943 Form 2021

943 Form 2021 - Web create my document form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Try it for free now! Save or instantly send your ready documents. In other words, it is a tax form used to report federal income tax, social. Web form 943 is required for agricultural businesses with farmworkers. Web filing 2021 form 943 form 943, just like any other tax return can be filed electronically. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Line by line instruction for 2022. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file.

In other words, it is a tax form used to report federal income tax, social. You’ll file this form with the irs annually. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Web 1 number of agricultural employees employed in the pay period that includes march 12, 2022. Form 943 (employer’s annual federal tax. Web form 943 is required for agricultural businesses with farmworkers. Ad get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. For this, you must purchase tax software.

Web for 2022 tax year, file form 943 by january 31, 2023. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web form 943, is the employer’s annual federal tax return for agricultural employees. Web find and fill out the correct irs 943 form. Web 1 number of agricultural employees employed in the pay period that includes march 12, 2022. Web see purpose of form 943, earlier, for household employee information. You’ll file this form with the irs annually. Ad get ready for tax season deadlines by completing any required tax forms today. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified.

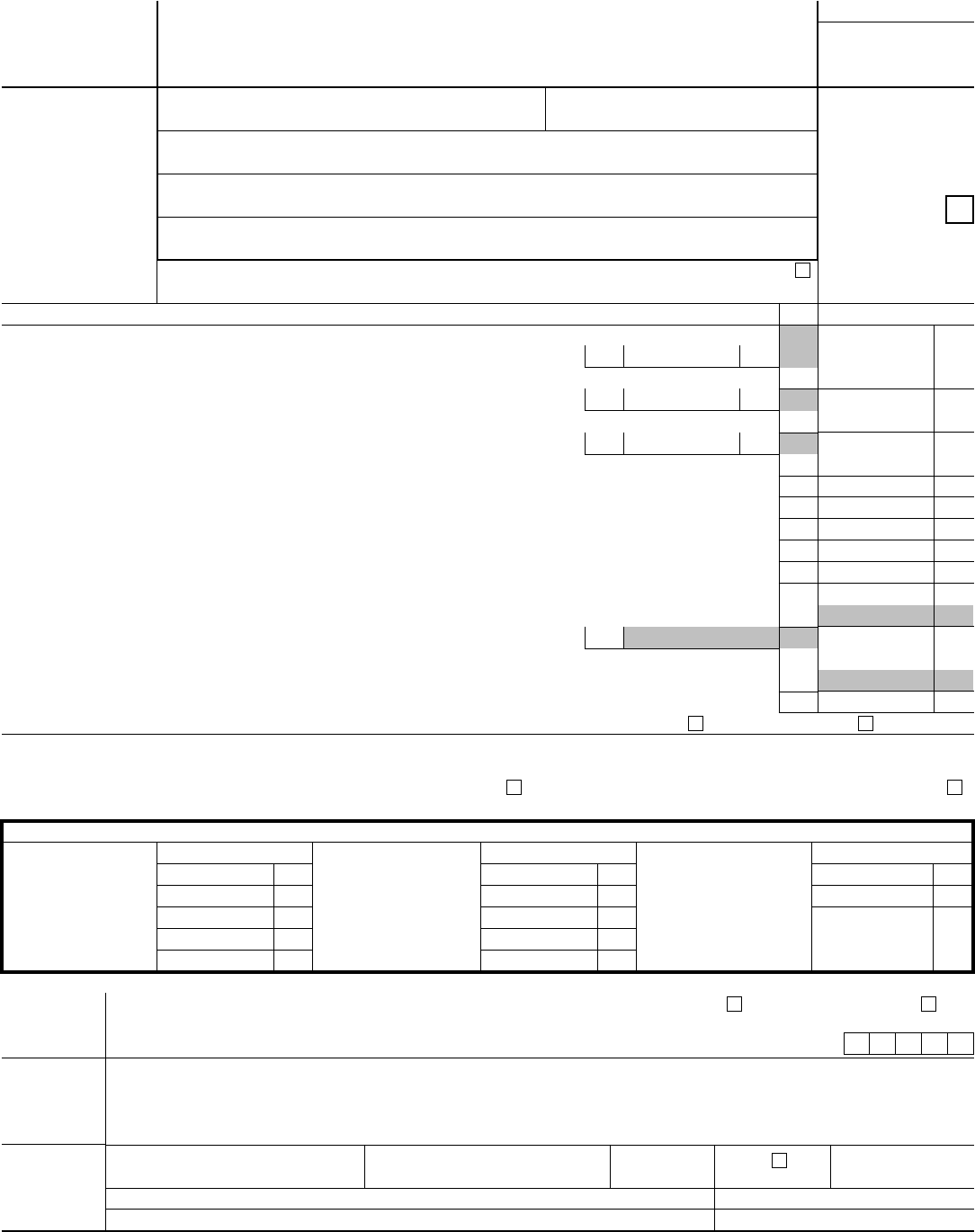

Form 943 Edit, Fill, Sign Online Handypdf

1 2 wages subject to social security tax*. Complete, edit or print tax forms instantly. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Web find and fill out the correct irs 943 form. Web we last updated the employer's annual federal tax return for agricultural employees in.

Drafts of Form 943, 944 and 940 are Now Available with COVID19 Changes

Web form 943, is the employer’s annual federal tax return for agricultural employees. The instructions include five worksheets similar to those. Web form 943 is required for agricultural businesses with farmworkers. Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim.

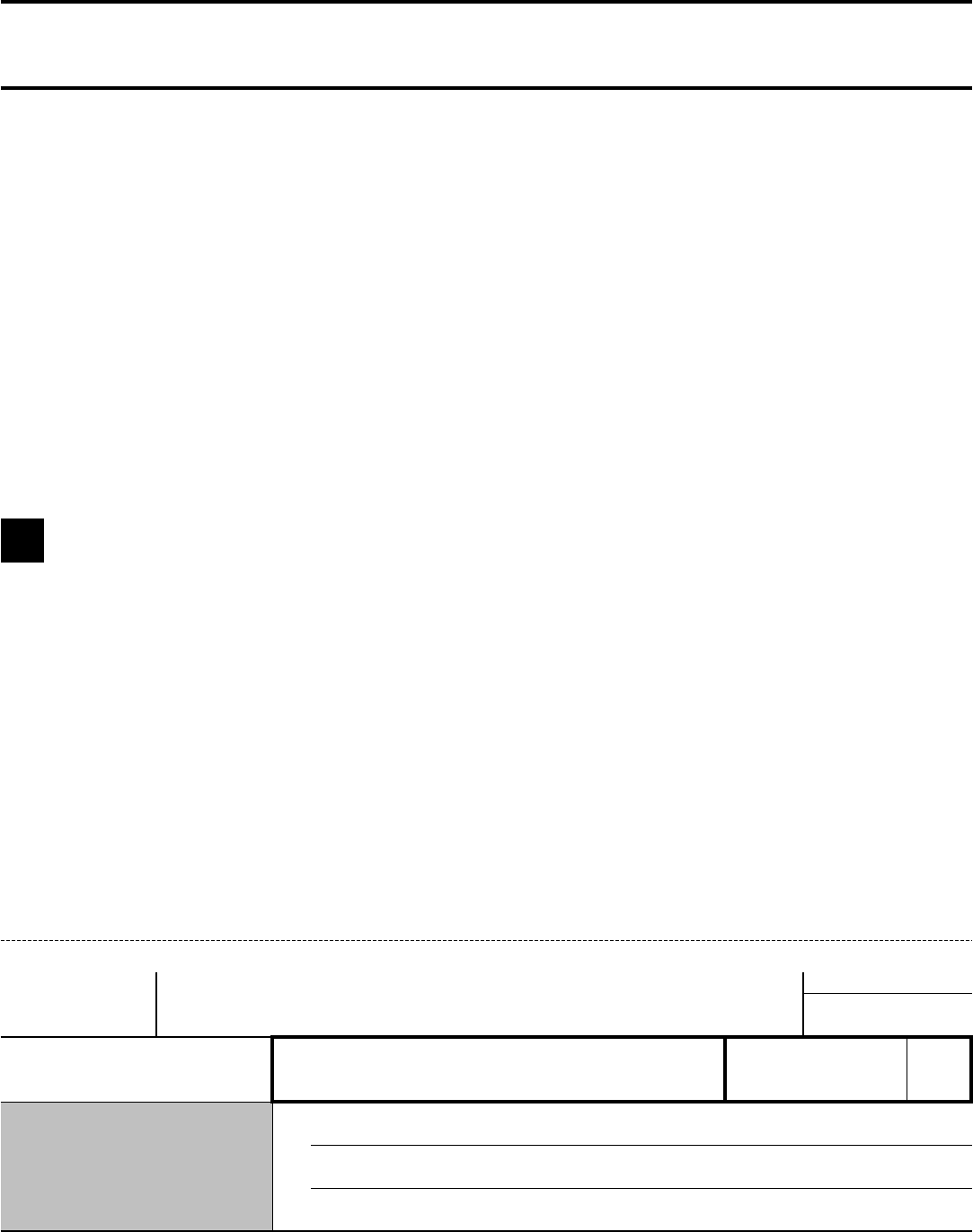

Ft 943 Form Fill Out and Sign Printable PDF Template signNow

Web create my document form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Ad get ready for tax season deadlines by completing any required tax forms today. 1 2 wages subject to social security tax*. Web for 2022 tax year, file form 943 by january 31, 2023. Save.

Form 943 Edit, Fill, Sign Online Handypdf

Easily fill out pdf blank, edit, and sign them. Web irs form 943: Web form 943 is required for agricultural businesses with farmworkers. Web for 2022 tax year, file form 943 by january 31, 2023. Ad upload, modify or create forms.

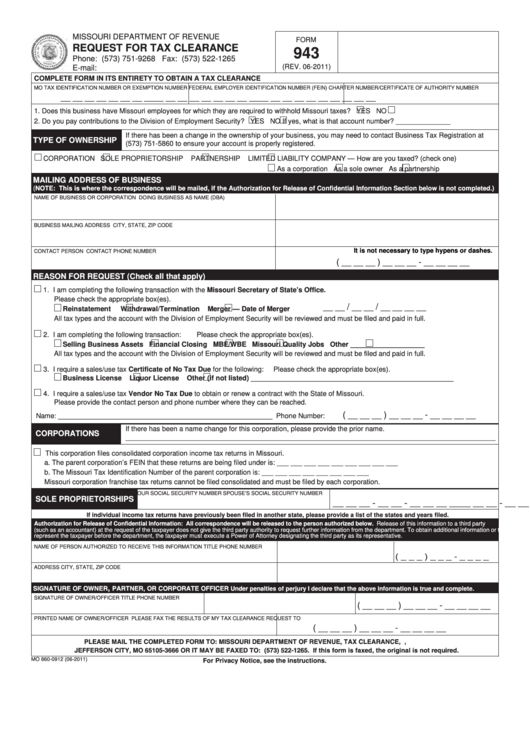

943 Form Fill Out and Sign Printable PDF Template signNow

Choose the correct version of the editable pdf form from the list and. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web form 943, is the employer’s annual federal tax return for agricultural employees. Web remember the erc when you file your form 943.

What Is Form 943 Santos Czerwinski's Template

Web form 943 is required for agricultural businesses with farmworkers. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified. Web see purpose of form 943, earlier, for household employee.

943 Form 2021 IRS Forms Zrivo

Web filing 2021 form 943 form 943, just like any other tax return can be filed electronically. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms.

Form 943 Joins The TaxBandits Lineup Blog TaxBandits

You’ll file this form with the irs annually. The instructions include five worksheets similar to those. Web form 943, is the employer’s annual federal tax return for agricultural employees. Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit.

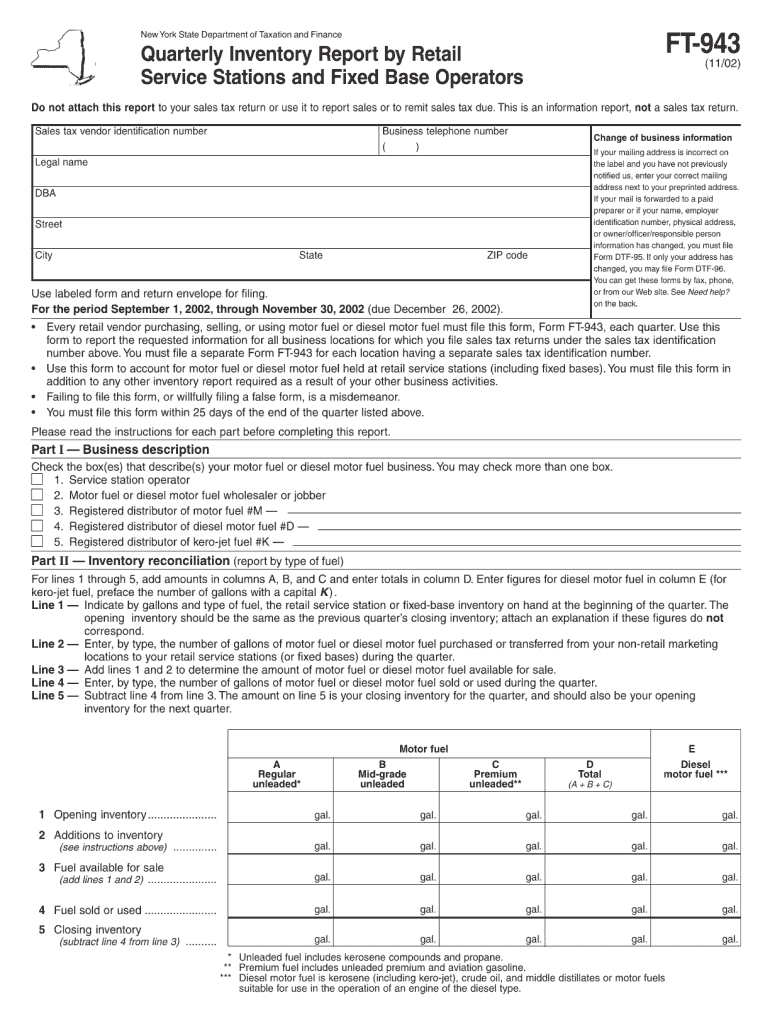

2021 Form MO DoR 943 Fill Online, Printable, Fillable, Blank pdfFiller

Web filing 2021 form 943 form 943, just like any other tax return can be filed electronically. Some businesses may be required to file both a 943 and. 1 2 wages subject to social security tax*. In other words, it is a tax form used to report federal income tax, social. Easily fill out pdf blank, edit, and sign them.

Web Filing 2021 Form 943 Form 943, Just Like Any Other Tax Return Can Be Filed Electronically.

Web 1 number of agricultural employees employed in the pay period that includes march 12, 2022. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web irs form 943: Line by line instruction for 2022.

Web Create My Document Form 943, Employer's Annual Federal Tax Return For Agricultural Employees, Is A Tax Form Used Employers In The Field Of Agriculture.

1 2 wages subject to social security tax*. Complete, edit or print tax forms instantly. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Ad get ready for tax season deadlines by completing any required tax forms today.

For This, You Must Purchase Tax Software.

Choose the correct version of the editable pdf form from the list and. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Save or instantly send your ready documents. It is used to record.

Form 943 (Employer’s Annual Federal Tax.

In other words, it is a tax form used to report federal income tax, social. Try it for free now! The instructions include five worksheets similar to those. Easily fill out pdf blank, edit, and sign them.