1040 2017 Form

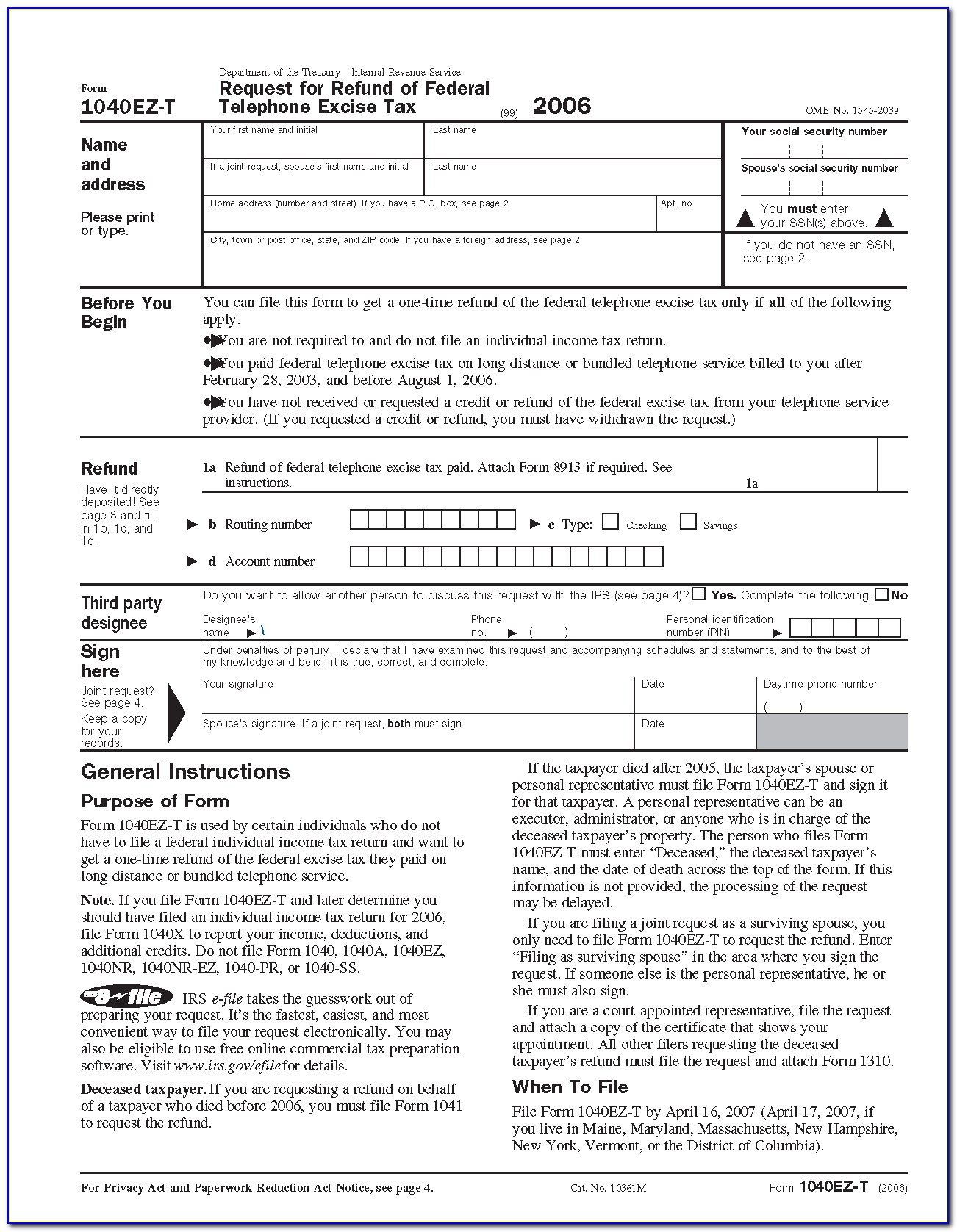

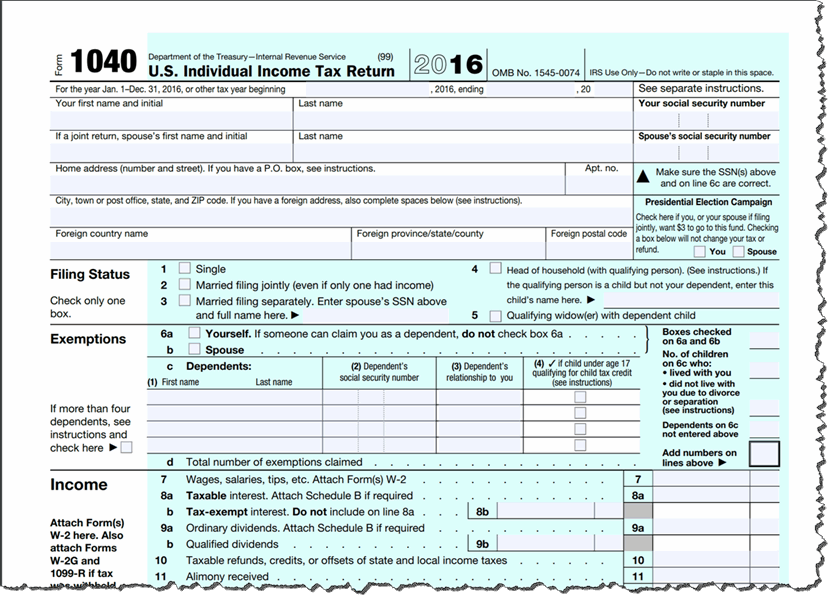

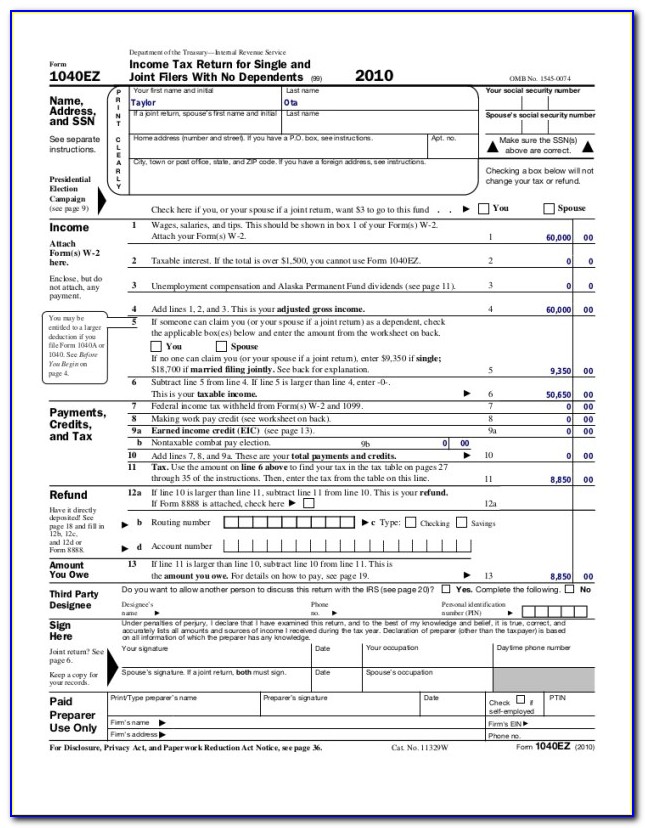

1040 2017 Form - See form 1040 or form 1040a instructions and form 1040x. Form 1040 schedule 3 (2021) pdf. Attach form 6251 47 61 48 social security and medicare tax on tip income not reported to employer. Visit our form 1040 page to view a complete list of federal income tax forms. Form 1040 schedule 2 (2021) pdf. January 2017) department of the treasury—internal revenue service. (you may file both federal and state income tax returns.) Do i need to file an income tax return chart. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return.

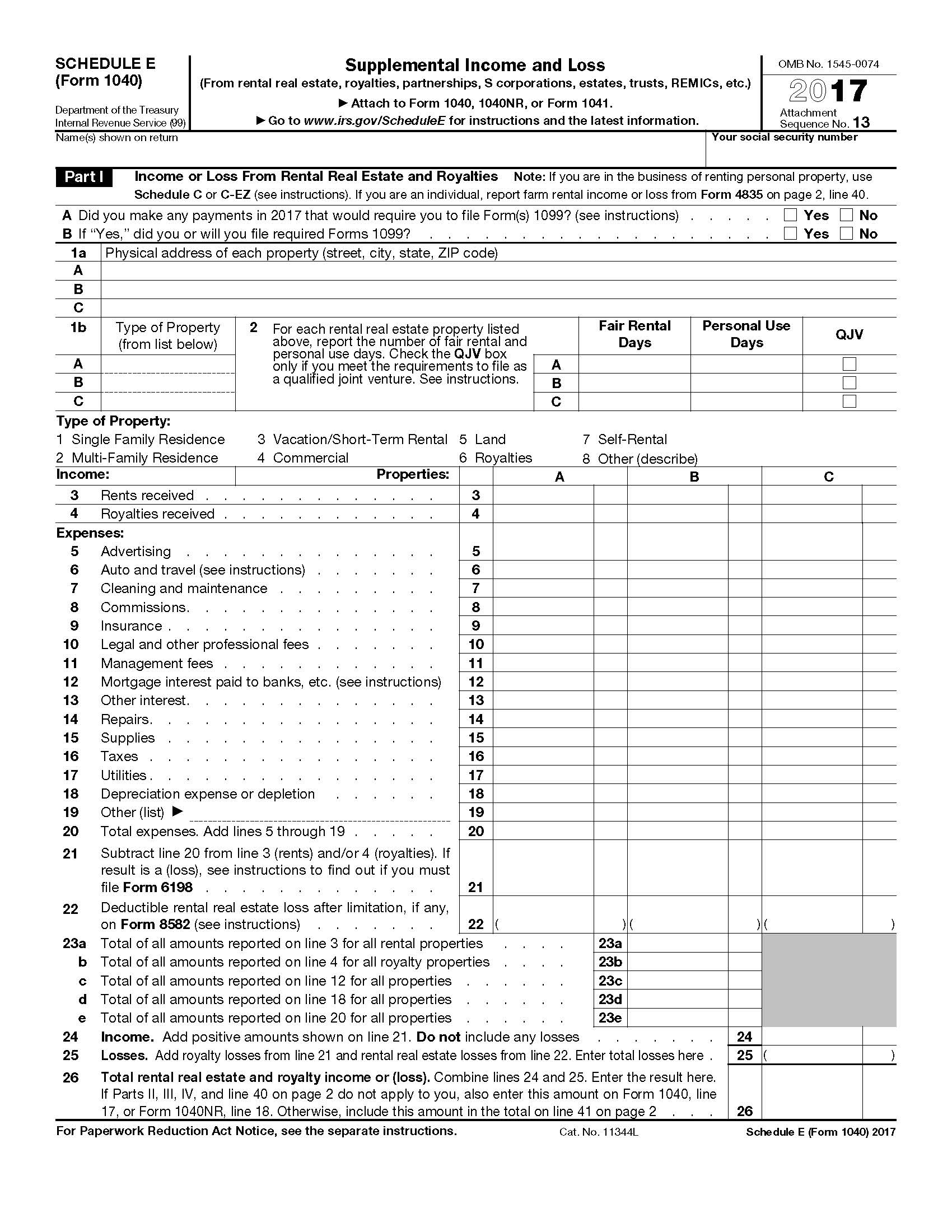

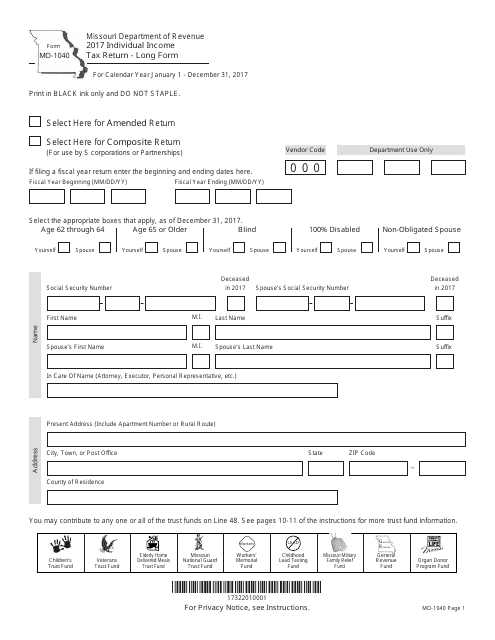

Being aware of tax terms as well as both 1040 and 1099 rules is beneficial. Select the applicable forms below and open them in the editor. Federal adjusted gross income (from the federal 1040, line 37; See form 1040 or form 1040a instructions and form 1040x. Department of the treasury—internal revenue service. Web the irs has released a new tax filing form for people 65 and older. Partnerships generally must file form 1065. 31, 2017, or other tax year beginning , 2017, ending , 20 see separate instructions. Web 2017 schedule c (form 1040) schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Form 1040 is used by citizens or residents of the united states to file an annual income tax return.

Federal adjusted gross income (from the federal 1040, line 37; Web form 1040 is what individual taxpayers use to file their taxes with the irs. Attach form 6251 47 61 48 social security and medicare tax on tip income not reported to employer. Web fill online, printable, fillable, blank form 2017: Web any us resident taxpayer can file form 1040 for tax year 2017. Line item instructions for form 1040. Use fill to complete blank online irs pdf forms for free. Include page 1 of your federal return if the amount is zero or negative. Attach to form 1040, 1040nr, or 1041; Use information from your federal income tax return to complete your form 540.

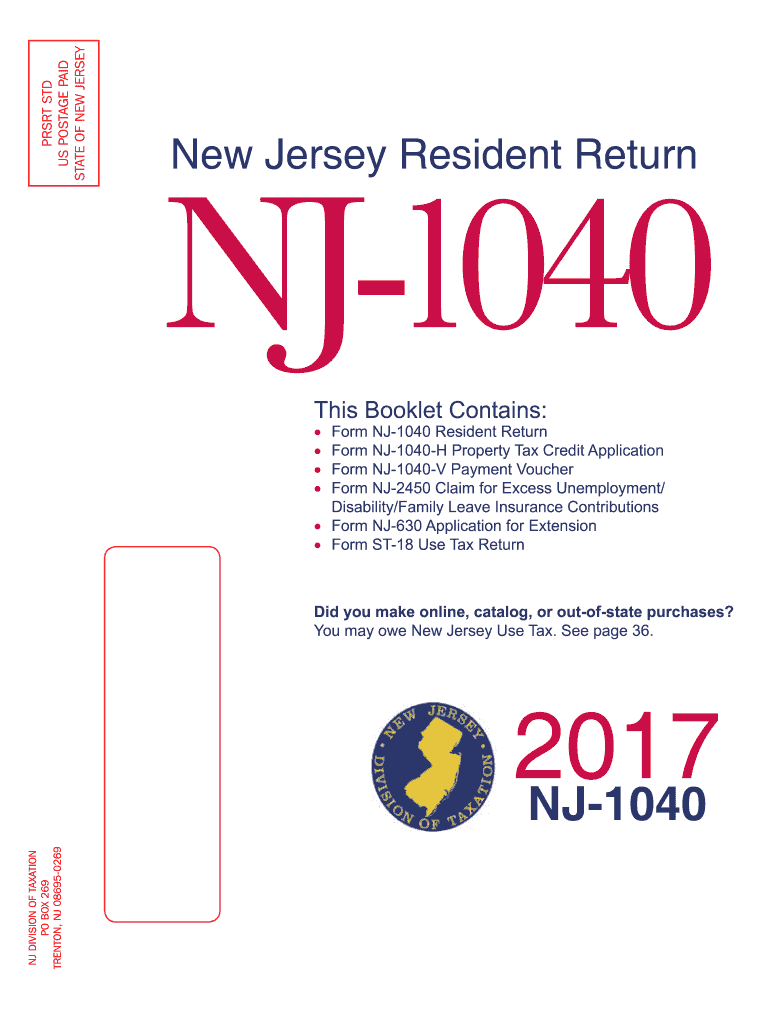

Nj 1040 Tax Form 2017 Form Resume Examples EAkwR6ROgY

Form 1040 is used by citizens or residents of the united states to file an annual income tax return. Your first name and initial. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. Check if from 44 45 43 46 add lines 40 through 44 44 47 subtract line.

2017 Irs Tax Form 1040 Schedule E (supplement And Loss) U.S

Web form 1040 is what individual taxpayers use to file their taxes with the irs. Form 1040 schedule 2 (2021) pdf. Attach form 1116 43 42 other. Form 1040 is used by citizens or residents of the united states to file an annual income tax return. Web fill online, printable, fillable, blank form 1040:

2017 1040 Tax Form PDF

Use information from your federal income tax return to complete your form 540. Web information about form 1040, u.s. It has bigger print, less shading, and features like a standard deduction chart. The 1099 form provides information needed to complete a tax return, while the 1040 form is used to file the actual taxes due. Web attach form 1116 43.

How to Use a 1040 With Your College Funding Clients to Sell Life

Web start with the 2017 calculators to get an idea of your 2017 taxes. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. Select the applicable forms below and open them in the editor. Complete, save, sign, download, and print the forms. Web get federal tax return forms and.

Sample 10402015

Complete and mail form 540 by. Web information about form 1040, u.s. Web version f, cycle 10. Form 1040 schedule 3 (2021) pdf. Use information from your federal income tax return to complete your form 540.

Nj 1040 Tax Form 2017 Form Resume Examples EAkwR6ROgY

Attach schedule r credits foreign tax credit. Web 1040 department of the treasury—internal revenue service (99) u.s. Web complete your federal income tax return (form 1040, form 1040a, or form 1040ez) before you begin your form 540, california resident income tax return. The form is optional and uses the same schedules, instructions, and attachments as the regular 1040. 2017 tax.

NJ NJ1040 2017 Fill out Tax Template Online US Legal Forms

Attach schedule se taxes 49 alternative minimum. Web attach form 1116 43 42 other. Web start with the 2017 calculators to get an idea of your 2017 taxes. Attach form 1116 43 42 other. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their.

Tax Form 1040 Schedule 1 Form Resume Examples N48mYd68yz

See form 1040 or form 1040a instructions and form 1040x. Attach to form 1040, 1040nr, or 1041; The form determines if additional taxes are due or if the filer will receive a tax refund. Individual income tax return (irs) form. Attach schedule se taxes 49 alternative minimum tax.

2017 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

Individual income tax return (irs) form. If you need to amend a federal income tax return, file form 1040x. Web attach form 244140 42 credit for the elderly or the disabled. Do not staple or paper clip. Information about form 1040x and its separate instructions is at.

31, 2017, Or Other Tax Year Beginning , 2017, Ending , 20 See Separate Instructions.

Web attach form 1116 43 42 other. It has bigger print, less shading, and features like a standard deduction chart. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. The 1099 form provides information needed to complete a tax return, while the 1040 form is used to file the actual taxes due.

Web Version F, Cycle 10.

Complete and mail form 540 by. Complete, save, sign, download, and print the forms. Once completed you can sign your fillable form or send for signing. January 2017) department of the treasury—internal revenue service.

Web 2017 Schedule C (Form 1040) Schedule C (Form 1040) Department Of The Treasury Internal Revenue Service (99) Profit Or Loss From Business (Sole Proprietorship) Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Line item instructions for form 1040. Earned income credit (eic) instructions. Attach form 1116 43 42 other. Mailing address for where to mail your forms.

Web Information About Form 1040, U.s.

2017 tax table to use with form 1040. Attach schedule r credits foreign tax credit. If you need to amend a federal income tax return, file form 1040x. Web fill online, printable, fillable, blank form 2017: