Ag Exemption Form Texas

Ag Exemption Form Texas - Web form f is returned to reserve tables for sales or raffles at aggie moms’ boutique. Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. Web how many acres do you need for a special ag valuation? Registration number (must enter 11 numbers) or. Web registration and renewal agricultural timber exemption application new ag/timber registration select new ag/timber registration if: Complete, edit or print tax forms instantly. Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Federation form f is used to reserve tables for member club sales and/or raffles at aggie moms’. Web texas agricultural and timber exemption registration number unless otherwise exempt from the requirement.

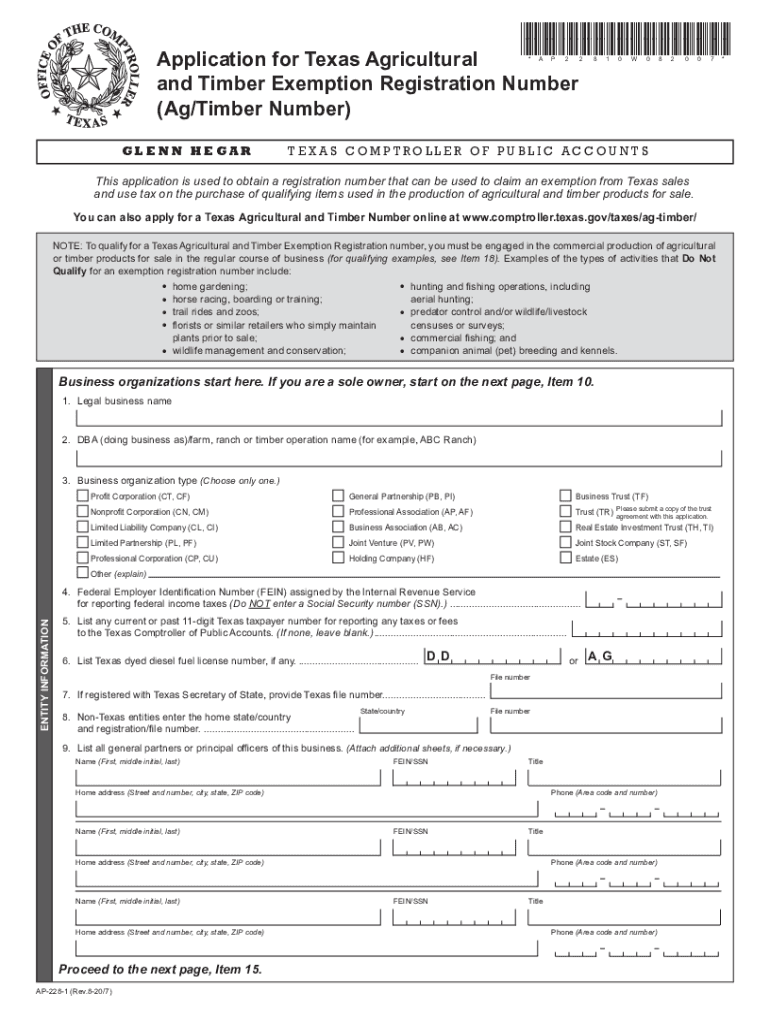

Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Web a texas agricultural exemption for property taxes is actually not an exemption from taxes, but rather a special use valuation for a tract of land. Form download (alternative format) instructions download. But, after you have that for a certain amount of time, you can switch over to wildlife, maintain your. And even though titled an. Web as a farm, in texas you may be required to file a general personal property rendition form with your appraisal district each year by april 15th. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. The appraisal district will send you a. Complete, edit or print tax forms instantly. Application for section 18 emergency exemption:

Web farmers, ranchers and timber producers can claim exemptions from some texas taxes when purchasing certain items used exclusively to produce agricultural and timber. Registration number (must enter 11 numbers) or. Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Web for my county, its 10 acres minimum to get ag exemption. Middle name (optional) last name. But, after you have that for a certain amount of time, you can switch over to wildlife, maintain your. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Federation form f is used to reserve tables for member club sales and/or raffles at aggie moms’. And even though titled an. The appraisal district will send you a.

Brazos County Homestead Exemption Fill Online, Printable, Fillable

Application for section 18 emergency exemption. Web for my county, its 10 acres minimum to get ag exemption. Web farmers, ranchers and timber producers can claim exemptions from some texas taxes when purchasing certain items used exclusively to produce agricultural and timber. Registration number (must enter 11 numbers) or. Ag exemption requirements vary by county, but generally you need at.

Alabama State Sales And Use Tax Certificate Of Exemption Form Ste 1

Web farmers, ranchers and timber producers can claim exemptions from some texas taxes when purchasing certain items used exclusively to produce agricultural and timber. But, after you have that for a certain amount of time, you can switch over to wildlife, maintain your. Web the form used to apply for a texas agricultural and timber exemption registration number that can.

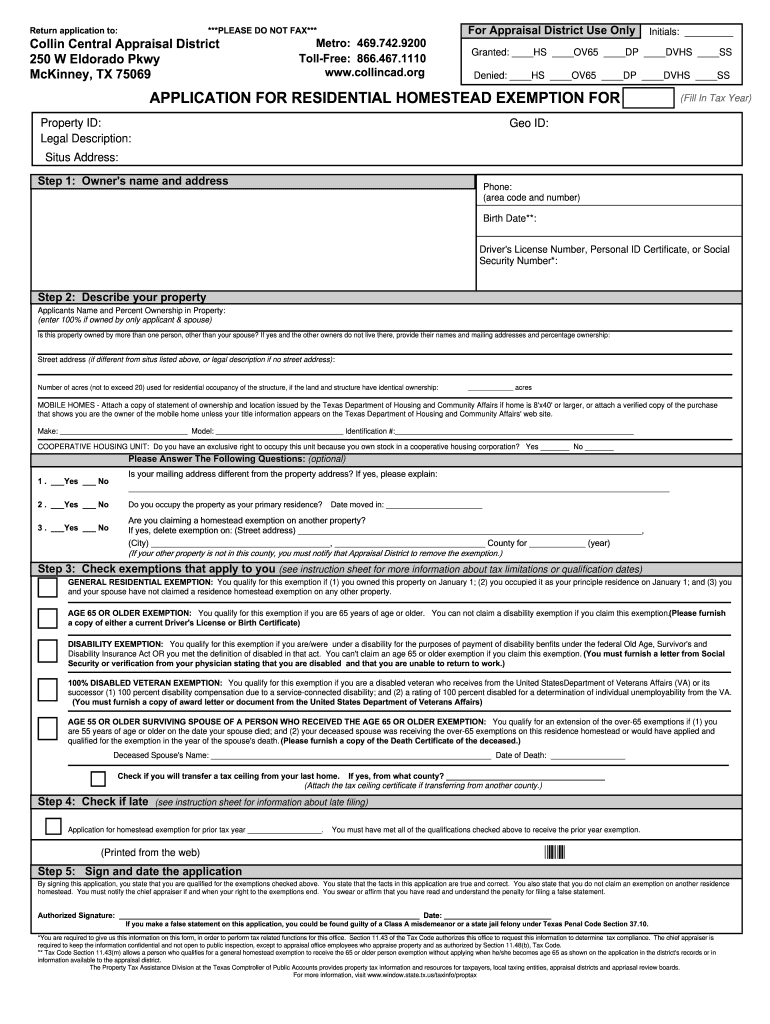

Texas Homestead Tax Exemption Form

Middle name (optional) last name. You do not have an ag/timber. Web as a farm, in texas you may be required to file a general personal property rendition form with your appraisal district each year by april 15th. Web farmers, ranchers and timber producers can claim exemptions from some texas taxes when purchasing certain items used exclusively to produce agricultural.

Texas Sr 22 Form Pdf Resume Examples

The appraisal district will send you a. Complete, edit or print tax forms instantly. Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. Web for my county, its 10 acres minimum to get ag exemption. But, after.

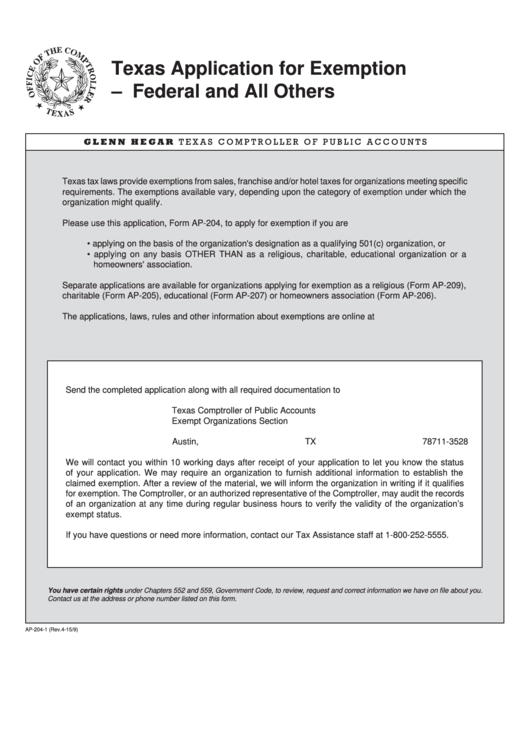

Fillable Texas Application For Exemption printable pdf download

Web form f is returned to reserve tables for sales or raffles at aggie moms’ boutique. Web a texas agricultural exemption for property taxes is actually not an exemption from taxes, but rather a special use valuation for a tract of land. Web as a farm, in texas you may be required to file a general personal property rendition form.

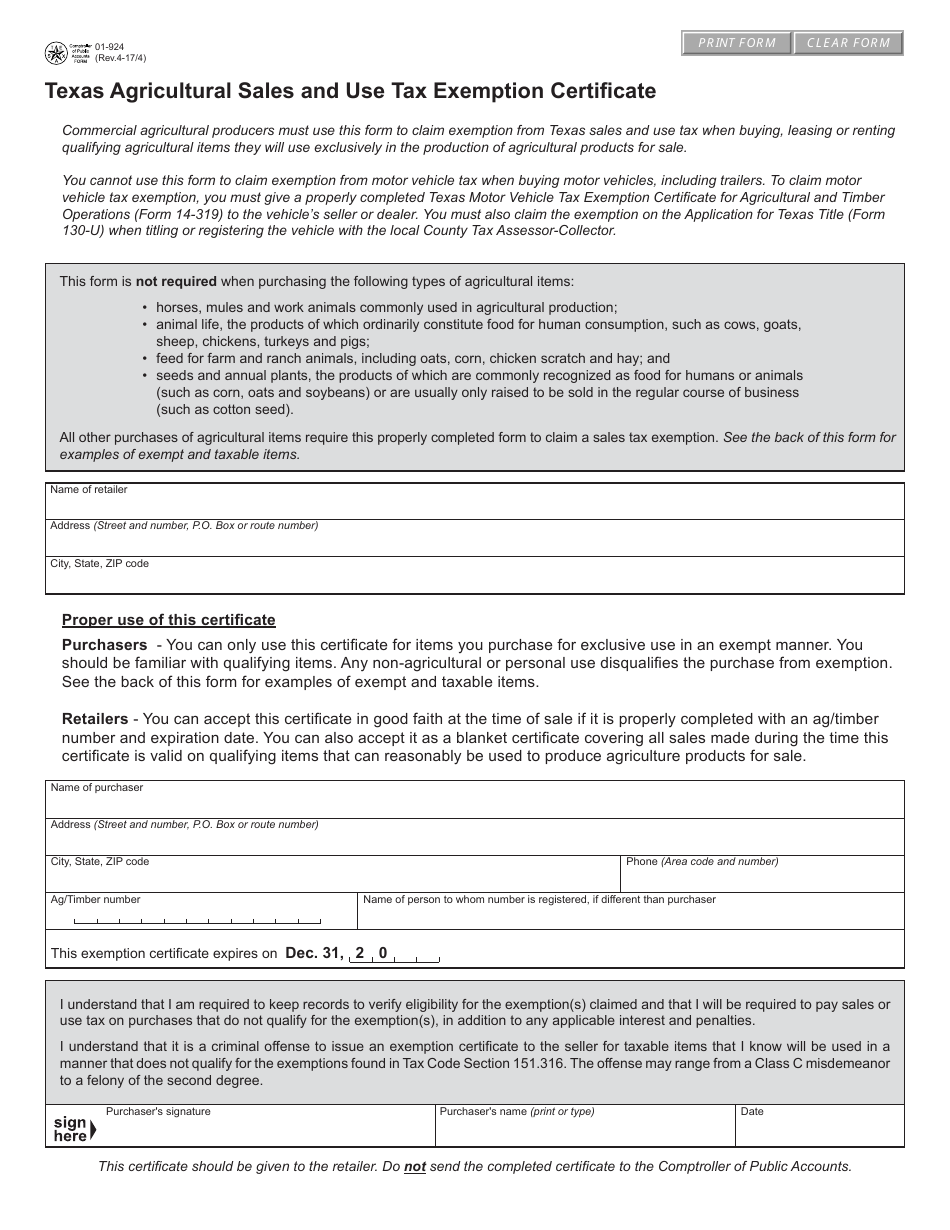

Form 01924 Download Fillable PDF or Fill Online Texas Agricultural

Registration number (must enter 11 numbers) or. Web how many acres do you need for a special ag valuation? Federation form f is used to reserve tables for member club sales and/or raffles at aggie moms’. The appraisal district will send you a. Web texas agricultural and timber exemption registration number unless otherwise exempt from the requirement.

Texas Exemption Port Fill Online, Printable, Fillable, Blank pdfFiller

Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Web a texas agricultural exemption for property taxes is actually not an exemption from taxes, but rather a special use valuation for a tract of land. Application for section 18 emergency exemption. Ad.

2008 Form TX Comptroller AP209 Fill Online, Printable, Fillable, Blank

Web “ag exemption” o common term used to explain the central appraisal district’s (cad) appraised value of the land o is not an exemption is a special use appraisal based on. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. But, after you have that for a certain amount.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. Web form f is returned to reserve tables for sales or raffles at aggie moms’ boutique. Federation form f is used to reserve tables for member club sales and/or raffles at aggie moms’. Web “ag exemption” o common term used.

20202022 Form TX AP2281 Fill Online, Printable, Fillable, Blank

Application for section 18 emergency exemption: Web a texas agricultural exemption for property taxes is actually not an exemption from taxes, but rather a special use valuation for a tract of land. Web for my county, its 10 acres minimum to get ag exemption. The appraisal district will send you a. Web as a farm, in texas you may be.

Complete, Edit Or Print Tax Forms Instantly.

And even though titled an. Registration number (must enter 11 numbers) or. Web farmers, ranchers and timber producers can claim exemptions from some texas taxes when purchasing certain items used exclusively to produce agricultural and timber. Web as a farm, in texas you may be required to file a general personal property rendition form with your appraisal district each year by april 15th.

Farm Truck Or Farm Truck Tractor License Plates May Not

Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Web for my county, its 10 acres minimum to get ag exemption. Web form f is returned to reserve tables for sales or raffles at aggie moms’ boutique. Web producers of agricultural products for sale must provide this completed form to retailers when claiming an exemption from sales and use tax on the purchase of qualifying.

Web Texas Agricultural And Timber Exemption Registration Number Unless Otherwise Exempt From The Requirement.

Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. Form download (alternative format) instructions download. Application for section 18 emergency exemption: Web “ag exemption” o common term used to explain the central appraisal district’s (cad) appraised value of the land o is not an exemption is a special use appraisal based on.

Web Registration And Renewal Agricultural Timber Exemption Application New Ag/Timber Registration Select New Ag/Timber Registration If:

Web a texas agricultural exemption for property taxes is actually not an exemption from taxes, but rather a special use valuation for a tract of land. You do not have an ag/timber. But, after you have that for a certain amount of time, you can switch over to wildlife, maintain your. Web how many acres do you need for a special ag valuation?