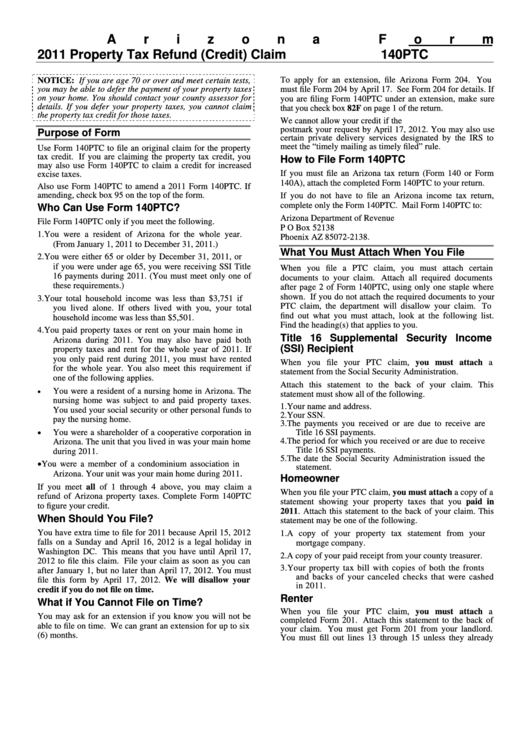

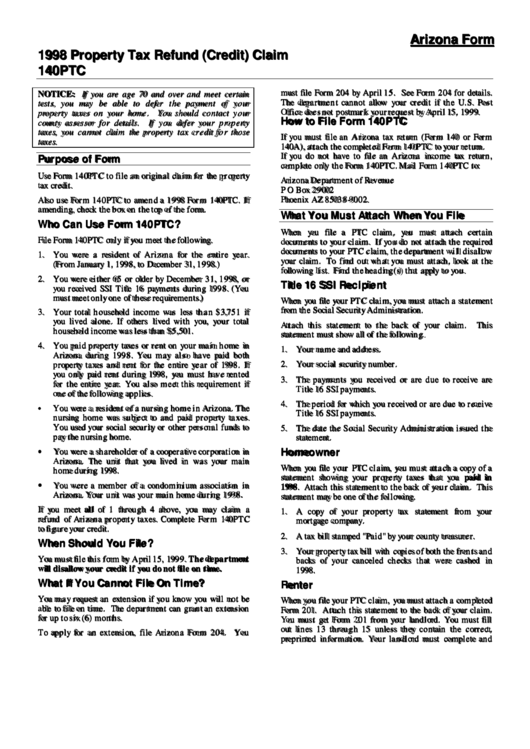

Az Form 140Ptc Instructions

Az Form 140Ptc Instructions - If you are claiming the property tax credit, you may also use form 140ptc to claim a. Qualifications for credit (check the boxes that apply): Do not mark in this area. 4on december 31, 2020, were you renting or did. Form 140ptc is due april by 15, 2020.file your claim as soon as you. The most common arizona income tax form is the arizona form 140. Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. Web 26 rows 140ptc : If you defer your property taxes, you cannot claim the property tax credit for those taxes. You were a resident of arizona for the whole year.

Web use arizona form 140ptc to file an original claim for the property tax credit. You were either 65 or older by december 31, 2019, or if you were. (january 1, 2019, to december 31, 2019) 2. Form 140ptc is due april by 15, 2020.file your claim as soon as you. Qualifications for credit (check the boxes that apply): You were a resident of arizona for the whole year. 81 pm 80 rcvd do not staple any items to the claim. Web you must file this form, or arizona form 204, by april 15, 2021. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. Web 140ptc property tax refund (credit) claim 2021 88 revenue use only.

If you defer your property taxes, you cannot claim the property tax credit for those taxes. Fill out each fillable area. Sign it in a few clicks. For information or help, call one of the numbers listed: When should i file form 140ptc? Web common arizona income tax forms & instructions. Type text, add images, blackout confidential details, add comments, highlights and more. Complete form 140ptc to figure your credit. If you are claiming the property tax credit, you may also use form 140ptc to claim a. If you have questions on this form, contact customer.

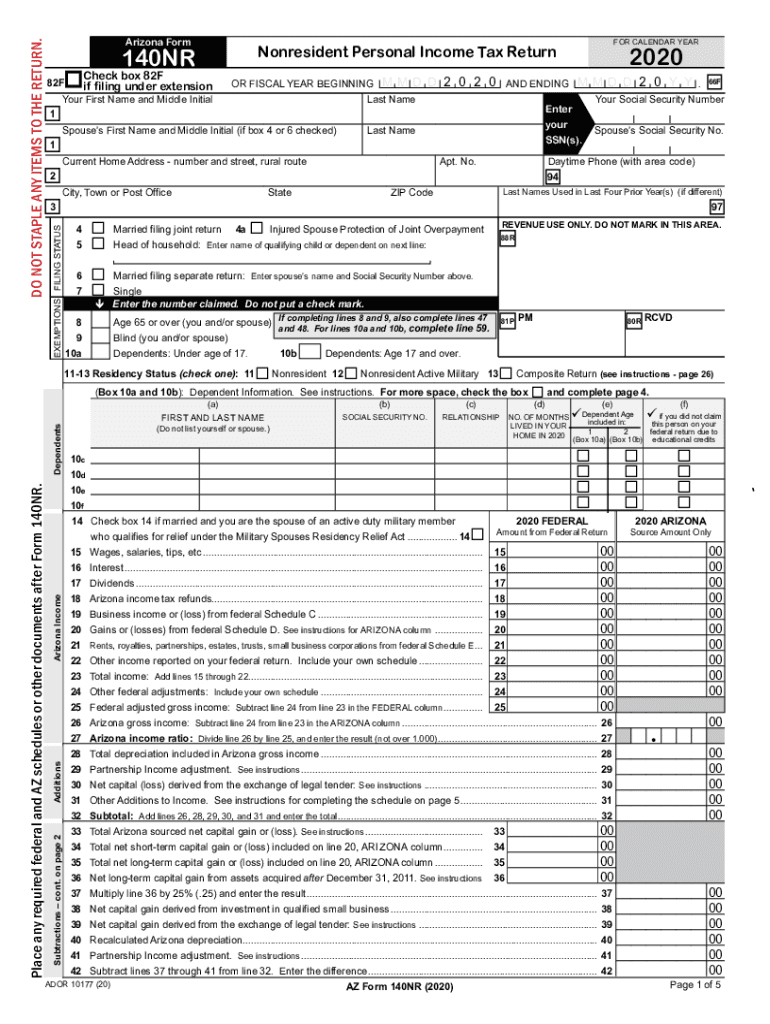

2020 Form AZ DoR 140NR Fill Online, Printable, Fillable, Blank pdfFiller

If you are claiming the property tax credit, you may also use form 140ptc to claim a. 4on december 31, 2020, were you renting or did. Type text, add images, blackout confidential details, add comments, highlights and more. Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona.

Arizona Resale Certificate Master of Documents

Type text, add images, blackout confidential details, add comments, highlights and more. Form 140ptc is due april by 15, 2020.file your claim as soon as you. Web activate the wizard mode in the top toolbar to get additional suggestions. Web use arizona form 140ptc to file an original claim for the property tax credit. Complete form 140ptc to figure your.

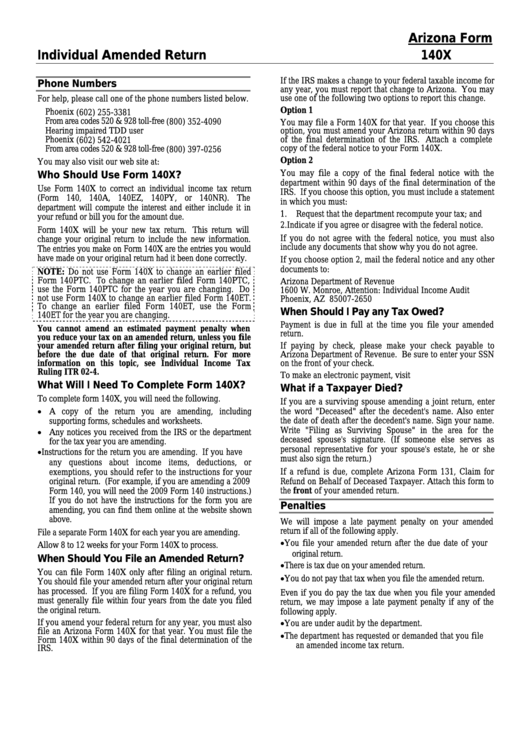

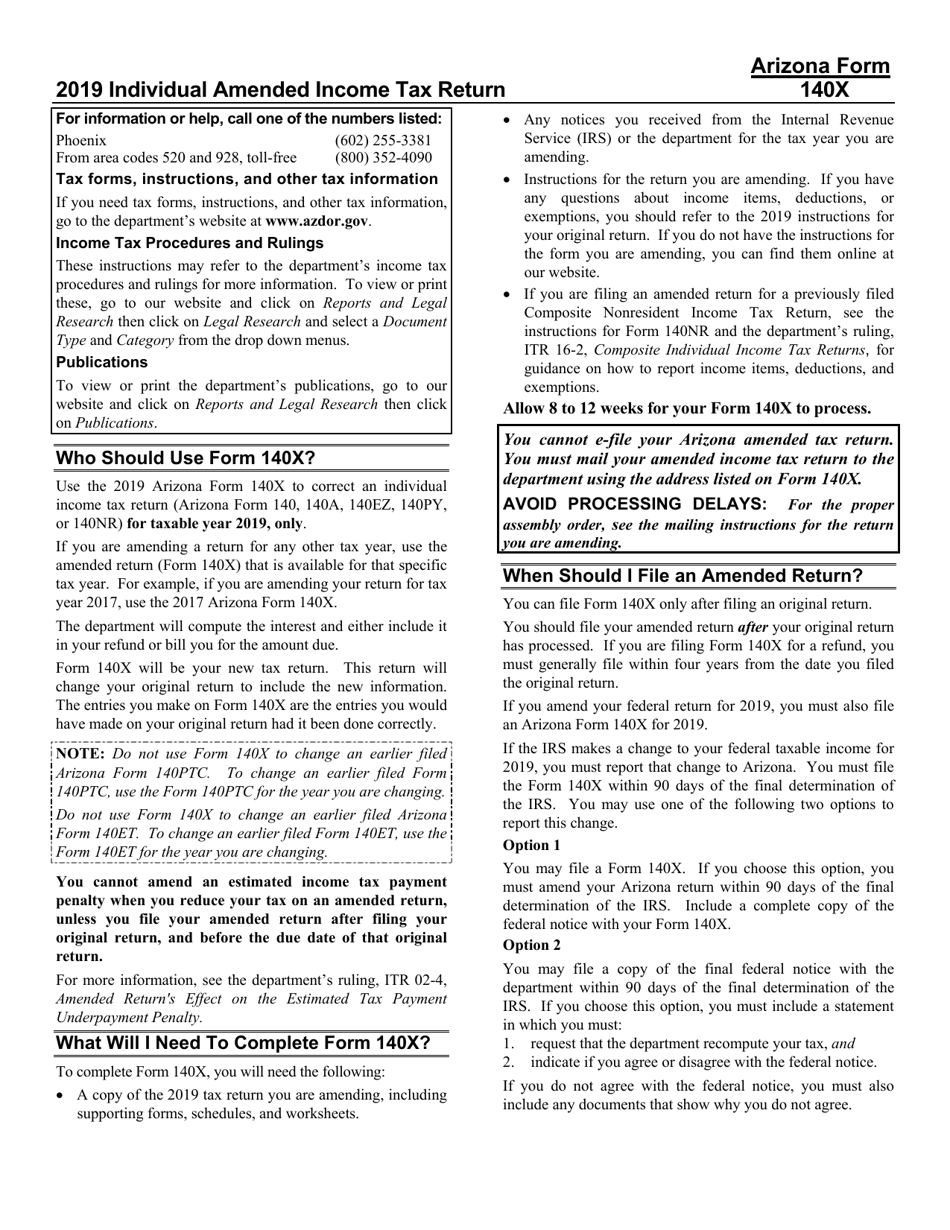

Instructions For Arizona Form 140x Individual Amended Return

If you have questions on this form, contact customer. Form 140ptc is due april by 15, 2020.file your claim as soon as you. Web view form 140ptc and instructions: The most common arizona income tax form is the arizona form 140. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for.

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. You were a resident of arizona for the whole year. 81 pm 80 rcvd do not staple any items to the claim. Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property.

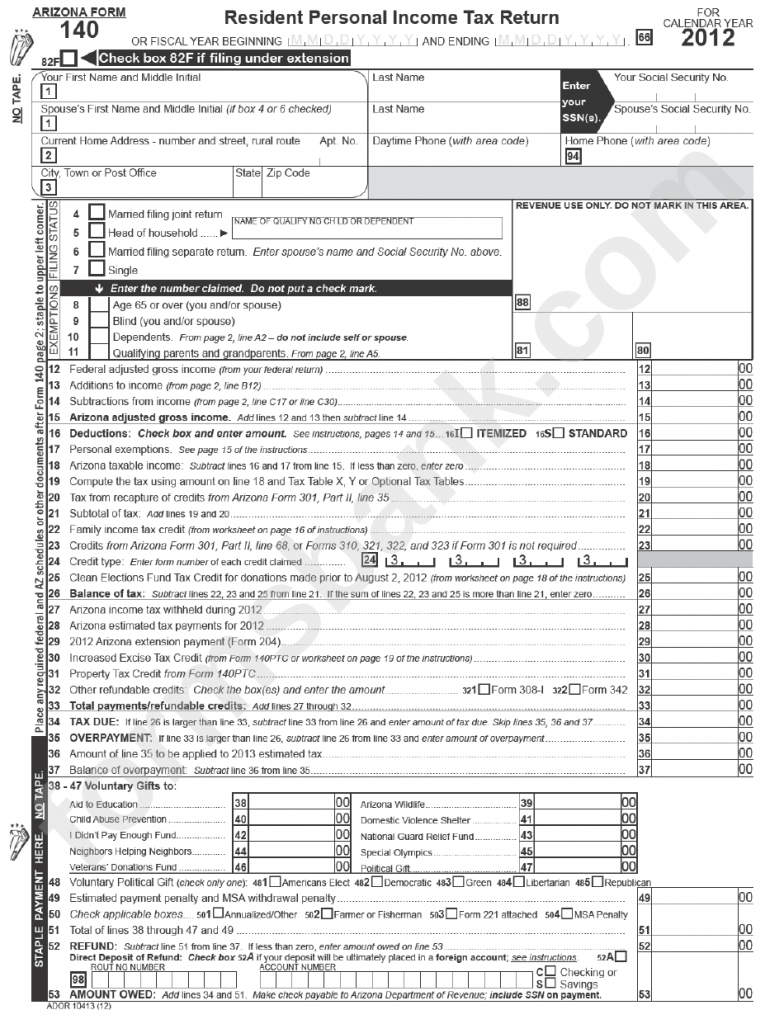

Printable Az 140 Tax Form Printable Form 2022

If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. Complete form 140ptc to figure your credit. This form is used by residents who file an individual. 4on december 31, 2020, were you renting or did. Do not mark in this area.

Arizona Form 140ptc Instruction Property Tax Refund (Credit) Claim

If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. Type text, add images, blackout confidential details, add comments, highlights and more. Do not mark in this area. You were either 65 or older by december 31, 2019, or if you were. Web on form 140ptc, you cannot claim the excise.

Download Instructions for Arizona Form 140X, ADOR10573 Individual

Web activate the wizard mode in the top toolbar to get additional suggestions. Web on form 140ptc, you cannot claim the excise tax credit for your spouse if your spouse was sentenced for at least 60 days during 2019 to a county, state or federal prison. 4on december 31, 2020, were you renting or did. If you are claiming the.

Instructions For Property Tax Refund (Credit) Claim Arizona Form 140ptc

Do not mark in this area. Web common arizona income tax forms & instructions. Web use arizona form 140ptc to file an original claim for the property tax credit. Web arizona — property tax refund (credit) claim package download this form print this form it appears you don't have a pdf plugin for this browser. Web taxpayer's claiming the property.

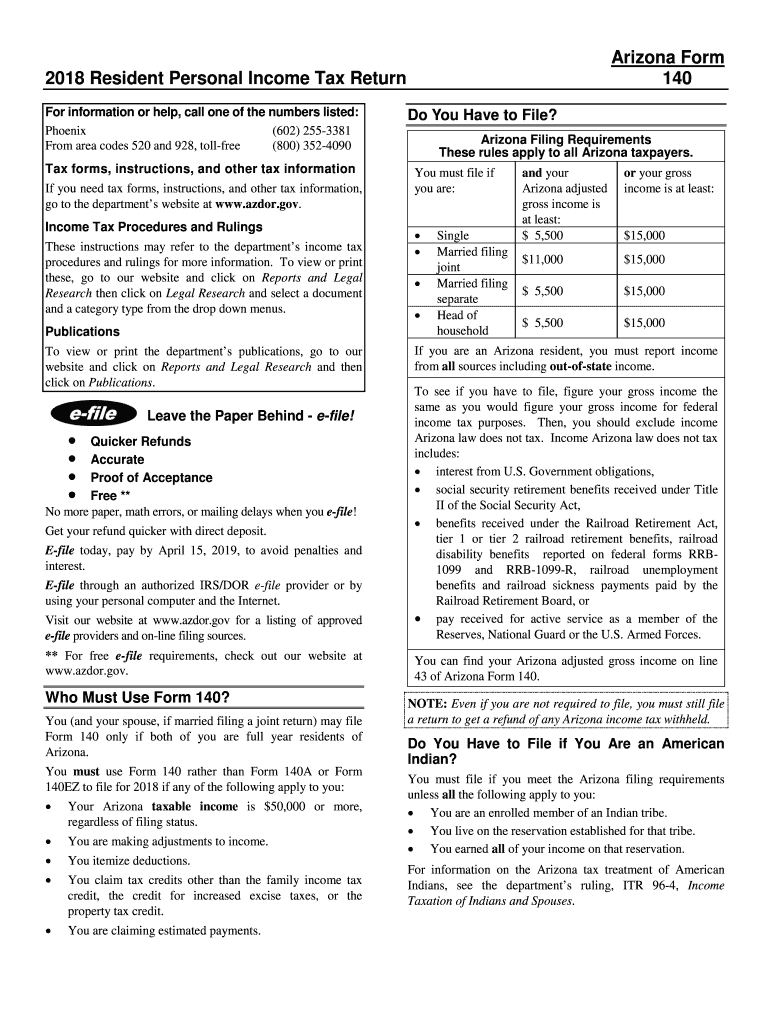

2018 Form AZ DoR 140 Instructions Fill Online, Printable, Fillable

If you are claiming the property tax credit, you may also use form 140ptc to claim a. If you defer your property taxes, you cannot claim the property tax credit for those taxes. Do not mark in this area. Web you must file this form, or arizona form 204, by april 15, 2021. Fill out each fillable area.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Edit your arizona form 140ptc fillable online. Web activate the wizard mode in the top toolbar to get additional suggestions. Web use arizona form 140ptc to file an original claim for the property tax credit. Web taxpayer's claiming the property income tax credit, may also use this form to claim a credit for increased excise taxes. You were either 65.

Web 140Ptc Property Tax Refund (Credit) Claim 2021 88 Revenue Use Only.

Web use arizona form 140ptc to file an original claim for the property tax credit. If you are claiming the property tax credit, you may also use form 140ptc to claim a. If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. This form is used by residents who file an individual.

Web 26 Rows 140Ptc :

If you are claiming the property tax credit, you may also use form 140ptc to claim a credit for. Fill out each fillable area. Enter your ssn in the space provided. Web view form 140ptc and instructions:

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web activate the wizard mode in the top toolbar to get additional suggestions. You were a resident of arizona for the whole year. Please use the link below. Sign it in a few clicks.

If You Defer Your Property Taxes, You Cannot Claim The Property Tax Credit For Those Taxes.

Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. (january 1, 2019, to december 31, 2019) 2. Web arizona — property tax refund (credit) claim package download this form print this form it appears you don't have a pdf plugin for this browser. Complete form 140ptc to figure your credit.