1091 Tax Form

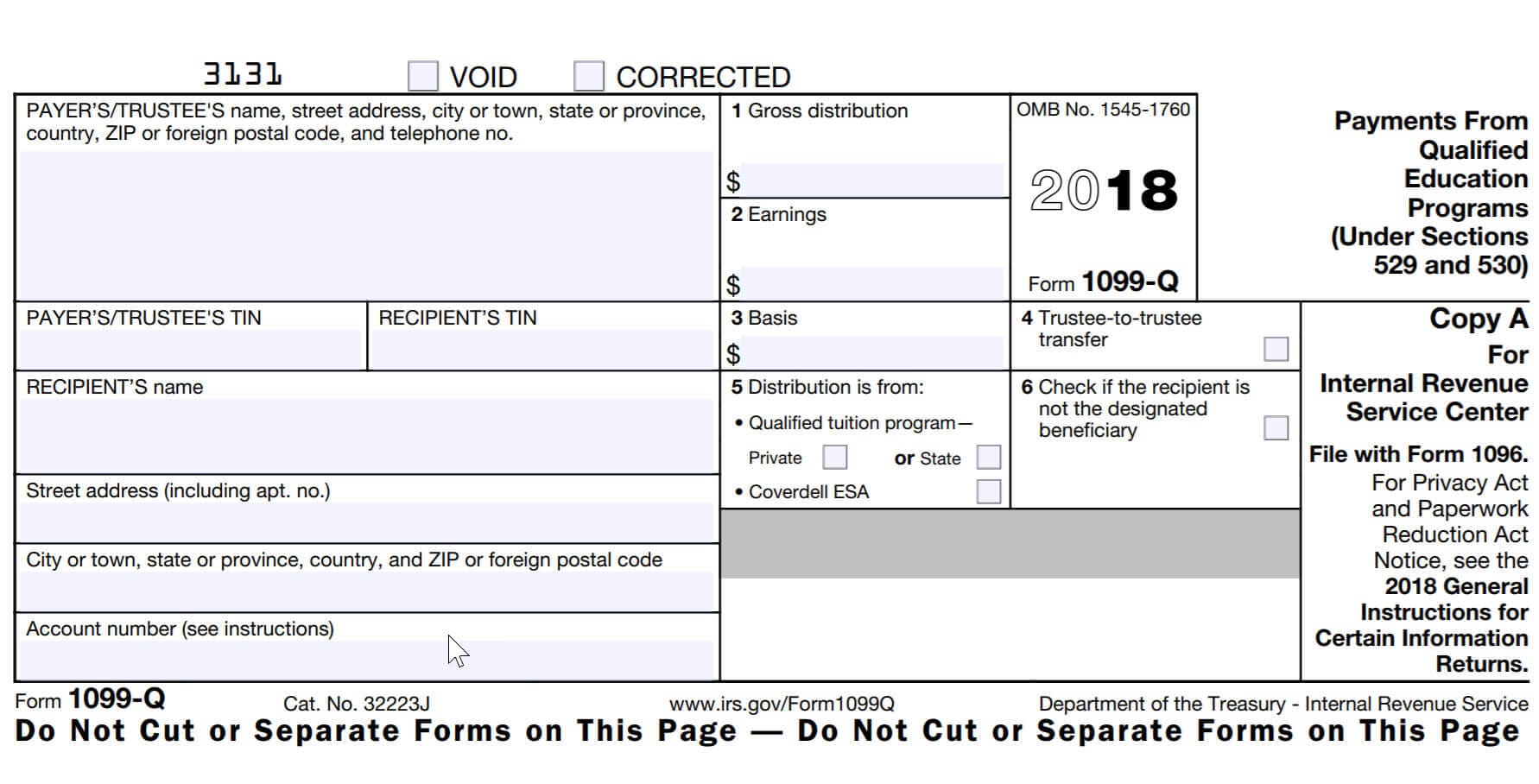

1091 Tax Form - Veterans exemption q and a: Web base erosion tax benefits related to payments reported on lines 3 through 11, on which tax is imposed by section 871 or 881, with respect to which tax has been withheld under. Web popular forms & instructions; Web find irs addresses for private delivery of tax returns, extensions and payments. You will report this income on your tax return. Web a 1099 form, also called an information return, is a document sent to you by an entity that paid you certain types of income throughout the tax year. Sign it in a few clicks. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Draw your signature, type it,.

Web go to www.irs.gov/form1041 for instructions and the latest information. Draw your signature, type it,. Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior to. Web according to the national society of accountants' 2018\u20132019 income and fees survey, the average tax preparation fee for a tax professional to prepare a form 1040. Irs form 1041 is an income tax return filed by a decedent's estate or living trust after their death. Veterans exemption q and a: Web popular forms & instructions; Web (1) substantially identical stock or securities were sold, or (2) another short sale of (or securities futures contracts to sell) substantially identical stock or securities was. Web find irs addresses for private delivery of tax returns, extensions and payments. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred.

Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Draw your signature, type it,. Citizen or resident who participates in or receives annuities from a registered canadian retirement. Web go to www.irs.gov/form1041 for instructions and the latest information. You will report this income on your tax return. Irs form 1041 is an income tax return filed by a decedent's estate or living trust after their death. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. Web popular forms & instructions; Web base erosion tax benefits related to payments reported on lines 3 through 11, on which tax is imposed by section 871 or 881, with respect to which tax has been withheld under. Web according to the national society of accountants' 2018\u20132019 income and fees survey, the average tax preparation fee for a tax professional to prepare a form 1040.

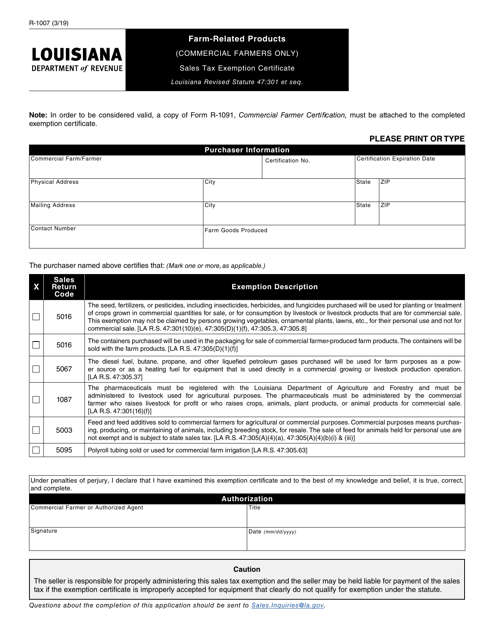

Form R1007 Download Fillable PDF or Fill Online FarmRelated Products

Type text, add images, blackout confidential details, add comments, highlights and more. It reports income, capital gains, deductions, and losses,. Sign it in a few clicks. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. The income that is either accumulated or held for future distribution or distributed currently to.

2021 Form IRS 1040 Schedule 2 Fill Online, Printable, Fillable, Blank

Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior to. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web find irs addresses for private delivery of tax returns, extensions and payments. Veterans.

Form 1099K Report it or Not? YouTube

An irs form that must be completed by any u.s. Sign it in a few clicks. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web base erosion tax benefits related to payments reported on lines 3 through 11, on which tax is imposed by section 871 or 881, with.

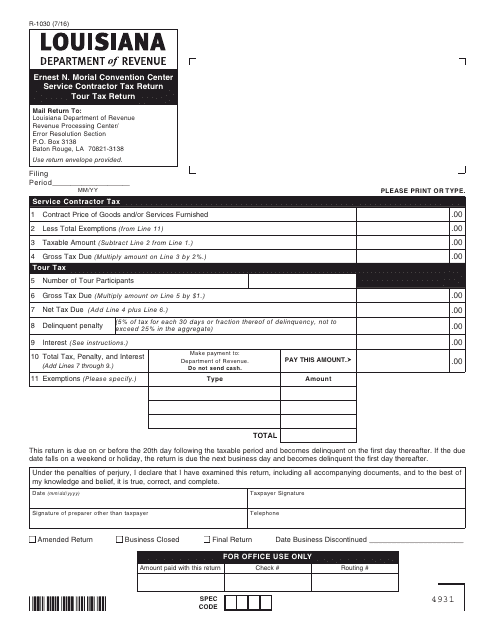

Form R1030 Download Fillable PDF or Fill Online Ernest N. Morial

Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Web the income, deductions, gains, losses, etc. Web a 1099 form, also called an information return, is a document sent to you by an entity that paid you certain types of income throughout the tax year. The.

Que Es Data Transfer En Espanol Sitios Online Para Adultos En Navarra

Individual tax return form 1040 instructions; Web a 1099 form, also called an information return, is a document sent to you by an entity that paid you certain types of income throughout the tax year. Veterans exemption q and a: Web (1) substantially identical stock or securities were sold, or (2) another short sale of (or securities futures contracts to.

1099 K Form 2020 Blank Sample to Fill out Online in PDF

Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior to. The term—which gets its name from. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. Irs form 1041 is an income tax return filed by.

Why You Need Form 1091 YouTube

Web the income, deductions, gains, losses, etc. Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior to. Edit your form 1091 online. Web base erosion tax benefits related to payments reported on lines 3 through 11, on which tax is imposed by section.

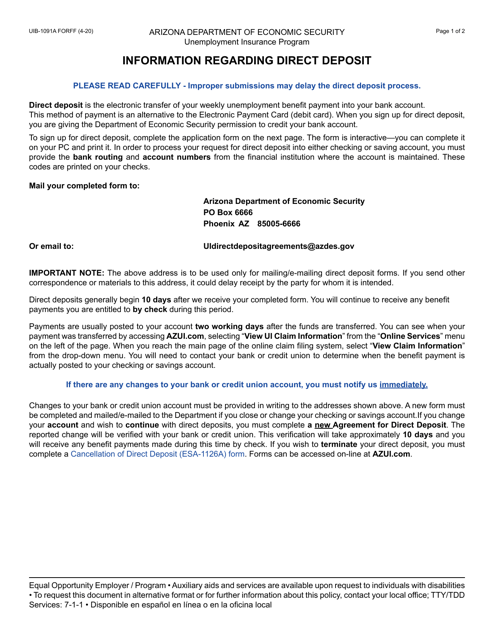

Form UIB1091A Download Fillable PDF or Fill Online Agreement for

Edit your form 1091 online. Web the income, deductions, gains, losses, etc. Citizen or resident who participates in or receives annuities from a registered canadian retirement. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Web (1) substantially identical stock or securities were sold, or (2).

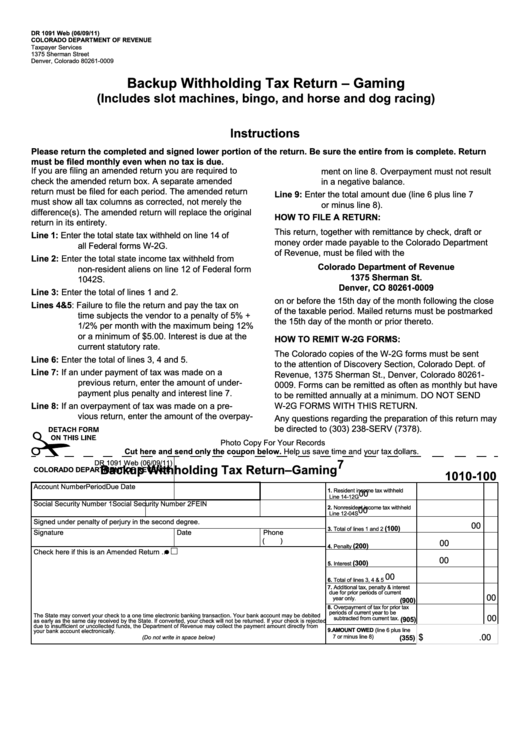

Form Dr 1091 Backup Withholding Tax ReturnGaming printable pdf download

Web go to www.irs.gov/form1041 for instructions and the latest information. Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior to. An irs form that must be completed by any u.s. Web trade or business is not subject to the withholding tax on foreign.

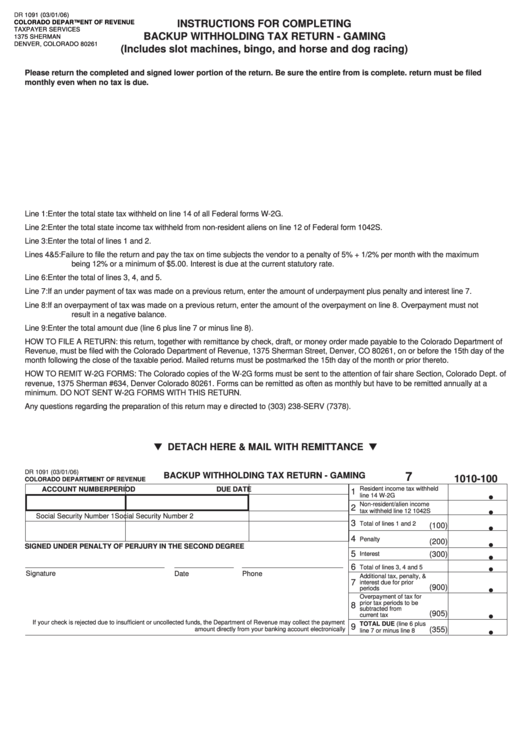

Form Dr 1091 Backup Withholding Tax Return Gaming printable pdf

Type text, add images, blackout confidential details, add comments, highlights and more. Veterans exemption q and a: Draw your signature, type it,. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Web go to www.irs.gov/form1041 for instructions and the latest information.

Web A 1099 Form, Also Called An Information Return, Is A Document Sent To You By An Entity That Paid You Certain Types Of Income Throughout The Tax Year.

The term—which gets its name from. Web go to www.irs.gov/form1041 for instructions and the latest information. Of the estate or trust. Private delivery services should not deliver returns to irs offices other than.

Irs Form 1041 Is An Income Tax Return Filed By A Decedent's Estate Or Living Trust After Their Death.

Type text, add images, blackout confidential details, add comments, highlights and more. Edit your form 1091 online. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred.

It Reports Income, Capital Gains, Deductions, And Losses,.

Web the income, deductions, gains, losses, etc. Sign it in a few clicks. Web (1) substantially identical stock or securities were sold, or (2) another short sale of (or securities futures contracts to sell) substantially identical stock or securities was. Senior citizens property tax exemption:

An Irs Form That Must Be Completed By Any U.s.

The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. 2019 changes to exemptions for property. Web according to the national society of accountants' 2018\u20132019 income and fees survey, the average tax preparation fee for a tax professional to prepare a form 1040. Web popular forms & instructions;