2290 Form Due Date

2290 Form Due Date - Web the deadline to file your form 2290 return depends on the first used month (fum) of the vehicle for the tax year. Stamped schedule 1 in minutes. Web the due date for the vehicles having july as their fum is august 31, 2023. Web the 2290 form due date to report your suspended vehicle is july 1st, 2023. Ad online 2290 tax filing in minutes. Web irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. Go to www.irs.gov/form2290 for instructions and the latest information. What is the irs form 2290 due date? The current tax period for heavy highway vehicles. Web the deadline to file form 2290 with the irs will be the last day of the month following the vehicle's first used month (fum).

Fast, easy and secure filing Web the deadline to file form 2290 with the irs will be the last day of the month following the vehicle's first used month (fum). Web when is form 2290 due for 2021? Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Go to www.irs.gov/form2290 for instructions and the latest information. Web the 2290 form due date to report your suspended vehicle is july 1st, 2023. Click here to know more about form 2290 due date file form 2290 now irs form. Web irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. Stamped schedule 1 in minutes. The due date will be on august 31st, 2023.

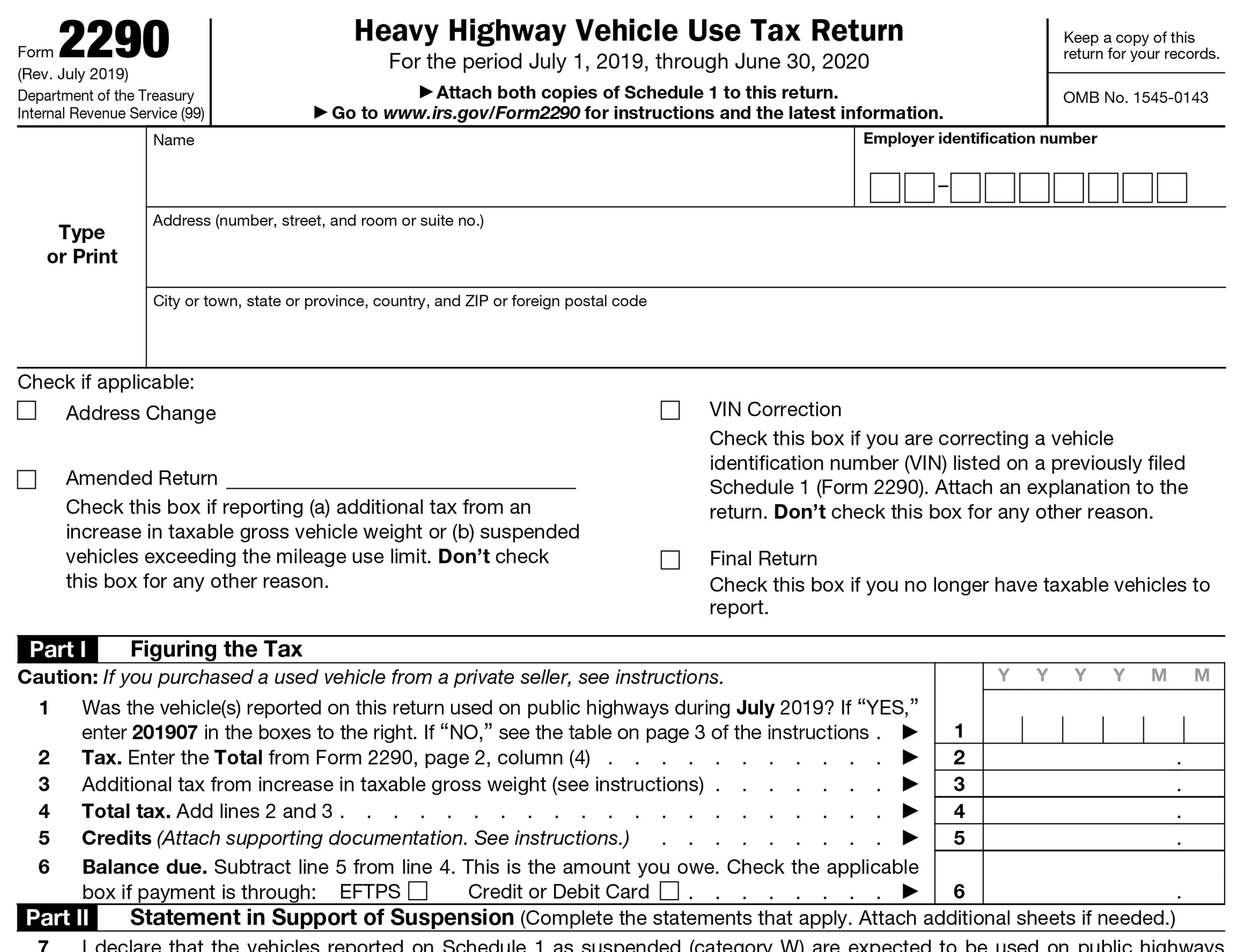

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web may 1, 2023 june 30, 2023 filing season july 1, 2023 august 31, 2023 it’s important to remember form 2290 due date, so you can complete your hvut on time. The current tax period for heavy highway vehicles. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Each year, the tax periods usually begin on july 1 and end on june 30. Web the due date for the vehicles having july as their fum is august 31, 2023. Web the annual tax irs 2290 payment period is from july 1st to august 31st. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Click here to know more about form 2290 due date file form 2290 now irs form.

Understanding Form 2290 StepbyStep Instructions for 20222023

The due date will be on august 31st, 2023. Ad online 2290 tax filing in minutes. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Go to www.irs.gov/form2290 for instructions and the latest information. Stamped schedule 1 in minutes.

Tax Form 2290 Due Date Form Resume Examples wRYPmOEV4a

Web the current period begins july 1, 2023, and ends june 30, 2024. Click here to know more about form 2290 due date file form 2290 now irs form. What is the irs form 2290 due date? Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june.

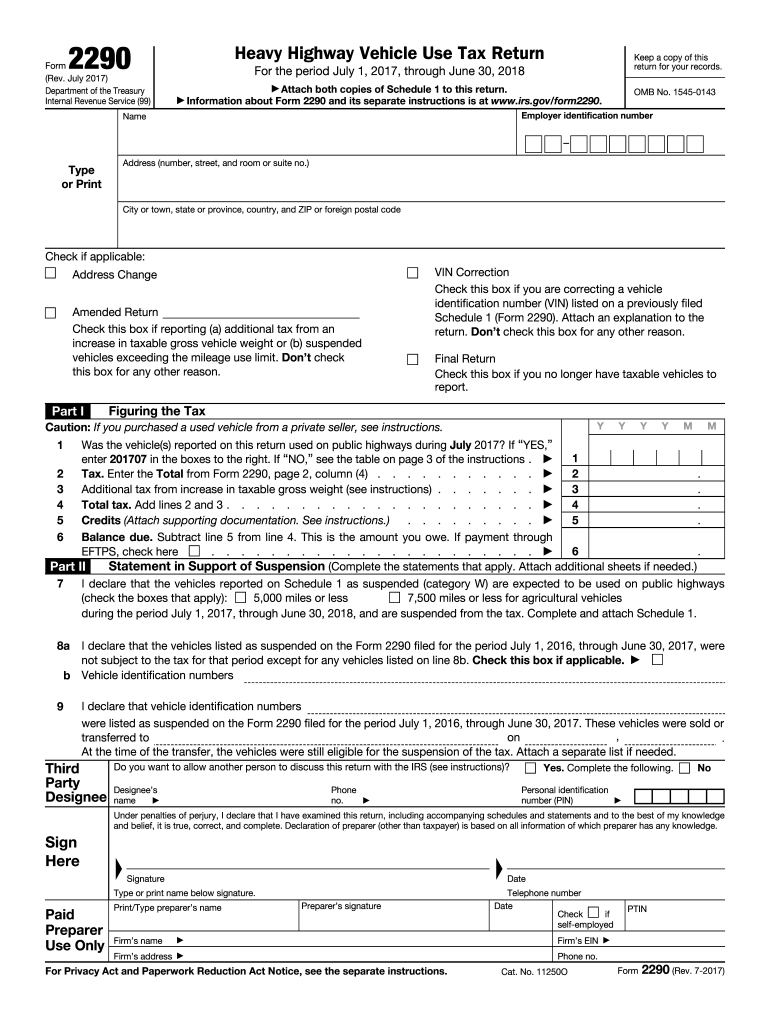

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

These two months are essential for truckers to pay heavy vehicle use tax (hvut). Web the 2290 form due date to report your suspended vehicle is july 1st, 2023. Web the deadline to file your form 2290 return depends on the first used month (fum) of the vehicle for the tax year. Go to www.irs.gov/form2290 for instructions and the latest.

IRS Form 2290 Due Date For 20212022 Tax Period

Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of. What is the irs form 2290 due date? Web the 2290 form is due annually between july 1 and august 31. The current tax period for heavy highway vehicles. Web the.

File IRS 2290 Form Online for 20222023 Tax Period

Web the deadline to file form 2290 with the irs will be the last day of the month following the vehicle's first used month (fum). Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of. Each year, the tax periods usually.

Printable IRS Form 2290 for 2020 Download 2290 Form

Web the deadline to file form 2290 with the irs will be the last day of the month following the vehicle's first used month (fum). Web the 2290 form is due annually between july 1 and august 31. Web the due date for the vehicles having july as their fum is august 31, 2023. The due date will be on.

Irs Form 2290 Printable Form Resume Examples

Fast, easy and secure filing Click here to know more about form 2290 due date file form 2290 now irs form. Each year, the tax periods usually begin on july 1 and end on june 30. Go to www.irs.gov/form2290 for instructions and the latest information. A typical tax year for form 2290 begins on july 1.

Heavy Highway Use Tax Form 2290 Due Date Form Resume Examples

Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of. Web when is form 2290 due for 2021? Web the deadline to file form 2290 with the irs will be the last day of the month following the vehicle's first used.

Irs Form 2290 Due Date Form Resume Examples

Web the deadline to file your form 2290 return depends on the first used month (fum) of the vehicle for the tax year. The current tax period for heavy highway vehicles. Do your truck tax online & have it efiled to the irs! Web the annual tax irs 2290 payment period is from july 1st to august 31st. Web the.

IRS Form 2290 Instructions for 20222023 Tax Period

Web the annual tax irs 2290 payment period is from july 1st to august 31st. Web the 2290 form due date to report your suspended vehicle is july 1st, 2023. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Easy, fast, secure & free to try. Web may 1, 2023 june 30, 2023 filing.

A Typical Tax Year For Form 2290 Begins On July 1.

Web the deadline to file your form 2290 return depends on the first used month (fum) of the vehicle for the tax year. Web the 2290 form is due annually between july 1 and august 31. Truckers and trucking businesses must be filed the irs form 2290 for heavy vehicle use taxes (hvut) every year by august. Web the due date for form 2290 is determined by the taxable vehicle's first month of use.

Web The Annual Tax Irs 2290 Payment Period Is From July 1St To August 31St.

Web the due date for the vehicles having july as their fum is august 31, 2023. Each year, the tax periods usually begin on july 1 and end on june 30. Go to www.irs.gov/form2290 for instructions and the latest information. The current tax period for heavy highway vehicles.

Both The Tax Return And The Heavy Highway Vehicle Use Tax Must Be Paid By The Deadline In Order To Avoid Penalties.

Web the deadline to file form 2290 with the irs will be the last day of the month following the vehicle's first used month (fum). What is the irs form 2290 due date? Easy, fast, secure & free to try. Fast, easy and secure filing

Web Heavy Highway Vehicle Use Tax Return Department Of The Treasury Internal Revenue Service (99) For The Period July 1, 2021, Through June 30, 2022 Attach Both Copies Of.

Web irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. These two months are essential for truckers to pay heavy vehicle use tax (hvut). Web when is form 2290 due for 2021? Web for the period july 1, 2023, through june 30, 2024 attach both copies of schedule 1 to this return.