Ca Form 100S Instructions

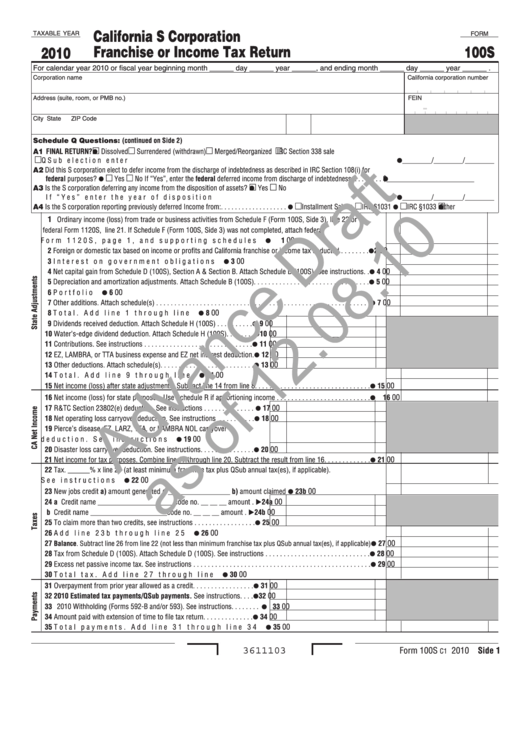

Ca Form 100S Instructions - Web california law is also different in the following areas: Web 2021 instructions for form 100california corporation franchise or income tax return. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Web see the links below for the california ftb form instructions. When do i file my corporation return? Web instructions for form 100s california s corporation franchise or income tax return references in these instructions are to the internal revenue code (irc) as of january. Web forms & instructions 100s 2010 s corporation tax booklet members of the franchise tax board john chiang, chair betty t. The s corporation is allowed tax credits and net operating losses. California s corporation franchise or income tax return. Web marking s corporate form 100s as an initial return in proconnect.

File your california and federal tax returns online with turbotax in minutes. Corporations that incorporated or qualified. Web 2015 instructions for form 100s. 2022 form 100s 2022 form 100s k1 2021 form 100s 2021 form 100s k1 2020 form 100s 2020. Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web 2022 instructions for form 100 california corporation franchise or income tax return. We are taking appointments at our field offices. All federal s corporations subject to california laws must file form 100s. When do i file my corporation return? Web forms & instructions 100s 2010 s corporation tax booklet members of the franchise tax board john chiang, chair betty t.

Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web california law is also different in the following areas: The s corporation is allowed tax credits and net operating losses. Web follow the simple instructions below: Choosing a legal professional, making a scheduled appointment and going to the business office for a personal meeting makes completing a. Web see the links below for the california ftb form instructions. 2022 form 100s 2022 form 100s k1 2021 form 100s 2021 form 100s k1 2020 form 100s 2020. California s corporation franchise or income tax return. File your california and federal tax returns online with turbotax in minutes. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable.

Form 100S California S Corporation Franchise or Tax Return YouTube

Web 2021 instructions for form 100california corporation franchise or income tax return. Web california law is also different in the following areas: Web efile your california tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web forms & instructions 100s 2010 s corporation tax booklet members of the franchise tax board john chiang, chair.

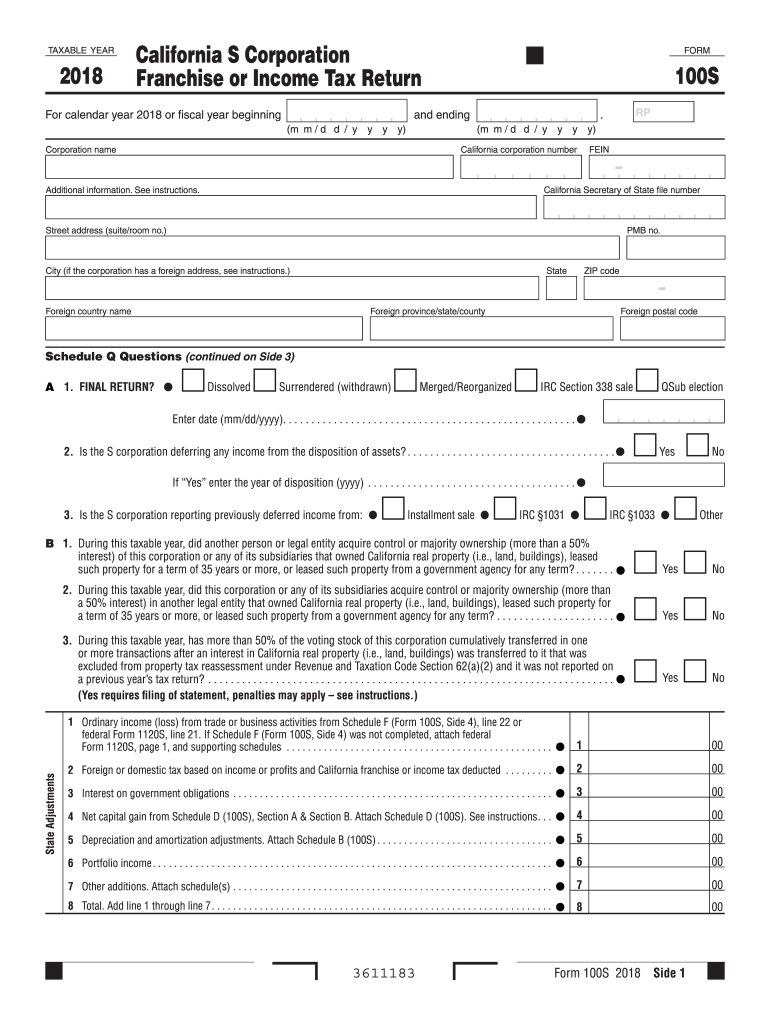

20182022 Form CA FTB 100S Tax Booklet Fill Online, Printable, Fillable

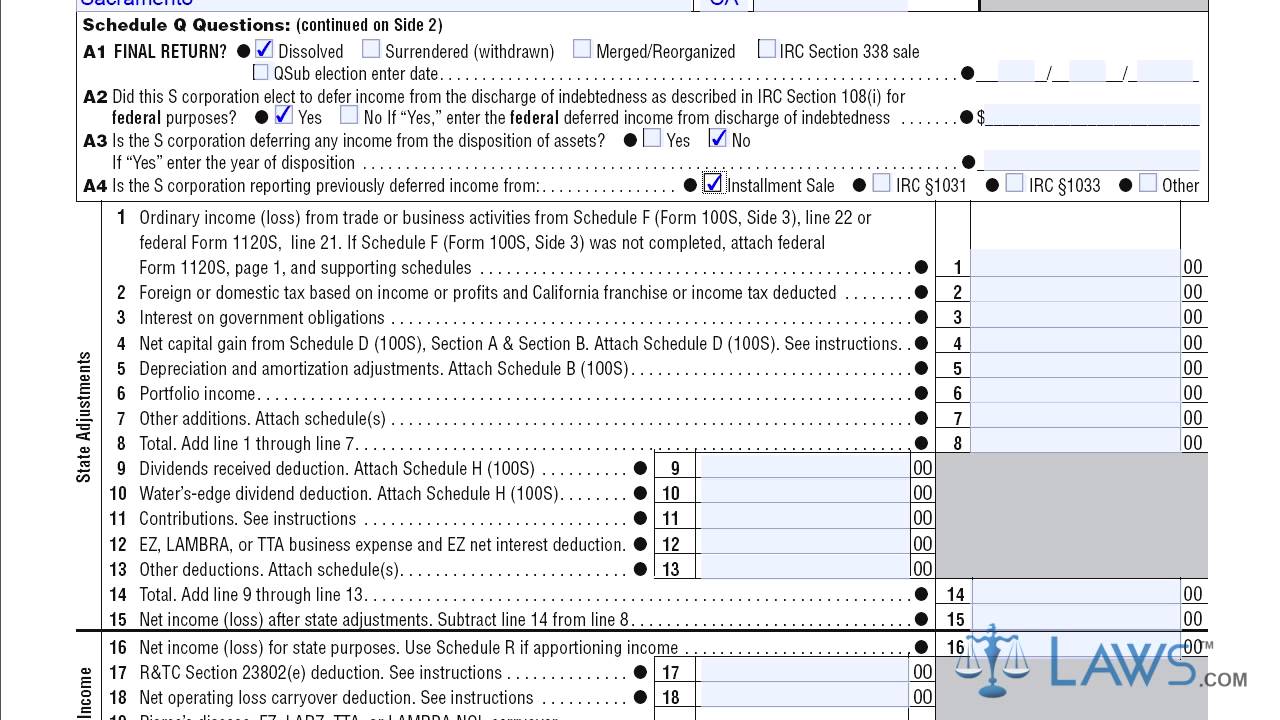

This is a reminder for you and your clients to make sure to file form 100s, california s. We are taking appointments at our field offices. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. References in these instructions are to the internal revenue code (irc) as of. Side 4.

2012 Form 100S Franchise Tax Board Edit, Fill, Sign Online Handypdf

2022 form 100s 2022 form 100s k1 2021 form 100s 2021 form 100s k1 2020 form 100s 2020. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Web follow the simple instructions below:.

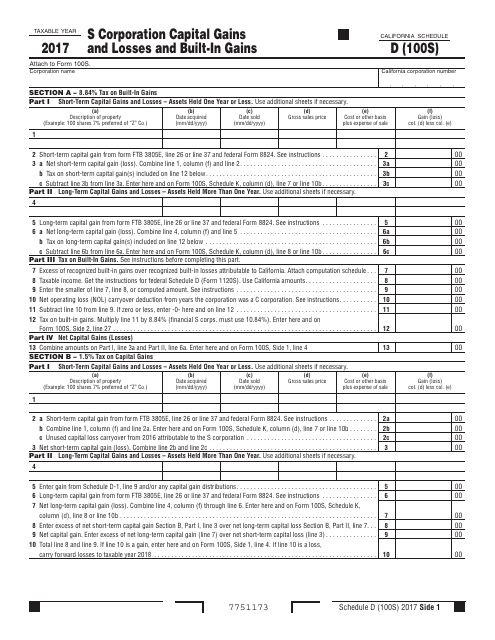

Form 100S Schedule D Download Printable PDF or Fill Online S

Web marking s corporate form 100s as an initial return in proconnect. Web 3611193 form 100s 2019 side 1 b 1. Web 2021 instructions for form 100california corporation franchise or income tax return. Web instructions for form 100s california s corporation franchise or income tax return references in these instructions are to the internal revenue code (irc) as of january..

California Form 100s Instructions PDF Fill Out and Sign Printable PDF

The s corporation is allowed tax credits and net operating losses. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Side 4 form 100s 20203614203. 2022 form 100s 2022 form 100s k1 2021 form 100s 2021 form 100s k1 2020 form 100s 2020. This is a reminder for you and.

Ca form 100s instructions 2017

The s corporation is allowed tax credits and net operating losses. All federal s corporations subject to california laws must file form 100s. This is a reminder for you and your clients to make sure to file form 100s, california s. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). We.

Form 100s Draft California S Corporation Franchise Or Tax

Web instructions for form 100s california s corporation franchise or income tax return references in these instructions are to the internal revenue code (irc) as of january. 1 a)gross receipts or sales ____________ b)less returns and allowances _______________ c)balance. When do i file my corporation return? During this taxable year, did another person or legal entity acquire control or majority.

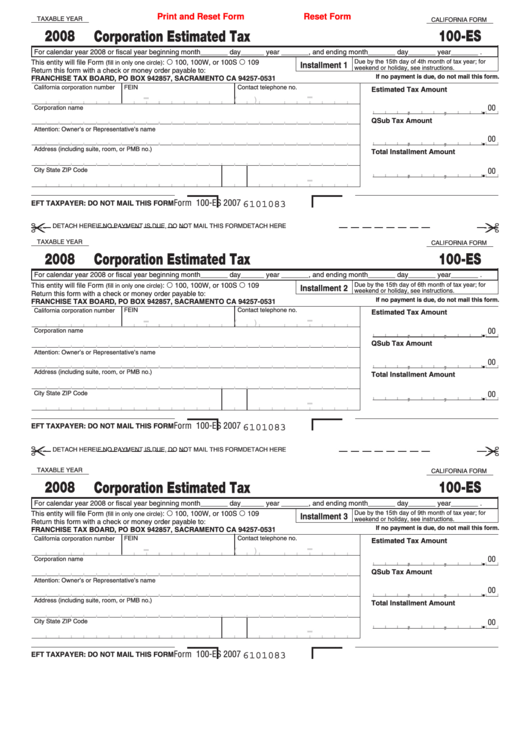

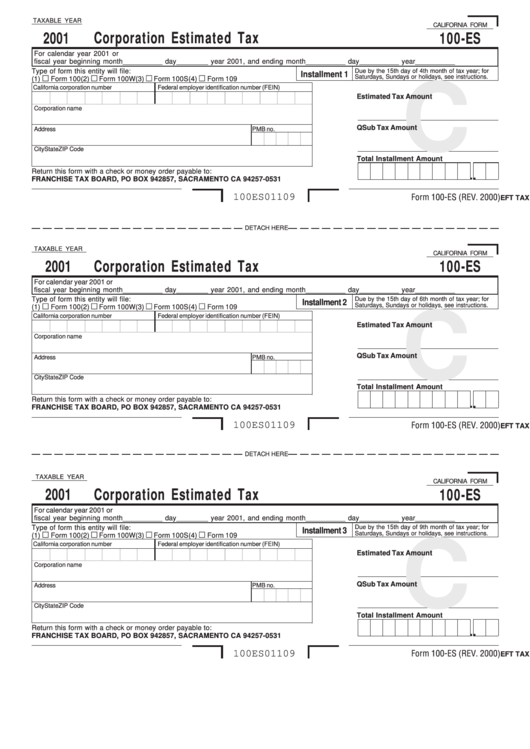

Fillable California Form 100Es Corporation Estimated Tax 2008

Web marking s corporate form 100s as an initial return in proconnect. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). This is a reminder for you and your clients to make.

2012 Form 100S Franchise Tax Board Edit, Fill, Sign Online Handypdf

References in these instructions are to the internal revenue code (irc) as of. Web follow the simple instructions below: During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. The s corporation is allowed tax credits and net operating losses. Web california law is also different in the following areas:

Form 100Es Corporation Estimated Tax California printable pdf download

References in these instructions are to the internal revenue code (irc) as of january. 2022 form 100s 2022 form 100s k1 2021 form 100s 2021 form 100s k1 2020 form 100s 2020. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web 3611193 form 100s 2019 side 1 b 1..

Original Due Date Is The 15Th Day Of The 3Rd Month After The Close Of The Taxable Year And Extended Due Date Is The 15Th Day Of The 9Th Month After The Close Of The Taxable.

Web instructions for form 100s california s corporation franchise or income tax return references in these instructions are to the internal revenue code (irc) as of january. Web 2015 instructions for form 100s. Side 4 form 100s 20203614203. This is a reminder for you and your clients to make sure to file form 100s, california s.

Web 3611193 Form 100S 2019 Side 1 B 1.

Web 2022 instructions for form 100 california corporation franchise or income tax return. References in these instructions are to the internal revenue code (irc) as of january. 1 a)gross receipts or sales ____________ b)less returns and allowances _______________ c)balance. California s corporation franchise or income tax return.

Web Form 100S Is Used If A Corporation Has Elected To Be A Small Business Corporation (S Corporation).

2022 form 100s 2022 form 100s k1 2021 form 100s 2021 form 100s k1 2020 form 100s 2020. Corporations that incorporated or qualified. Web follow the simple instructions below: Solved • by intuit • 2 • updated march 21, 2023.

The S Corporation Is Allowed Tax Credits And Net Operating Losses.

Web see the links below for the california ftb form instructions. Web california law is also different in the following areas: Web 2021 instructions for form 100california corporation franchise or income tax return. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%.