Form 480.6C

Form 480.6C - Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Return the completed form in duplicate. Web #1 2014 nc resident and pureto rico income on pr form 480.6c? Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Report that income when you file your return Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,. Web what is a form 480.6 a?

Report that income when you file your return Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a. Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,. A new box has been added to include general information in reporting the total amount of. Web #1 2014 nc resident and pureto rico income on pr form 480.6c? Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web what is a form 480.6 a?

Web what is a form 480.6 a? Return the completed form in duplicate. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. A new box has been added to include general information in reporting the total amount of. Report that income when you file your return Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a.

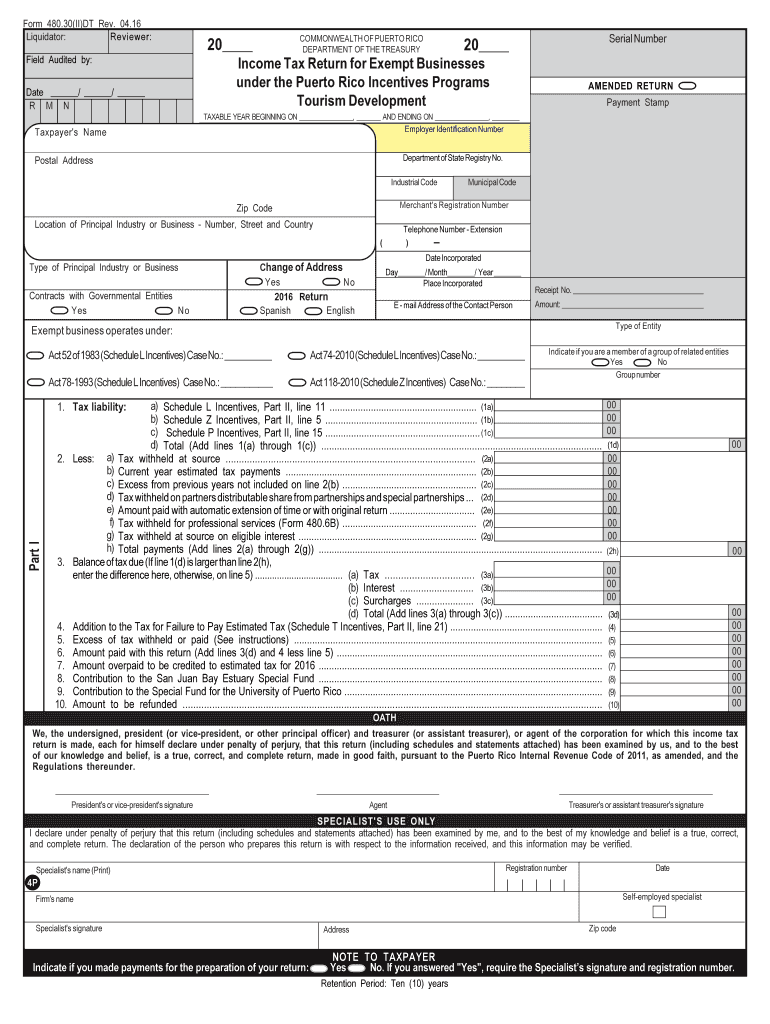

W2 Puerto Rico Form Fill Out and Sign Printable PDF Template signNow

Return the completed form in duplicate. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web what is a form 480.6 a? Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct.

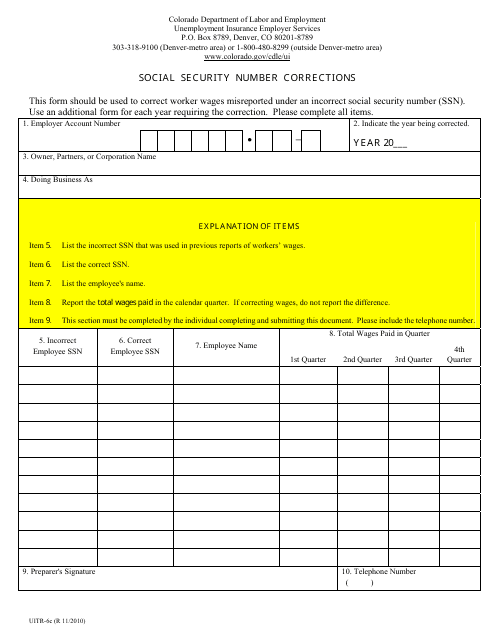

Form UITR6C Download Printable PDF or Fill Online Social Security

Return the completed form in duplicate. Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical,.

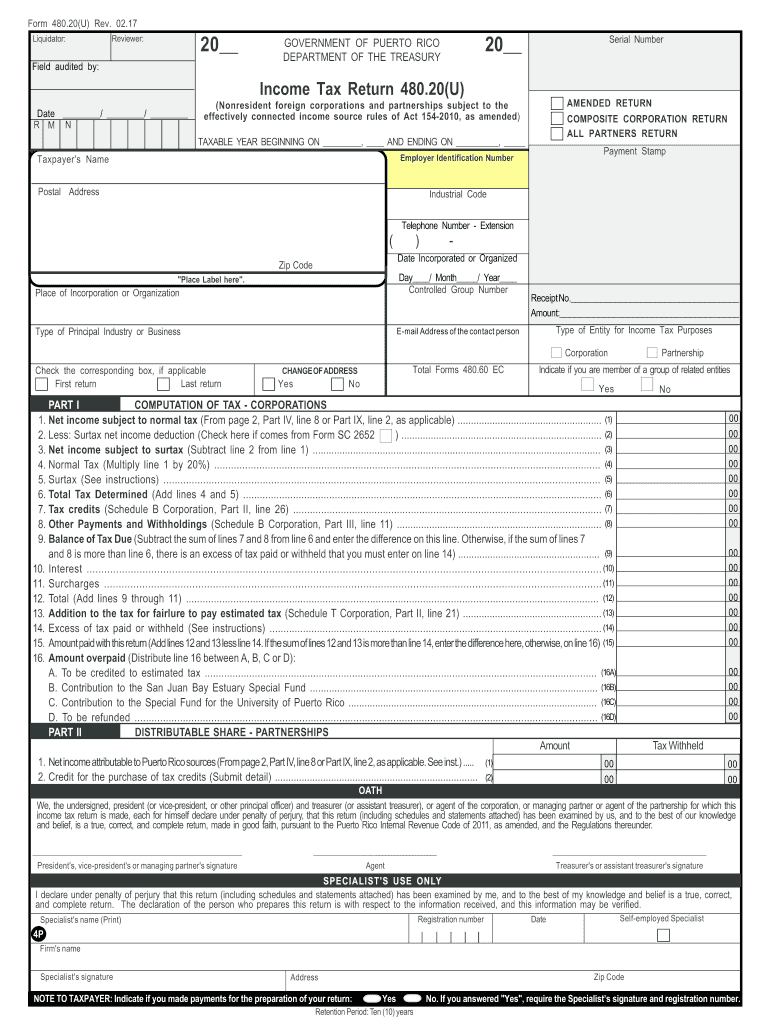

Form 480 20 Fill Online, Printable, Fillable, Blank pdfFiller

Return the completed form in duplicate. Web what is a form 480.6 a? Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. A new box has been added to include general information in reporting the total amount of. Web any natural or.

What is a withholding statement W2PR, 480? Taxmania

A new box has been added to include general information in reporting the total amount of. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in.

Table Structure for Informative Returns data

Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web 16 rows i nformative.

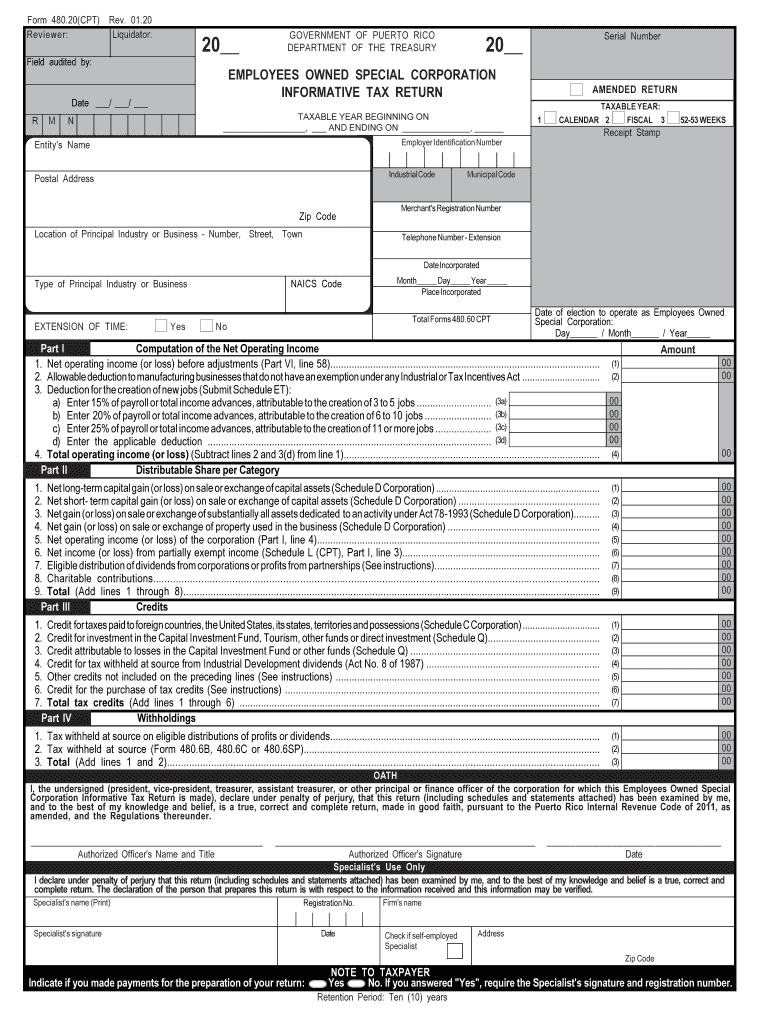

480 20 CPT Rev 01 20 480 20 CPT Rev 01 20 Fill Out and Sign Printable

Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web prepare.

PR 480.2 2016 Fill out Tax Template Online US Legal Forms

Web #1 2014 nc resident and pureto rico income on pr form 480.6c? Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a. Report that income when you file your return Return the completed form in duplicate. Web prepare form 480.6c.

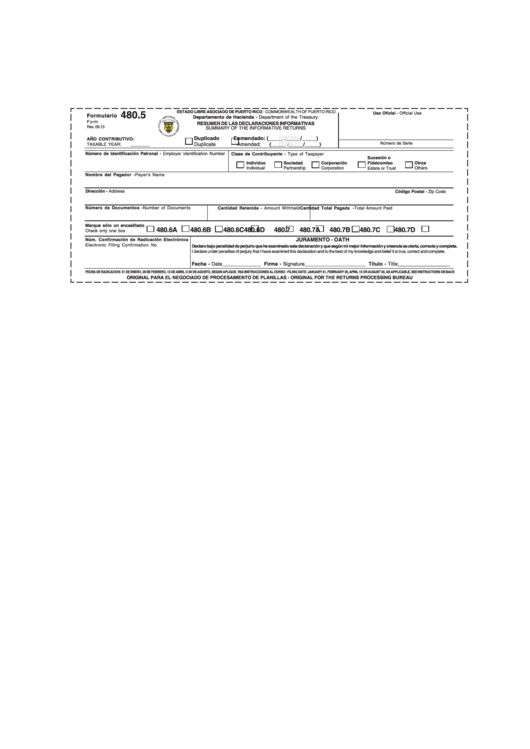

Formulario 480.5 Resumen De Las Declarationes Informativas printable

Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web #1 2014 nc resident and pureto rico income on pr form 480.6c? Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each.

Form 480.7E Tax Alert RSM Puerto Rico

Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web any natural or legal person doing business in puerto rico who.

2007 Form PR 480.6D Fill Online, Printable, Fillable, Blank pdfFiller

A new box has been added to include general information in reporting the total amount of. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web what is a form 480.6 a? Web se requerirá la preparación de un formulario 480.6c.

Web What Is A Form 480.6 A?

Return the completed form in duplicate. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a. Web #1 2014 nc resident and pureto rico income on pr form 480.6c? Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto.

Web Any Natural Or Legal Person Doing Business In Puerto Rico Who Makes Payments (Payer) For Rendered Services Must Deduct And Withhold 29% From The Payment Made To Foreign Non.

A new box has been added to include general information in reporting the total amount of. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Report that income when you file your return

Web 16 Rows I Nformative Returns Are To Be Filed For Any Payment Of Dividends Or Any Payment In Excess Of $500 For Interest, Rent, Salaries Or Wages Not Otherwise Reported, Premiums,.

Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a.