2553 Form Fax Number

2553 Form Fax Number - Instructions to complete form 2553; The fax number for filing form 2553 with the cincinnati service center has changed. Web irs form 2553 is the form that a business entity files to be treated as an s corporation for federal tax purposes. Filling out your form 2553; Web use the following address or fax number: December 2017) department of the treasury internal revenue service. Web form 2553 fax number. How to fax form 2553 online with. Election by a small business corporation (under section 1362 of the internal revenue. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana,.

How to fax form 2553 online with. Web form 2553 is an official document used by the i nternal revenue service (irs) to recognize a small business as an s corporation. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana,. December 2020) (for use with the december 2017 revision of form 2553, election by a. Filling out your form 2553; Web irs form 2553 is the form that a business entity files to be treated as an s corporation for federal tax purposes. By submitting this form, qualified s corporations. Web form 2553 fax number. Web use the following address or fax number: Web what is form 2553 used for?

You can mail in a paper copy of the original, or you can send it by fax to one of two numbers. Web instructions for form 2553 department of the treasury internal revenue service (rev. Ad download or email irs 2553 & more fillable forms, register and subscribe now! Web you can mail or fax form 2553 to the appropriate irs center for your state. Web form 2553 is an official document used by the i nternal revenue service (irs) to recognize a small business as an s corporation. Web form 2553 fax number. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. First, make sure you’re authorized to conduct business transactions on behalf of. Web fax numbers for filing form 2553 have changed. Web here’s how to get a copy of your form 2553 so you can file taxes as an s corp:

Ssurvivor Form 2553 Irs Phone Number

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. By submitting this form, qualified s corporations. Web also indicate the business’s legal name and employer identification number at the top of each page of form 2553. Web use the following address or fax number: Web what is form 2553 used for?

Fill Free fillable form 2553 election by a small business corporation

Web form 2553 is an official document used by the i nternal revenue service (irs) to recognize a small business as an s corporation. Instructions to complete form 2553; Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. The fax number for filing form 2553 with the cincinnati.

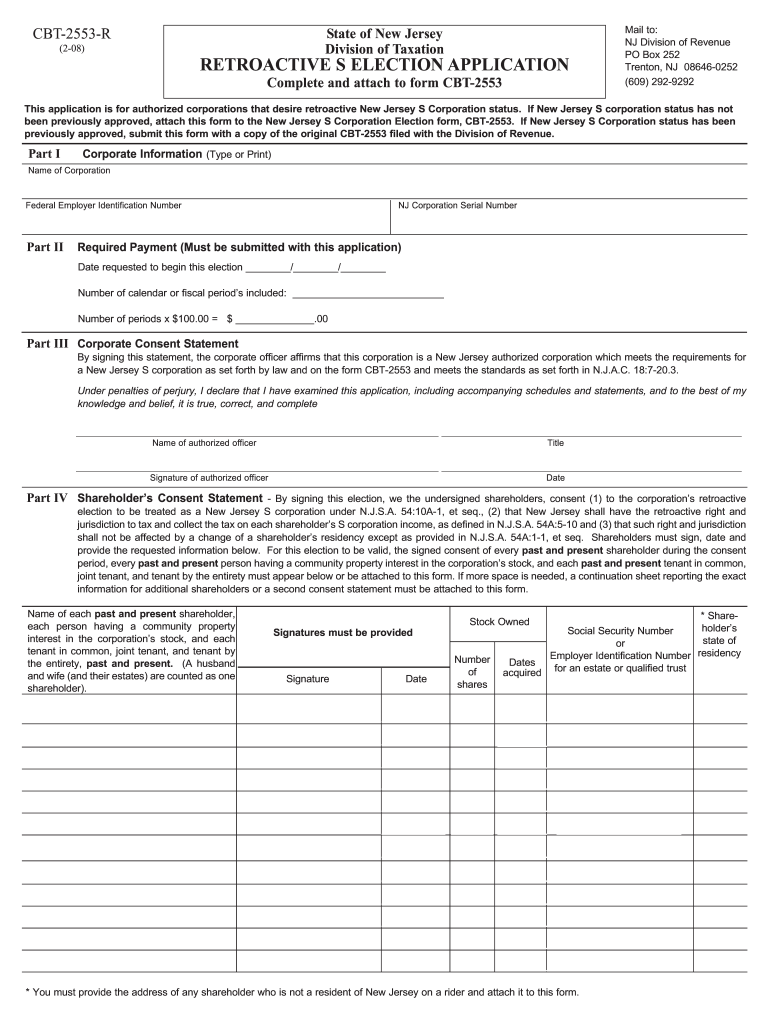

Cbt 2553 Fill Out and Sign Printable PDF Template signNow

Web form 2553 is an official document used by the i nternal revenue service (irs) to recognize a small business as an s corporation. Web you can mail or fax form 2553 to the appropriate irs center for your state. The fax number will depend on the state. Web fax numbers for filing form 2553 have changed. The fax number.

2553 Vorwahl

Web form 2553 fax number. Where to file form 2553 where you file form 2553. First, make sure you’re authorized to conduct business transactions on behalf of. Web fax numbers for filing form 2553 have changed. Election by a small business corporation (under section 1362 of the internal revenue.

Ssurvivor Form 2553 Irs Fax Number

Web fax numbers for filing form 2553 have changed. Web instructions for form 2553 department of the treasury internal revenue service (rev. Ad download or email irs 2553 & more fillable forms, register and subscribe now! December 2020) (for use with the december 2017 revision of form 2553, election by a. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky,.

Form 2553 Form Pros

By submitting this form, qualified s corporations. The fax number will depend on the state. Web here’s how to get a copy of your form 2553 so you can file taxes as an s corp: December 2020) (for use with the december 2017 revision of form 2553, election by a. Web you can mail or fax form 2553 to the.

Form 2553 by Jeni Issuu

The fax number for filing form 2553 with the cincinnati service center has changed. We know the irs from the inside out. Web also indicate the business’s legal name and employer identification number at the top of each page of form 2553. How to fax form 2553 online with. Web use the following address or fax number:

Ssurvivor Form 2553 Irs Phone Number

Web here’s how to get a copy of your form 2553 so you can file taxes as an s corp: Web what is form 2553 used for? The fax number for filing form 2553 with the cincinnati service center has changed. Web also indicate the business’s legal name and employer identification number at the top of each page of form.

Printable Pdf Printable Fax Cover Sheet

Web fax numbers for filing form 2553 have changed. First, make sure you’re authorized to conduct business transactions on behalf of. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana,. Web form 2553 fax number. Web what is form 2553 used for?

Ssurvivor Form 2553 Irs Phone Number

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. Web also indicate the business’s legal name and employer identification number at the top of each page of form 2553. Web if you have submitted form 2553 to the irs and are confident that it was completed correctly, you can call the department at any time to check.

Web Here’s How To Get A Copy Of Your Form 2553 So You Can File Taxes As An S Corp:

Web you can mail or fax form 2553 to the appropriate irs center for your state. First, make sure you’re authorized to conduct business transactions on behalf of. The irs recommends that the. Web instructions for form 2553 department of the treasury internal revenue service (rev.

Instructions To Complete Form 2553;

Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. December 2017) department of the treasury internal revenue service. We know the irs from the inside out. Web irs form 2553 is the form that a business entity files to be treated as an s corporation for federal tax purposes.

December 2020) (For Use With The December 2017 Revision Of Form 2553, Election By A.

Web address material advisor’s name (if different from the sender) date number of pages faxed (including the cover sheet) where to fax form 8918: Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana,. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. Web form 2553 is an official document used by the i nternal revenue service (irs) to recognize a small business as an s corporation.

The Fax Number For Filing Form 2553 With The Cincinnati Service Center Has Changed.

Where to file form 2553 where you file form 2553. Web form 2553 fax number. Web what is form 2553 used for? Web if you have submitted form 2553 to the irs and are confident that it was completed correctly, you can call the department at any time to check on your current.