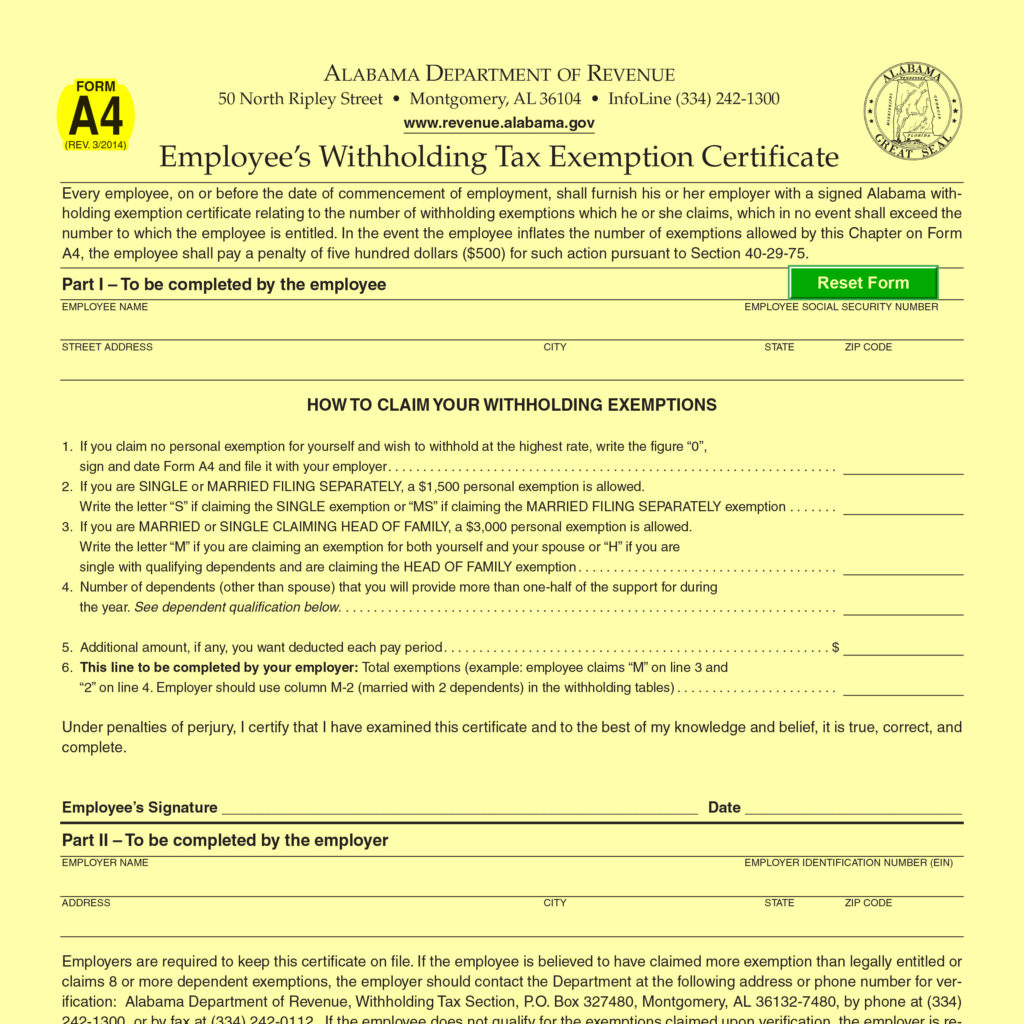

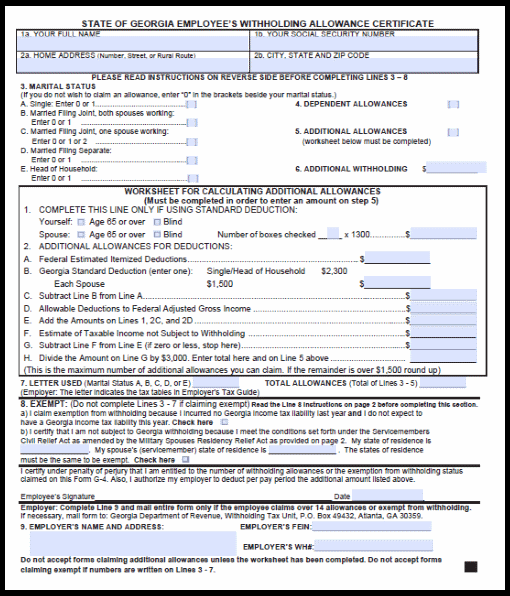

Alabama State Tax Withholding Form 2022

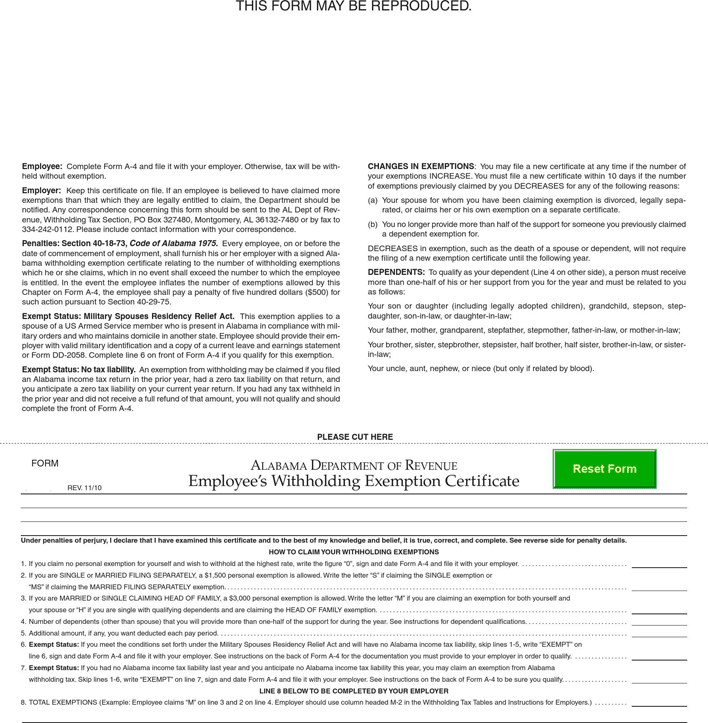

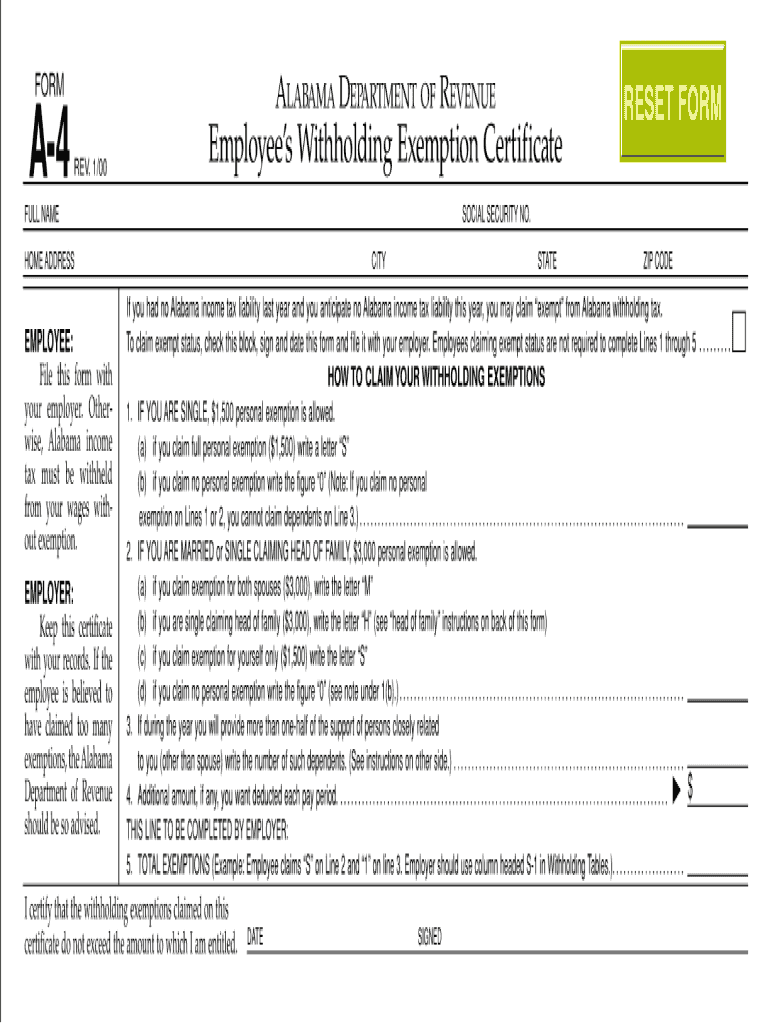

Alabama State Tax Withholding Form 2022 - Details on how to only. The zero (0) or single,. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: This form is used by alabama residents who file an individual income tax return. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local. Web to assist you in reviewing your state income tax withholding rates for 2022, below is a chart of the most recent income tax withholding tables published by states and us. Web the alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. Web state withholding tax alabama is one of many states which impose a state tax on personal income. Find your income exemptions 2. Withholding tax tables and instructions for employers.

State withholding tax is the money an employer is required to. The zero (0) or single,. Details on how to only. Web state withholding tax alabama is one of many states which impose a state tax on personal income. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. If you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim an exemption from alabama. Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o. Mat is an online filing system. Find your pretax deductions, including 401k, flexible.

Web in late april, the alabama department of revenue issued revised withholding tax tables and instructions for employers and withholding agents to reflect changes to the. Mat is an online filing system. There are a few variations of. The zero (0) or single,. Web the alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. Details on how to only. Web to assist you in reviewing your state income tax withholding rates for 2022, below is a chart of the most recent income tax withholding tables published by states and us. This form is used by alabama residents who file an individual income tax return. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes:

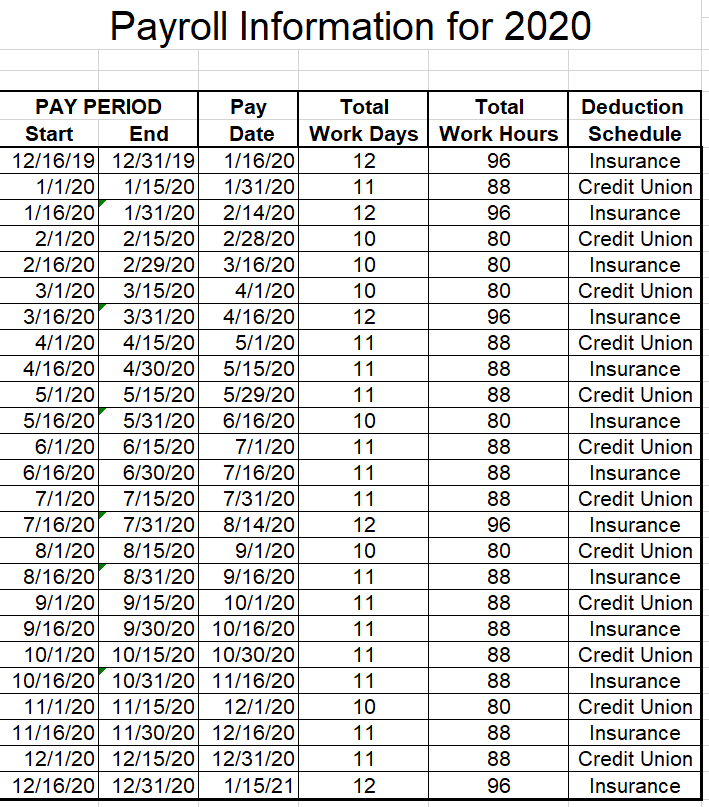

Reading your pay stub 8 factors that could be affecting your takehome pay

Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o. Web to assist you in reviewing your state income tax withholding rates for 2022, below is a chart of the most recent income tax withholding tables published by states and us. Web the withholding tables provided.

Alabama State Tax Withholding Form 2022 W4 Form

Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: The zero (0) or single,. Web the withholding tables provided in the “withholding tax tables and instructions for employers and withholding agents” have been updated to reflect these. Details on how to only. Mat is an online filing system.

State Tax Withholding Form 2022

The zero (0) or single,. Details on how to only. Web alabama small business development center. Mat is an online filing system. If you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim an exemption from alabama.

State Tax Withholding Forms Template Free Download Speedy Template

Withholding tax tables and instructions for employers. Web the alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. There are a few variations of. Web alabama small business development center. Web how to calculate 2022 alabama state income tax by using.

Alabama a 4 2000 form Fill out & sign online DocHub

If you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim an exemption from alabama. Web how to calculate 2022 alabama state income tax by using state income tax table 1. The zero (0) or single,. Find your income exemptions 2. Web in late april, the alabama department.

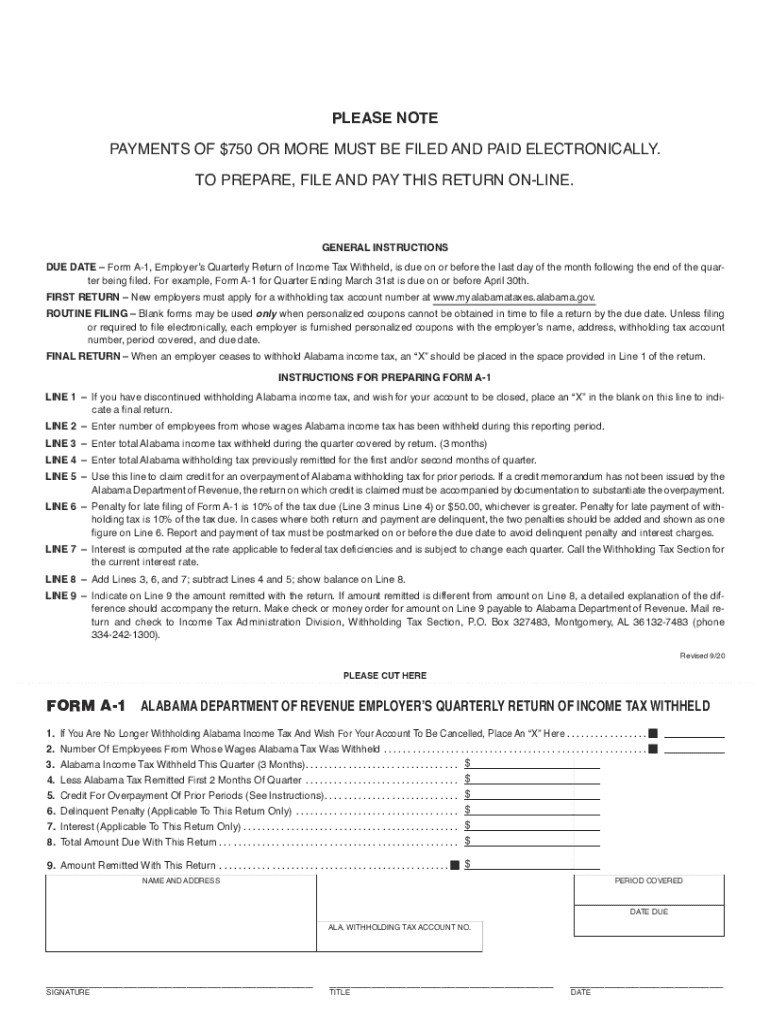

20202022 Form AL A1 Fill Online, Printable, Fillable, Blank pdfFiller

Web the alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area.

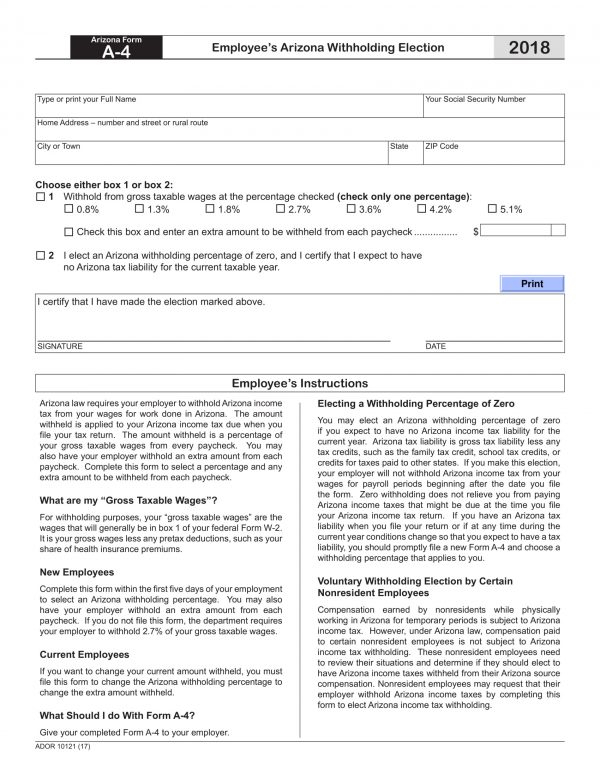

FREE 11+ Employee Election Forms in PDF MS Word

Web alabama small business development center. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. If you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim.

Nebraska State Tax Withholding Form 2022

Web how to calculate 2022 alabama state income tax by using state income tax table 1. Find your income exemptions 2. Web the withholding tables provided in the “withholding tax tables and instructions for employers and withholding agents” have been updated to reflect these. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes.

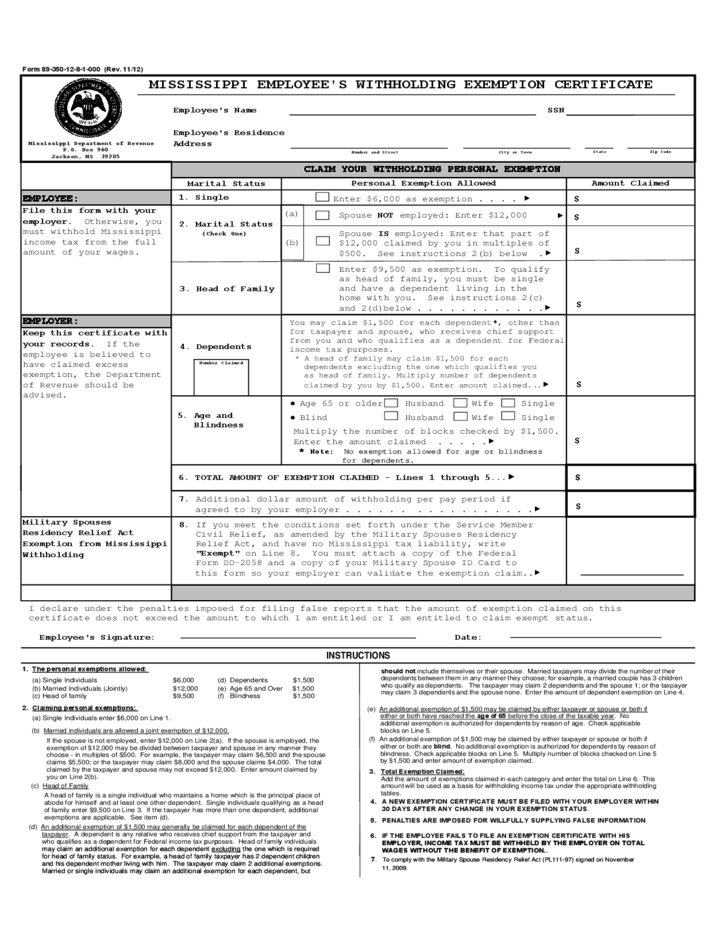

Mississippi State Withholding Form Personal Exemption

Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o. Find your pretax deductions, including 401k, flexible. Find your income exemptions 2. Sba.gov's business licenses and permits.

Happy tax day Forbes says Alabama is the 10th best state for taxes

The zero (0) or single,. Web state withholding tax alabama is one of many states which impose a state tax on personal income. Web the alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. There are a few variations of. This.

This Form Is Used By Alabama Residents Who File An Individual Income Tax Return.

Web alabama small business development center. Web state withholding tax alabama is one of many states which impose a state tax on personal income. Web to assist you in reviewing your state income tax withholding rates for 2022, below is a chart of the most recent income tax withholding tables published by states and us. State withholding tax is the money an employer is required to.

Web In Late April, The Alabama Department Of Revenue Issued Revised Withholding Tax Tables And Instructions For Employers And Withholding Agents To Reflect Changes To The.

Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Details on how to only. Find your pretax deductions, including 401k, flexible. There are a few variations of.

Withholding Tax Tables And Instructions For Employers.

Web how to calculate 2022 alabama state income tax by using state income tax table 1. Web the alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. Web withholding tax tables and instructions for employers and withholding agents. Web the withholding tables provided in the “withholding tax tables and instructions for employers and withholding agents” have been updated to reflect these.

If You Had No Alabama Income Tax Liability Last Year And You Anticipate No Alabama Income Tax Liability This Year, You May Claim An Exemption From Alabama.

The zero (0) or single,. Mat is an online filing system. Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax. Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o.