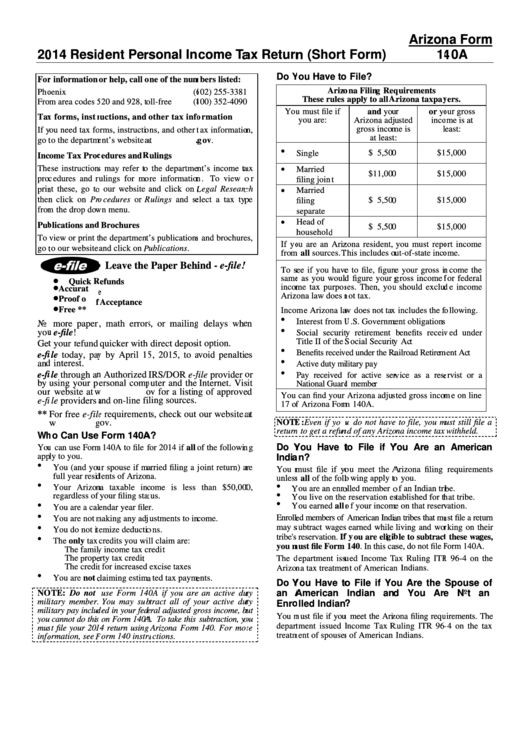

Az Form 140A

Az Form 140A - • you, and your spouse if married filing a joint return, are full year. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web arizona form resident personal income tax return (short form 140a ) stop! Web packet of instructions and forms for filling out your arizona form 140 tax return. Web who can use form 140a? • you (and your spouse if married filing a joint return) are both full year. Form 140ez (easy form), and form 140a (short form). You can use form 140a to file for 2017 if all of the following apply to you. Web if your arizonataxable incomeis $50,000 or more, you mustuse arizona form 140. Web the most common arizona income tax form is the arizona form 140.

Web up to $40 cash back printable arizona (az) state income tax form 140 must be postmarked by april 18, 2016 in order to avoid penalties and late fees. You can download or print. The az state tax table can be found. • you, and your spouse if married filing a joint return, are full year. Web arizona form resident personal income tax return (short form 140a ) stop! • you (and your spouse if married filing a joint return) are both full year. You can use form 140a to file for 2021 if all of the following apply to you. You may need to use use form 140 instead if all of the following apply: Web packet of instructions and forms for filling out your arizona form 140 tax return. Of the following apply to you:

Fill out the top section: Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully updated for tax year 2022. This form should be completed after. Stick to instructions on the screen. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. You may need to use use form 140 instead if all of the following apply: • you, and your spouse if married filing a joint return, are full year. Web who can use form 140a? Web arizona form 2016 resident personal income tax return (short form) 140a for information or help, call one of the numbers listed: You can use form 140a to file for 2021 if all of the following apply to you.

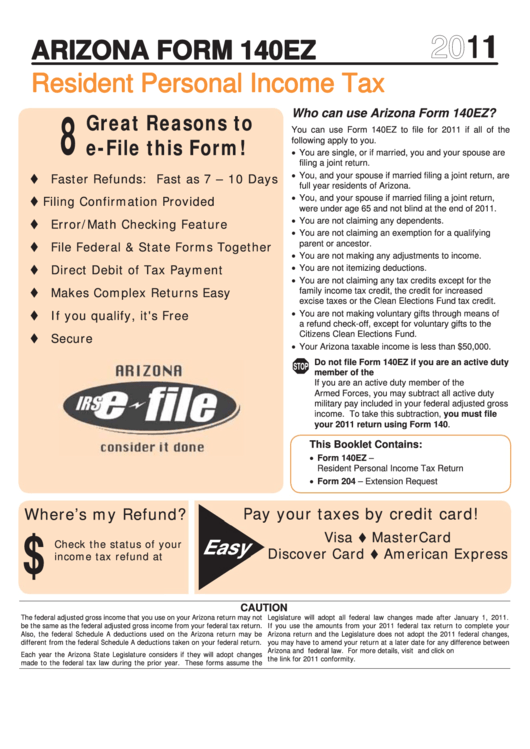

Arizona Form 140ez Resident Personal Tax Return (Ez Form

• you, and your spouse if married filing a joint return, are full year. You can use form 140a to file for 2017 if all of the following apply to you. The az state tax table can be found. Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form.

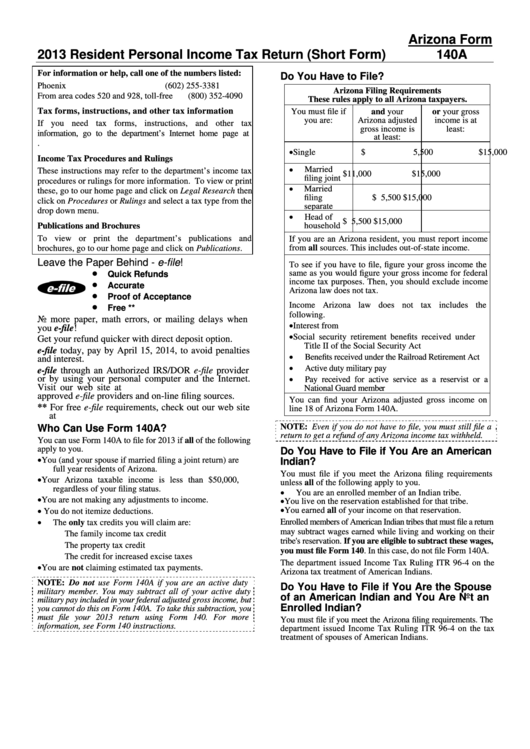

Instructions For Arizona Form 140a Resident Personal Tax

• you, and your spouse if married filing a joint return, are full year. If your arizona taxable income is $50,000 or more, you must use arizona form 140. This form is used by residents who file an individual income tax return. We last updated the income tax instruction packet in february 2023, so this is the latest version. Form.

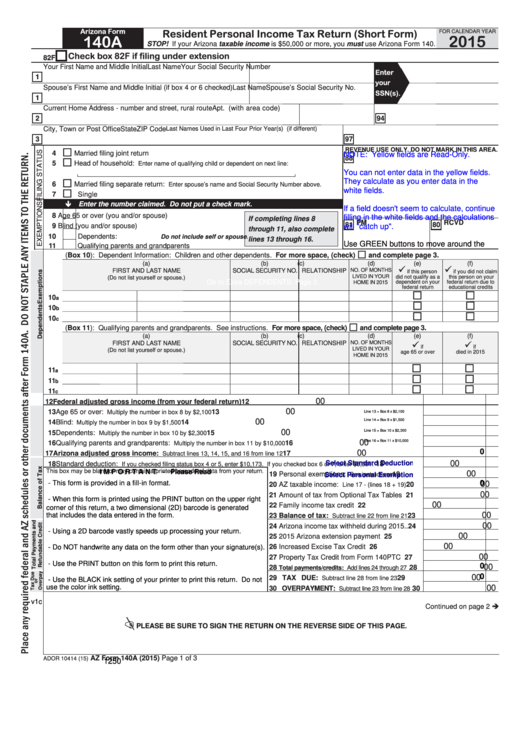

Fillable Arizona Form 140a Resident Personal Tax Return (Short

You may use form 140 if all of the following apply: Web arizona form resident personal income tax return (short form 140a ) stop! Web your return at a later date for any difference between arizona and federal law. You may need to use use form 140 instead if all of the following apply: Web up to $40 cash back.

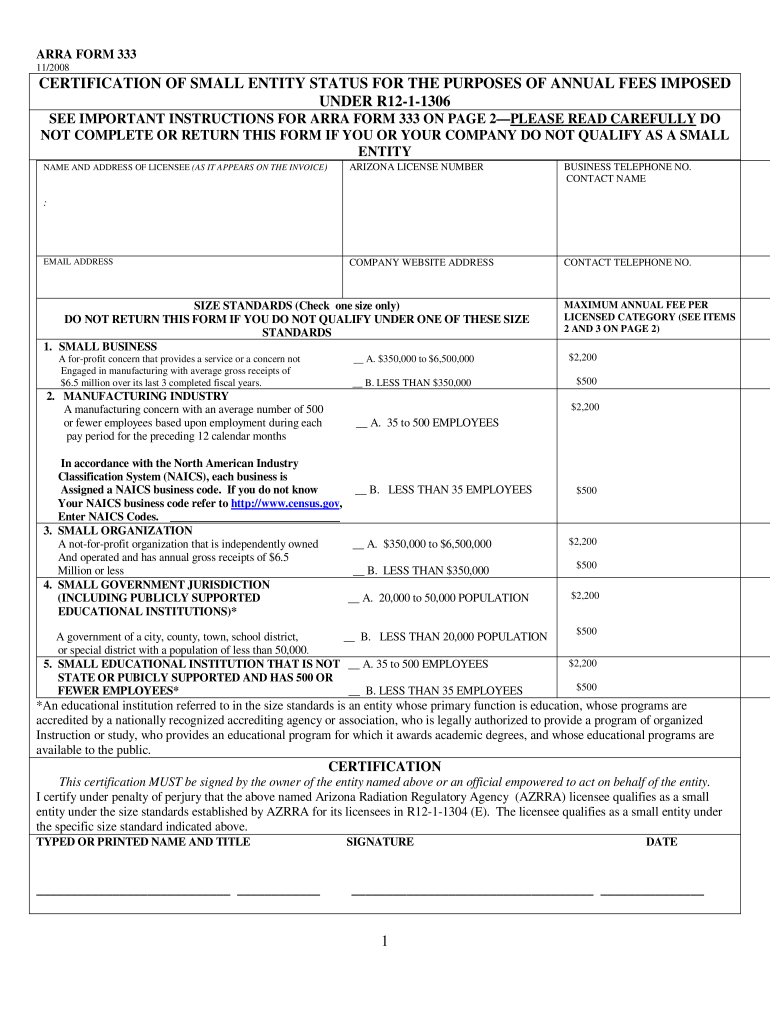

Az Form 333 Fill Online, Printable, Fillable, Blank pdfFiller

Web the most common arizona income tax form is the arizona form 140. We last updated the resident personal income tax. Web who can use arizona form 140a? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax..

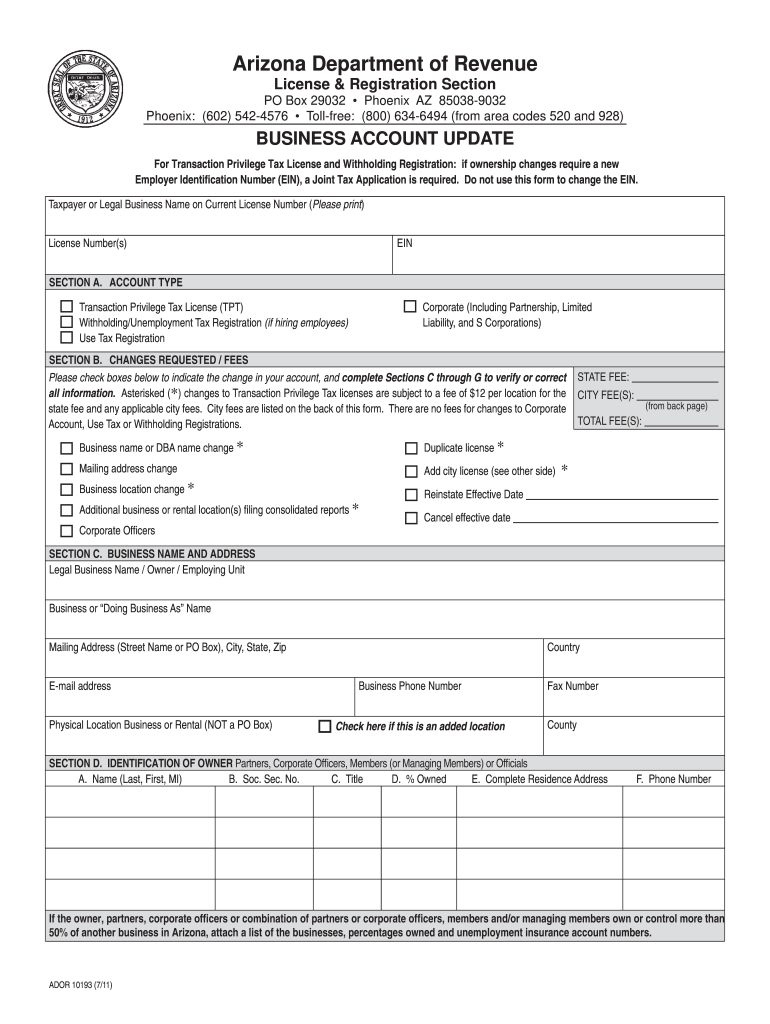

Az Form 10193 Fill Online, Printable, Fillable, Blank PDFfiller

Of the following apply to you: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web the most common arizona income tax form is the arizona form 140. Web your return at a later date for any.

Ariz Form 140 ≡ Fill Out Printable PDF Forms Online

Web up to $40 cash back printable arizona (az) state income tax form 140 must be postmarked by april 18, 2016 in order to avoid penalties and late fees. We last updated arizona form 140a in april 2023 from the arizona. For calendar year 2019 8age 65 or over (you and/or spouse) 9blind (you and/or. Web who can use arizona.

Instructions For Arizona Form 140a Resident Personal Tax

Web arizona form 2016 resident personal income tax return (short form) 140a for information or help, call one of the numbers listed: You may need to use use form 140 instead if all of the following apply: • you (and your spouse if married filing a joint return) are both full year. Web if your arizonataxable incomeis $50,000 or more,.

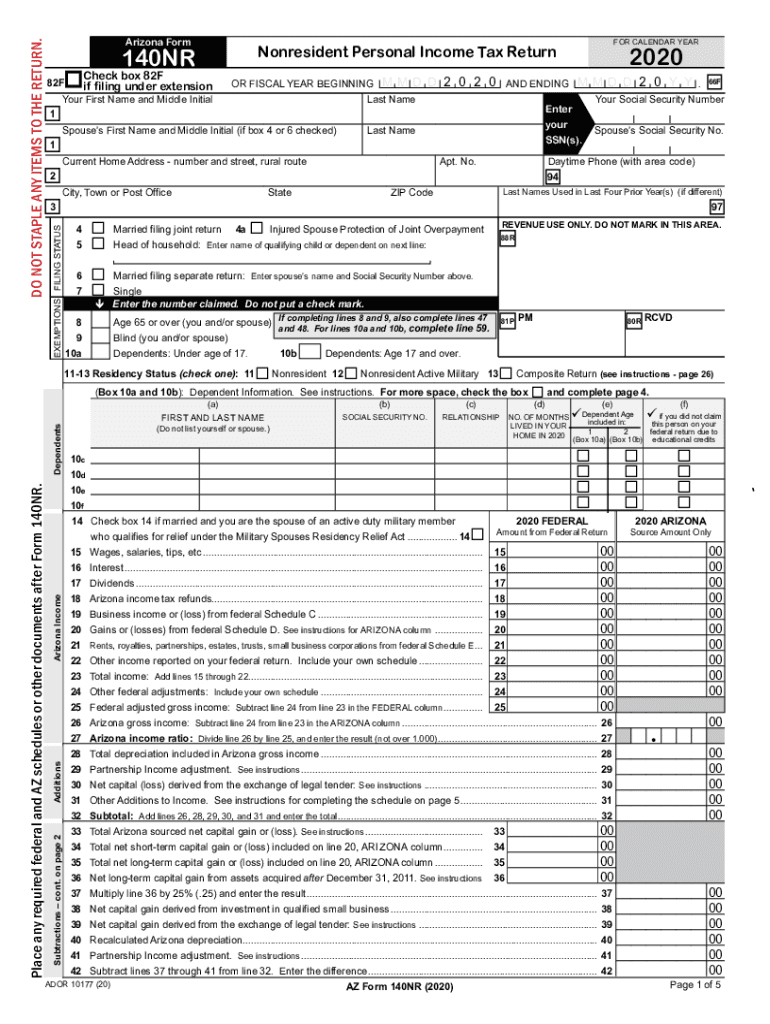

2020 Form AZ DoR 140NR Fill Online, Printable, Fillable, Blank pdfFiller

You can download or print. Stick to instructions on the screen. Web your return at a later date for any difference between arizona and federal law. Web who can use arizona form 140a? Form 140ez (easy form), and form 140a (short form).

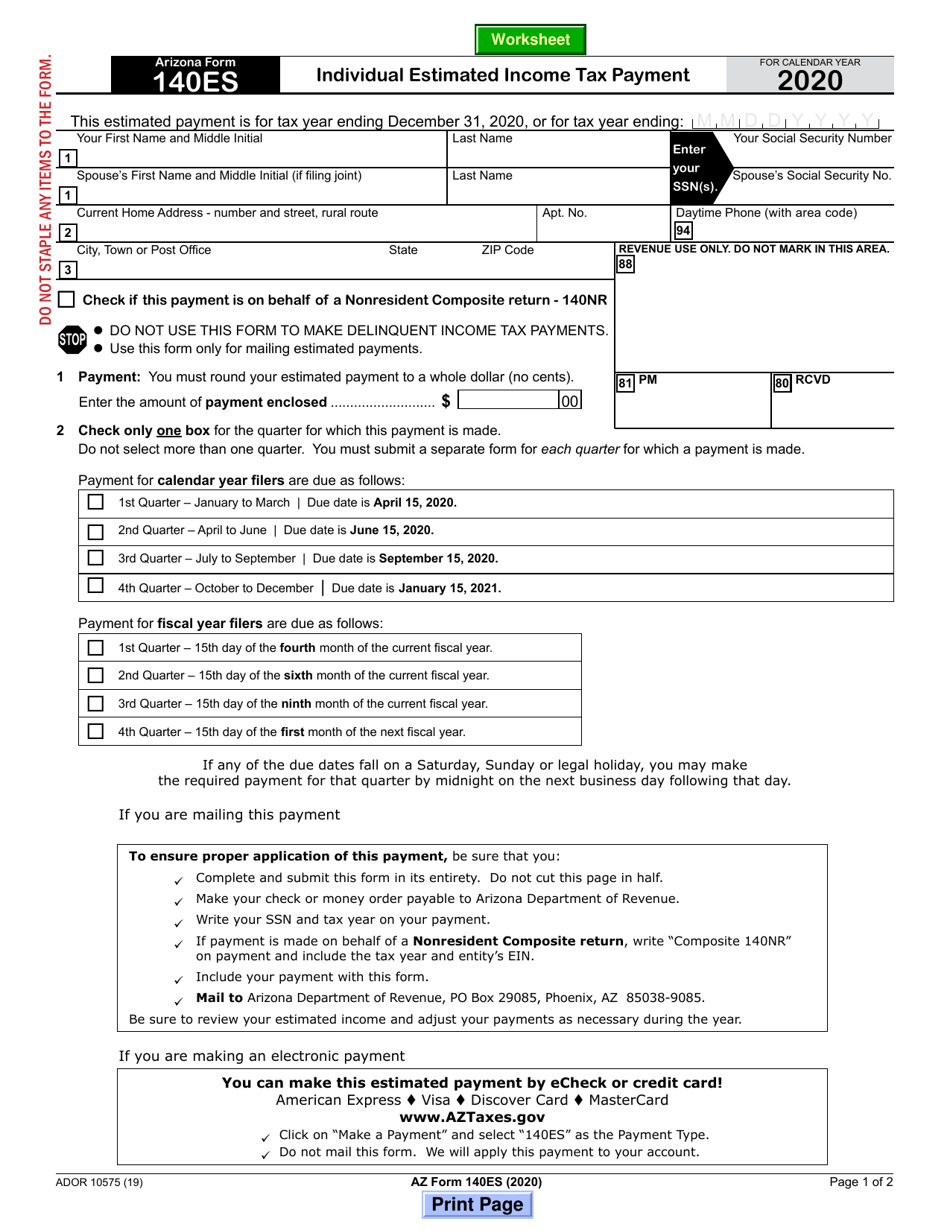

Arizona Form 140ES (ADOR10575) Download Fillable PDF or Fill Online

The az state tax table can be found. Web your return at a later date for any difference between arizona and federal law. Web use the same names(s) and social security number(s) that were listed on arizona form 140, 140a, 140ez, 140py or 140nr. If your arizona taxable income is $50,000 or more, you must use arizona form 140. You.

Fillable Online Arizona Form 140IA Arizona Department of Revenue Fax

Web packet of instructions and forms for filling out your arizona form 140 tax return. This form should be completed after. Your arizona taxable income is $50,000 or more, regardless of. Fill out the top section: We last updated arizona form 140a in april 2023 from the arizona.

Web Up To $40 Cash Back Printable Arizona (Az) State Income Tax Form 140 Must Be Postmarked By April 18, 2016 In Order To Avoid Penalties And Late Fees.

Once you receive your confirmation. Of the following apply to you: You can download or print. Web packet of instructions and forms for filling out your arizona form 140 tax return.

• You (And Your Spouse If Married Filing A Joint Return) Are Both Full Year.

You may need to use use form 140 instead if all of the following apply: Web if your arizonataxable incomeis $50,000 or more, you mustuse arizona form 140. • you, and your spouse if married filing a joint return, are full year. Web use the same names(s) and social security number(s) that were listed on arizona form 140, 140a, 140ez, 140py or 140nr.

Your Arizona Taxable Income Is $50,000 Or More, Regardless Of.

Web arizona also provides two additional forms taxpayers can use to file state tax returns: Web your return at a later date for any difference between arizona and federal law. The az state tax table can be found. You can use form 140a to file for 2021 if.

We Last Updated The Income Tax Instruction Packet In February 2023, So This Is The Latest Version.

Web arizona form resident personal income tax return (short form 140a ) stop! This form is used by residents who file an individual income tax return. We last updated arizona form 140a in april 2023 from the arizona. For more details, visit www.azdor.gov and click on the link for 2021 conformity.