Form 7004 - Section 1.6081-5

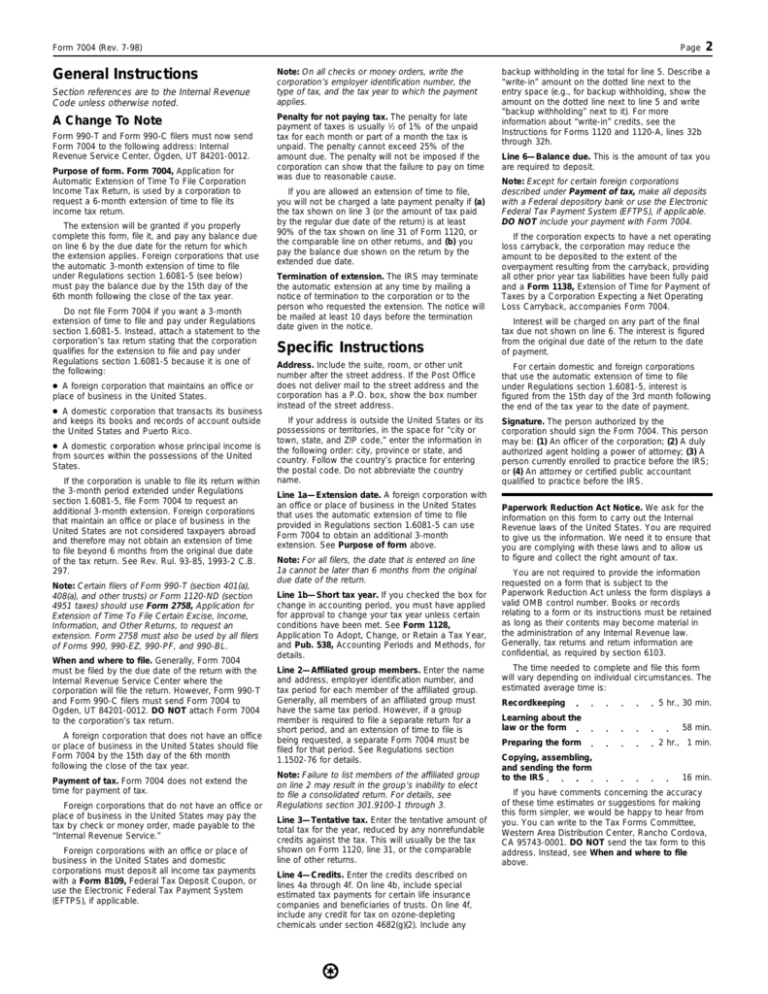

Form 7004 - Section 1.6081-5 - For further guidance regarding the. ( a ) an extension of time for filing returns of income and for. 9407, 73 fr 37366, july 1,. Web this section is applicable for applications for an automatic extension of time to file an individual income tax return filed after july 1, 2008. Web form 7004 can be filed electronically for most returns. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. November 2011) department of the treasury internal revenue service. You do not need to submit form 7004 for. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. (a) an extension of time for filing returns of income and for paying.

( a ) an extension of time for filing returns of income and for. Application for automatic extension of time to file certain business income tax,. November 2011) department of the treasury internal revenue service. 9407, 73 fr 37366, july 1,. Web certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under regulations section. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. Web this section is applicable for applications for an automatic extension of time to file an individual income tax return filed after july 1, 2008. For further guidance regarding the. You do not need to submit form 7004 for. Instead, attach a statement tothe.

Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. Web certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under regulations section. Instead, attach a statement tothe. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Application for automatic extension of time to file certain business income tax,. 9407, 73 fr 37366, july 1,. For further guidance regarding the. (a) an extension of time for filing returns of income and for paying. This section is used by foreign corporations,.

How to file an LLC extension Form 7004 YouTube

Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. 9407, 73 fr 37366, july 1,. Signature.—the person authorized by the corporation. Application for automatic extension of time to file certain business income tax,. Web this section is applicable for applications for.

Where to file Form 7004 Federal Tax TaxUni

9407, 73 fr 37366, july 1,. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. (a) an extension of time for filing returns of income and for paying. Signature.—the person authorized by the corporation. Web this section is applicable for applications.

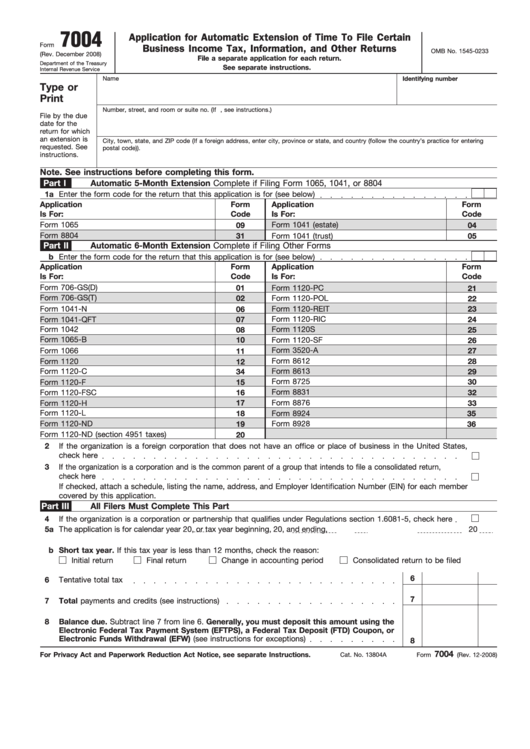

Fillable Form 7004 (Rev. December 2008) printable pdf download

9407, 73 fr 37366, july 1,. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. Web this section is applicable for applications for an automatic extension of time to file an individual income tax return filed after july 1, 2008. (a).

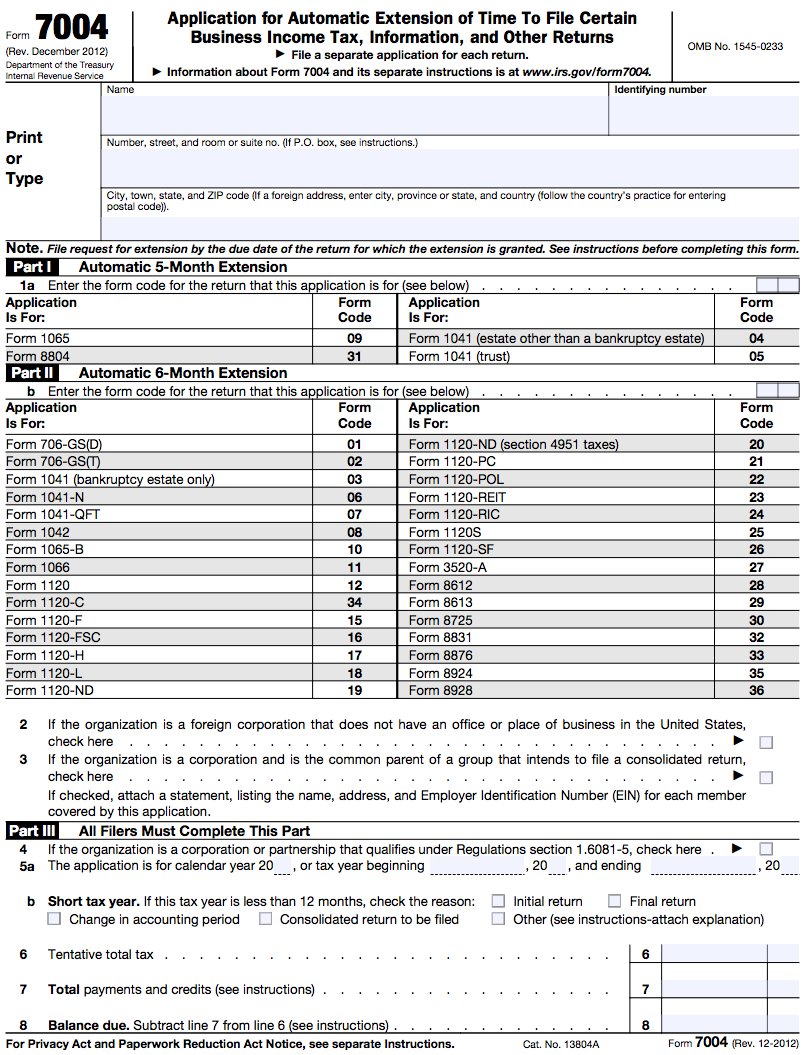

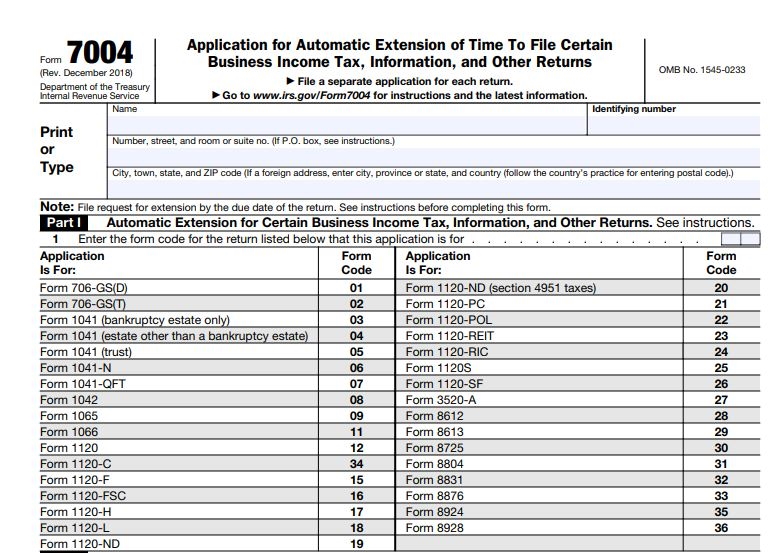

How to Fill Out IRS Form 7004

Instead, attach a statement tothe. 9407, 73 fr 37366, july 1,. (a) an extension of time for filing returns of income and for paying. This section is used by foreign corporations,. Web certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under regulations section.

Irs Form 7004 amulette

Instead, attach a statement tothe. Web form 7004 can be filed electronically for most returns. Signature.—the person authorized by the corporation. Application for automatic extension of time to file certain business income tax,. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in.

Form 7004 For Form 1065 Nina's Soap

Application for automatic extension of time to file certain business income tax,. Web form 7004 can be filed electronically for most returns. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. You do not need to submit form 7004 for. Signature.—the.

E File Form 7004 Online Universal Network

Signature.—the person authorized by the corporation. You do not need to submit form 7004 for. Instead, attach a statement tothe. 9407, 73 fr 37366, july 1,. Web form 7004 can be filed electronically for most returns.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

(a) an extension of time for filing returns of income and for paying. November 2011) department of the treasury internal revenue service. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Web (1) submit a complete application on form 7004, “application for automatic extension.

Form 7004 (Rev. July 1998)

This section is used by foreign corporations,. Signature.—the person authorized by the corporation. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. ( a ) an extension of time for filing returns of income and for. For further guidance regarding the.

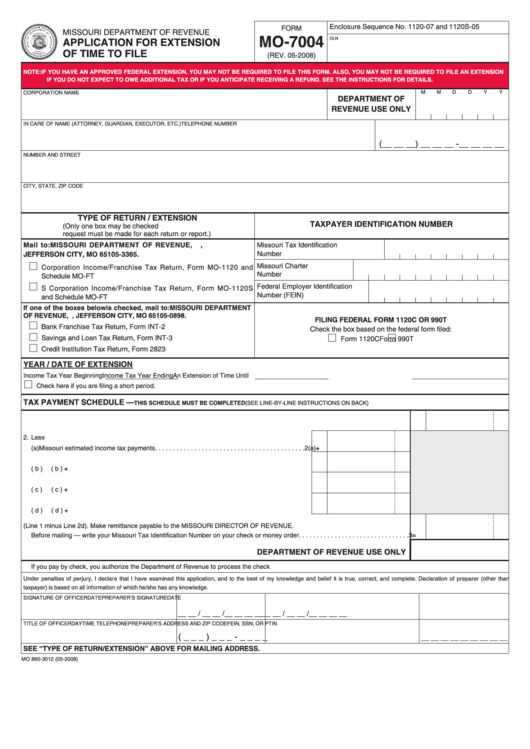

Fillable Form Mo7004 Application For Extension Of Time To File

Signature.—the person authorized by the corporation. ( a ) an extension of time for filing returns of income and for. (a) an extension of time for filing returns of income and for paying. For further guidance regarding the. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including.

Web Information About Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns, Including Recent Updates, Related.

Application for automatic extension of time to file certain business income tax,. November 2011) department of the treasury internal revenue service. Web form 7004 can be filed electronically for most returns. Web certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under regulations section.

This Section Is Used By Foreign Corporations,.

9407, 73 fr 37366, july 1,. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. Web this section is applicable for applications for an automatic extension of time to file an individual income tax return filed after july 1, 2008. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any.

You Do Not Need To Submit Form 7004 For.

For further guidance regarding the. Signature.—the person authorized by the corporation. (a) an extension of time for filing returns of income and for paying. Instead, attach a statement tothe.

( A ) An Extension Of Time For Filing Returns Of Income And For.

(a) an extension of time for filing returns of income and for paying.