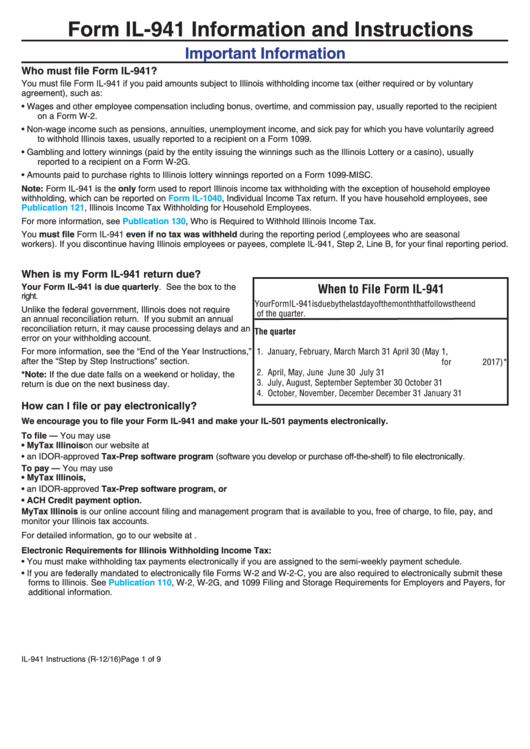

941 Form Pdf

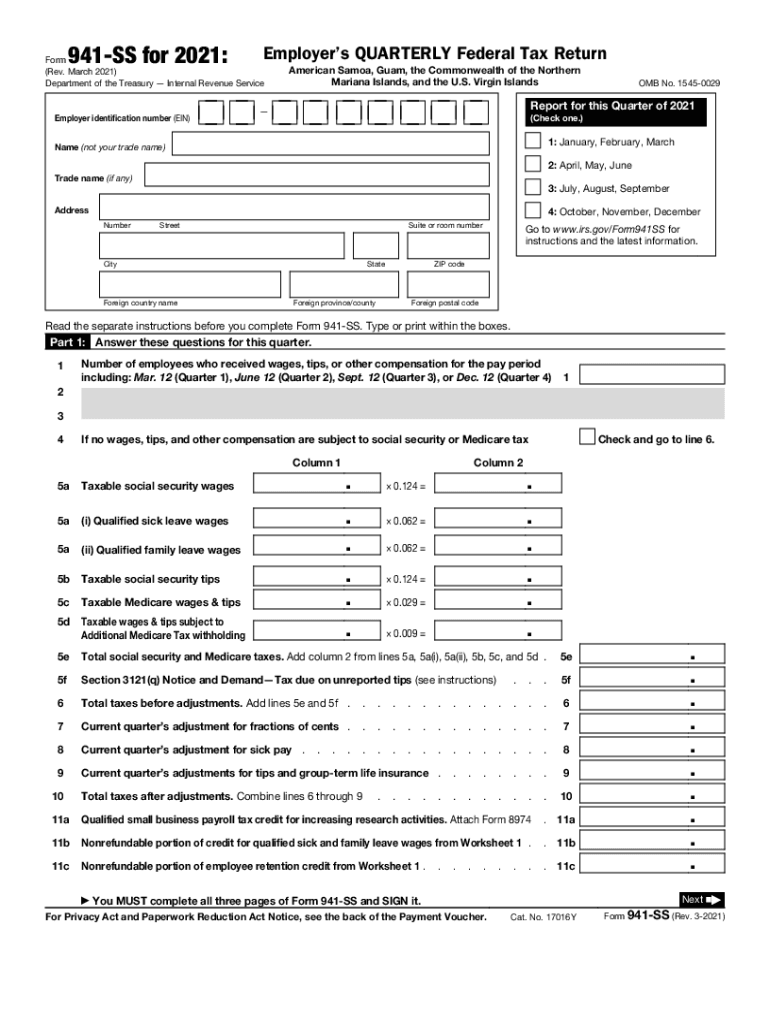

941 Form Pdf - Web form 1040 pdf. Employer identification number (ein) — name (not. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and before october 1, 2021, is 6.2% each for the employer and employee or 12.4% for both. Write your daily tax liability on the numbered space that corresponds to the date wages were paid. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web form 941 for 2023: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Pick the first field and start writing the requested info.

Web form 941 for 2021: See section 11 in pub. Web form 1040 pdf. Employee's withholding certificate form 941; Employer identification number (ein) — name (not. Enter the irs form 941 2020 in the editor. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Employer identification number (ein) small businesses. Pick the first field and start writing the requested info.

Employers engaged in a trade or business who pay compensation form 9465; Employer identification number (ein) — name (not. Web form 941 for 2023: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Enter the irs form 941 2020 in the editor. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Employer identification number (ein) — name (not. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Pick the first field and start writing the requested info. Web form 941 for 2021:

Form 941

Employer identification number (ein) — name (not. See section 11 in pub. Web form 941 for 2021: Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in.

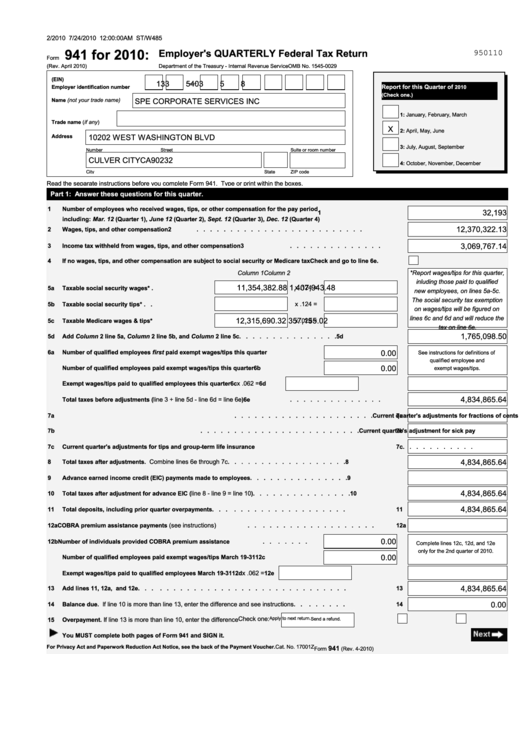

Form 941 Employer'S Quarterly Federal Tax Return 2010 printable pdf

You should simply follow the instructions: Go to the next field. If you filled all the needed information, click the done button. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web form 1040 pdf.

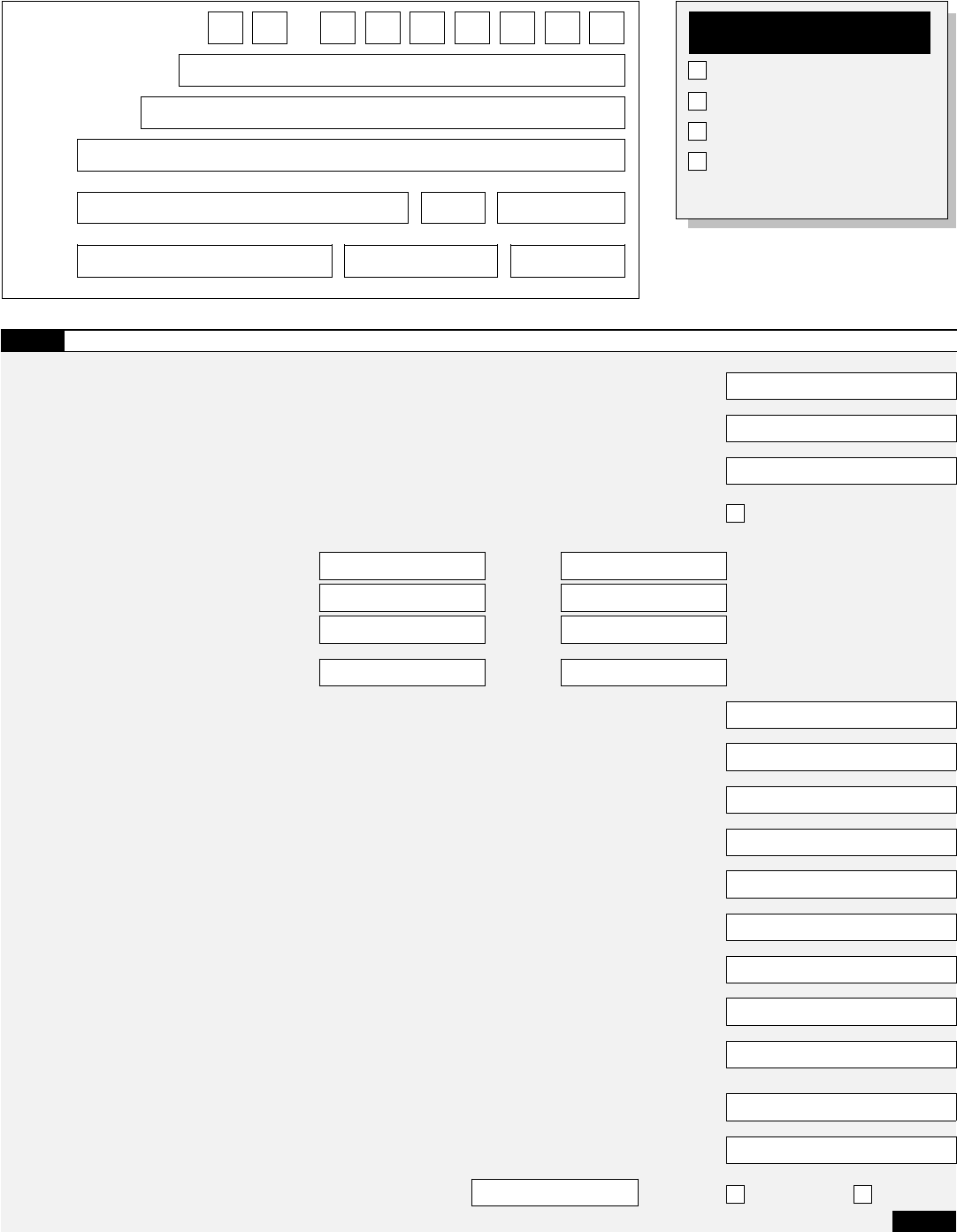

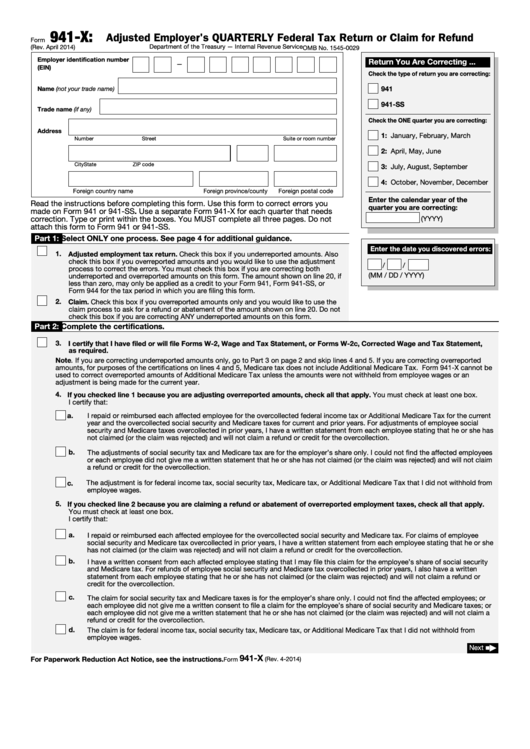

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

Go to the next field. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. See section 11 in pub. Employee's withholding certificate form 941; Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for.

Form 941 Employer's Quarterly Federal Tax Return Definition

Employer identification number (ein) — name (not. Pick the first field and start writing the requested info. See section 11 in pub. Employer identification number (ein) — name (not. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment.

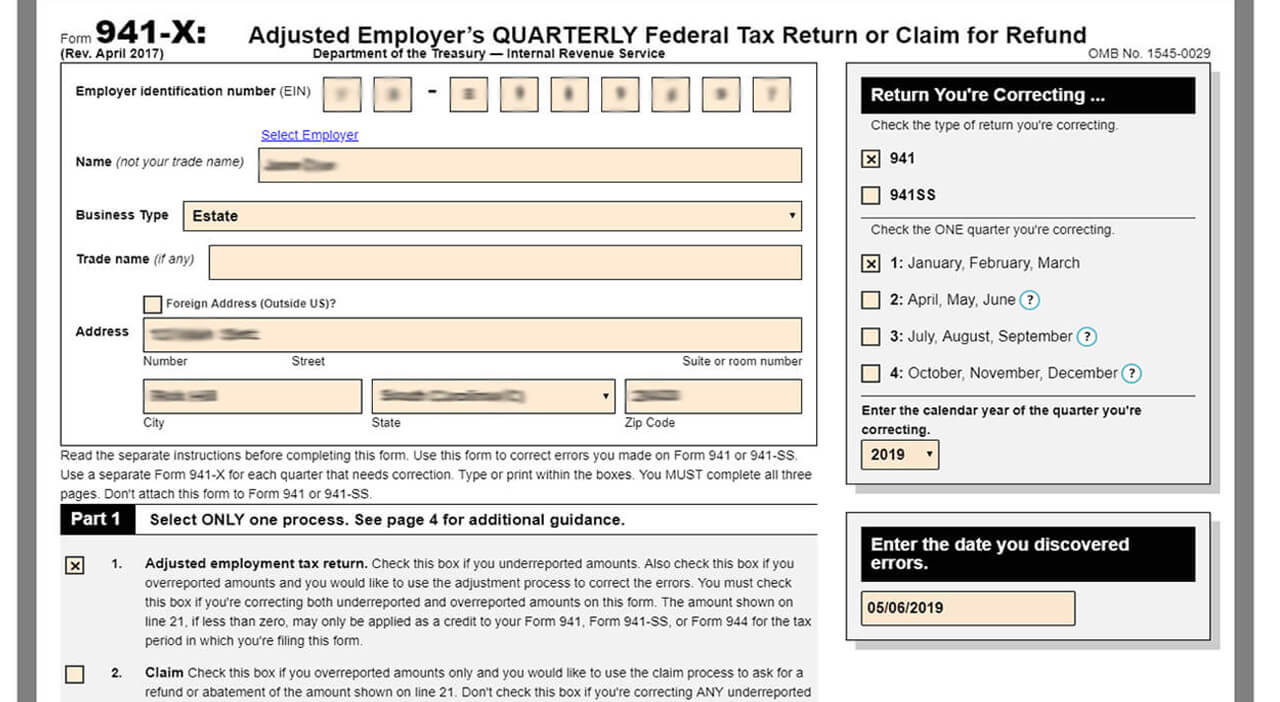

Form 941 Fill Out and Sign Printable PDF Template signNow

Web form 941 for 2021: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Employer identification number (ein) — name (not. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. See section 11 in pub.

How to Print Form 941 ezAccounting Payroll

Web form 941 for 2021: Employers engaged in a trade or business who pay compensation form 9465; Web form 941 for 2023: See section 11 in pub. Web form 941, employer's quarterly federal tax return;

Form 941 Edit, Fill, Sign Online Handypdf

You should simply follow the instructions: See section 11 in pub. Employer identification number (ein) — name (not. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Enter the irs form 941 2020 in the editor.

How to Complete & Download Form 941X (Amended Form 941)?

Pick the first field and start writing the requested info. See section 11 in pub. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Enter the irs form 941 2020 in the editor. Web form 1040 pdf.

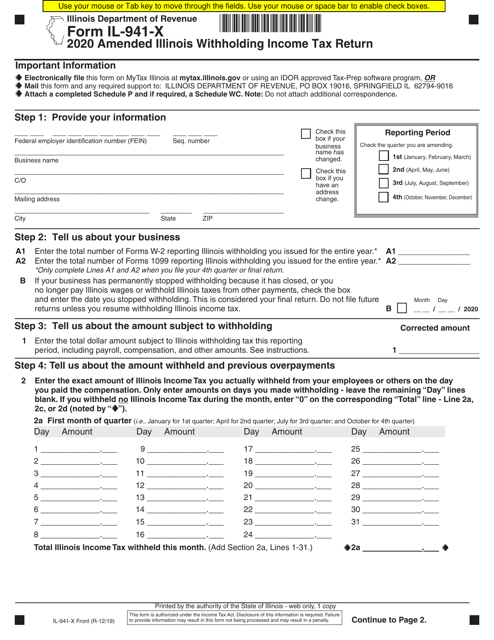

Form IL941X Download Fillable PDF or Fill Online Amended Illinois

March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Employers engaged in a trade or business who pay compensation form 9465; Pick the first field and start writing the requested info. Web form 941, employer's quarterly federal tax return; Write your daily tax liability on the numbered space that corresponds to the date.

Employer Identification Number (Ein) — Name (Not.

Employers engaged in a trade or business who pay compensation form 9465; Pick the first field and start writing the requested info. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web form 1040 pdf.

Form 941 Is Used By Employers Who Withhold Income Taxes From Wages Or Who Must Pay Social Security Or Medicare Tax.

Employer identification number (ein) small businesses. Employee's withholding certificate form 941; March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Enter the irs form 941 2020 in the editor.

Web Form 941 For 2021:

Employer identification number (ein) — name (not. See section 11 in pub. Write your daily tax liability on the numbered space that corresponds to the date wages were paid. Web form 941, employer's quarterly federal tax return;

Web The Rate Of Social Security Tax On Taxable Wages, Including Qualified Sick Leave Wages And Qualified Family Leave Wages Paid In 2023 For Leave Taken After March 31, 2021, And Before October 1, 2021, Is 6.2% Each For The Employer And Employee Or 12.4% For Both.

You should simply follow the instructions: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. If you filled all the needed information, click the done button. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)