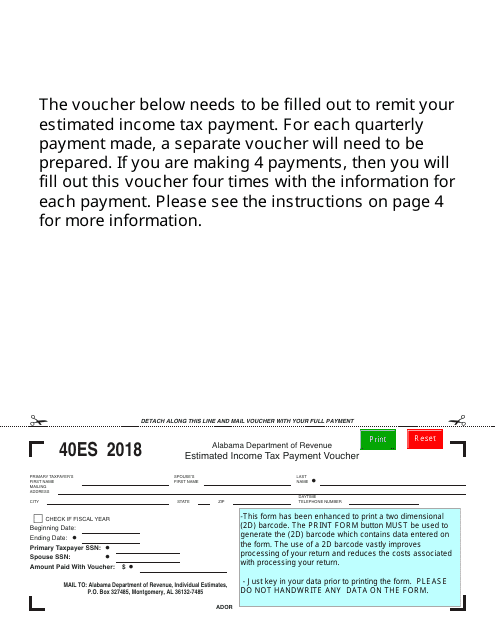

Alabama Form 40 Es

Alabama Form 40 Es - Web penalties are provided for underpaying the alabama income tax by at least $500.00. 2022 individual estimated tax form. The purpose of form 40 is to calculate how much income tax you owe the state. Please use the link below. Web form 40es is an estimated tax worksheet that will allow you to calculate your estimated quarterly income tax payments. Web be sure you are using a form for the proper year. Form 40es instructions instructions 1. Web 40es 2022 primary taxpayerʼs first name mailing address city 6 check if fiscal year beginning date: Finding a authorized professional, making an appointment and coming to the office for a personal meeting makes doing a al form. Web penalties are provided for underpaying the alabama income tax by at least $500.00.

Finding a authorized professional, making an appointment and coming to the office for a personal meeting makes doing a al form. Web follow the simple instructions below: Web instructions be sure you are using a form for the proper year. Web 40es 2022 primary taxpayerʼs first name mailing address city 6 check if fiscal year beginning date: Alabama expects you to pay income tax quarterly if you. Please use the link below. Do not use this form to file for any calendar year other than the year printed in bold type on the face of the form. This tax return package includes form 4952a,. 2022 individual estimated tax form. Web alabama tax form 40es fill this form show form versions (4.8 / 5) 33 votes get your alabama tax form 40es in 3 easy steps 01 fill and edit template 02 sign it online 03.

Form 40es instructions instructions 1. Web 2022 individual estimated tax form. Web penalties are provided for underpaying the alabama income tax by at least $500.00. Web form 40es is an estimated tax worksheet that will allow you to calculate your estimated quarterly income tax payments. Web 40es 2022 primary taxpayerʼs first name mailing address city 6 check if fiscal year beginning date: Web alabama tax form 40es fill this form show form versions (4.8 / 5) 33 votes get your alabama tax form 40es in 3 easy steps 01 fill and edit template 02 sign it online 03. Web be sure you are using a form for the proper year. Alabama department of revenue, p o box 2401,. Web form 40es is an estimated tax worksheet that will allow you to calculate your estimated quarterly income tax payments. Alabama expects you to pay income tax quarterly if you.

Form 40ES Download Fillable PDF or Fill Online Estimated Tax

Form 40es instructions instructions 1. Finding a authorized professional, making an appointment and coming to the office for a personal meeting makes doing a al form. Web penalties are provided for underpaying the alabama income tax by at least $500.00. Web alabama individual income tax return form 40 (print only) download form. Web follow the simple instructions below:

2018 Form AL 40A Booklet Fill Online, Printable, Fillable, Blank

Form 40es instructions instructions 1. Finding a authorized professional, making an appointment and coming to the office for a personal meeting makes doing a al form. Web form 40es is an estimated tax worksheet that will allow you to calculate your estimated quarterly income tax payments. 2022 individual estimated tax form. Web penalties are provided for underpaying the alabama income.

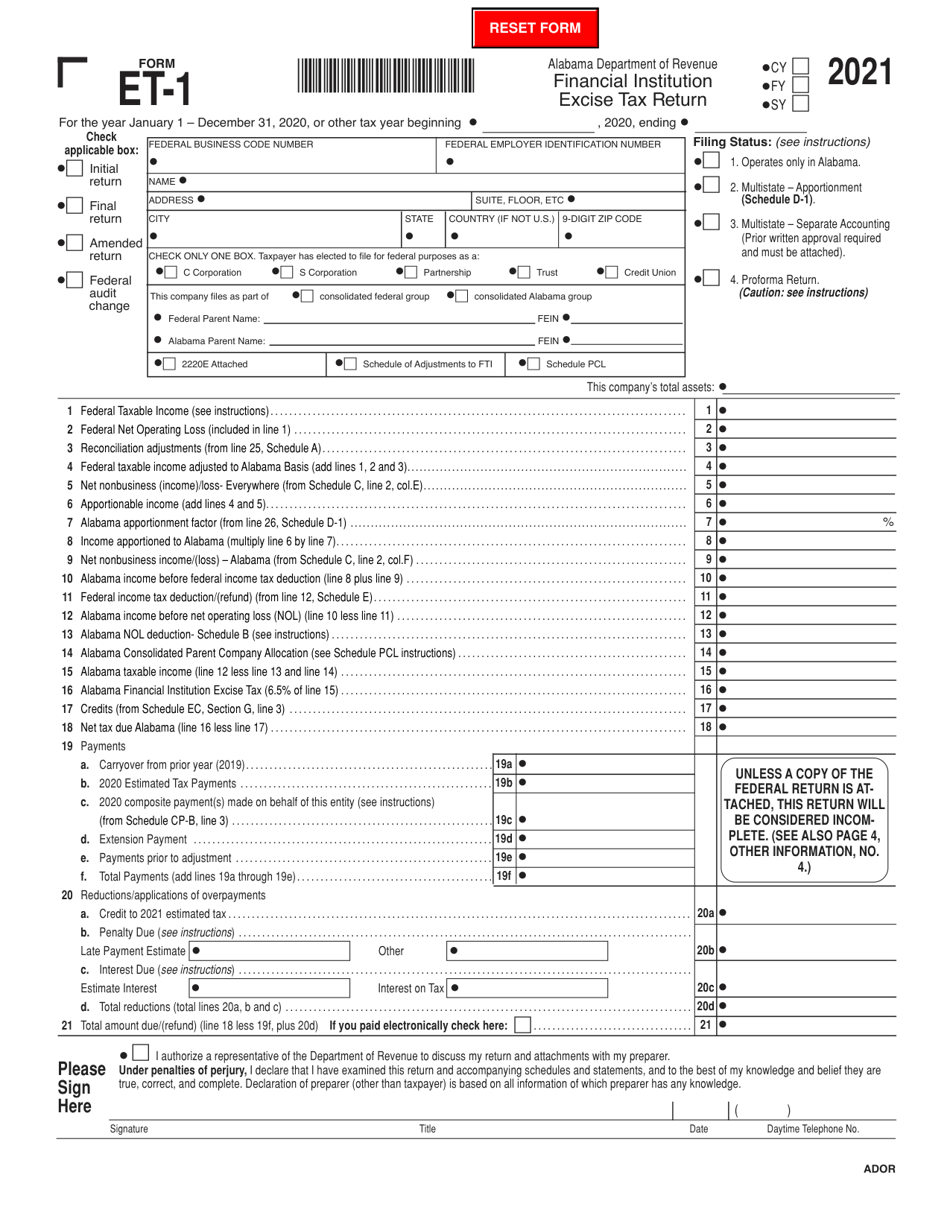

Form ET1 Download Fillable PDF or Fill Online Alabama Financial

Please use the link below. Web be sure you are using a form for the proper year. The purpose of form 40 is to calculate how much income tax you owe the state. Web penalties are provided for underpaying the alabama income tax by at least $500.00. Alabama individual income tax return form 40 (print only) all.

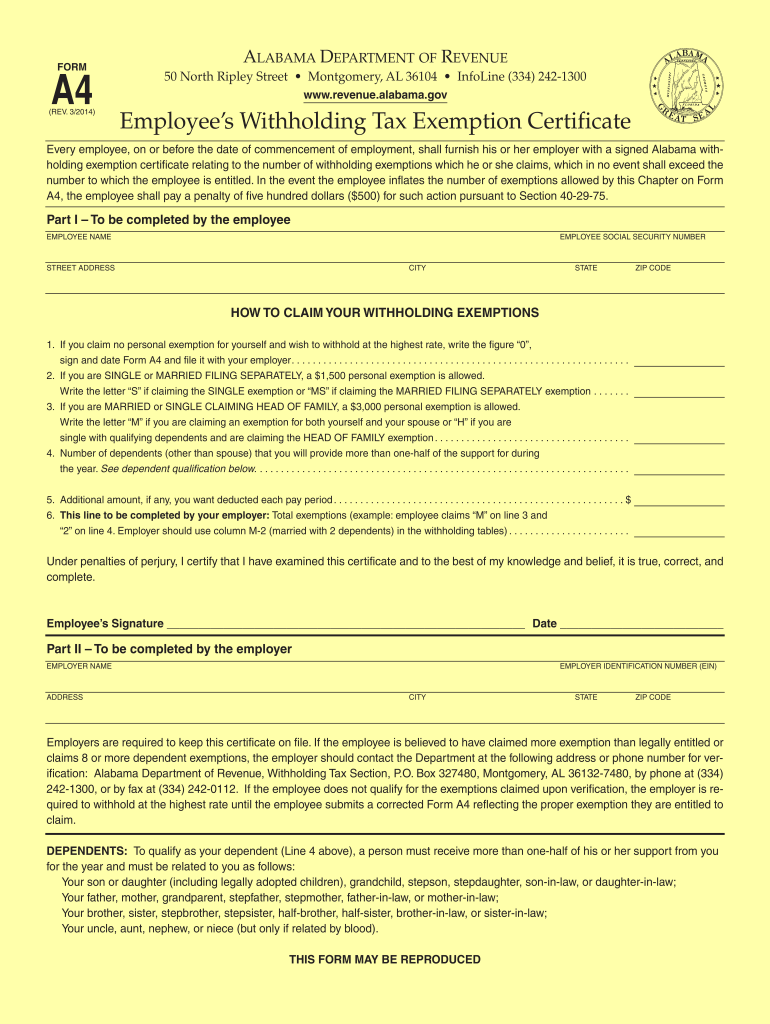

20142021 Form AL DoR A4 Fill Online, Printable, Fillable, Blank

2022 individual estimated tax form. Web 40es 2022 primary taxpayerʼs first name mailing address city 6 check if fiscal year beginning date: The purpose of form 40 is to calculate how much income tax you owe the state. Finding a authorized professional, making an appointment and coming to the office for a personal meeting makes doing a al form. Do.

Alabama Form Uc Cr4 Pdf 20202022 Fill and Sign Printable Template Online

Do not use this form to file for any calendar year other than the year printed in bold type on the face of. This tax return package includes form 4952a,. Form 40es instructions instructions 1. Alabama expects you to pay income tax quarterly if you. Do not use this form to file for any calendar year other than the year.

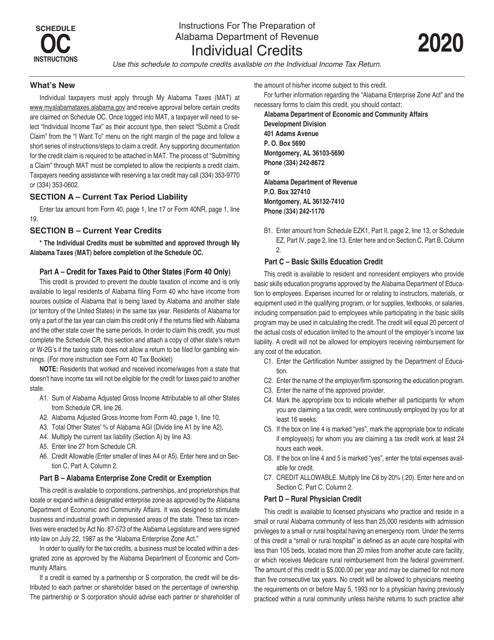

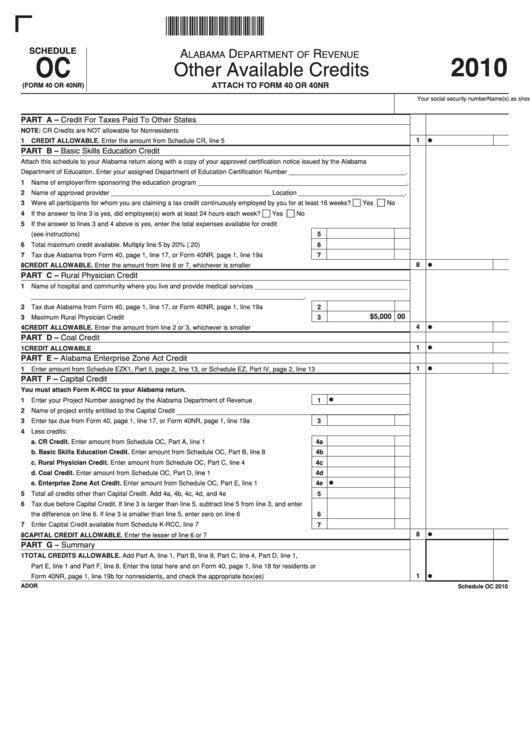

Download Instructions for Form 40, 40NR Addendum OC Other Available

Web form 40es is an estimated tax worksheet that will allow you to calculate your estimated quarterly income tax payments. Web instructions be sure you are using a form for the proper year. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the.

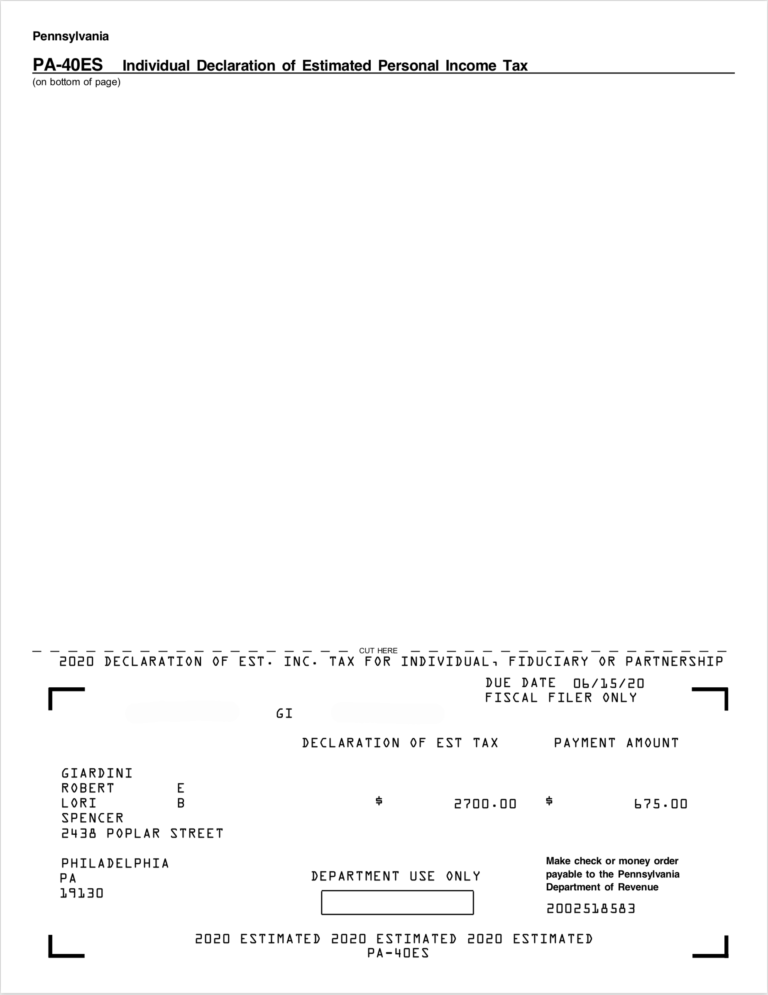

PA Form 40ES LS The Print Shop Williamstown

Alabama expects you to pay income tax quarterly if you. Be sure you are using a form for the proper year. Form 40es instructions instructions 1. Alabama department of revenue, p o box 2401,. Web instructions be sure you are using a form for the proper year.

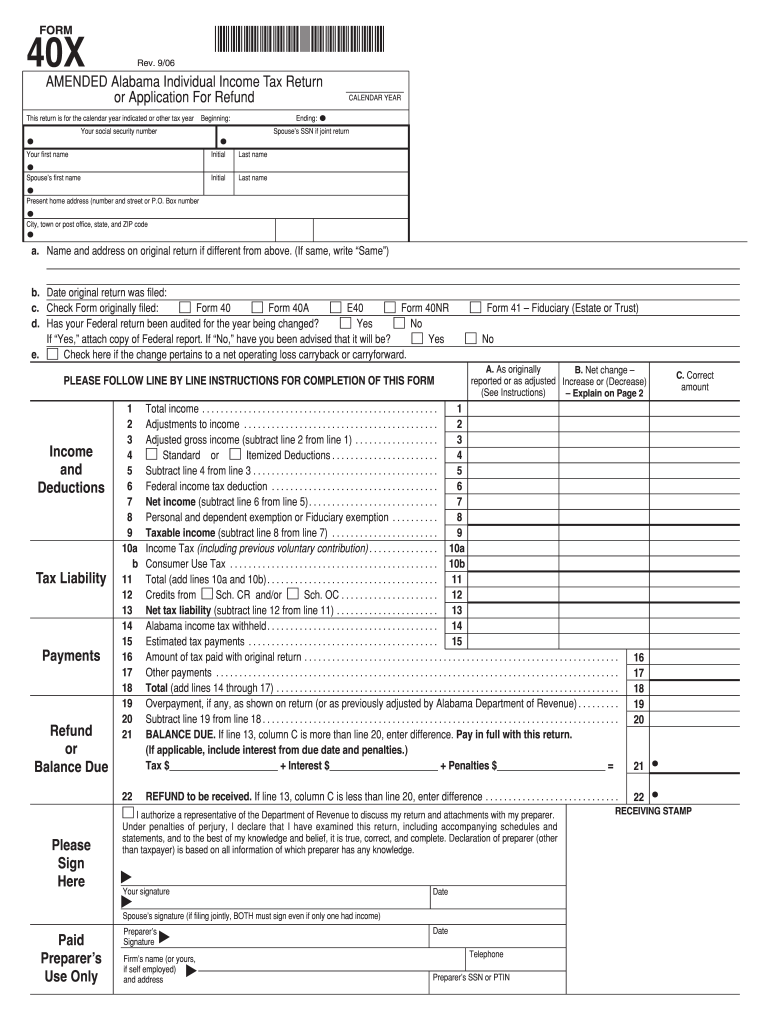

Form 40X Fill Out and Sign Printable PDF Template signNow

The purpose of form 40 is to calculate how much income tax you owe the state. Web instructions be sure you are using a form for the proper year. Web 2022 individual estimated tax form. Form 40es instructions instructions 1. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using.

Form 40 Or 40nr Schedule Oc Other Available Credits Alabama

Please use the link below. Alabama department of revenue, p o box 2401,. 2022 individual estimated tax form. This tax return package includes form 4952a,. The purpose of form 40 is to calculate how much income tax you owe the state.

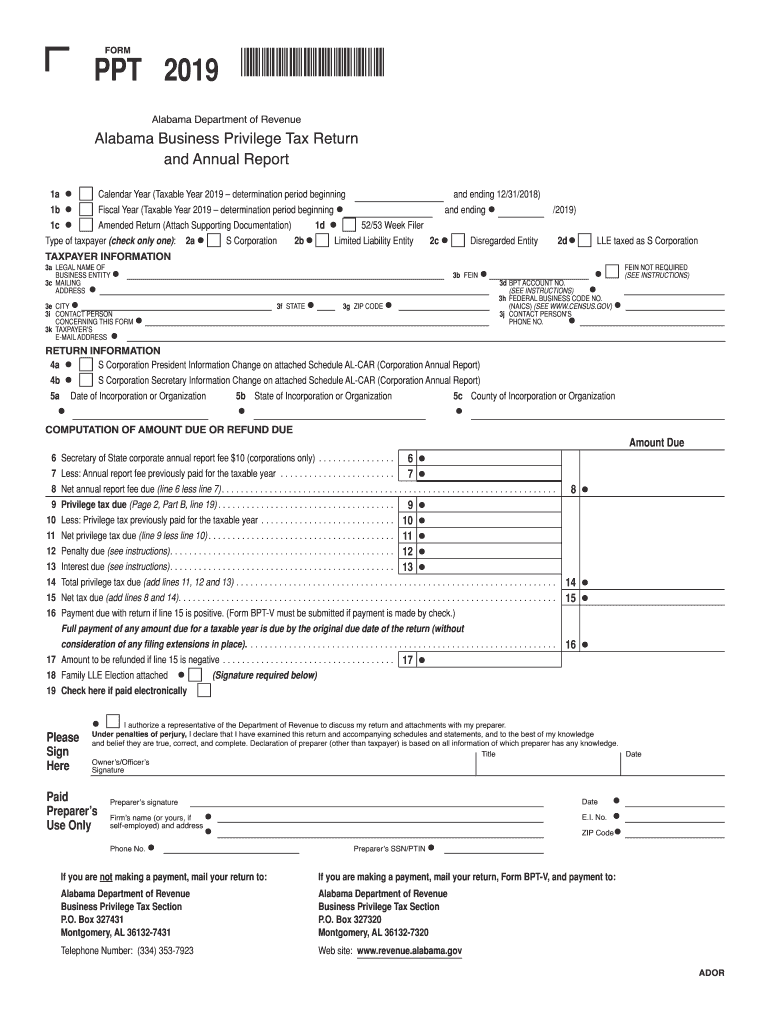

Alabama Form Ppt 2019 Fill Out and Sign Printable PDF Template signNow

Web alabama tax form 40es fill this form show form versions (4.8 / 5) 33 votes get your alabama tax form 40es in 3 easy steps 01 fill and edit template 02 sign it online 03. Alabama expects you to pay income tax quarterly if you. Web follow the simple instructions below: Be sure you are using a form for.

Alabama Individual Income Tax Return Form 40 (Print Only) All.

Be sure you are using a form for the. Form 40es instructions instructions 1. This tax return package includes form 4952a,. 2022 individual estimated tax form.

Web Form 40 No Payment:

Alabama expects you to pay income tax quarterly if you. Be sure you are using a form for the proper year. Web 2022 individual estimated tax form. Web penalties are provided for underpaying the alabama income tax by at least $500.00.

Web Instructions Be Sure You Are Using A Form For The Proper Year.

Web form 40 tax table. The purpose of form 40 is to calculate how much income tax you owe the state. Web follow the simple instructions below: Finding a authorized professional, making an appointment and coming to the office for a personal meeting makes doing a al form.

Web Alabama Individual Income Tax Return Form 40 (Print Only) Download Form.

Do not use this form to file for any calendar year other than the year printed in bold type on the face of. Form 40es instructions instructions 1. Web penalties are provided for underpaying the alabama income tax by at least $500.00. Alabama expects you to pay income tax quarterly if you.