Business Expense Form

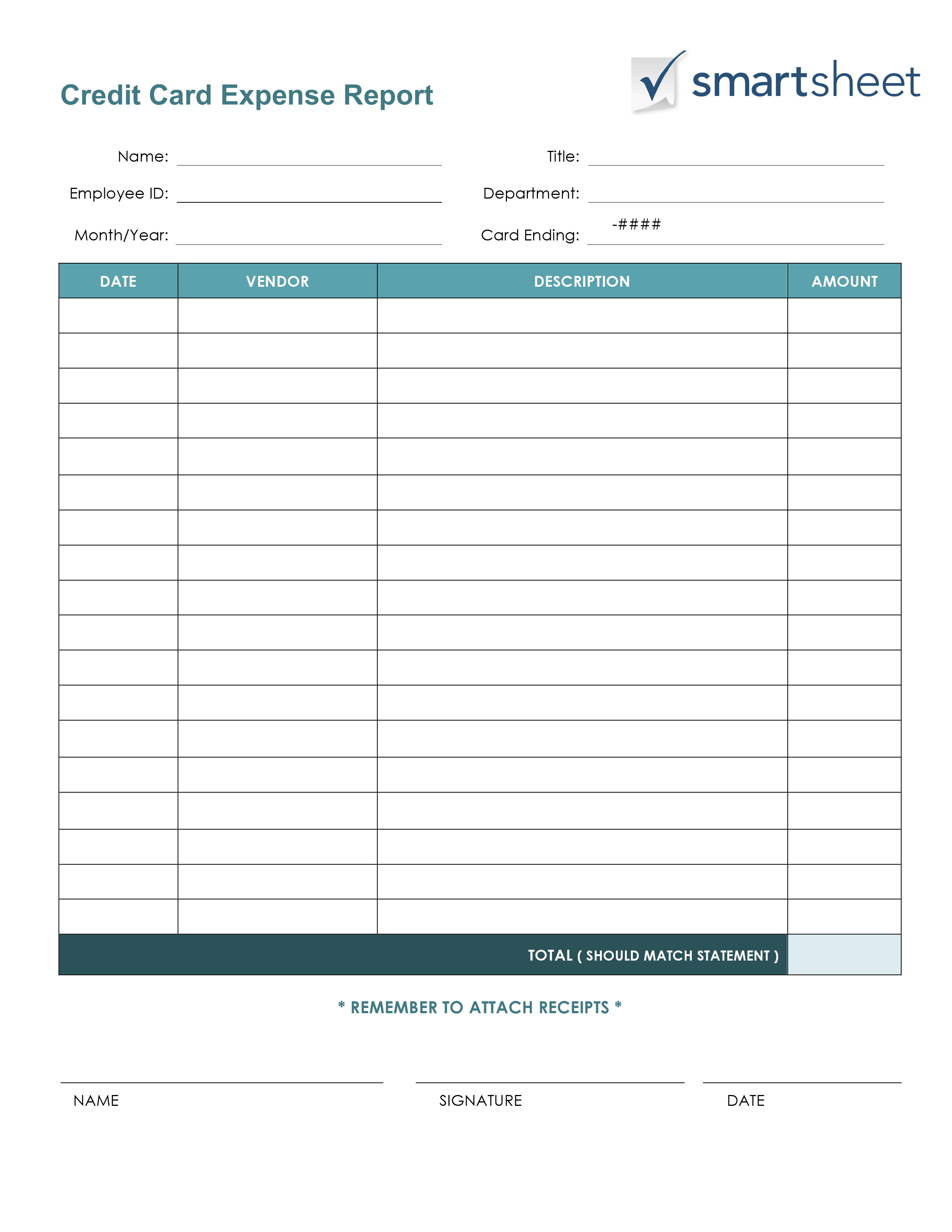

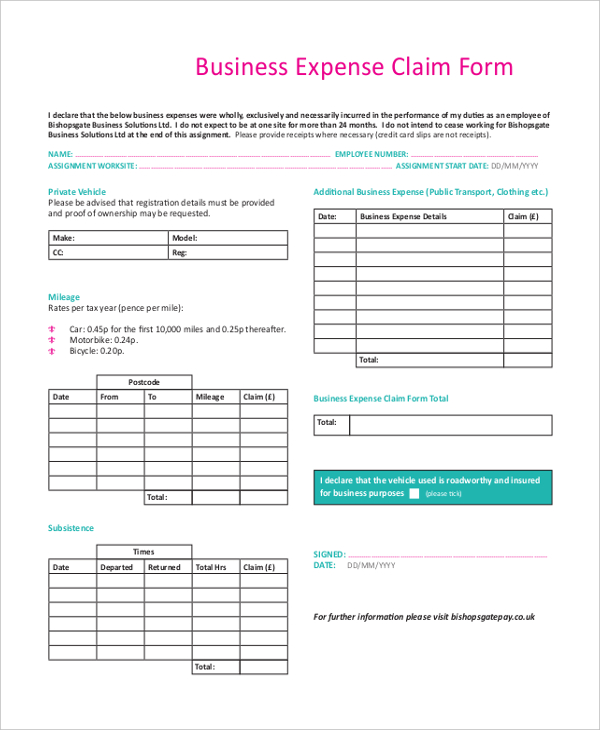

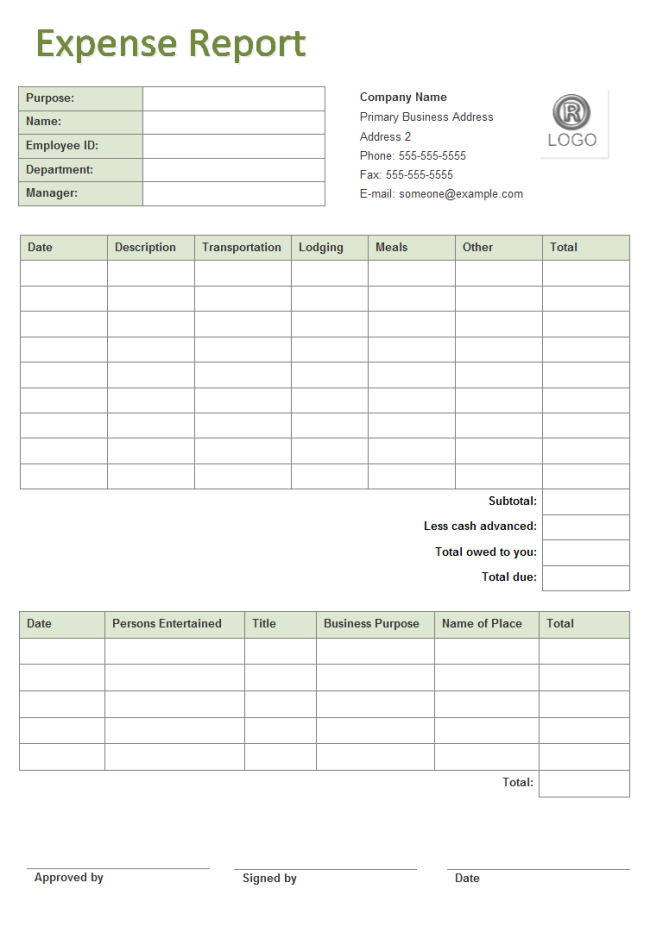

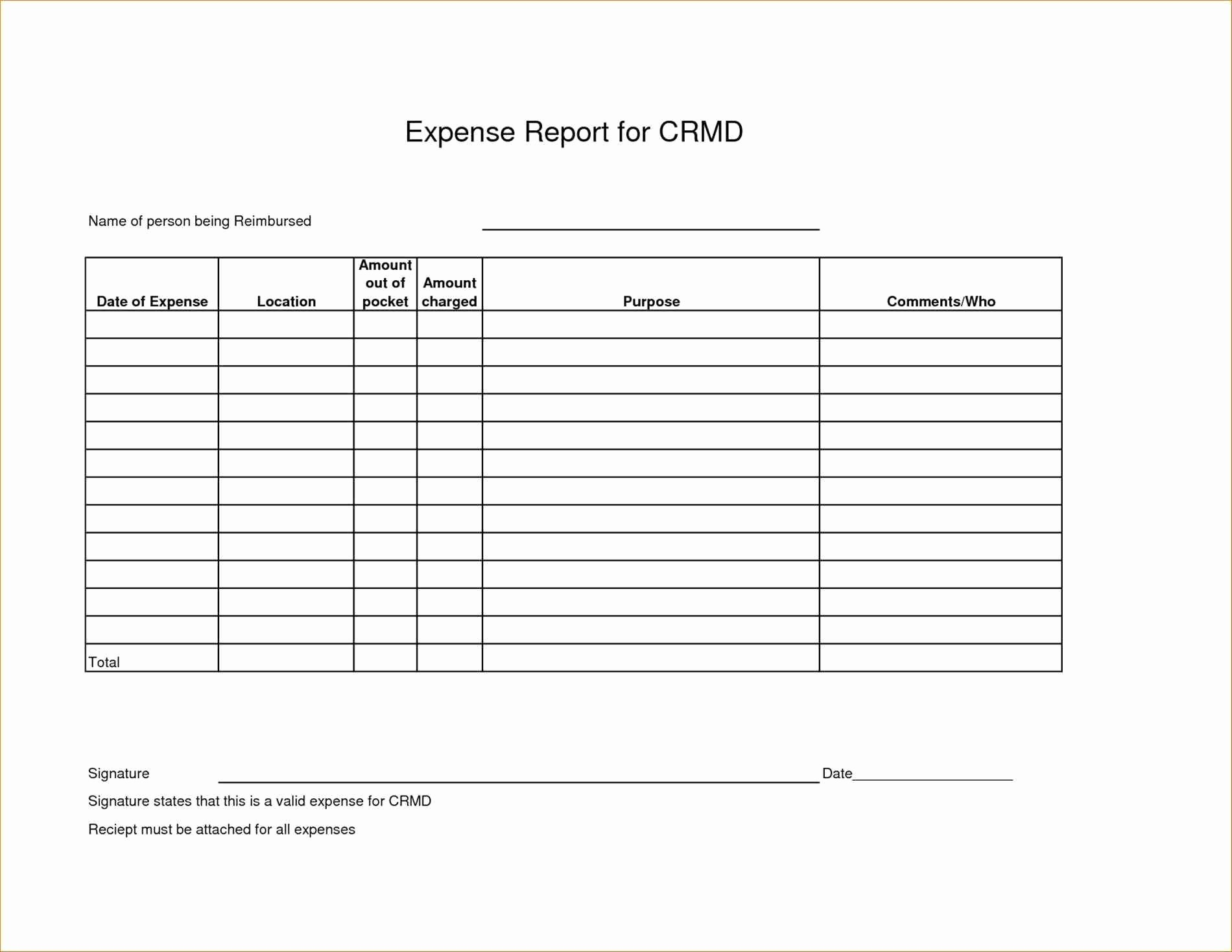

Business Expense Form - Web about form 2106, employee business expenses an ordinary expense is one that is common and accepted in your field of trade, business, or profession. Plus, get tips on completing small business expense tracker templates. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. You are involved in the activity with continuity and regularity. Web according to the internal revenue service (irs), business expenses are ordinary and necessary costs incurred to operate your business. The chapters that follow cover specific expenses and list other publications and forms you may need. Web download the simple printable expense report form for adobe pdf this basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue reimbursement quickly. Web this publication discusses common business expenses and explains what is and is not deductible. A necessary expense is one that is helpful and appropriate for your business. The details in this form are.

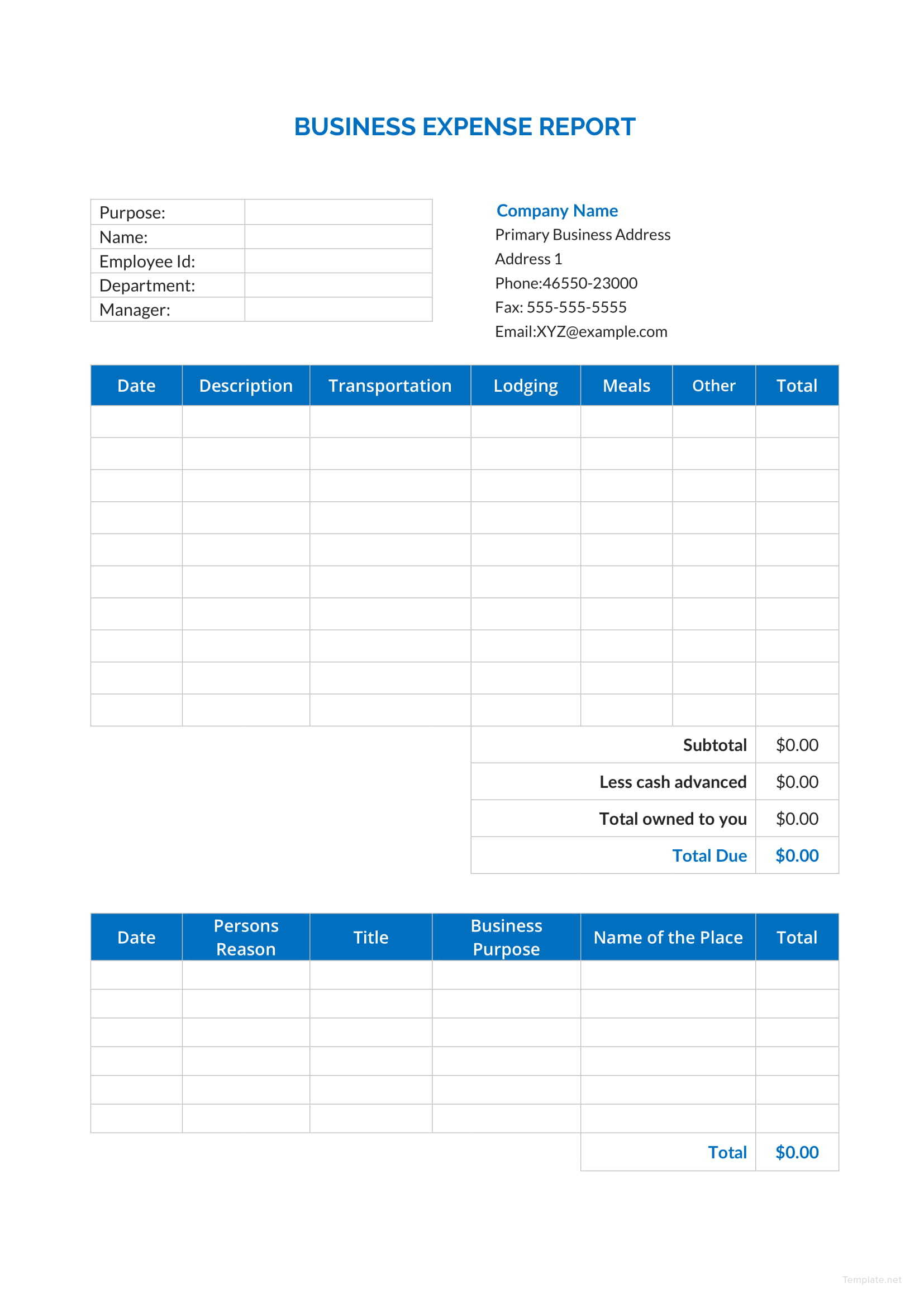

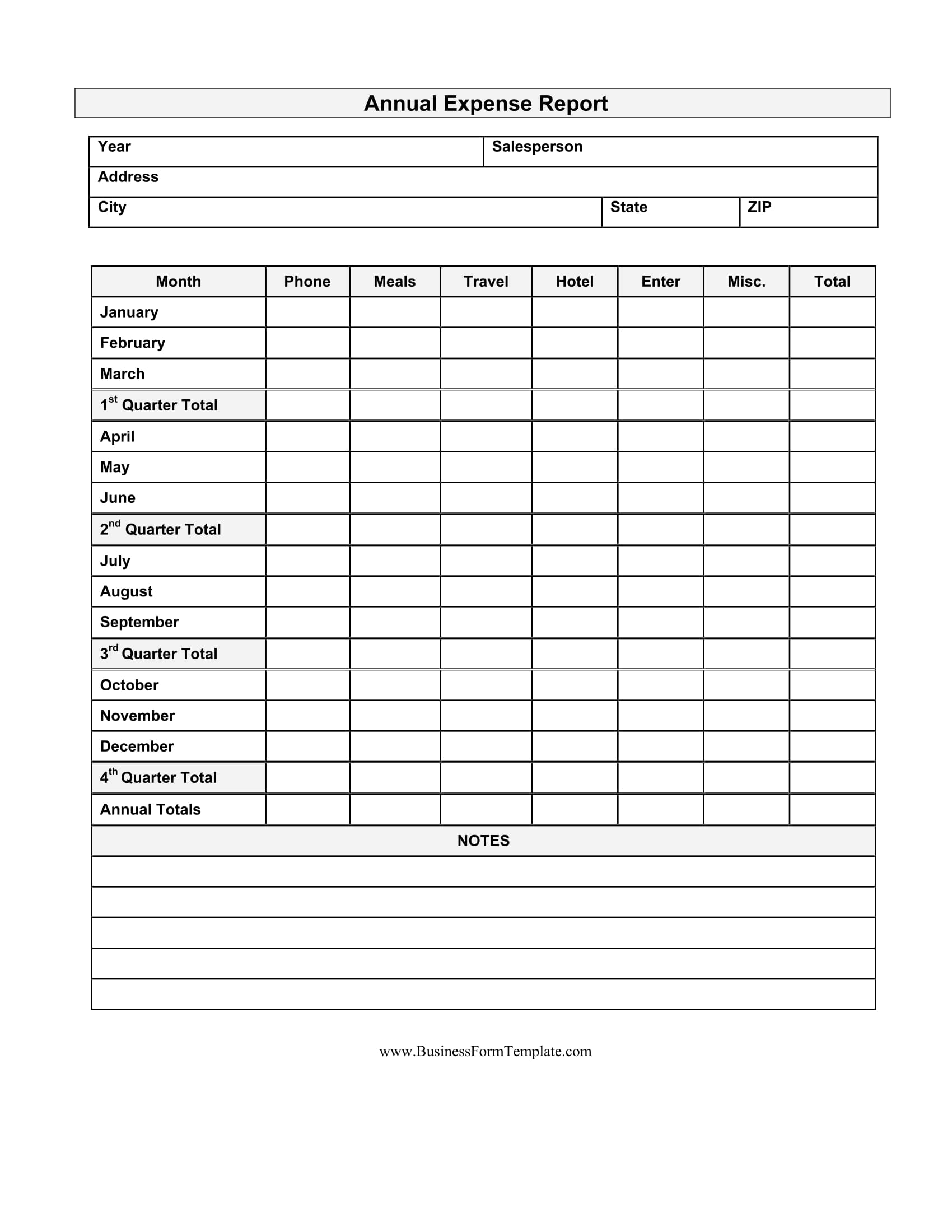

A necessary expense is one that is helpful and appropriate for your business. Computation of section 163 (j) limitation. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. The general rules for deducting business expenses are discussed in the opening chapter. The details in this form are. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). Web download the simple printable expense report form for adobe pdf this basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue reimbursement quickly. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Plus, get tips on completing small business expense tracker templates. This report includes details about each expense and acts as an organized record for reimbursement or accounting purposes.

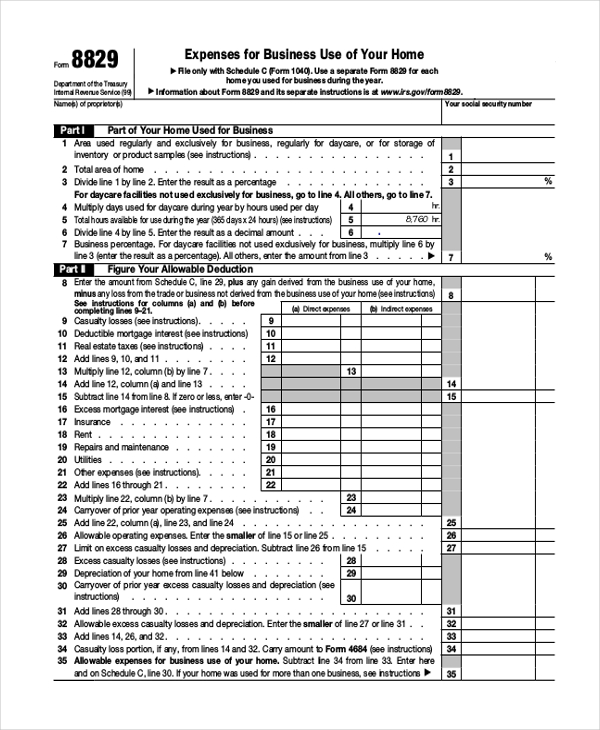

Web about form 2106, employee business expenses an ordinary expense is one that is common and accepted in your field of trade, business, or profession. Web use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. The chapters that follow cover specific expenses and list other publications and forms you may need. Computation of section 163 (j) limitation. You are involved in the activity with continuity and regularity. An expense does not have to be required to. Fixed expenses are regular and don’t change much — things like rent and insurance. Plus, get tips on completing small business expense tracker templates. Web download the simple printable expense report form for adobe pdf this basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue reimbursement quickly. The general rules for deducting business expenses are discussed in the opening chapter.

Simple Expense Report Template charlotte clergy coalition

Web according to the internal revenue service (irs), business expenses are ordinary and necessary costs incurred to operate your business. Web this publication discusses common business expenses and explains what is and is not deductible. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). Web download the simple printable expense report form for adobe.

FREE 10+ Sample Business Expense Report Forms in PDF Word Excel

An expense does not have to be required to. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as a business if: Web download the simple printable expense report form for adobe pdf this basic printable expense report.

Business Expense Report Free Business Expense Report Templates

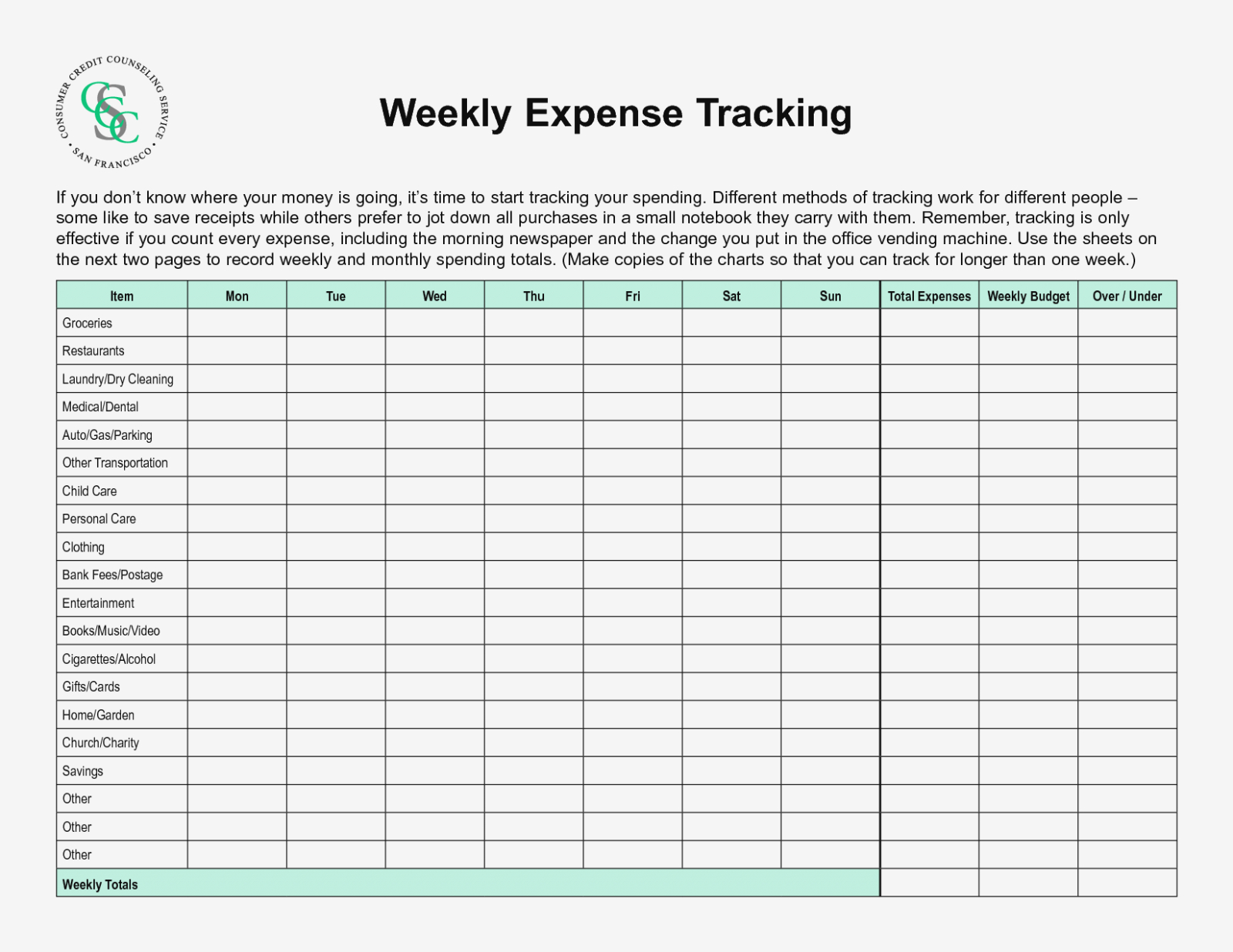

You are involved in the activity with continuity and regularity. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web included on this page, you’ll find a small business expense template for monthly and daily tracking, a template for tracking startup.

Business Expense Form Template Free —

Computation of section 163 (j) limitation. An expense does not have to be required to. A necessary expense is one that is helpful and appropriate for your business. Your primary purpose for engaging in the activity is for income or profit. Web about form 2106, employee business expenses an ordinary expense is one that is common and accepted in your.

Free Printable And Expense Form Free Printable

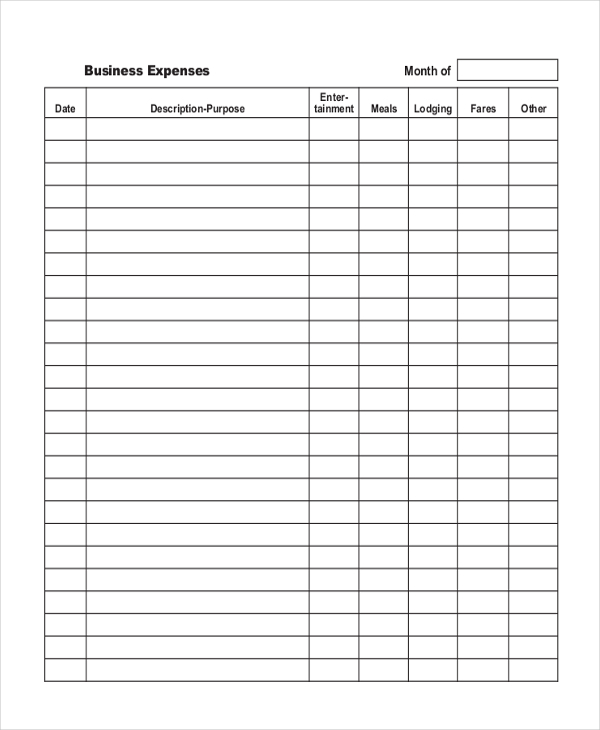

Partnerships must generally file form 1065. Web according to the internal revenue service (irs), business expenses are ordinary and necessary costs incurred to operate your business. The chapters that follow cover specific expenses and list other publications and forms you may need. Web this publication discusses common business expenses and explains what is and is not deductible. The details in.

FREE 11+ Sample Business Expense Forms in PDF Excel Word

The general rules for deducting business expenses are discussed in the opening chapter. Examples include inventory, payroll and rent. The chapters that follow cover specific expenses and list other publications and forms you may need. A necessary expense is one that is helpful and appropriate for your business. Plus, get tips on completing small business expense tracker templates.

Business Expense Report Template in Microsoft Word, Excel, Apple Pages

Fixed expenses are regular and don’t change much — things like rent and insurance. Partnerships must generally file form 1065. An expense does not have to be required to. Plus, get tips on completing small business expense tracker templates. The chapters that follow cover specific expenses and list other publications and forms you may need.

FREE 11+ Sample Business Expense Forms in PDF Excel Word

Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Plus, get tips on completing small business expense tracker templates. Web use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to.

FREE 13+ Expense Report Forms in MS Word PDF Excel

An activity qualifies as a business if: Partnerships must generally file form 1065. Plus, get tips on completing small business expense tracker templates. Web according to the internal revenue service (irs), business expenses are ordinary and necessary costs incurred to operate your business. Fixed expenses are regular and don’t change much — things like rent and insurance.

Monthly Expense Form Editable Forms

An expense does not have to be required to. Examples include inventory, payroll and rent. The details in this form are. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). This report includes details about each expense and acts as an organized record for reimbursement or accounting purposes.

For Each Expense, Enter The Date, Description, And Type (E.g., Lodging, Travel, Fuel Or Mileage).

Plus, get tips on completing small business expense tracker templates. Web about form 2106, employee business expenses an ordinary expense is one that is common and accepted in your field of trade, business, or profession. A necessary expense is one that is helpful and appropriate for your business. An activity qualifies as a business if:

You Are Involved In The Activity With Continuity And Regularity.

This report includes details about each expense and acts as an organized record for reimbursement or accounting purposes. The chapters that follow cover specific expenses and list other publications and forms you may need. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Computation Of Section 163 (J) Limitation.

Your primary purpose for engaging in the activity is for income or profit. Web according to the internal revenue service (irs), business expenses are ordinary and necessary costs incurred to operate your business. An expense does not have to be required to. Web download the simple printable expense report form for adobe pdf this basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue reimbursement quickly.

Fixed Expenses Are Regular And Don’t Change Much — Things Like Rent And Insurance.

The details in this form are. Examples include inventory, payroll and rent. Web use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web included on this page, you’ll find a small business expense template for monthly and daily tracking, a template for tracking startup expenses, and a spreadsheet for monitoring income and expenses.