1120 C Form

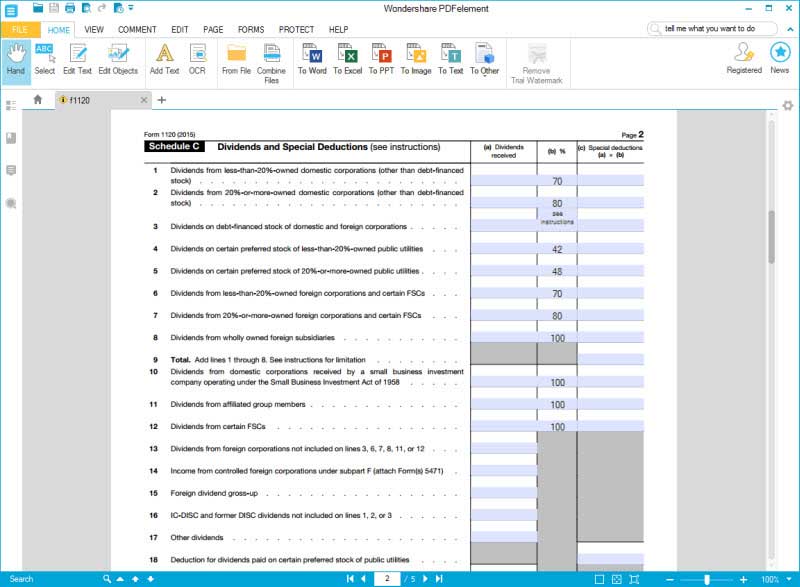

1120 C Form - Income tax return for cooperative associations, to report income, gains, losses, deductions, credits, and to figure the income tax liability. Web c corporation requesting a change to file as an s corporation. Corporation income tax return and paying the. 218) determine the taxability of dividends received and complete schedule c. What is difference between c corp and s corp? Maximize your deductions and save time with various imports & reports. Complete, edit or print tax forms instantly. Web information about form 1120, u.s. When changing their filing status from a c corporation (filing form 1120) to an s corporation. Corporation income tax return, including recent updates, related forms and instructions on how to file.

What is the difference between 1120 and 1120 c? Web taxact business 1120 easy guidance & tools for c corporation tax returns. Web we last updated the u.s. Bundle & save $ 124 95. Maximize your deductions and save time with various imports & reports. Is schedule c the same as 1120? Maximize your deductions and save time with various imports & reports. Income tax return for cooperative associations, to report income, gains, losses, deductions, credits, and to figure the income tax liability. Web taxact business 1120 easy guidance & tools for c corporation tax returns. When changing their filing status from a c corporation (filing form 1120) to an s corporation.

Bundle & save $ 124 95. Web taxact business 1120 easy guidance & tools for c corporation tax returns. Multiply line 20 by.001 then add $15 (fee cannot be less than $25 per. 2022 taxes are due april 18, 2023 for calendar year filers notes What is the difference between 1120 and 1120 c? 218) determine the taxability of dividends received and complete schedule c. Ad get ready for tax season deadlines by completing any required tax forms today. Income tax return for cooperative associations. When changing their filing status from a c corporation (filing form 1120) to an s corporation. Web we last updated the u.s.

Form 1120C U.S. Tax Return for Cooperative Associations (2014

Corporation income tax return, including recent updates, related forms and instructions on how to file. Use this form to report the income, gains, losses, deductions, credits, and to figure the. What is difference between c corp and s corp? Income tax return for cooperative associations, to report income, gains, losses, deductions, credits, and to figure the income tax liability. What.

Fill Free fillable Form 1120c Tax Return for Cooperative

Use this form to report the. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Ad easy guidance & tools for c corporation tax returns. When changing their filing status from a c corporation (filing form 1120) to an s corporation. Income tax return for cooperative associations for.

File 1120 Extension Online Corporate Tax Extension Form for 2020

Is schedule c the same as 1120? Multiply line 20 by.001 then add $15 (fee cannot be less than $25 per. Web taxact business 1120 easy guidance & tools for c corporation tax returns. What is the difference between 1120 and 1120 c? Maximize your deductions and save time with various imports & reports.

A Beginner's Guide to S Corporation Taxes The Blueprint

Corporation income tax return and paying the. Corporation income tax return, including recent updates, related forms and instructions on how to file. What is an 1120 c? Web information about form 1120, u.s. Is schedule c the same as 1120?

Form 1120C U.S. Tax Return for Cooperative Associations (2014

Multiply line 20 by.001 then add $15 (fee cannot be less than $25 per. Is schedule c the same as 1120? Maximize your deductions and save time with various imports & reports. Income tax return for cooperative associations for calendar year 2022 or tax year beginning, 2022,. Maximize your deductions and save time with various imports & reports.

Fill Free fillable Form 1120c Tax Return for Cooperative

Income tax return for cooperative associations for calendar year 2022 or tax year beginning, 2022,. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Web c corporation requesting a change to file as an s corporation. Income tax return for an.

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

Web information about form 1120, u.s. Corporations operating on a cooperative basis file this form to report their. Bundle & save $ 124 95. Income tax return for cooperative associations, to report income, gains, losses, deductions, credits, and to figure the income tax liability. Multiply line 20 by.001 then add $15 (fee cannot be less than $25 per.

IRS Form 1120 Complete this Form with Wondershare PDFelement

Bundle & save $ 124 95. Web information about form 1120, u.s. Corporation income tax return, including recent updates, related forms and instructions on how to file. Use this form to report the income, gains, losses, deductions, credits, and to figure the. Income tax return for cooperative associations.

Form 1120C U.S. Tax Return for Cooperative Associations (2014

Property and casualty insurance company income tax return. Maximize your deductions and save time with various imports & reports. Income tax return for cooperative associations for calendar year 2022 or tax year beginning, 2022,. Web we last updated the u.s. 218) determine the taxability of dividends received and complete schedule c.

1120 Tax Form Blank Sample to Fill out Online in PDF

When changing their filing status from a c corporation (filing form 1120) to an s corporation. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Use this form to report the income, gains, losses, deductions, credits, and to figure the. Property and casualty insurance company income tax return..

Use This Form To Report The Income, Gains, Losses, Deductions, Credits, And To Figure The.

Income tax return for cooperative associations, to report income, gains, losses, deductions, credits, and to figure the income tax liability. Web taxact business 1120 easy guidance & tools for c corporation tax returns. Ad easy guidance & tools for c corporation tax returns. Corporation income tax return and paying the.

Use This Form To Report The.

Bundle & save $ 124 95. What is the difference between 1120 and 1120 c? Income tax return for cooperative associations. What is an 1120 c?

Income Tax Return For An S Corporation Do Not File This Form Unless The Corporation Has Filed Or Is Attaching.

Is schedule c the same as 1120? Web taxact business 1120 easy guidance & tools for c corporation tax returns. Web information about form 1120, u.s. When changing their filing status from a c corporation (filing form 1120) to an s corporation.

2022 Taxes Are Due April 18, 2023 For Calendar Year Filers Notes

Maximize your deductions and save time with various imports & reports. Ad get ready for tax season deadlines by completing any required tax forms today. Web we last updated the u.s. Web c corporation requesting a change to file as an s corporation.