2022 Form Ct-1040

2022 Form Ct-1040 - Web delivering a false return or document to the department of revenue services (drs) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. Please use the link below to download. Web file your connecticut and federal tax returns online with turbotax in minutes. Payments made with form ct‑1040 ext (request for extension of time to file) 20.00 20a. We will update this page with a new version of the form for 2024 as soon as it is made available. Connecticut earned income tax credit: Web we last updated the tax instruction booklet: Web file your 2022 connecticut income tax return online! Web connecticut — tax calculation schedule download this form print this form it appears you don't have a pdf plugin for this browser. 12/22 1040 1222w 01 9999.

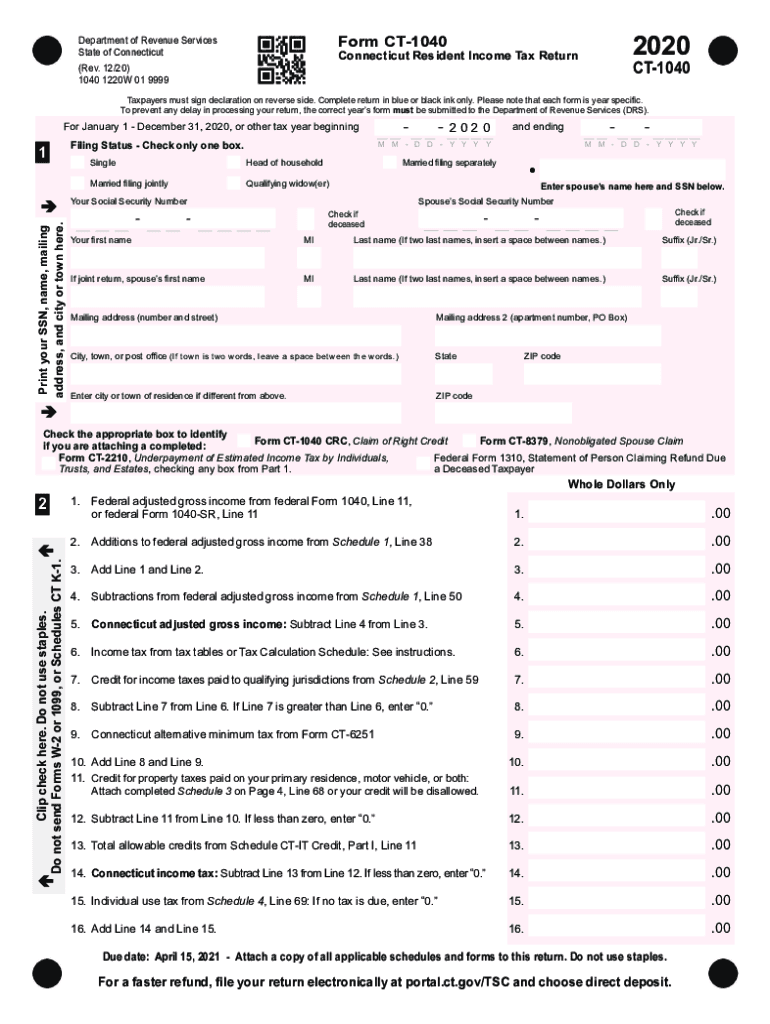

Web we last updated the tax instruction booklet: Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Payments made with form ct‑1040 ext (request for extension of time to file) 20.00 20a. Web 2022 form ct‑1040, line 20b; Benefits to electronic filing include: Filing status check only one box. Simple, secure, and can be completed from the comfort of your home. From schedule ct‑eitc, line 16. Web form 1040, line 11, or federal form 1040‑sr, line 11. 12/22 1040 1222w 01 9999.

Web for a faster refund, file your return electronically at portal.ct.gov/tsc and choose direct deposit. 12/22 1040 1222w 01 9999. For january 1 ‐ december 31, 2022, or other tax year. Form 1040 (schedule lep) (sp) request for change in language. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. This amount is considered a tax payment and will be credited against your. Web 2022 form ct‑1040, line 20b; Please use the link below to download. Web file your 2022 connecticut income tax return online! Web form 1040, line 11, or federal form 1040‑sr, line 11.

What Is Ct State Tax

12/22 1040 1222w 01 9999. Web delivering a false return or document to the department of revenue services (drs) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. Web 2022 department of the treasury—internal revenue service omb no. Web form 1040, line 11, or federal form 1040‑sr, line 11. For january.

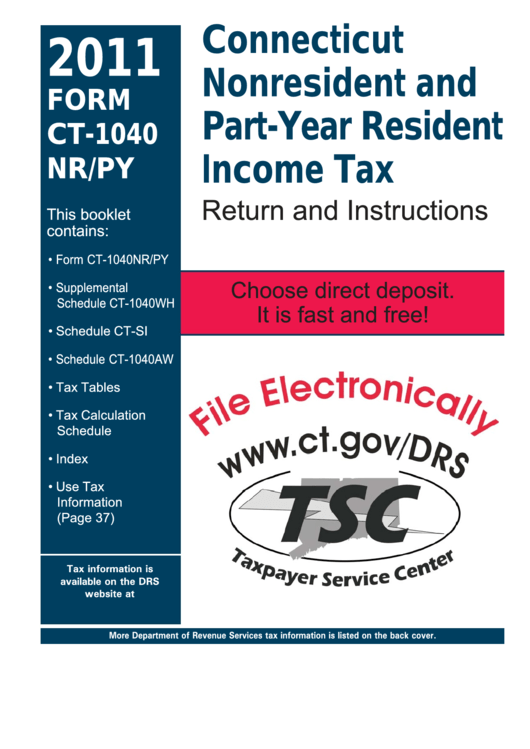

Form Ct1040 Nr/py Connecticut Nonresident And PartYear Resident

Form 1040 (schedule lep) (sp) request for change in language. We will update this page with a new version of the form for 2024 as soon as it is made available. Simple, secure, and can be completed from the comfort of your home. 12/22 1040 1222w 01 9999. Web for a faster refund, file your return electronically at portal.ct.gov/tsc and.

CT DRS CT1040 20202022 Fill out Tax Template Online US Legal Forms

For january 1 ‐ december 31, 2022, or other tax year. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Benefits to electronic filing include: Connecticut earned income tax credit: Web delivering a false return or document.

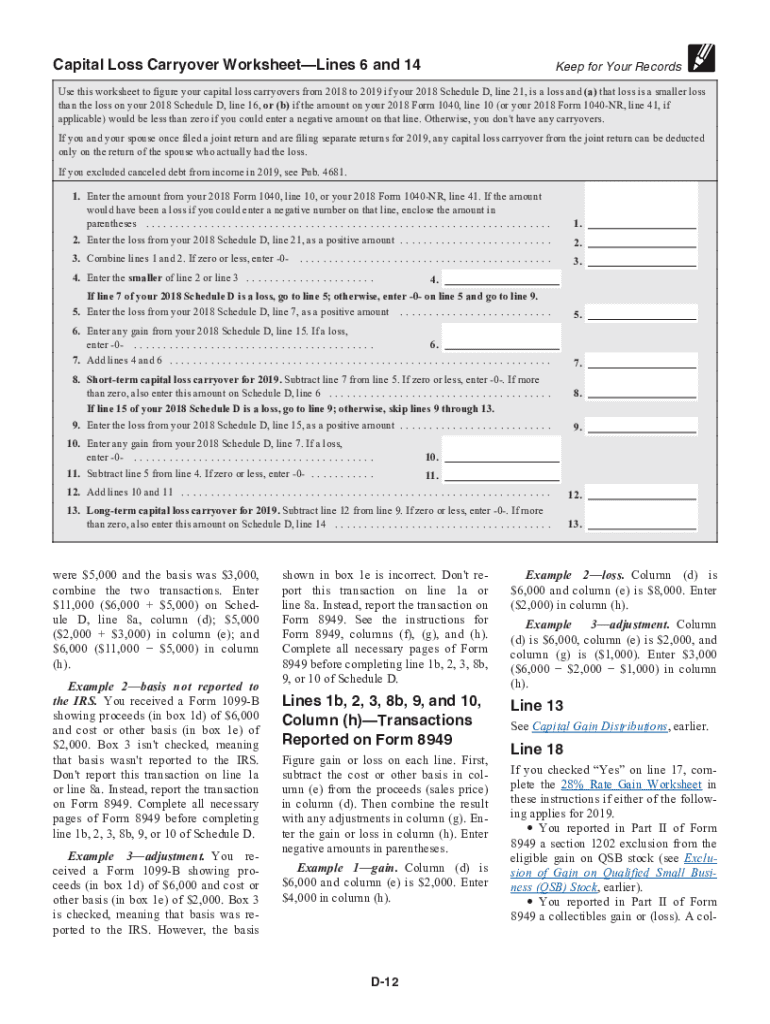

2020 Irs 1040 Schedule Instructions Fill Out and Sign Printable PDF

This amount is considered a tax payment and will be credited against your. Form 1040 (schedule lep) (sp) request for change in language. Web file your connecticut and federal tax returns online with turbotax in minutes. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue.

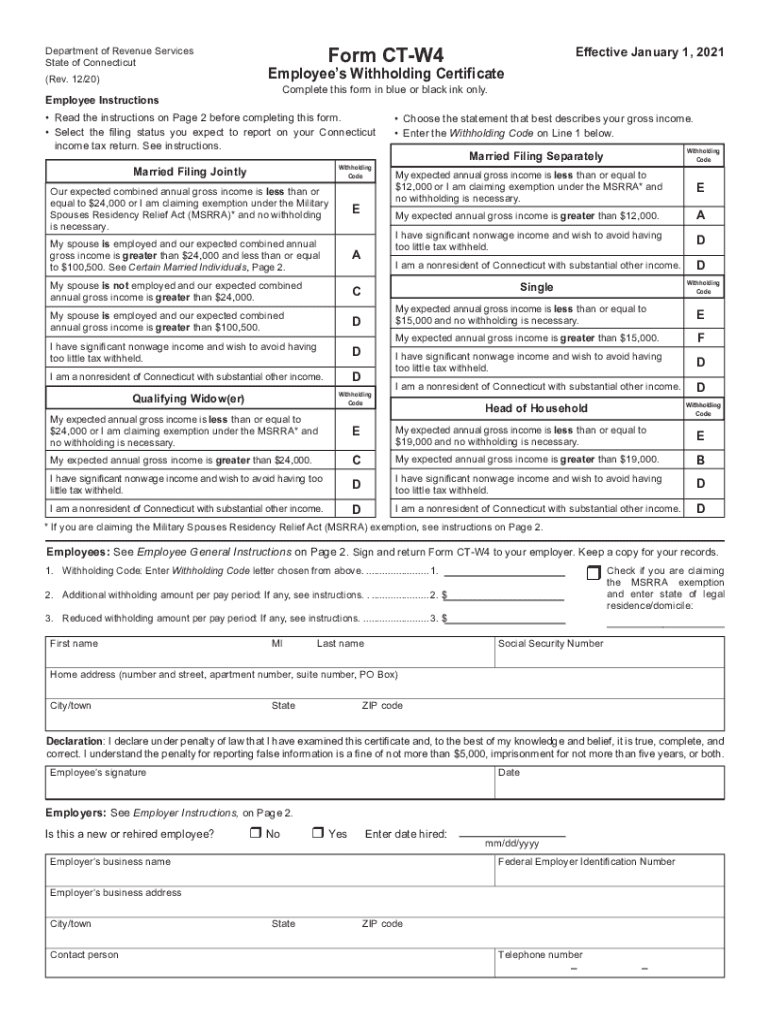

Ct W4 Fill Out and Sign Printable PDF Template signNow

Form 1040 (schedule lep) (sp) request for change in language. Web 2022 department of the treasury—internal revenue service omb no. Payments made with form ct‑1040 ext (request for extension of time to file) 20.00 20a. Web form 1040, line 11, or federal form 1040‑sr, line 11. From schedule ct‑eitc, line 16.

1040 Social Security Worksheets 2021

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web for a faster refund, file your return electronically at portal.ct.gov/tsc and choose direct deposit. From schedule ct‑eitc, line 16. Payments made with form ct‑1040 ext (request for extension of time to file) 20.00 20a. This amount is considered a tax payment.

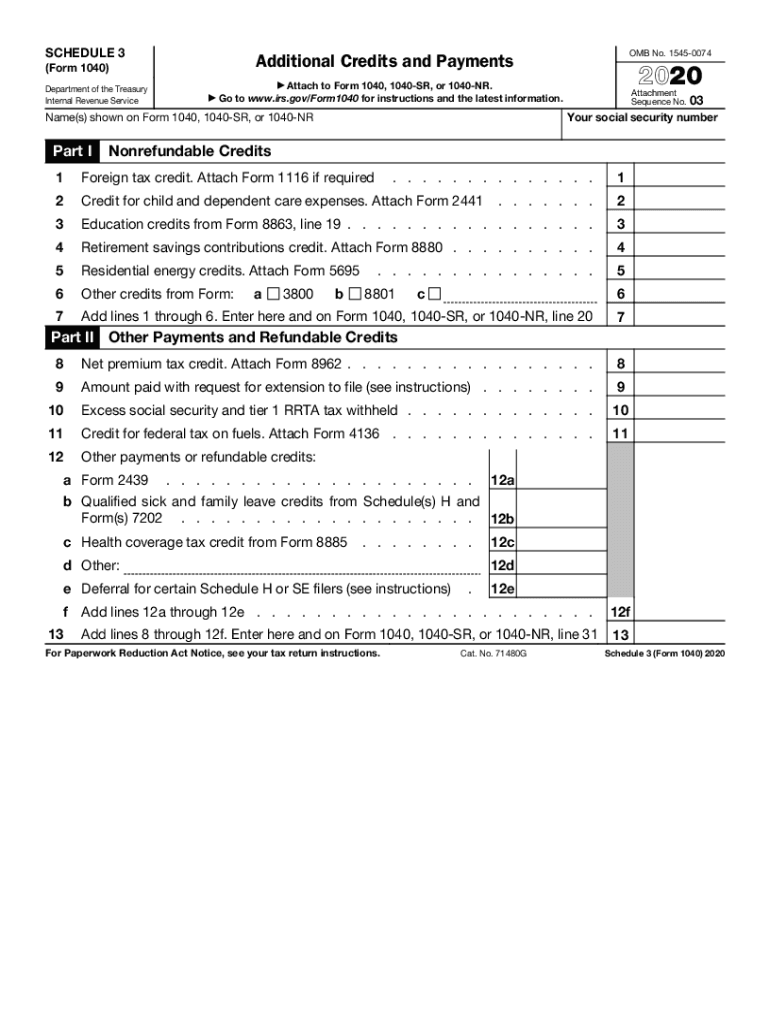

IRS 1040 Schedule 3 20202022 Fill and Sign Printable Template

This amount is considered a tax payment and will be credited against your. Form 1040 (schedule lep) (sp) request for change in language. Web form 1040, line 11, or federal form 1040‑sr, line 11. Web file your connecticut and federal tax returns online with turbotax in minutes. Payments made with form ct‑1040 ext (request for extension of time to file).

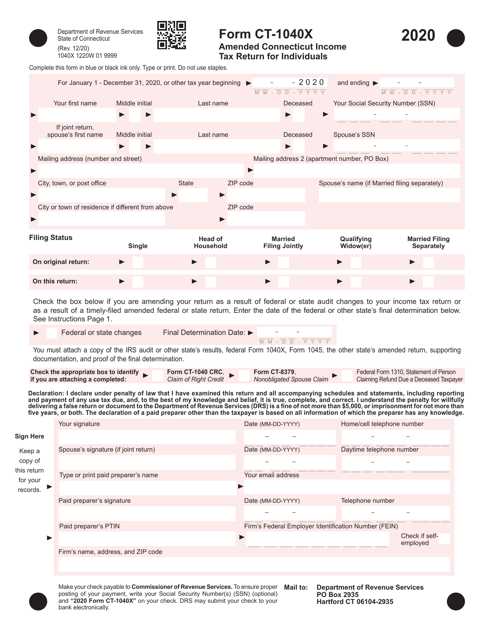

Form CT1040X Download Printable PDF or Fill Online Amended Connecticut

For january 1 ‐ december 31, 2022, or other tax year. Web form 1040, line 11, or federal form 1040‑sr, line 11. Web connecticut — tax calculation schedule download this form print this form it appears you don't have a pdf plugin for this browser. Payments made with form ct‑1040 ext (request for extension of time to file) 20.00 20a..

2022 Form 1040nr Ez Example Calendar Template 2022

Web for a faster refund, file your return electronically at portal.ct.gov/tsc and choose direct deposit. Simple, secure, and can be completed from the comfort of your home. We will update this page with a new version of the form for 2024 as soon as it is made available. Web delivering a false return or document to the department of revenue.

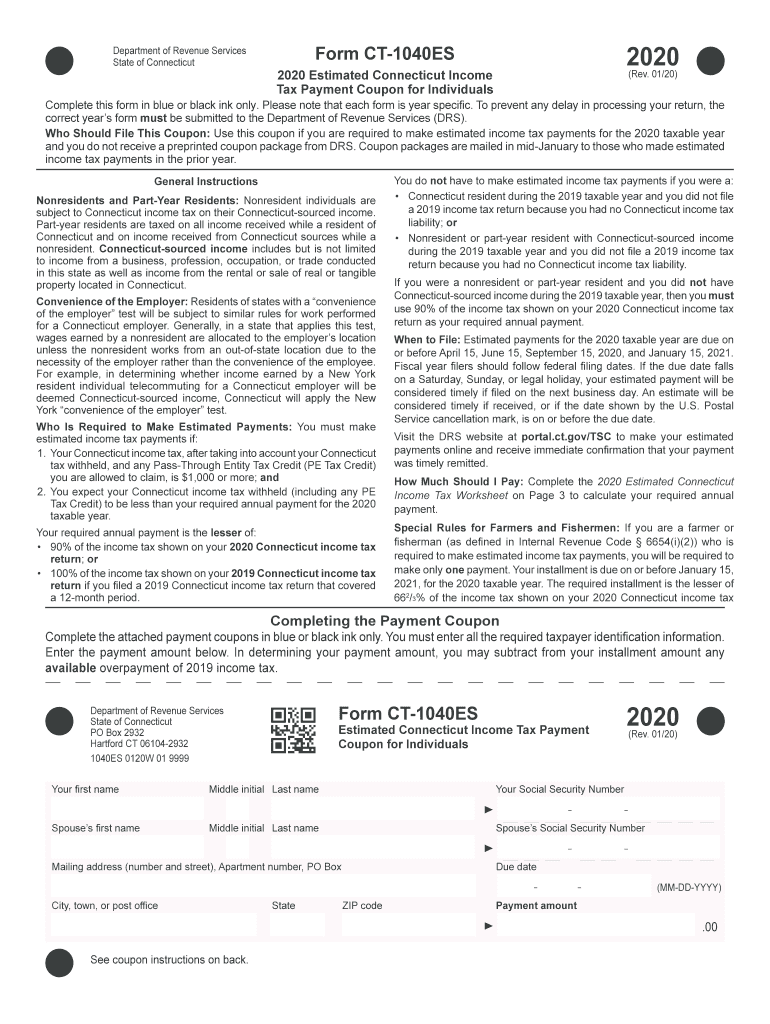

2020 Form CT DRS CT1040ES Fill Online, Printable, Fillable, Blank

From schedule ct‑eitc, line 16. Web file your connecticut and federal tax returns online with turbotax in minutes. Benefits to electronic filing include: This amount is considered a tax payment and will be credited against your. 12/22 1040 1222w 01 9999.

Simple, Secure, And Can Be Completed From The Comfort Of Your Home.

From schedule ct‑eitc, line 16. For january 1 ‐ december 31, 2022, or other tax year. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available.

Web Form 1040, Line 11, Or Federal Form 1040‑Sr, Line 11.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web we last updated the tax instruction booklet: Web connecticut — tax calculation schedule download this form print this form it appears you don't have a pdf plugin for this browser. Web file your connecticut and federal tax returns online with turbotax in minutes.

Filing Status Check Only One Box.

Form 1040 (schedule lep) (sp) request for change in language. Web 2022 department of the treasury—internal revenue service omb no. Payments made with form ct‑1040 ext (request for extension of time to file) 20.00 20a. 12/22 1040 1222w 01 9999.

Connecticut Earned Income Tax Credit:

Web file your 2022 connecticut income tax return online! Web for a faster refund, file your return electronically at portal.ct.gov/tsc and choose direct deposit. Web delivering a false return or document to the department of revenue services (drs) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. Please use the link below to download.