Are Funeral Expenses Deductible On Form 1041

Are Funeral Expenses Deductible On Form 1041 - Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements. Funeral and burial expenses are only tax. Web individual taxpayers cannot deduct funeral expenses on their tax return. Web you may deduct the expense from the estate’s gross income as part of the estate’s income tax calculation on form 1041, u.s. Web ask an expert tax questions are funeral expenses deductible on form 1041? The executor or trustee can claim deductions when filing form 1041 to reduce the estate or trust taxable income. Funeral, burial, cremation or interment costs can be considered part of estate expenses, though these may not be covered by estate assets. Web most individuals don’t qualify for tax deductions on the funeral expenses of a close relative, although some estates may make them eligible. Yes, except for medical and funeral expenses, which you do not deduct on form. Thank you for your quick reply, but my question was.

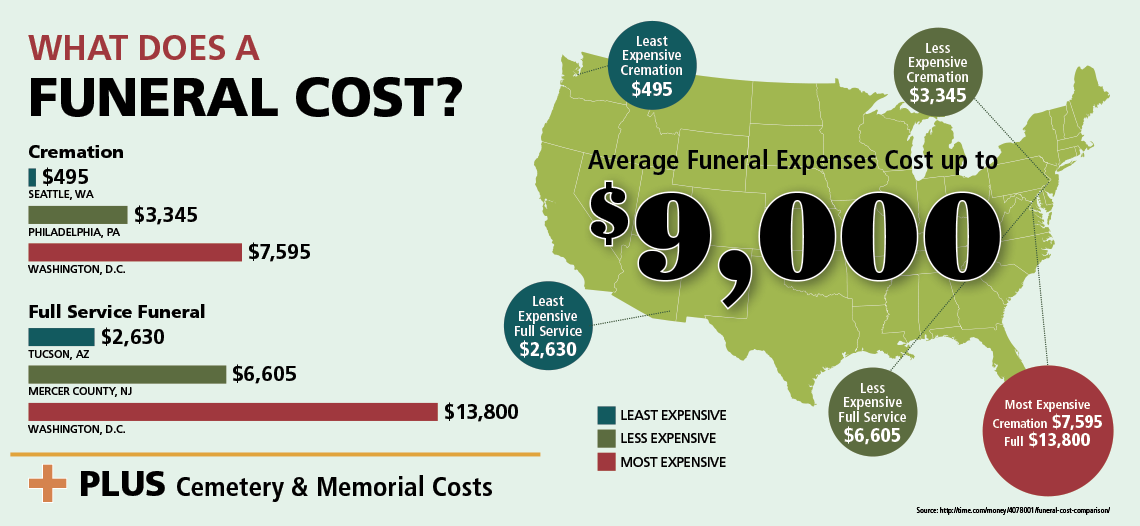

Placement of the cremains in a cremation urn or cremation burial plot. Web the internal revenue service (irs) sets strict rules about what expenses can and cannot be deducted from your tax bill. Web the costs of funeral expenses, including embalming, cremation, casket, hearse, limousines, and floral costs, are deductible. Web individual taxpayers cannot deduct funeral expenses on their tax return. Yes, except for medical and funeral expenses, which you do not deduct on form. While the irs allows deductions for medical expenses, funeral costs are not included. Web can i enter any of those in federal taxes/deductions/other deductions? Web are funeral expenses deductible on form 1041? Web most individuals don’t qualify for tax deductions on the funeral expenses of a close relative, although some estates may make them eligible. Web no, you are not able to claim deductions for funeral expenses on form 1041.

You can’t take the deductions. Web you may deduct the expense from the estate’s gross income as part of the estate’s income tax calculation on form 1041, u.s. What expenses are deductible on estate tax return? The cost of a funeral and burial can be deducted on a form 1041, which is the final income tax return filed for a. The cost of transporting the body. Funeral and burial expenses are only tax. Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements. According to the irs, funeral expenses are only deductible on form 706, a separate tax return used by. However, funeral expenses are simply not deductible on form 1041 and. Web no, you are not able to claim deductions for funeral expenses on form 1041.

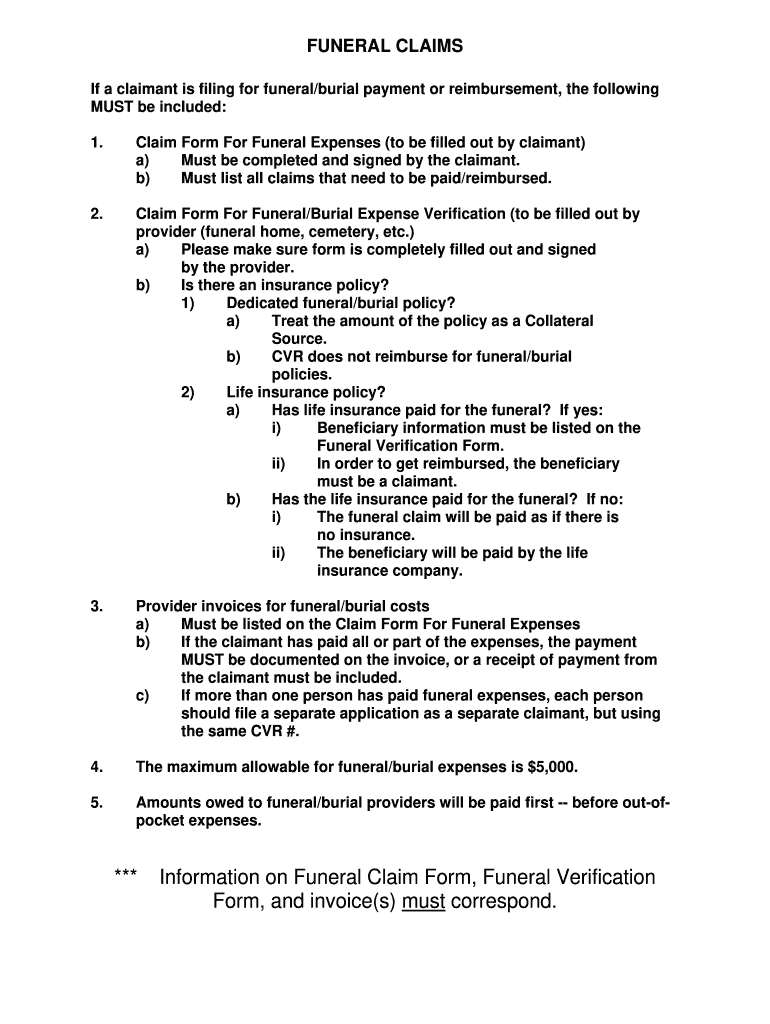

Funeral Expenses Claim Form Fill Online, Printable, Fillable, Blank

Web are funeral expenses deductible on form 1041? Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements. Web what expenses are deductible? However, funeral expenses are simply not deductible on form 1041 and. You can’t take the deductions.

Can I Deduct Funeral Expenses On Form 1041 ELCTIO

Web are funeral expenses deductible on form 1041? While the irs allows deductions for medical expenses, funeral costs are not included. Web home forms and instructions about form 1041, u.s. What expenses are deductible on estate tax return? Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form.

Funeral Advantage Final Expense Insurance Program Saves Burial Costs

It requests information about income distributed to. The cost of transporting the body. Placement of the cremains in a cremation urn or cremation burial plot. Funeral, burial, cremation or interment costs can be considered part of estate expenses, though these may not be covered by estate assets. Web the costs of funeral expenses, including embalming, cremation, casket, hearse, limousines, and.

Can Funeral Expenses Be Deducted on a Federal Tax? Sapling

Web can i enter any of those in federal taxes/deductions/other deductions? Thank you for your quick reply, but my question was. While the irs allows deductions for medical expenses, funeral costs are not included. However, funeral expenses are simply not deductible on form 1041 and. Web the costs of funeral expenses, including embalming, cremation, casket, hearse, limousines, and floral costs,.

Are Funeral Expenses Tax Deductible? Claims, WriteOffs, etc.

The cost of a funeral and burial can be deducted on a form 1041, which is the final income tax return filed for a. Medical expenses of the decedent paid by the estate may be deductible on the. Web are funeral expenses deductible on form 1041? Income tax return for estates and trusts the fiduciary of a domestic decedent's estate,.

Funeral Expenses Spreadsheet Pertaining To Funeral Bill Template

Funeral and burial expenses are only tax. Web individual taxpayers cannot deduct funeral expenses on their tax return. Web ask an expert tax questions are funeral expenses deductible on form 1041? Yes, except for medical and funeral expenses, which you do not deduct on form. Income tax return for estates and trusts the fiduciary of a domestic decedent's estate, trust,.

FREE 47+ Claim Forms in PDF

However, funeral expenses are simply not deductible on form 1041 and. The executor or trustee can claim deductions when filing form 1041 to reduce the estate or trust taxable income. Income tax return for estates and. Funeral and burial expenses are only tax. Web unfortunately, you can not deduct medical or funeral expenses on form 1041.

Burial Insurance For Parents A Comprehensive Guide

Web funeral expenses are never deductible for income tax purposes, whether they're paid by an individual or the estate, which might also have to file an income tax. Web unfortunately, you can not deduct medical or funeral expenses on form 1041. Web the internal revenue service (irs) sets strict rules about what expenses can and cannot be deducted from your.

Funeral Budget Spreadsheet For Funeral Bill Template Expenses Blank

Web ask an expert tax questions are funeral expenses deductible on form 1041? The cost of transporting the body. Web form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. Web what expenses are deductible? Web funeral expenses are never deductible for income tax purposes, whether they're paid by an individual or the.

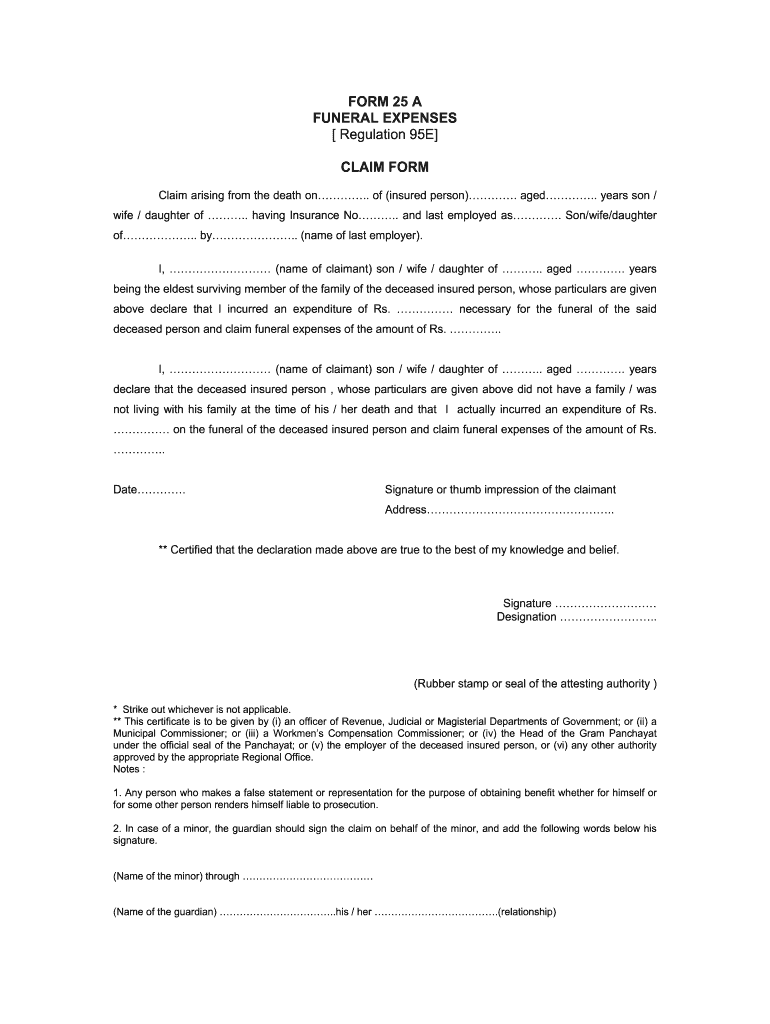

Funeral Expenses Claim Form 25a Fill Online, Printable, Fillable

Web deductions in respect of decedent estate tax deduction gifts, insurance, inheritances other items of income income tax return of an estate—form 1041 filing requirements. Funeral and burial expenses are only tax. Placement of the cremains in a cremation urn or cremation burial plot. Medical expenses of the decedent paid by the estate may be deductible on the. Web funeral.

You Can’t Take The Deductions.

Thank you for your quick reply, but my question was. The cost of transporting the body. The cost of a funeral and burial can be deducted on a form 1041, which is the final income tax return filed for a. Income tax return for estates and trusts the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files.

What Expenses Are Deductible On Estate Tax Return?

Placement of the cremains in a cremation urn or cremation burial plot. Web the internal revenue service (irs) sets strict rules about what expenses can and cannot be deducted from your tax bill. Web are funeral expenses deductible on form 1041? While the irs allows deductions for medical expenses, funeral costs are not included.

Web Funeral Expenses Are Never Deductible For Income Tax Purposes, Whether They're Paid By An Individual Or The Estate, Which Might Also Have To File An Income Tax.

Web home forms and instructions about form 1041, u.s. Web you may deduct the expense from the estate’s gross income as part of the estate’s income tax calculation on form 1041, u.s. Web can i enter any of those in federal taxes/deductions/other deductions? Web ask an expert tax questions are funeral expenses deductible on form 1041?

The Executor Or Trustee Can Claim Deductions When Filing Form 1041 To Reduce The Estate Or Trust Taxable Income.

According to the irs, funeral expenses are only deductible on form 706, a separate tax return used by. Web individual taxpayers cannot deduct funeral expenses on their tax return. It requests information about income distributed to. However, funeral expenses are simply not deductible on form 1041 and.