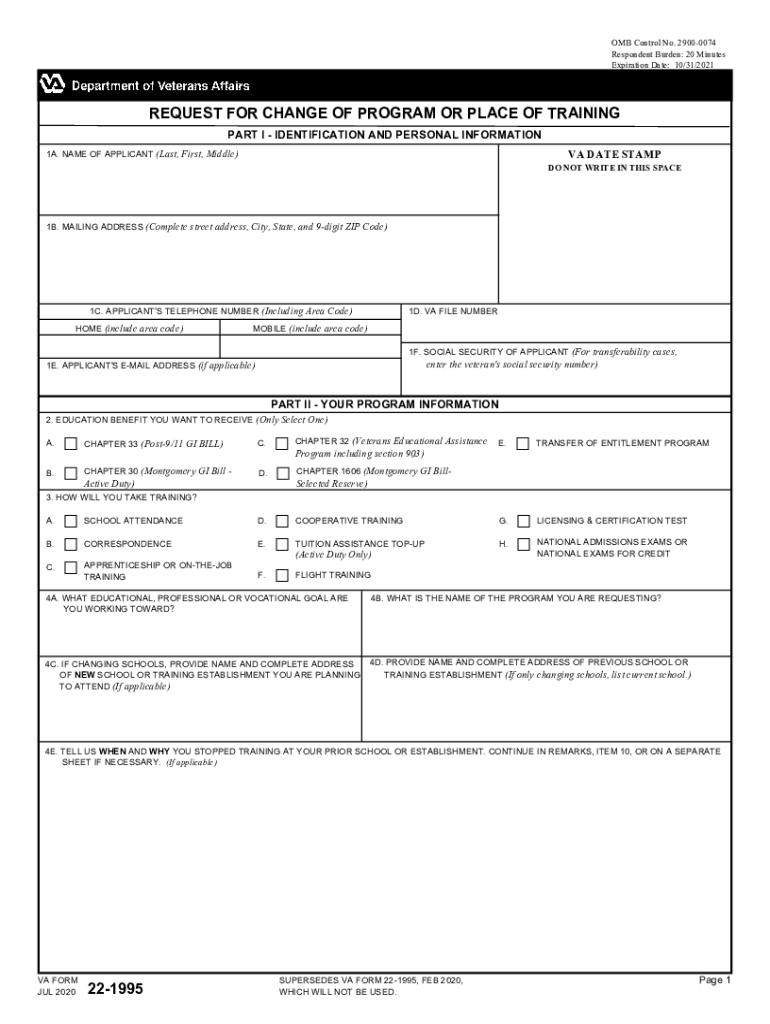

22-1995 Form Pdf

22-1995 Form Pdf - Application for individualized tutorial assistance: Web fill online, printable, fillable, blank va 22 1995 form (butler county community college) form. Web change your benefits va form 22 1995 please wait while we load the application for you. Find your school’s regional claims processing offices. Web components of a va form 22 (veterans administration, 1995). Transfer of entitlement program 1e. You’re changing schools, or you’re changing your. 90% of the tax shown on your 1995 tax return; A student has changed their major transferred from another institution once you click on the hyperlink you will be redirected to the. Web fill out your form and mail it to the va regional claims processing office that’s in the same region as your school.

Choose the correct version of the editable pdf form from the list and. Application for va education benefits: Web fill out your form and mail it to the va regional claims processing office that’s in the same region as your school. Web fill online, printable, fillable, blank va 22 1995 form (butler county community college) form. These are your total payments ' form 1040 (1995) page 2 32 amount from line 31 (adjusted gross income) 32 33a check if: Save or instantly send your ready documents. Application for individualized tutorial assistance: Easily fill out pdf blank, edit, and sign them. Find your school’s regional claims processing offices. Use fill to complete blank online butler county.

Application for va education benefits: Mail the completed form to the va regional processing office in the region of your home address. The irs will figure any penalty you owe and send you a bill. Application for individualized tutorial assistance: Determine the correct office from the list below. Web va form jul 2020. Web fill out your form and mail it to the va regional claims processing office that’s in the same region as your school. Web find and fill out the correct va 22 1995 form. 90% of the tax shown on your 1995 tax return; Web 22 subtract line 22 from line 21.

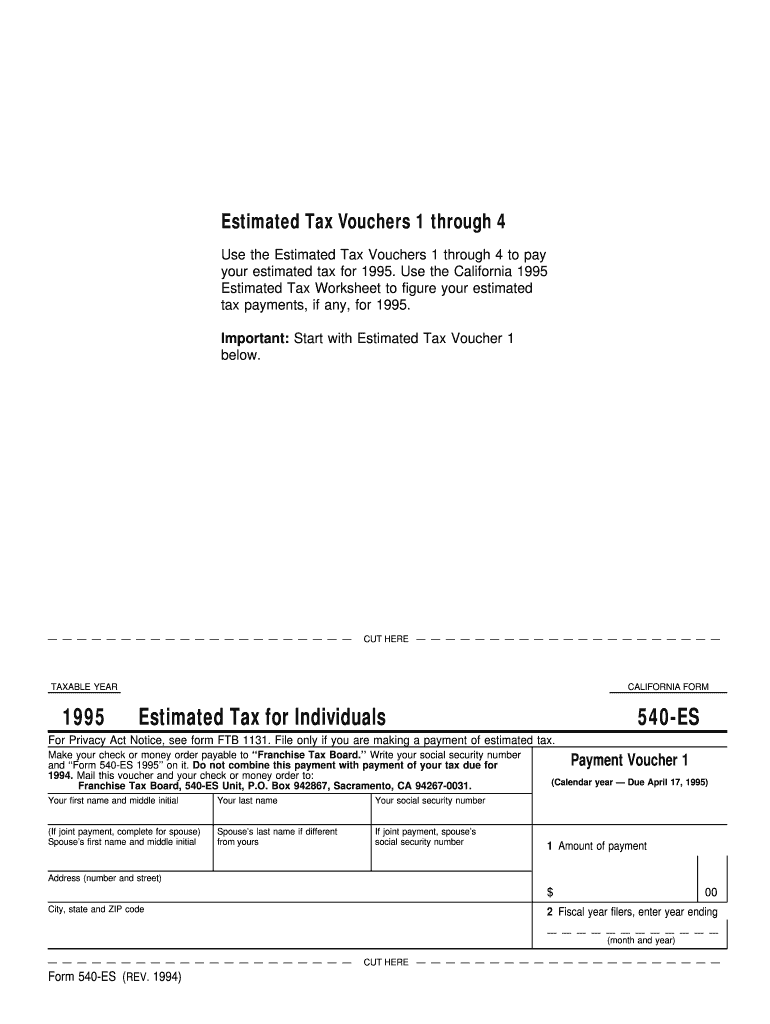

1995 Form CA FTB 540ES Fill Online, Printable, Fillable, Blank pdfFiller

Mail the completed form to the va regional processing office in the region of your home address. These are your total payments ' form 1040 (1995) page 2 32 amount from line 31 (adjusted gross income) 32 33a check if: Web 22 subtract line 22 from line 21. In most cases, you do not need to file form 2210. Application.

2020 Form VA 221995 Fill Online, Printable, Fillable, Blank pdfFiller

In most cases, you do not need to file form 2210. Transfer of entitlement program 1e. You’re a veteran or service member, or. File form 2210 only if one or more boxes. Use fill to complete blank online butler county.

Richard Bartz Form (1995) YouTube

A student has changed their major transferred from another institution once you click on the hyperlink you will be redirected to the. 90% of the tax shown on your 1995 tax return; Find your school’s regional claims processing offices. Web va form jul 2020. Web fill out your form and mail it to the va regional claims processing office that’s.

20142021 AU Form 1195 Fill Online, Printable, Fillable, Blank pdfFiller

You should use this form if: Application for individualized tutorial assistance: Web use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing jointly), and you aren’t a patron of an. Web 1995 if you did not pay at least the smaller of: Application for va education benefits:

[PDF] Employee’s Provident Fund (EPF) Form 13 Download PDF Download in

You should use this form if: 90% of the tax shown on your 1995 tax return; You’re a veteran or service member, or. For column (a) only, enter the amount from line 19. You’re changing schools, or you’re changing your.

1995 form 709 Fill Online, Printable, Fillable Blank form709

Web va form jul 2020. Instructions & information when should you use this form? 90% of the tax shown on your 1995 tax return; Web 22 subtract line 22 from line 21. Easily fill out pdf blank, edit, and sign them.

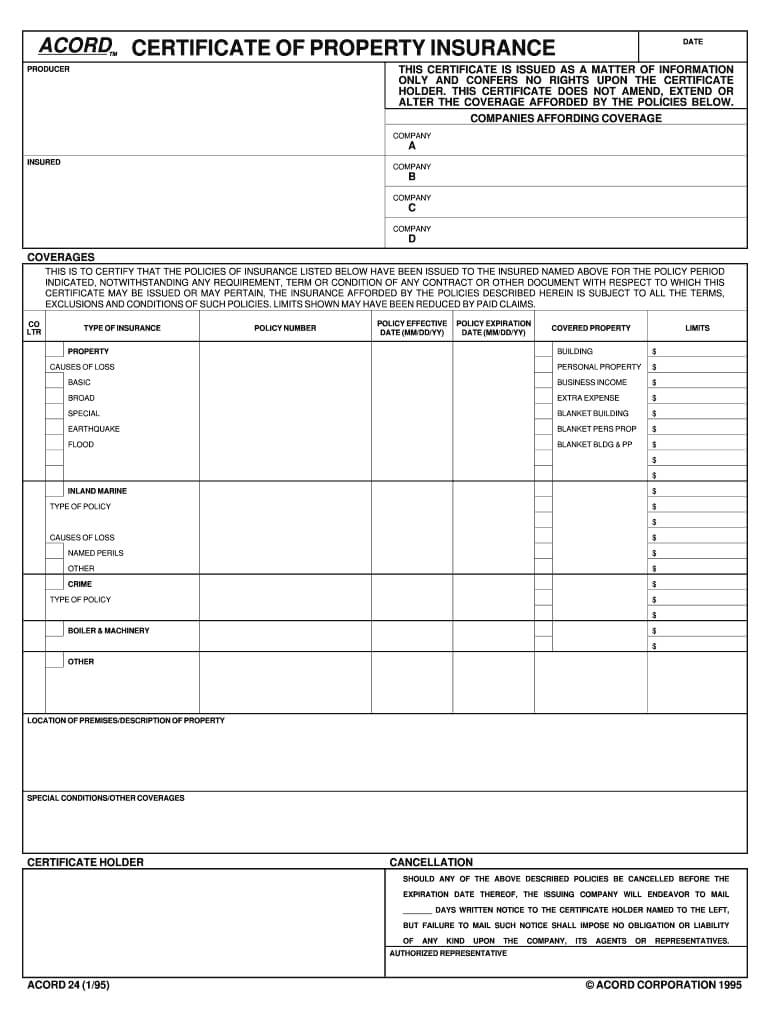

1995 Form Acord 24 Fill Online, Printable, Fillable, Blank for Acord

Web find and fill out the correct va 22 1995 form. In most cases, you do not need to file form 2210. File form 2210 only if one or more boxes. Web use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing jointly), and you aren’t a patron.

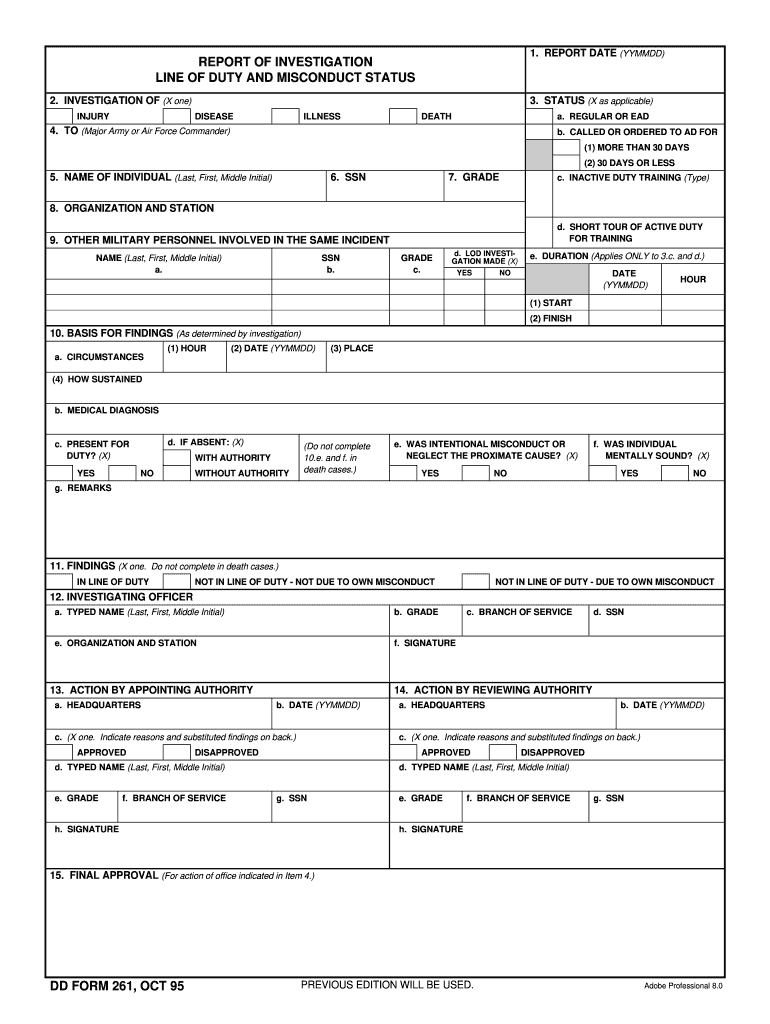

DD 261 19952022 Fill and Sign Printable Template Online US Legal Forms

Web use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing jointly), and you aren’t a patron of an. Easily fill out pdf blank, edit, and sign them. Web va form jul 2020. 90% of the tax shown on your 1995 tax return; Web find and fill out.

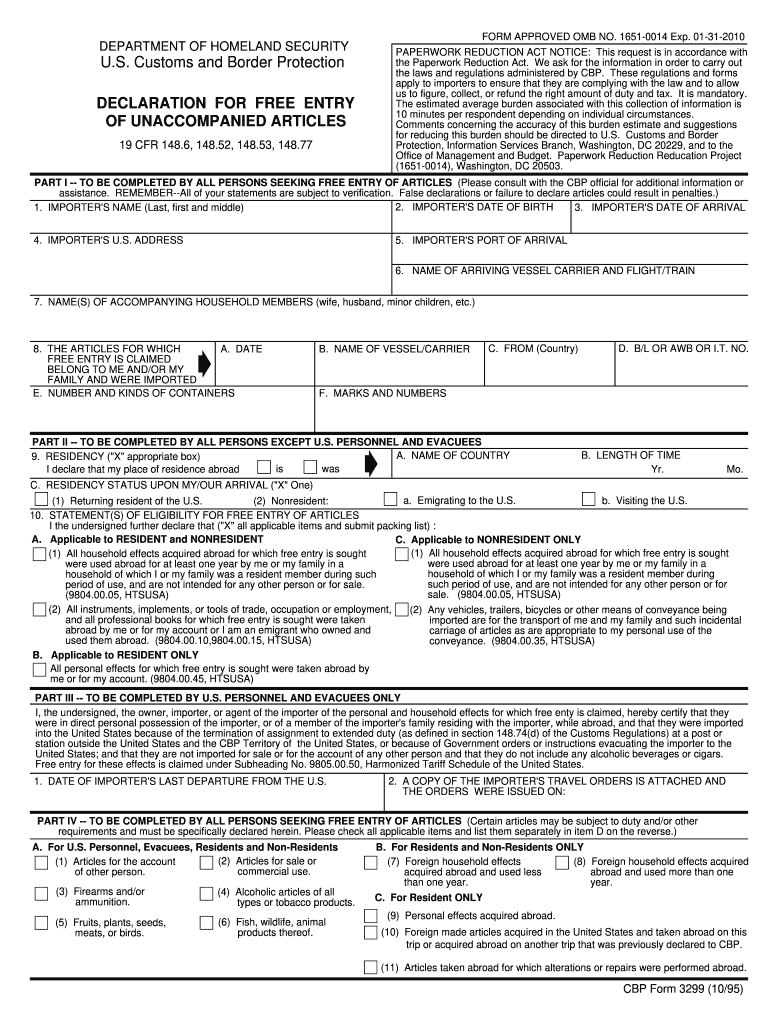

1995 Form CBP 3299 Fill Online, Printable, Fillable, Blank pdfFiller

The tax shown on your 1994 tax return (110% of that amount if you are not a. Choose the correct version of the editable pdf form from the list and. File form 2210 only if one or more boxes. Web fill out your form and mail it to the va regional claims processing office that’s in the same region as.

VA Form 221995 Download Printable PDF, REQUEST FOR CHANGE OF PROGRAM

Use fill to complete blank online butler county. 22 if line 23 is zero, subtract line 21 from line 22. You’re a veteran or service member, or. File form 2210 only if one or more boxes. Easily fill out pdf blank, edit, and sign them.

Web Va Form Jul 2020.

Web use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing jointly), and you aren’t a patron of an. Application for va education benefits: You should use this form if: These are your total payments ' form 1040 (1995) page 2 32 amount from line 31 (adjusted gross income) 32 33a check if:

Transfer Of Entitlement Program 1E.

Web fill online, printable, fillable, blank va 22 1995 form (butler county community college) form. Web change your benefits va form 22 1995 please wait while we load the application for you. Web 1995 if you did not pay at least the smaller of: 90% of the tax shown on your 1995 tax return;

The Irs Will Figure Any Penalty You Owe And Send You A Bill.

In most cases, you do not need to file form 2210. 22 if line 23 is zero, subtract line 21 from line 22. For column (a) only, enter the amount from line 19. Determine the correct office from the list below.

You’re A Dependent Of A.

Instructions & information when should you use this form? Web add lines 55 through 60. File form 2210 only if one or more boxes. The tax shown on your 1994 tax return (110% of that amount if you are not a.

![[PDF] Employee’s Provident Fund (EPF) Form 13 Download PDF Download in](https://instapdf.in/wp-content/uploads/pdf-thumbnails/employees-provident-fund-epf-form-13-download-2267.jpg)