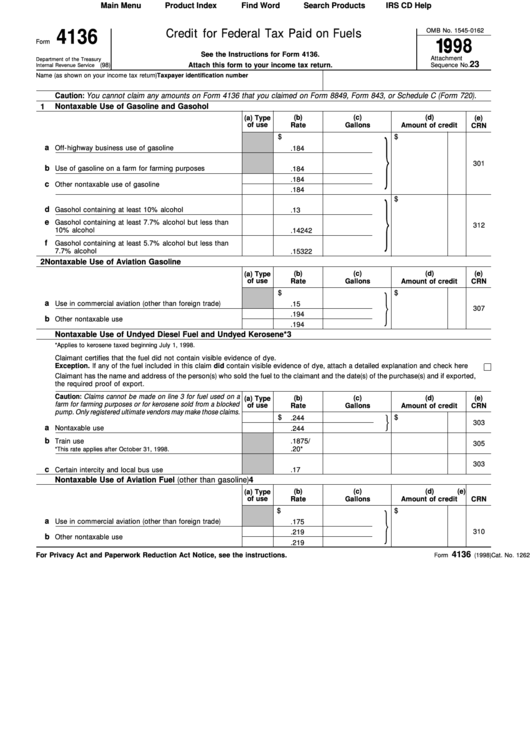

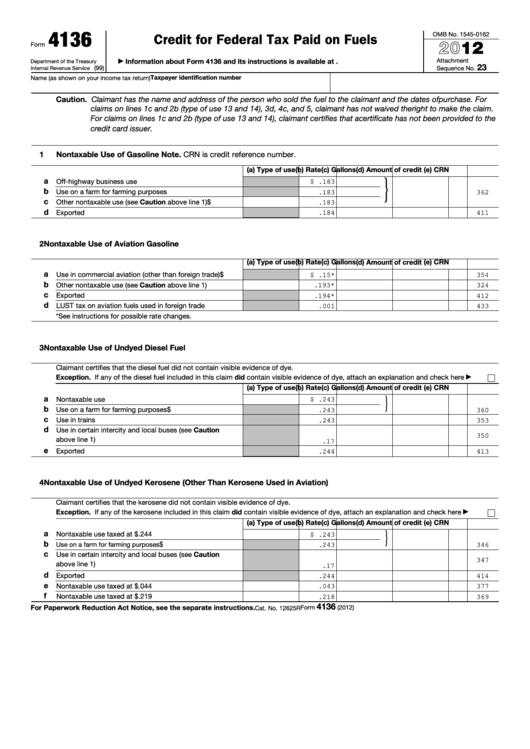

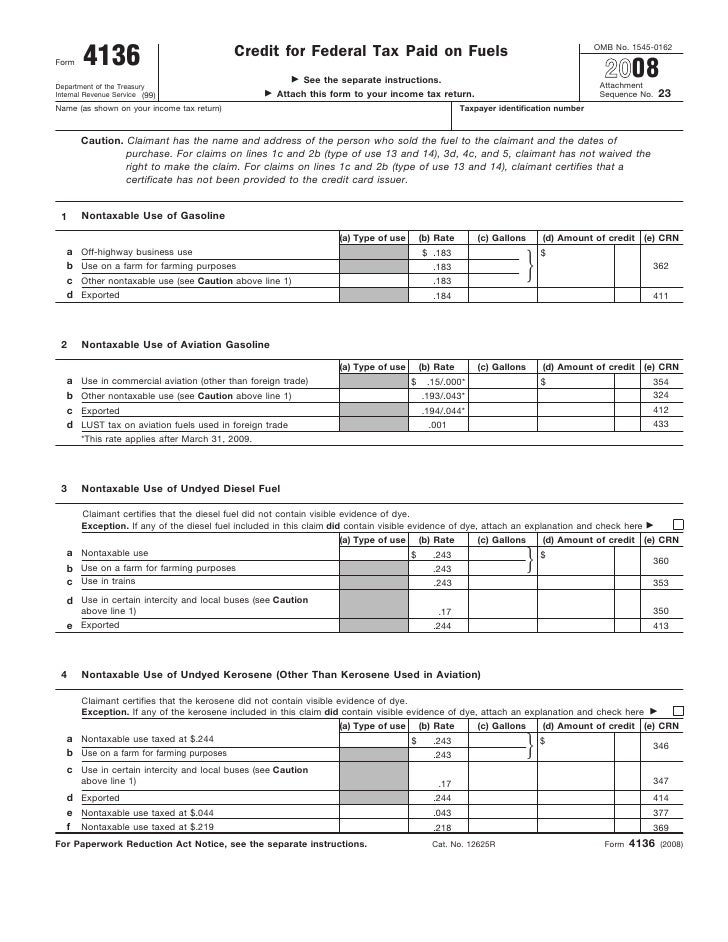

Form 4136 - Credit For Federal Tax Paid On Fuels

Form 4136 - Credit For Federal Tax Paid On Fuels - Fill out the credit for federal tax paid on fuels online and print it out for free. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Ad sovos combines tax automation with a human touch. The internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can. Web common credits you can claim on form 4136 include those for: 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration no. The biodiesel or renewable diesel mixture credit. Recordkeeping use form 4136 to claim the credit for federal excise. Reach out to learn how we can help you! Web download or print the 2022 federal form 4136 (credit for federal tax paid on fuels) for free from the federal internal revenue service.

Recordkeeping use form 4136 to claim the credit for federal excise. Ad work with federal tax credits and incentives specialists who have decades of experience. Nontaxable use of gasoline who can claim this credit generally, the ultimate purchaser is the only entity who can claim a tax credit on business use of. Complete, edit or print tax forms instantly. Reach out to learn how we can help you! If any of the diesel fuel included in this claim did contain visible evidence of dye, attach an explanation and check here. Web tax return for the taxes paid and that deduction reduced your tax liability. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. A credit for exported taxable fuel can be claimed on lines. The biodiesel or renewable diesel mixture credit.

Ad work with federal tax credits and incentives specialists who have decades of experience. Ad sovos combines tax automation with a human touch. The biodiesel or renewable diesel mixture credit. The biodiesel or renewable diesel mixture credit. A credit for exported taxable fuel can be claimed on lines. Nontaxable use of gasoline who can claim this credit generally, the ultimate purchaser is the only entity who can claim a tax credit on business use of. Web to claim this credit, complete form 4136: Web may claim a credit for taxes paid on fuels. Web tax return for the taxes paid and that deduction reduced your tax liability. General instructions purpose of form.—form 4136 is used by individuals, estates, trusts, or.

Red Dye Diesel Fuel Near Me Risala Blog

You must enter the number from the table in the type of use column. Complete, edit or print tax forms instantly. Reach out to learn how we can help you! Web tax return for the taxes paid and that deduction reduced your tax liability. Ad sovos combines tax automation with a human touch.

Fillable Credit For Federal Tax Paid On Fuels Irs 4136 printable pdf

Web download or print the 2022 federal form 4136 (credit for federal tax paid on fuels) for free from the federal internal revenue service. Web common credits you can claim on form 4136 include those for: Nontaxable uses of alternative fuels such as liquified hydrogen liquified petroleum “p series” fuels liquified. General instructions purpose of form.—form 4136 is used by.

Fillable Form 4136 Credit For Federal Tax Paid On Fuels 2012

With the right expertise, federal tax credits and incentives could benefit your business. Web use form 4136 to claim the following. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration no. You must enter the number from the table in the type of use column. Nontaxable uses of.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

The credits available on form 4136 are: Web use form 4136 to claim the following. .a (a) type of use (b) rate (c) gallons (d). Credit for federal tax paid on fuels at www.irs.gov. Web may claim a credit for taxes paid on fuels.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Ad sovos combines tax automation with a human touch. Web •form 720, quarterly federal excise tax return, to claim a credit against your taxable fuel liability. The internal revenue service usually releases income tax forms.

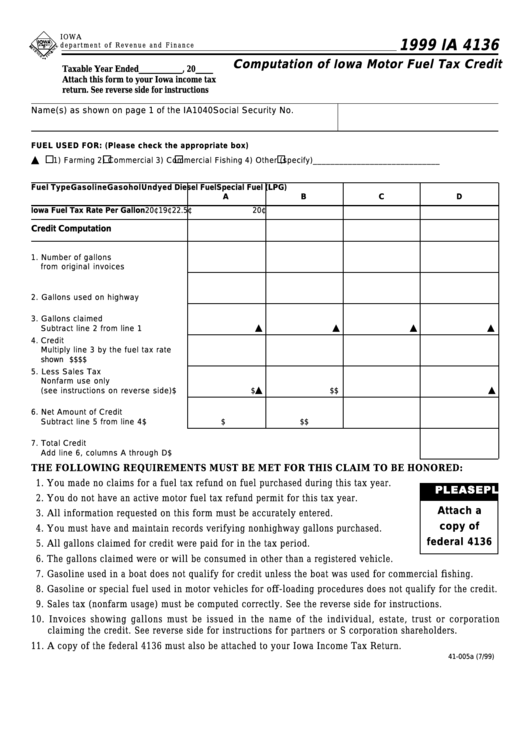

Form Ia 4136 Computation Of Iowa Motor Fuel Tax Credit 1999

Web download or print the 2022 federal form 4136 (credit for federal tax paid on fuels) for free from the federal internal revenue service. Reach out to learn how we can help you! General instructions purpose of form.—form 4136 is used by individuals, estates, trusts, or. Get ready for tax season deadlines by completing any required tax forms today. Credit.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Web to claim this credit, complete form 4136: Ad access irs tax forms. The internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can. Recordkeeping use form 4136 to claim the credit for federal excise. Web use form 4136 to claim a credit for federal taxes paid.

How to Prepare IRS Form 4136 (with Form) wikiHow

Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Complete, edit or print tax forms instantly. Web credit for federal tax paid on fuels go to www.irs.gov/form4136 for instructions and the latest information. Web use form 4136 to claim a credit for federal taxes.

Form 4136Credit for Federal Tax Paid on Fuel

The biodiesel or renewable diesel mixture credit. Web to claim this credit, complete form 4136: If any of the diesel fuel included in this claim did contain visible evidence of dye, attach an explanation and check here. General instructions purpose of form.—form 4136 is used by individuals, estates, trusts, or. A credit for exported taxable fuel can be claimed on.

Fuels Credit Photos Free & RoyaltyFree Stock Photos from Dreamstime

Web common credits you can claim on form 4136 include those for: Nontaxable use of gasoline who can claim this credit generally, the ultimate purchaser is the only entity who can claim a tax credit on business use of. Web use form 4136 to claim the following. Nontaxable uses of alternative fuels such as liquified hydrogen liquified petroleum “p series”.

12625Rform 4136 5Kerosene Used In Aviation (See Caution Above Line 1) 6Sales By Registered Ultimate Vendors Of Undyed Diesel Fuel Registration No.

Web download or print the 2022 federal form 4136 (credit for federal tax paid on fuels) for free from the federal internal revenue service. The alternative fuel a credit for certain nontaxable uses (or sales). Web to claim this credit, complete form 4136: Ad work with federal tax credits and incentives specialists who have decades of experience.

A Credit For Exported Taxable Fuel Can Be Claimed On Lines.

You must enter the number from the table in the type of use column. General instructions purpose of form.—form 4136 is used by individuals, estates, trusts, or. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Web may claim a credit for taxes paid on fuels.

The Internal Revenue Service Usually Releases Income Tax Forms For The Current Tax Year Between October And January, Although Changes To Some Forms Can.

Nontaxable use of gasoline who can claim this credit generally, the ultimate purchaser is the only entity who can claim a tax credit on business use of. The biodiesel or renewable diesel mixture credit. Complete, edit or print tax forms instantly. Nontaxable uses of alternative fuels such as liquified hydrogen liquified petroleum “p series” fuels liquified.

Ad Access Irs Tax Forms.

Recordkeeping use form 4136 to claim the credit for federal excise. Get ready for tax season deadlines by completing any required tax forms today. Reach out to learn how we can help you! The biodiesel or renewable diesel mixture credit.