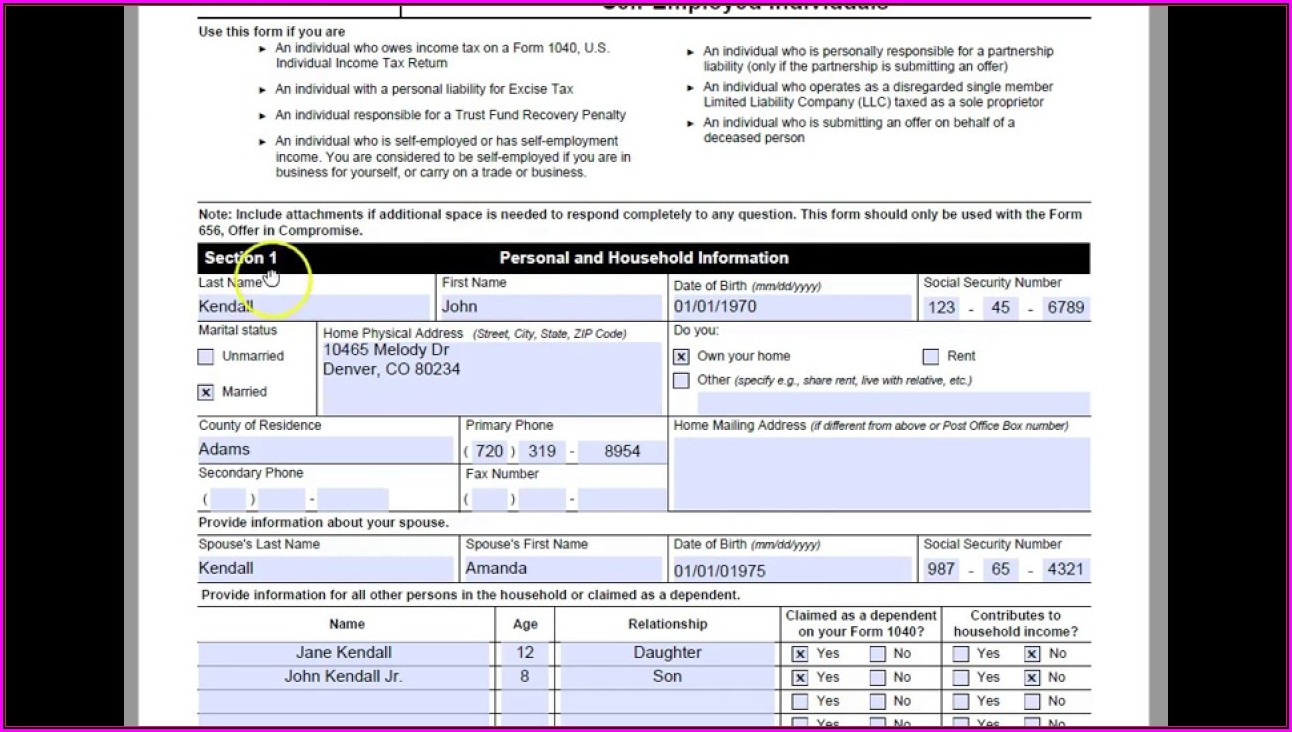

Axs Irs Form

Axs Irs Form - Web for individuals only. Web click on your name to select account settings, then tax information. Web follow these simple steps to transfer the money to your selected financial institution. Individual income tax return, including recent updates, related forms and instructions on how to file. Buying basics, axs official resale, accessible seats and more. Individual income tax return 2022 department of the treasury—internal revenue service. Web get tax records and transcripts online or by mail. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. The portion we keep helps us cover the costs. You will need to create an irs online account before using this option.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Web for individuals only. You will need to create an irs online account before using this option. Web get federal tax return forms and file by mail. View the amount you owe, your payment plan details, payment history,. How can i edit a payment method on my axs account? How can i remove a payment method from my. Individual income tax return, including recent updates, related forms and instructions on how to file. Web internal revenue service center where original return was filed. Please select the appropriate country for your request.

Read the irs instructions for 990 forms. Web click on your name to select account settings, then tax information. Web follow these simple steps to transfer the money to your selected financial institution. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Click on “your account” and select the. The portion we keep helps us cover the costs. Web get federal tax return forms and file by mail. You will need to create an irs online account before using this option. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Desktop sign in to your account on axs.com.

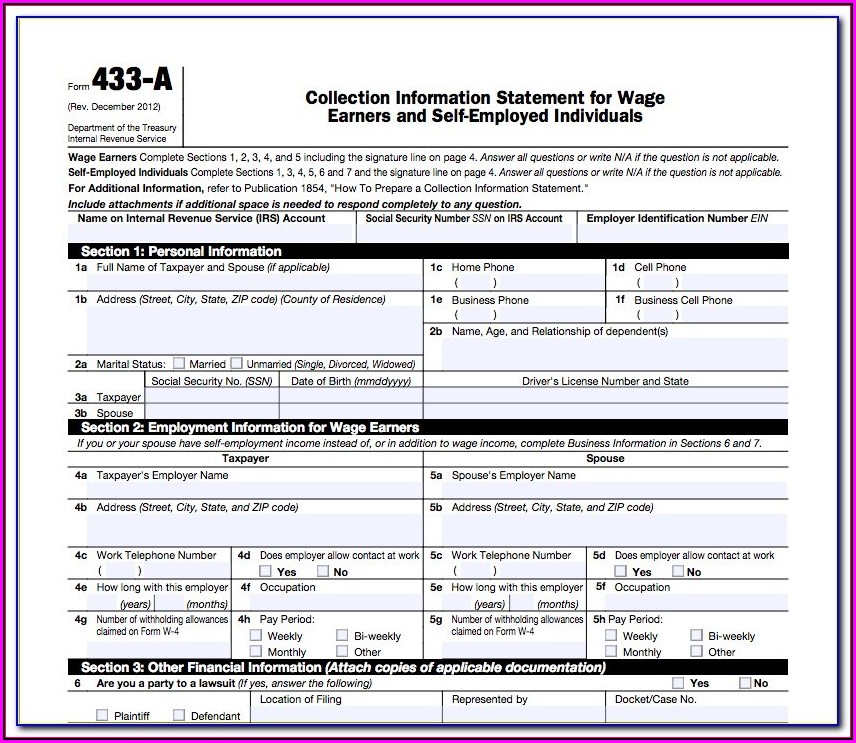

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

How can i remove a payment method from my. Individual income tax return 2022 department of the treasury—internal revenue service. Web in addition, you may be required to file form 8938, statement of specified foreign financial assets, if you have an interest in specified foreign financial assets with. Web get tax records and transcripts online or by mail. Web internal.

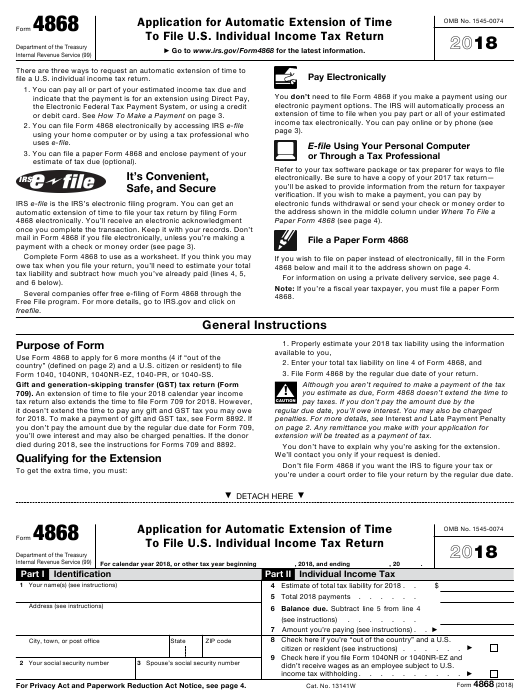

Free Printable Irs Form 4868 Printable Form 2022

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Web get tax records and transcripts online or by mail. Web get federal tax return forms and file by mail. Desktop sign in to your account on axs.com. Get paper copies of federal and state tax forms, their instructions, and the address for mailing.

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

Web click on your name to select account settings, then tax information. Web premium tax credit were made to your insurance company to reduce your monthly premium payment, you must attach form 8962 to your return to reconcile (compare) the advance. View the amount you owe, your payment plan details, payment history,. Web get tax records and transcripts online or.

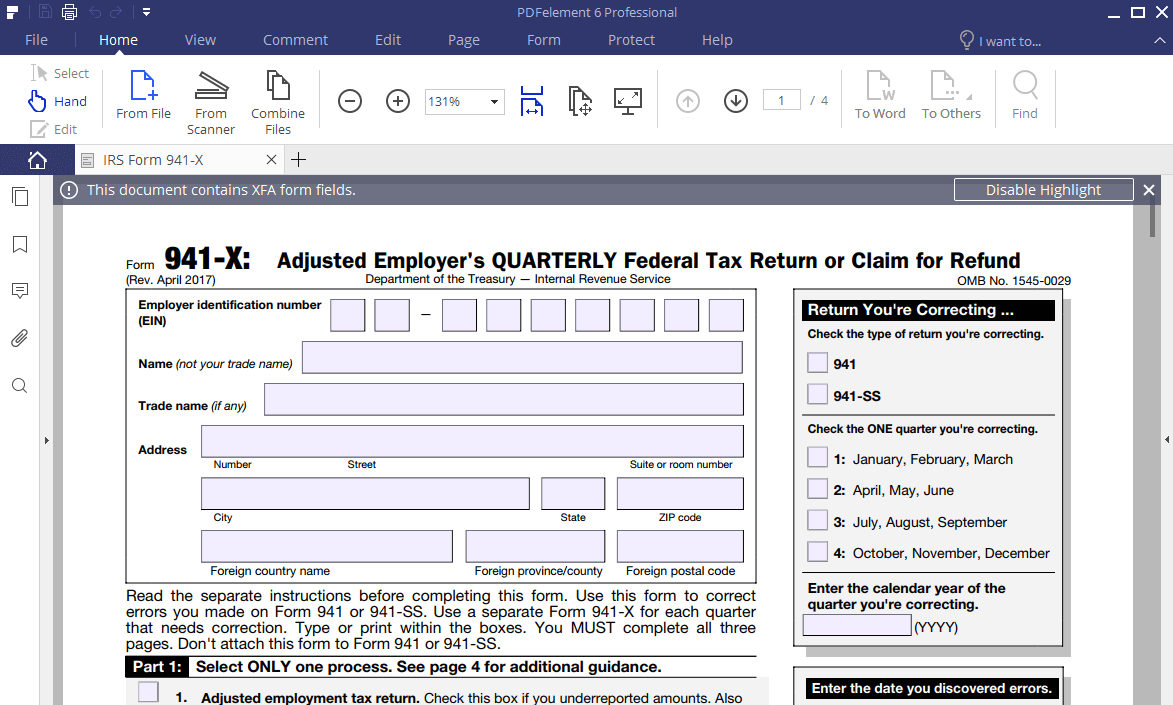

IRS Form 941X Learn How to Fill it Easily

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. You will need to create an irs online account before using this option. Web get tax records and transcripts online or by mail. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Desktop sign in to.

Irs Form 8379 File Online Universal Network

Irs use only—do not write or staple in this. You will need to create an irs online account before using this option. Web form 4686 is the form you want to file with the irs if you think you'll need extra time beyond tax day to complete your 1040 return. Desktop sign in to your account on axs.com. Get paper.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

Account basics, your events, personal information, security. Web premium tax credit were made to your insurance company to reduce your monthly premium payment, you must attach form 8962 to your return to reconcile (compare) the advance. Web get federal tax return forms and file by mail. Click on “your account” and select the. Read the irs instructions for 990 forms.

Irs Form 501c3 Ez Universal Network

Web premium tax credit were made to your insurance company to reduce your monthly premium payment, you must attach form 8962 to your return to reconcile (compare) the advance. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Read the irs instructions for 990 forms. Web click on your name to select.

AXS Stock Price and Chart — NYSEAXS — TradingView

Web get federal tax return forms and file by mail. Web for individuals only. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web click on your name to select account settings, then tax information. Individual income tax return 2022 department of the treasury—internal revenue service.

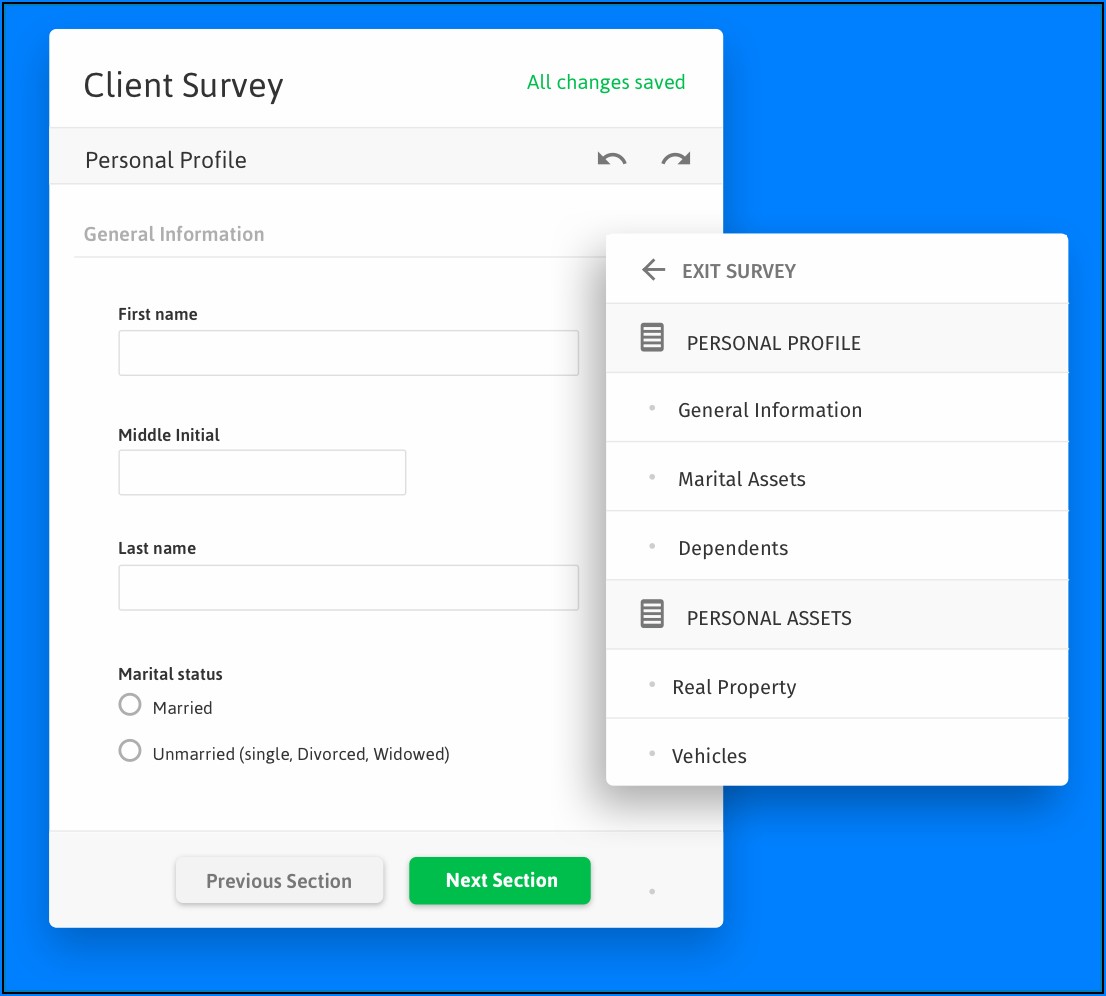

IRS Form 8821 Fill it out with the Best Program

Web for individuals only. Individual income tax return, including recent updates, related forms and instructions on how to file. You will need to create an irs online account before using this option. Web get tax records and transcripts online or by mail. Web the 1040 form is the official tax return that taxpayers have to file with the irs each.

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

Web get federal tax return forms and file by mail. Web click on your name to select account settings, then tax information. Read the irs instructions for 990 forms. Account basics, your events, personal information, security. You will need to create an irs online account before using this option.

You Will Need To Create An Irs Online Account Before Using This Option.

Click edit royalty tax interview to access the tax dashboard. Web click on your name to select account settings, then tax information. The portion we keep helps us cover the costs. Desktop sign in to your account on axs.com.

Account Basics, Your Events, Personal Information, Security.

Read the irs instructions for 990 forms. Web form 4686 is the form you want to file with the irs if you think you'll need extra time beyond tax day to complete your 1040 return. How can i edit a payment method on my axs account? To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,.

How Can I Add A Payment Method To My Axs Account?

Individual income tax return, including recent updates, related forms and instructions on how to file. View the amount you owe, your payment plan details, payment history,. Click on “your account” and select the. Web get federal tax return forms and file by mail.

How Can I Remove A Payment Method From My.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web follow these simple steps to transfer the money to your selected financial institution. Web get tax records and transcripts online or by mail. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.