llc) Estimated Fee For Llcs 2013 printable

Web your annual llc tax will be due on september 15, 2020 (15th day of the 4th month) your subsequent annual tax payments will continue to be due on the 15th day of the 4th month of your taxable year. You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for.

CreekBridge Village Apartments Apartments in Salinas, CA

16, 2023, to file and pay taxes. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Form 3536 only needs to be filed if your income is $250,000 or more. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to.

Fillable California Form 3537 (Llc) Payment For Automatic Extension

Web file form ftb 3536. Web look for form 3536 and click the link to download; The fee is $2,500 for llcs that make between $500,000 and $1,000,000 during the tax year. To ensure the timely and proper application of the payment to the llc’s account, enter the Form 3536 only needs to be filed if your income is $250,000.

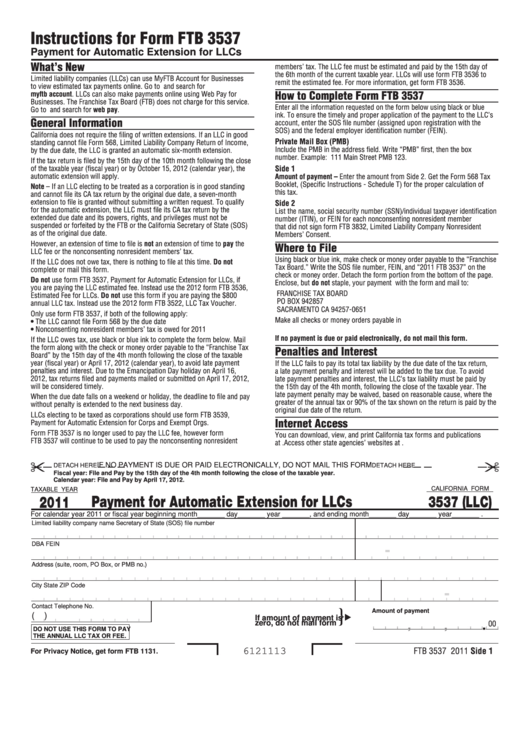

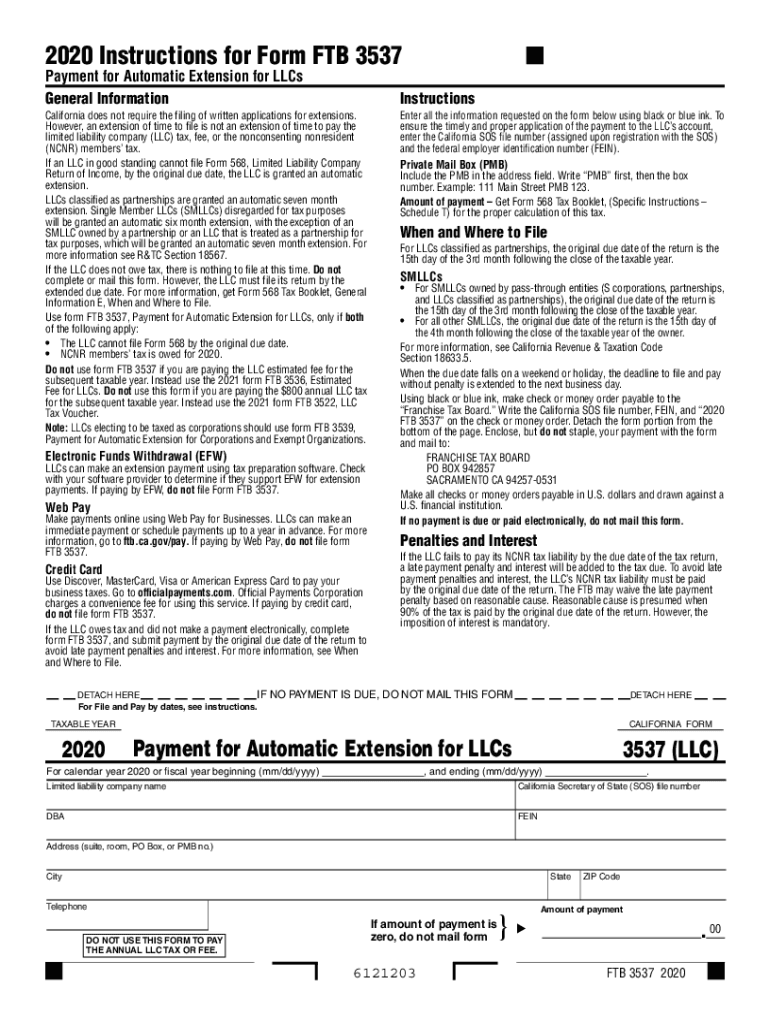

Form 3537 California Fill Out and Sign Printable PDF Template signNow

This form is due by the “15th day of the 6th month” after your llc is approved. In this form, you’ll report the: Web your annual llc tax will be due on september 15, 2020 (15th day of the 4th month) your subsequent annual tax payments will continue to be due on the 15th day of the 4th month of.

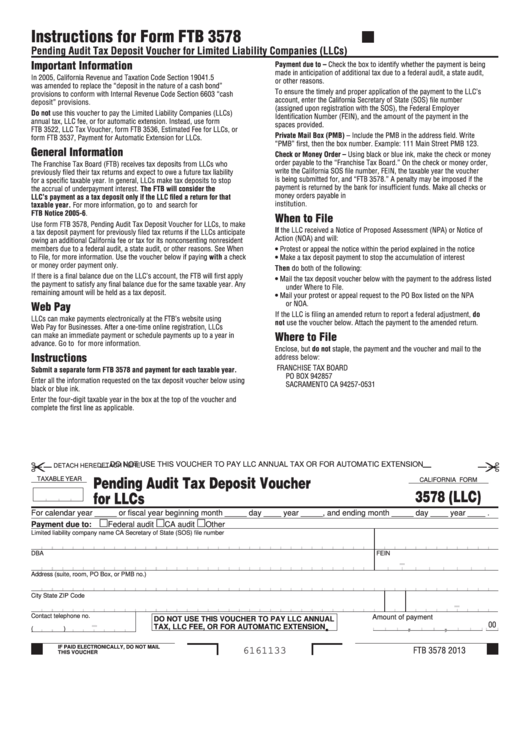

California Form 3578 Pending Audit Tax Deposit Voucher For Llcs

To ensure the timely and proper application of the payment to the llc’s account, enter the Exempt organizations forms and payments. Form 3536 only needs to be filed if your income is $250,000 or more. You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. Llcs must file.

If he had a physical form I would’ve strangled the brat MassEffectMemes

Exempt organizations forms and payments. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Afterward, llcs will need to file form 3536 by june 15.

Ca Form 3536 2022

Amounts will carry to the ca 568, line 6 and produce a detailed statement. To ensure the timely and proper application of the payment to the llc’s account, enter the In this form, you’ll report the: Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Ftb 3536, estimated.

Fillable California Form 3537 (Llc) Payment For Automatic Extension

Ftb 3536, estimated fee for llcs. Use form ftb 3536 if you are paying the 2022 $800 annual llc tax. You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. Web look for form 3536 and click the link to download; This form is used to estimate and.

In This Form, You’ll Report The:

For tax years that begin on or after january 1, 2009, llcs must estimate and pay their applicable fee by the 15th day of the 6th month of the current tax year. Use form ftb 3536 if you are paying the 2022 $800 annual llc tax. Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. Form 3536 only needs to be filed if your income is $250,000 or more.

Web Your Annual Llc Tax Will Be Due On September 15, 2020 (15Th Day Of The 4Th Month) Your Subsequent Annual Tax Payments Will Continue To Be Due On The 15Th Day Of The 4Th Month Of Your Taxable Year.

Amounts will carry to the ca 568, line 6 and produce a detailed statement. Afterward, llcs will need to file form 3536 by june 15 every year. The fee is $2,500 for llcs that make between $500,000 and $1,000,000 during the tax year. The annual tax payment is due with llc tax voucher (ftb 3522).

When Are My Estimate Payments Due?

Web the fee is $900 for llcs that make between $250,000 and $500,000 during the year. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. It summarizes your california llc’s financial activity during a taxable year. You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year.

Exempt Organizations Forms And Payments.

This form is used to estimate and pay the annual llc tax. This form is due by the “15th day of the 6th month” after your llc is approved. Web look for form 3536 and click the link to download; Llcs must file form 3536 within six months after formation.

.jpg?crop=(0,0,300,200)&cropxunits=300&cropyunits=200&quality=85&scale=both&)