2019 Schedule C Tax Form

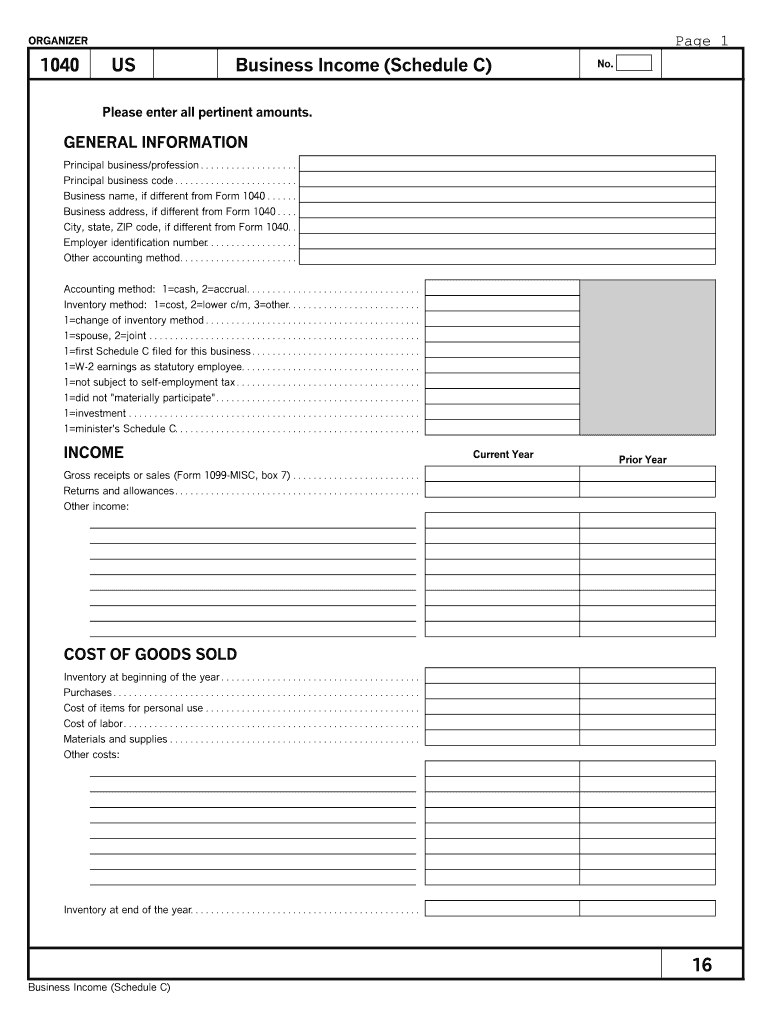

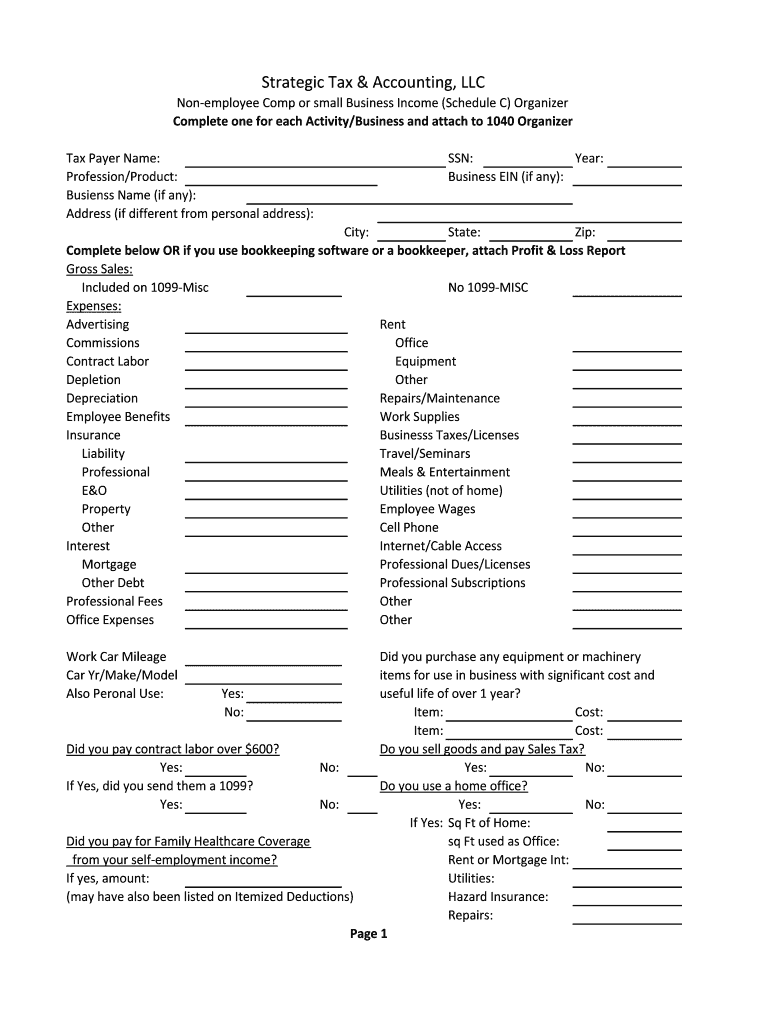

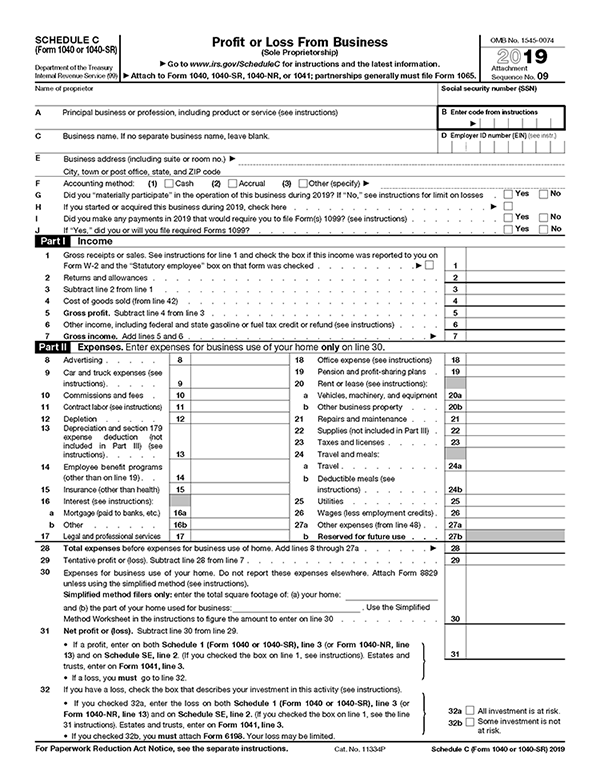

2019 Schedule C Tax Form - Send filled & signed schedule c pdf 2019 or save. The resulting profit or loss. • if a loss, you. Complete, edit or print tax forms instantly. Edit your fillable 2019 schedule c online type text, add images, blackout confidential details, add comments, highlights and more. Web form 1041, line 3. Web of what country are you a resident for tax purposes?caution: • if you checked 32a,. It's used by sole proprietors to let the irs know how much their business made or lost in the last year. Sign it in a few clicks draw your.

Average monthly payroll for employees. Your 2019 or 2020 irs form 1040, schedule c, line 7 amount, minus the sum of line 14, line 19, and line 26: Web form 1041, line 3. Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. Complete, edit or print tax forms instantly. • if a loss, you. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Edit your fillable 2019 schedule c online type text, add images, blackout confidential details, add comments, highlights and more. It's used by sole proprietors to let the irs know how much their business made or lost in the last year. Complete, edit or print tax forms instantly.

A final income tax return. Send filled & signed schedule c pdf 2019 or save. If you have a loss, check the box that describes your investment in this activity. The resulting profit or loss. Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. Easily sign the irs gov forms 2019 with your finger. Web department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest. If you’re using any other type of business. Average monthly payroll for employees. Use fill to complete blank online irs pdf forms for free.

Form 1040 With Schedule C I Will Tell You The Truth About Form 1040

Sign it in a few clicks draw your. • if you checked 32a,. It's used by sole proprietors to let the irs know how much their business made or lost in the last year. • if a loss, you. To enter the data in.

Printable Schedule C Form Fill Out and Sign Printable PDF Template

Send filled & signed schedule c pdf 2019 or save. To enter the data in. Go to line 32.} 31. Open the 2019 pdf schedule c and follow the instructions. • if a loss, you.

Form 1040 With Schedule C I Will Tell You The Truth About Form 1040

If you have a loss, check the box that describes your investment in this activity. • if you checked 32a,. If you’re using any other type of business. A final income tax return. Average monthly payroll for employees.

Fillable Online 2019 Schedule C (Form 1040 or 1040SR) Internal

Open the 2019 pdf schedule c and follow the instructions. Web department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest. Web form 1041, line 3. If you have a loss, check the box that describes your investment in this activity. File a final return on the.

√100以上 1099 schedule c tax form 315657What is a schedule c 1099 form

Edit your fillable 2019 schedule c online type text, add images, blackout confidential details, add comments, highlights and more. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Use fill to complete blank online irs pdf forms for free. • if you.

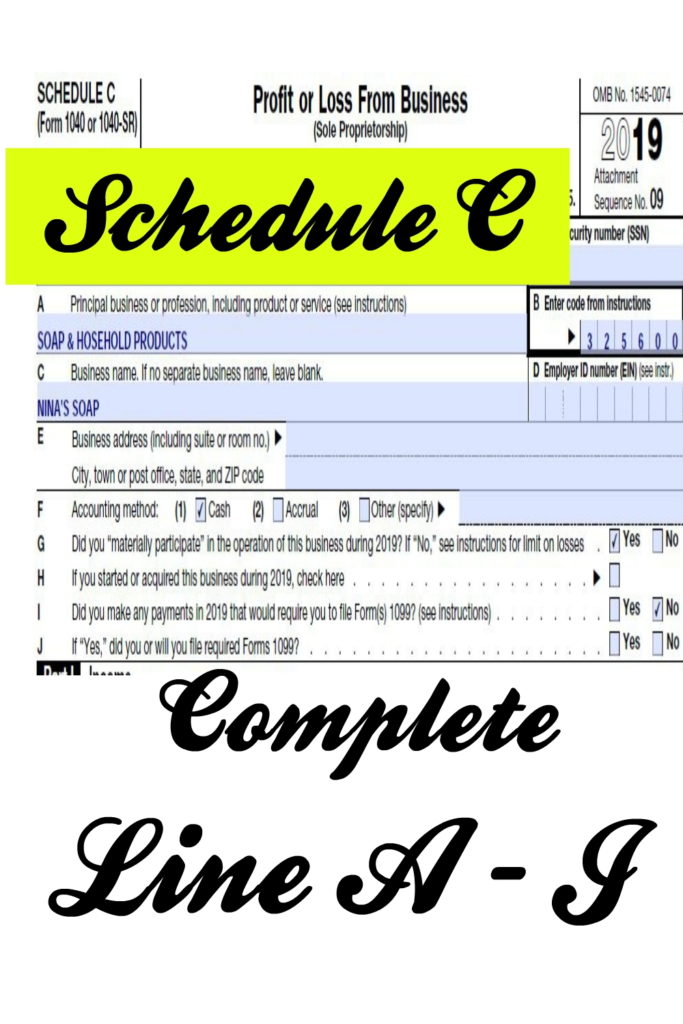

How to Complete 2019 Schedule C Form 1040 Line A to J Nina's Soap

Your 2019 or 2020 irs form 1040, schedule c, line 7 amount, minus the sum of line 14, line 19, and line 26: Web schedule c is part of form 1040. Open the 2019 pdf schedule c and follow the instructions. If you have a loss, check the box that describes your investment in this activity. Average monthly payroll for.

2019 IRS Tax Form 1040 Schedule C 2019 Profit Or Losses From Business

A final income tax return. • if you checked 32a,. Web of what country are you a resident for tax purposes?caution: If you have a loss, check the box that describes your investment in this activity. A d cost b d lower of cost or market c d.

How To Make A 1040 Schedule C 2020 Hampel Bloggen

If you’re using any other type of business. Go to line 32.} 31. • if you checked 32a,. Web form 1041, line 3. File a final return on the correct form after your tax year.

Sample Schedule C Tax Form Classles Democracy

Download or email irs 1040 sc & more fillable forms, register and subscribe now! To enter the data in. Web form 1041, line 3. A d cost b d lower of cost or market c d. Easily sign the irs gov forms 2019 with your finger.

2019 Form IRS 1120C Fill Online, Printable, Fillable, Blank pdfFiller

If you have a loss, check the box that describes your investment in this activity. Open the 2019 pdf schedule c and follow the instructions. Your 2019 or 2020 irs form 1040, schedule c, line 7 amount, minus the sum of line 14, line 19, and line 26: Send filled & signed schedule c pdf 2019 or save. • if.

Average Monthly Payroll For Employees.

Web form 1041, line 3. • if a loss, you. Web form 1041, line 3. If you’re using any other type of business.

Send Filled & Signed Schedule C Pdf 2019 Or Save.

Download or email irs 1040 sc & more fillable forms, register and subscribe now! Go to line 32.} 31 32. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. To enter the data in.

Complete, Edit Or Print Tax Forms Instantly.

Web department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest. The resulting profit or loss. Web the schedule c is meant for sole proprietors who have made $400 or more in gross income from their business that year. Open the 2019 pdf schedule c and follow the instructions.

File A Final Return On The Correct Form After Your Tax Year.

The irs uses the information in. Divide a by 12 (if $ c. • if a loss, you. • if you checked 32a,.