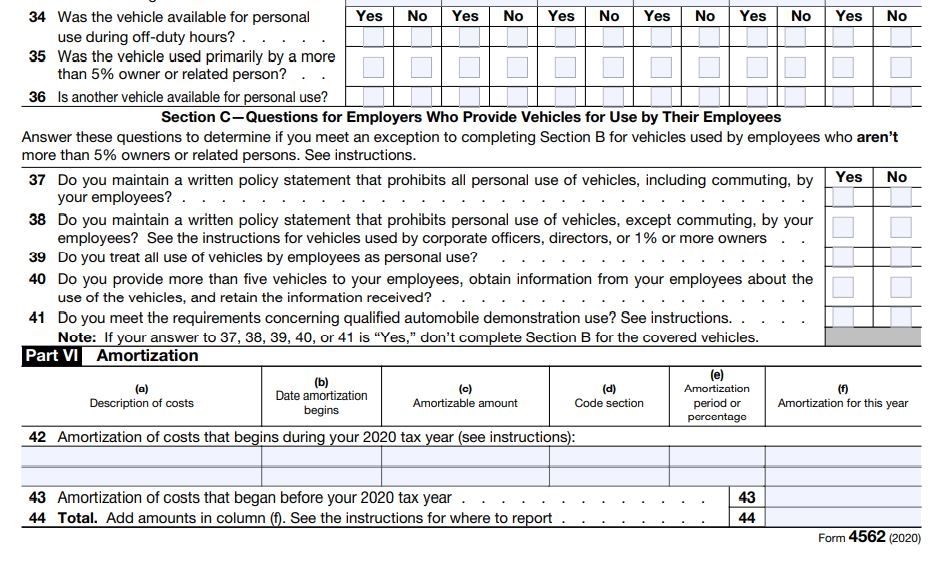

2020 Form 4562

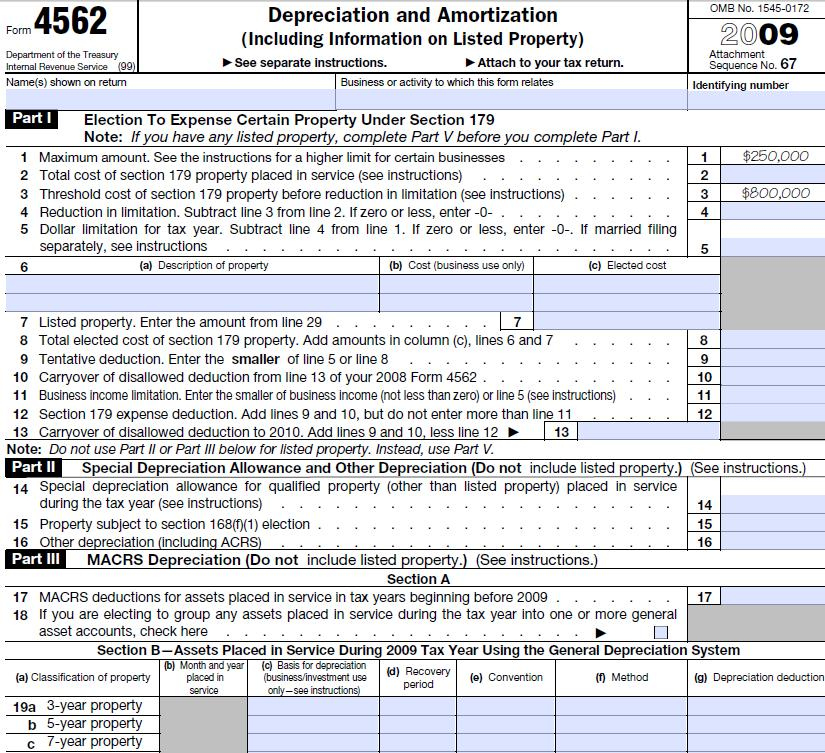

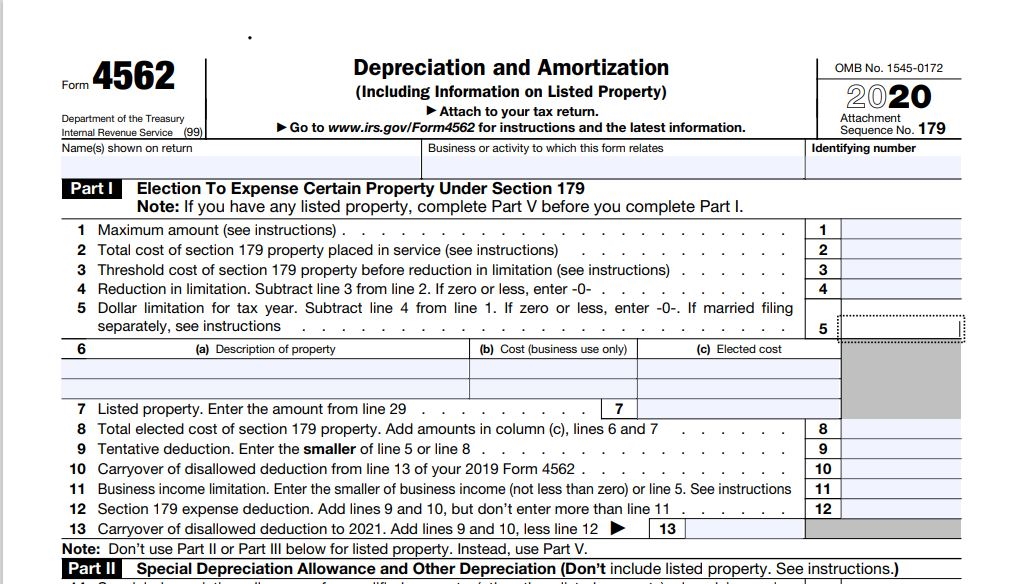

2020 Form 4562 - Web up to $40 cash back 3. Web it only takes a few minutes. To complete form 4562, you'll need to know the cost of assets like. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Attach to your tax return. Stick to these simple instructions to get irs 4562 instructions prepared for submitting: Get ready for tax season deadlines by completing any required tax forms today. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Ad access irs tax forms. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of.

Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web general instructions purpose of form use form 4562 to: Stick to these simple instructions to get irs 4562 instructions prepared for submitting: Web form 4562 is filed at the same time as your tax return. Ad access irs tax forms. Web use form 4562 to: Learn more about how to complete form 4562 for 2021 rapidly and easily. Web up to $40 cash back 3. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the. Web video instructions and help with filling out and completing form 4562 2020.

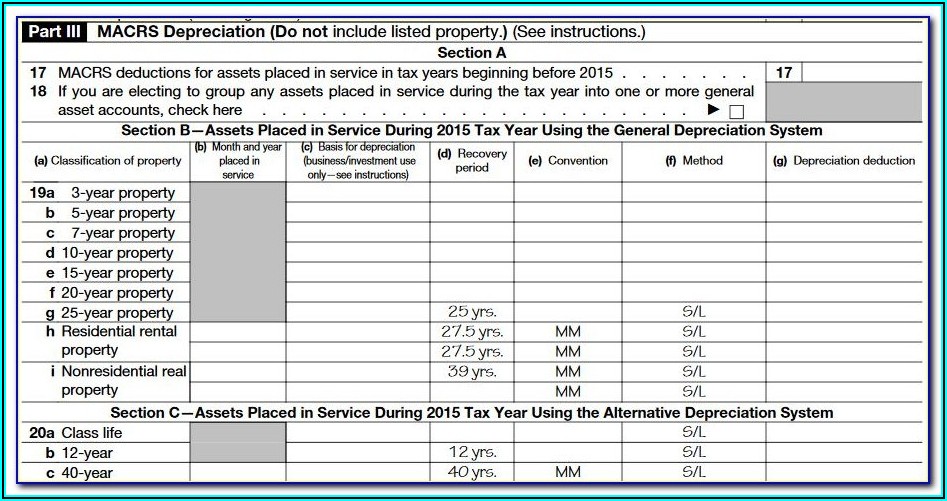

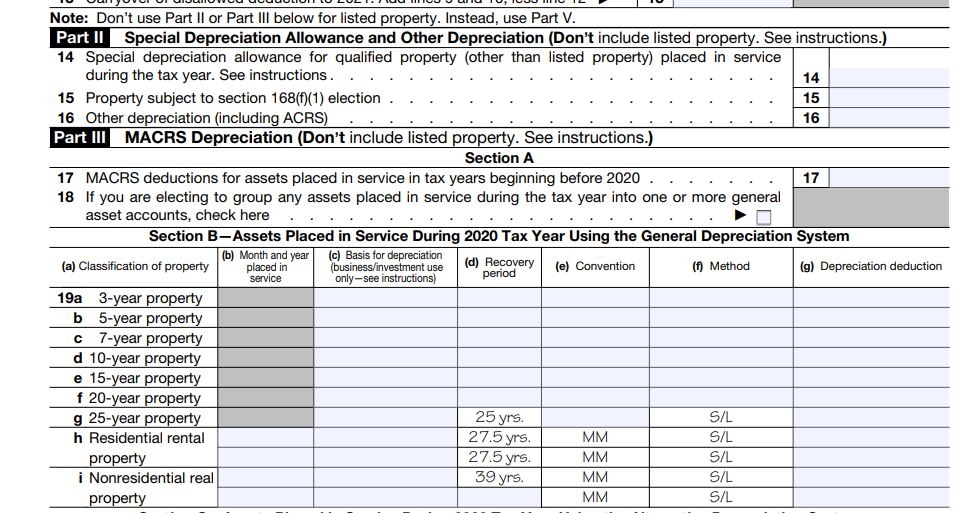

2022 4562 depreciation amortization including information listed property. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Ad access irs tax forms. Attach to your tax return. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Web it only takes a few minutes. Enter the smaller of line 5 or the total taxable income from any trade or business you actively conducted, computed without regard to any section 179 expense deduction,. Complete, edit or print tax forms instantly. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets.

2020 Form 4562 Depreciation and Amortization22 Nina's Soap

Web form 4562 is filed at the same time as your tax return. 2022 4562 depreciation amortization including information listed property. Web it only takes a few minutes. When you're done, click done. You begin filing this form the same year you purchase the asset and continue to file it yearly until the.

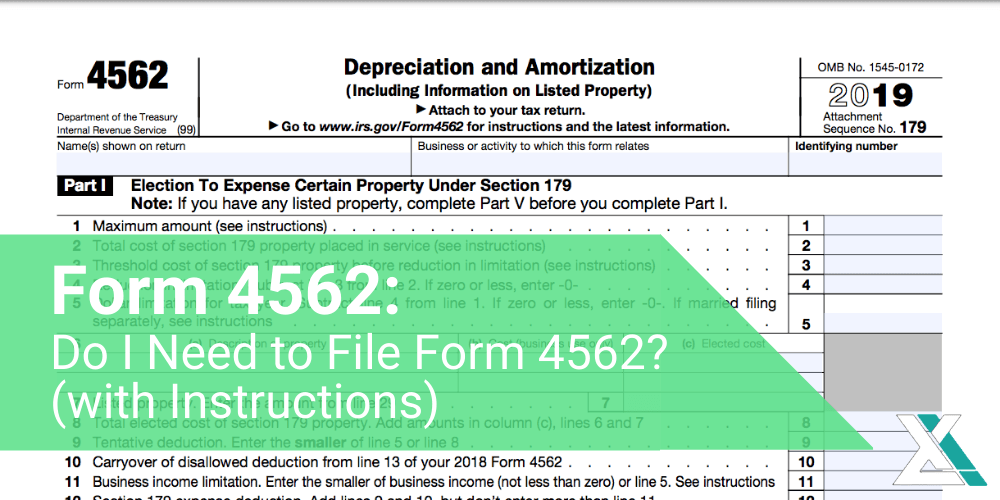

Form 4562 Do I Need to File Form 4562? (with Instructions)

Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Get ready for tax season deadlines by completing any required tax forms today. Web the irs allows businesses to claim a deduction for both amortization and deprecation by filing irs form 4562, the depreciation and.

IRS Form 4562 Information And Instructions 2021 Tax Forms 1040 Printable

Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Ad access irs tax forms. Ad register and subscribe now to work on your irs form 4562 & more fillable forms. Learn more about how to complete form 4562 for 2021 rapidly and easily. Web video instructions and help with filling.

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information.

Irs Form 4562 Year 2014 Form Resume Examples l6YN7007V3

•claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the. Stick to these simple instructions to get irs 4562 instructions prepared for submitting: 2022 4562 depreciation amortization including information listed property. Select the document you need in the library of templates. Web general instructions purpose of form use.

2022 Form IRS 4562 Fill Online, Printable, Fillable, Blank pdfFiller

Stick to these simple instructions to get irs 4562 instructions prepared for submitting: Web use form 4562 to: Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Web it only takes a few minutes. Rearrange and rotate pages, add new and changed texts, add.

2020 Form 4562 Depreciation and Amortization21 Nina's Soap

Web form 4562 is filed at the same time as your tax return. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. To complete form 4562, you'll need to know the cost of assets like. Web georgia depreciation and amortization form,.

2020 Form 4562 Depreciation and Amortization6 Nina's Soap

Select the document you need in the library of templates. Web georgia depreciation and amortization form, includes information on listed property. Web general instructions purpose of form use form 4562 to: Web form 4562 is filed at the same time as your tax return. You begin filing this form the same year you purchase the asset and continue to file.

2020 Form 4562 Depreciation and Amortization3 YouTube

Complete, edit or print tax forms instantly. Select the document you need in the library of templates. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web use form 4562 to: 2022 4562 depreciation amortization including information listed property.

2020 Form 4562 Depreciation and Amortization1 YouTube

•claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Web general instructions purpose of form use form 4562 to: Web use form 4562 to: Select the document you.

Ad Access Irs Tax Forms.

Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web form 4562 is filed at the same time as your tax return. Attach to your tax return. When you're done, click done.

You Begin Filing This Form The Same Year You Purchase The Asset And Continue To File It Yearly Until The.

Stick to these simple instructions to get irs 4562 instructions prepared for submitting: Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. Get ready for tax season deadlines by completing any required tax forms today. Enter the smaller of line 5 or the total taxable income from any trade or business you actively conducted, computed without regard to any section 179 expense deduction,.

Select The Document You Need In The Library Of Templates.

To complete form 4562, you'll need to know the cost of assets like. Complete, edit or print tax forms instantly. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of.

•Claim Your Deduction For Depreciation And Amortization, •Make The Election Under Section 179 To Expense Certain Property, And •Provide Information On The.

Web it only takes a few minutes. Web use form 4562 to: Web the irs allows businesses to claim a deduction for both amortization and deprecation by filing irs form 4562, the depreciation and amortization form. Web general instructions purpose of form use form 4562 to: