8812 Form 2021

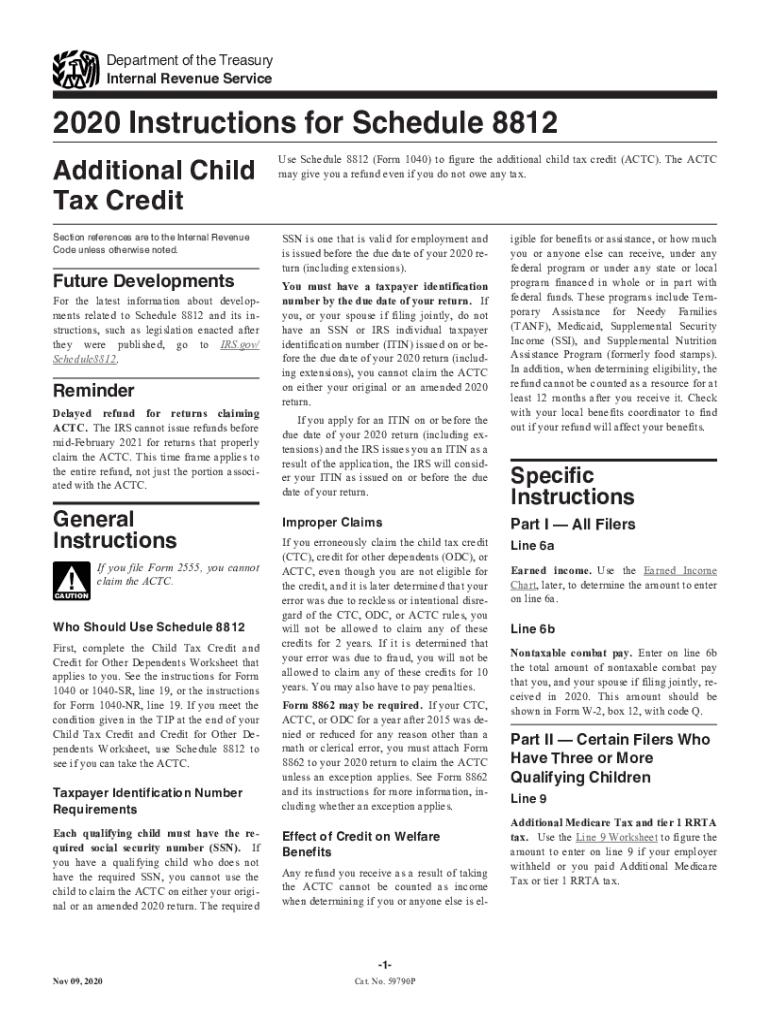

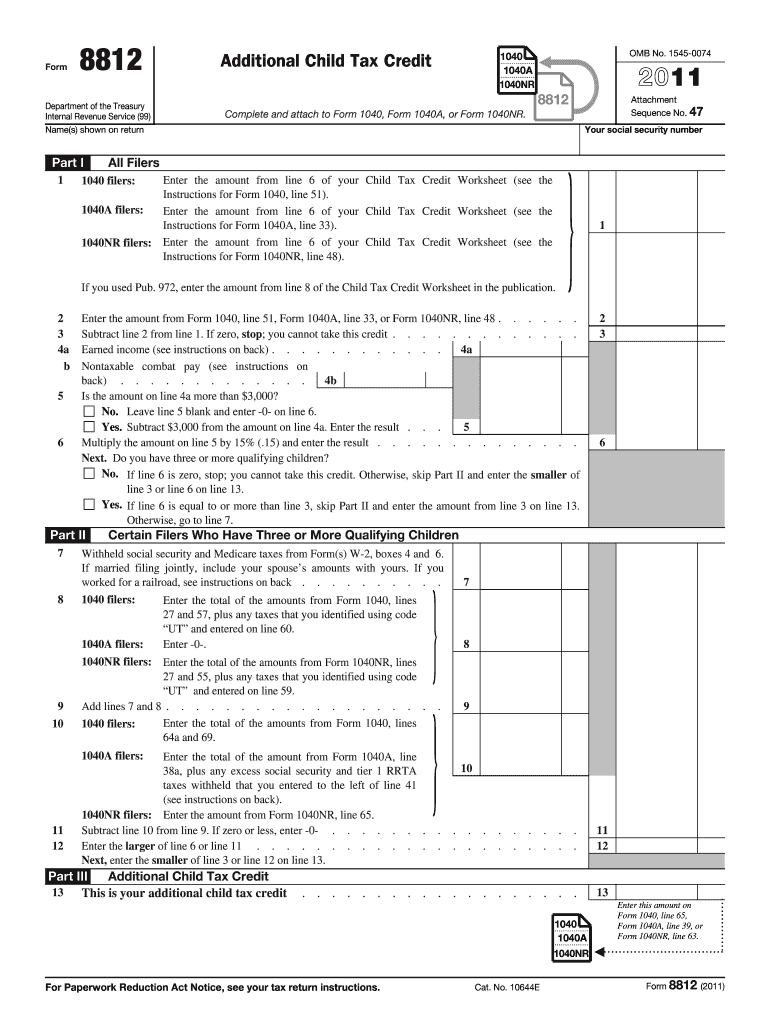

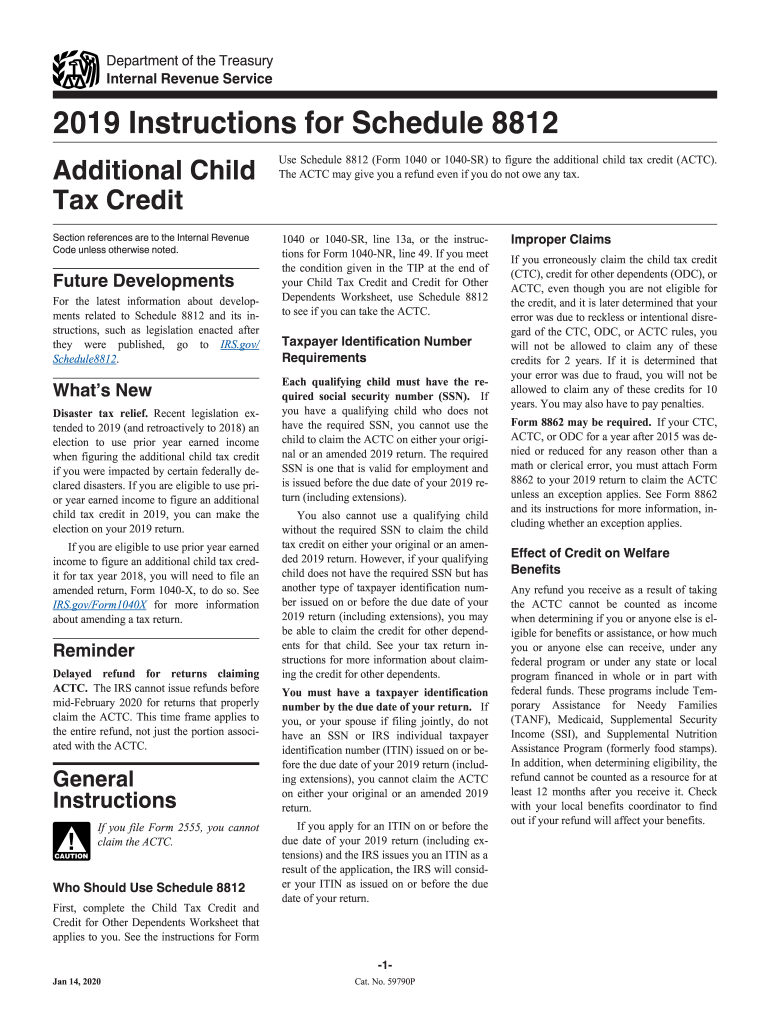

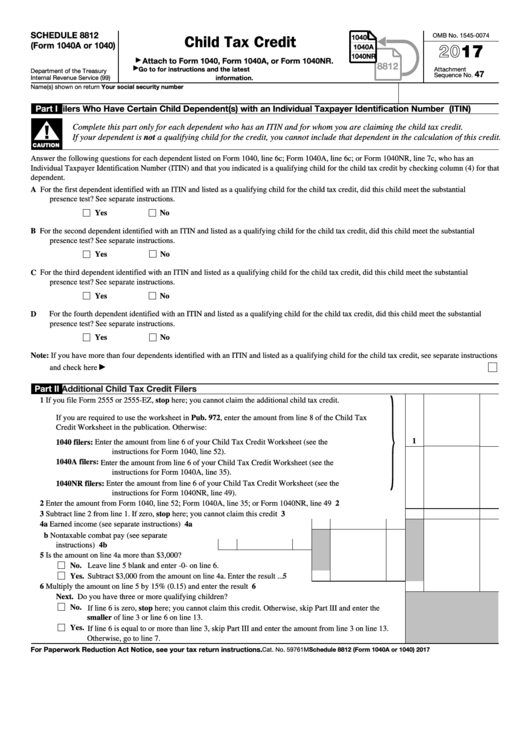

8812 Form 2021 - Web tax forms for irs and state income tax returns. Web internal revenue service 2022 instructions for schedule 8812 credits for qualifying children and other dependents use schedule 8812 (form 1040) to figure your child tax. Web the expanded schedule 8812 is now three pages for 2021. Web solved • by turbotax • 3264 • updated january 25, 2023. For tax years 2020 and prior: You can download or print current or. Should be completed by all filers to claim the basic. Web families should hold onto the letter and use it to correctly reconcile the child tax credit when they file their 2021 taxes. From july 2021 to december 2021, taxpayers may. The child tax credit is a partially refundable credit offered.

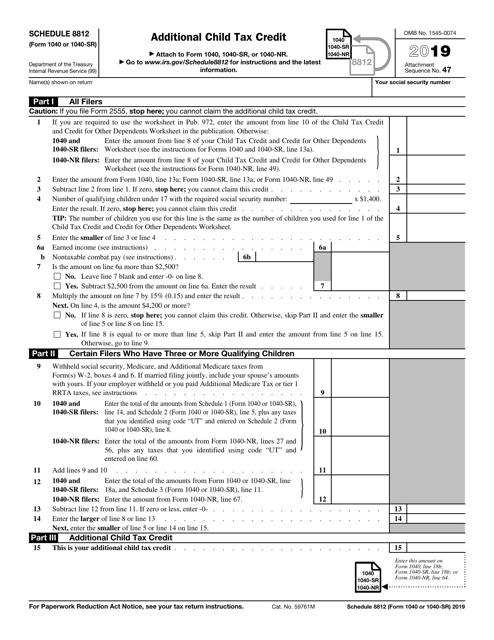

For 2022, there are two parts to this form: Web tax forms for irs and state income tax returns. The ctc and odc are. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. For tax years 2020 and prior: But i do not have any dependents or children. Web you'll use form 8812 to calculate your additional child tax credit. You can download or print current or. Web turbotax 2021 is asking me to fill out the schedule 8812 form. Web published january 17, 2023 one of the most significant tax changes for 2022 applies to the child tax credit, which is claimed by tens of millions of parents each year:.

Web the expanded schedule 8812 is now three pages for 2021. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. But i do not have any dependents or children. Web turbotax 2021 is asking me to fill out the schedule 8812 form. The child tax credit is a partially refundable credit offered. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web based on the amount of qualifying dependents you claim on your tax return, the irs might require you to fill out form 8812. The ctc and odc are.

Irs 8812 Instructions Fill Out and Sign Printable PDF Template signNow

The child tax credit is a partially refundable credit offered. Why is it asking me to fill this out? For example, if the amount. Web solved • by turbotax • 3264 • updated january 25, 2023. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents.

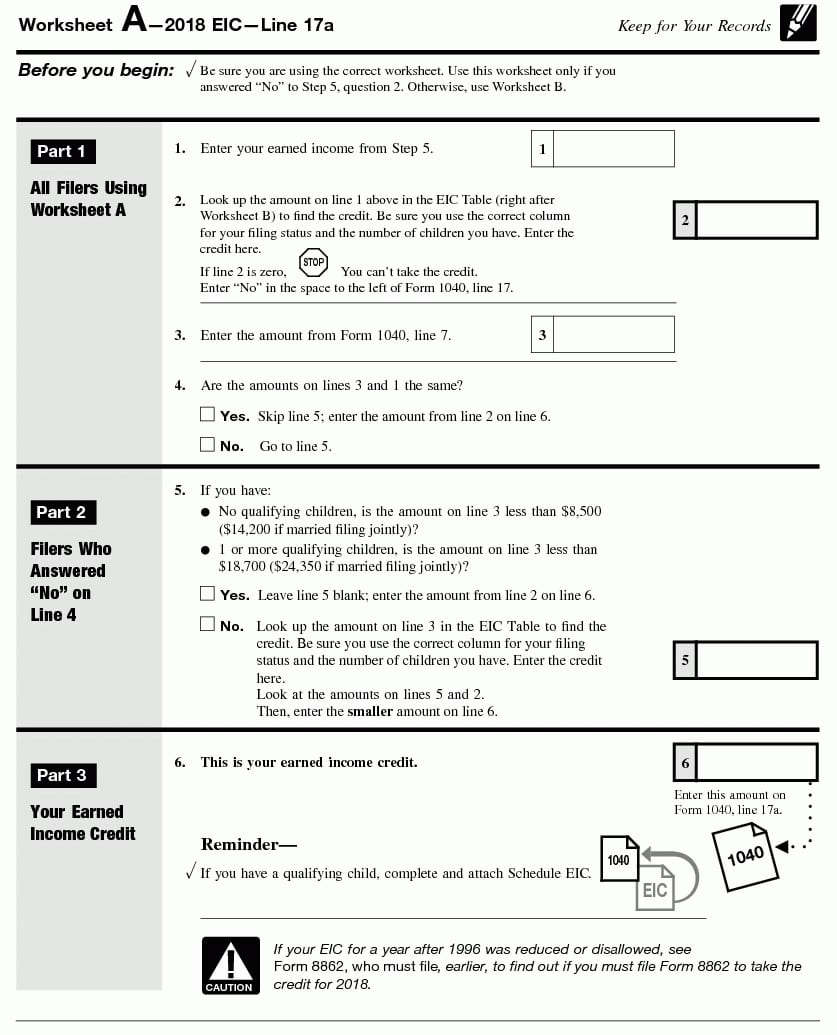

8812 Worksheet

Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. You can download or print current or. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). For example, if.

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

Web you'll use form 8812 to calculate your additional child tax credit. Web turbotax 2021 is asking me to fill out the schedule 8812 form. Web based on the amount of qualifying dependents you claim on your tax return, the irs might require you to fill out form 8812. Web up to 10% cash back because of these changes to.

8812 Worksheet

Web schedule 8812 (form 1040) is now used to calculate child tax credits and to report advance child tax credit payments received in 2021, and to figure any additional. Web the expanded schedule 8812 is now three pages for 2021. Web solved • by turbotax • 3264 • updated january 25, 2023. Why is it asking me to fill this.

Irs Child Tax Credit IRS Form 1040 Schedule 8812 Download Fillable

For tax years 2020 and prior: For example, if the amount. Irs form 8812 will need to be filed alongside your. The information will be helpful in filling out. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc).

️Form 8812 Worksheet 2013 Free Download Goodimg.co

Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Web published january 17, 2023 one of the most significant tax changes for 2022 applies to the child tax credit, which is claimed by tens of millions of parents each year:. Web for more information on the child tax credit for 2021,.

What Is The Credit Limit Worksheet A For Form 8812

Web turbotax 2021 is asking me to fill out the schedule 8812 form. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. The information will be helpful in filling out. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the.

Form 8812 Line 5 Worksheet

But i do not have any dependents or children. Should be completed by all filers to claim the basic. You can download or print current or. Web schedule 8812 (form 1040) is now used to calculate child tax credits and to report advance child tax credit payments received in 2021, and to figure any additional. Web published january 17, 2023.

Qualified Dividends And Capital Gains Worksheet 2018 —

Web families should hold onto the letter and use it to correctly reconcile the child tax credit when they file their 2021 taxes. Web tax forms for irs and state income tax returns. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022..

What Is A 1040sr Worksheet

The ctc and odc are. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web the schedule 8812 form is found on form 1040, and it’s used to.

But I Do Not Have Any Dependents Or Children.

Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web tax forms for irs and state income tax returns. Why is it asking me to fill this out? Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”.

For Example, If The Amount.

Web up to 10% cash back because of these changes to the credit, all worksheets for figuring the 2021 child credit have been moved from the form 1040 instructions, and are. Irs form 8812 will need to be filed alongside your. Web you'll use form 8812 to calculate your additional child tax credit. Should be completed by all filers to claim the basic.

Web Solved • By Turbotax • 3264 • Updated January 25, 2023.

Web the expanded schedule 8812 is now three pages for 2021. The information will be helpful in filling out. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The ctc and odc are.

For Tax Years 2020 And Prior:

Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Web based on the amount of qualifying dependents you claim on your tax return, the irs might require you to fill out form 8812. Web families should hold onto the letter and use it to correctly reconcile the child tax credit when they file their 2021 taxes. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents.