Form 35.1 Colorado

Form 35.1 Colorado - Web mandatory disclosure form 35.1 reference to 16.2 (e) (2) form. To end a marriage, click here. Web we would like to show you a description here but the site won’t allow us. Taxformfinder provides printable pdf copies of 65 current. Web mandatory disclosure form 35.1 [reference to c.r.c.p. This is an official form from the colorado state judicial branch, which complies with all applicable laws and statutes. Web for a complete list of required disclosures, see form 35.1 to the colorado rules of civil procedure. These disclosure forms are not to be filed with the court, except as may be ordered pursuant to c.r.c.p. This is a colorado form and can be use in domestic relations statewide. These disclosure forms are not to be filed with the court, except as may be ordered pursuant to c.r.c.p.

Web formulario 35.1 [reference to c.r.c.p. These disclosure forms are not to be filed with the court, except as may be ordered pursuant to c.r.c.p. Web we would like to show you a description here but the site won’t allow us. As amended through rule change 2023 (7), effective april 6, 2023. Colorado has a state income tax of 4.63%. Web following mandatory disclosures as required by rule 16.2(e)(7) of the colorado rules of civil procedure. This is an official form from the colorado state judicial branch, which complies with all applicable laws and statutes. This is a colorado form and can be use in domestic relations statewide. Web mandatory disclosure form 35.1 [reference to c.r.c.p. Web mandatory disclosure form 35.1 reference to 16.2 (e) (2) form.

Web following mandatory disclosures as required by rule 16.2(e)(7) of the colorado rules of civil procedure. This is an official form from the colorado state judicial branch, which complies with all applicable laws and statutes. Web for a complete list of required disclosures, see form 35.1 to the colorado rules of civil procedure. This is a colorado form and can be use in domestic relations statewide. These disclosure forms are not to be filed with the court, except as may be ordered pursuant to c.r.c.p. Web mandatory disclosure form 35.1 reference to 16.2 (e) (2) form. Colorado has a state income tax of 4.63%. Web mandatory disclosure form 35.1 [reference to c.r.c.p. Use these forms to srat a case to end or legally separate from civil union when you don't have children. Web formulario 35.1 [reference to c.r.c.p.

[Resolved] India Infoline Finance [IIFL] — noc and form 35 long time

These disclosures are due in all cases, without even waiting for. Colorado has a state income tax of 4.63%. Web mandatory disclosure form 35.1 [reference to c.r.c.p. This is an official form from the colorado state judicial branch, which complies with all applicable laws and statutes. Web following mandatory disclosures as required by rule 16.2(e)(7) of the colorado rules of.

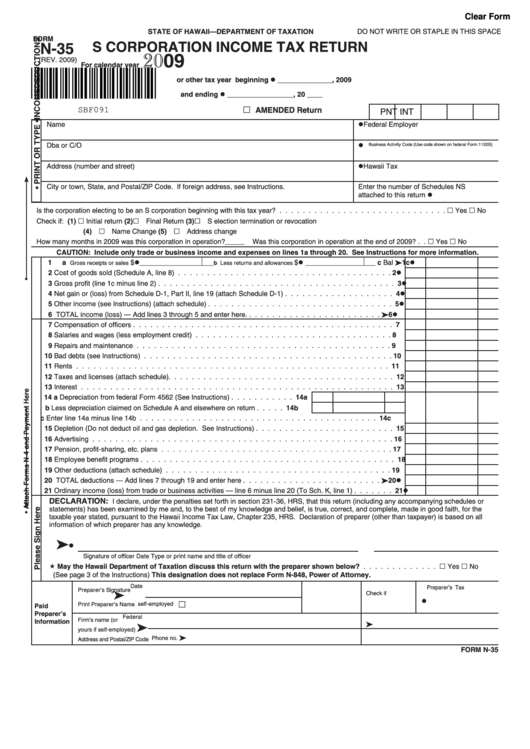

Fillable Form N35 S Corporation Tax Return 2009 printable

This is a colorado form and can be use in domestic relations statewide. Use these forms to srat a case to end or legally separate from civil union when you don't have children. These disclosures are due in all cases, without even waiting for. Web formulario 35.1 [reference to c.r.c.p. Colorado has a state income tax of 4.63%.

20 INFO FORM 35 FOR RTO PDF ZIP DOCX PRINTABLE DOWNLOAD * Form

Web following mandatory disclosures as required by rule 16.2(e)(7) of the colorado rules of civil procedure. As amended through rule change 2023 (7), effective april 6, 2023. These disclosure forms are not to be filed with the court, except as may be ordered pursuant to c.r.c.p. Colorado has a state income tax of 4.63%. Use these forms to srat a.

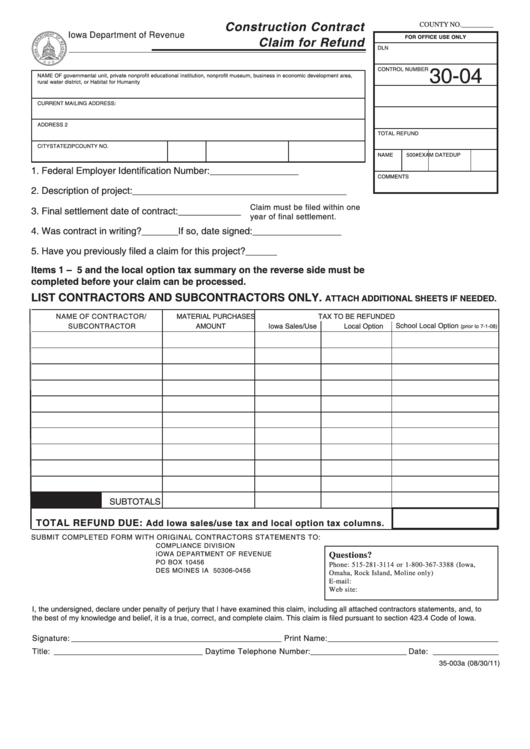

Form 35003a Construction Contract Claim For Refund 2011 printable

Web mandatory disclosure form 35.1 [reference to c.r.c.p. Web following mandatory disclosures as required by rule 16.2(e)(7) of the colorado rules of civil procedure. Taxformfinder provides printable pdf copies of 65 current. These disclosures are due in all cases, without even waiting for. Web colorado has a flat state income tax of 4.63% , which is administered by the colorado.

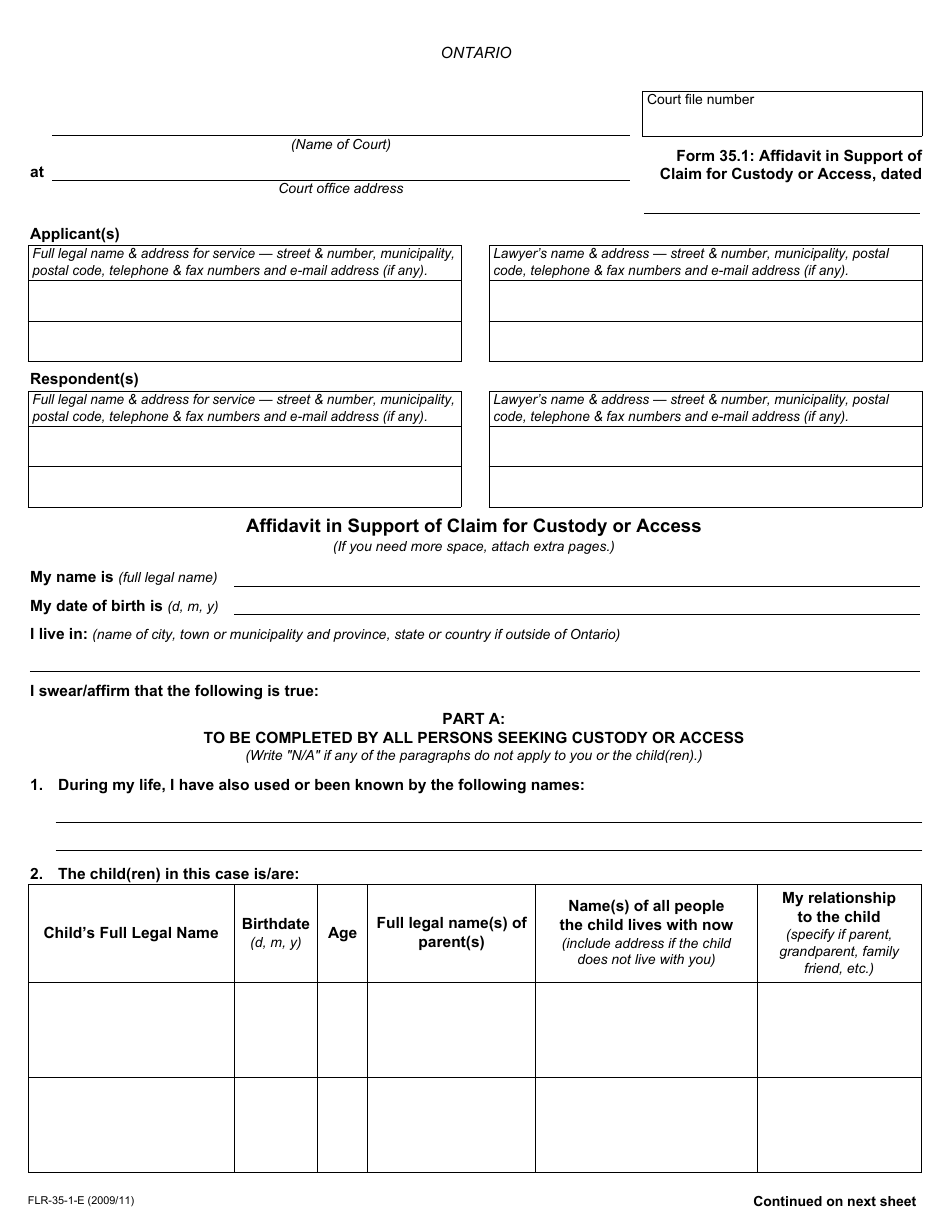

Form 35.1 Affidavit in Support of Claim for Custody or Access1

Web colorado has a flat state income tax of 4.63% , which is administered by the colorado department of revenue. Use these forms to srat a case to end or legally separate from civil union when you don't have children. This is an official form from the colorado state judicial branch, which complies with all applicable laws and statutes. Taxformfinder.

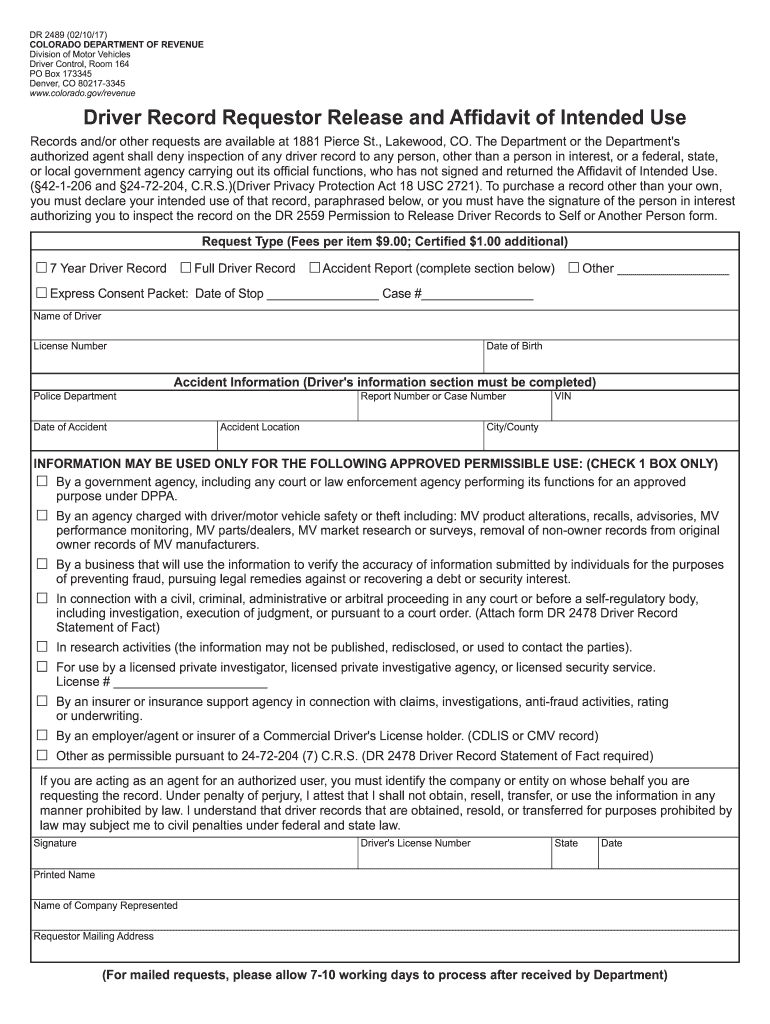

Form 35 0 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

These disclosure forms are not to be filed with the court, except as may be ordered pursuant to c.r.c.p. These disclosure forms are not to be filed with the court, except as may be ordered pursuant to c.r.c.p. Taxformfinder provides printable pdf copies of 65 current. Use these forms to srat a case to end or legally separate from civil.

how to fill form 35 for hypothecation how to fill form 35 rto online

Web mandatory disclosure form 35.1 [reference to c.r.c.p. This is a colorado form and can be use in domestic relations statewide. To end a marriage, click here. These disclosures are due in all cases, without even waiting for. Colorado has a state income tax of 4.63%.

Colorado Use Form Fill Online, Printable, Fillable, Blank PDFfiller

To end a marriage, click here. This is a colorado form and can be use in domestic relations statewide. This is an official form from the colorado state judicial branch, which complies with all applicable laws and statutes. Web for a complete list of required disclosures, see form 35.1 to the colorado rules of civil procedure. Web following mandatory disclosures.

NWMLS Form 35, 35W & 35F Feasibility & Inspections YouTube

Check those that you have furnished to the other party. Colorado has a state income tax of 4.63%. To end a marriage, click here. Web we would like to show you a description here but the site won’t allow us. Web mandatory disclosure form 35.1 reference to 16.2 (e) (2) form.

Form 35.1 Download Fillable PDF or Fill Online Affidavit in Support of

Taxformfinder provides printable pdf copies of 65 current. This is an official form from the colorado state judicial branch, which complies with all applicable laws and statutes. To end a marriage, click here. Use these forms to srat a case to end or legally separate from civil union when you don't have children. As amended through rule change 2023 (12),.

Use These Forms To Srat A Case To End Or Legally Separate From Civil Union When You Don't Have Children.

These disclosures are due in all cases, without even waiting for. As amended through rule change 2023 (7), effective april 6, 2023. As amended through rule change 2023 (12), effective june 15, 2023. Web we would like to show you a description here but the site won’t allow us.

Web For A Complete List Of Required Disclosures, See Form 35.1 To The Colorado Rules Of Civil Procedure.

Check those that you have furnished to the other party. Web following mandatory disclosures as required by rule 16.2(e)(7) of the colorado rules of civil procedure. Web mandatory disclosure form 35.1 reference to 16.2 (e) (2) form. These disclosure forms are not to be filed with the court, except as may be ordered pursuant to c.r.c.p.

Web Mandatory Disclosure Form 35.1 [Reference To C.r.c.p.

Web colorado has a flat state income tax of 4.63% , which is administered by the colorado department of revenue. To end a marriage, click here. This is an official form from the colorado state judicial branch, which complies with all applicable laws and statutes. Colorado has a state income tax of 4.63%.

Web Formulario 35.1 [Reference To C.r.c.p.

This is a colorado form and can be use in domestic relations statewide. Taxformfinder provides printable pdf copies of 65 current. These disclosure forms are not to be filed with the court, except as may be ordered pursuant to c.r.c.p.

![[Resolved] India Infoline Finance [IIFL] — noc and form 35 long time](https://www.consumercomplaints.in/thumb.php?complaints=2120162&src=157655964.jpg&wmax=900&hmax=900&quality=85&nocrop=1)